Close Menu

March 17, 2021

WANT PRACTICAL NO BS FINANCE CONTENT EVERY WEEK?

Join thousands of readers and subscribe to the Strong Money Newsletter below.

Most readers know that I added an international index fund to our personal investment portfolio.

Ever since then, I’ve been meaning to write this post. Because let me tell you, there’s no shortage of options to choose from!

Too much choice often leads to overwhelm, which is really unhelpful when it comes to investing. So today, we’ll browse the menu and take a look at some of the most common options for investing overseas.

From there, we’ll look under the hood and see what’s inside. Which funds make sense? What are the pros and cons of each? And how should we decide what to invest in? Lots to discuss, so let’s dive in.

(Friendly disclaimer: These comparisons are for informational purposes only. Please do your own research when making financial decisions.)

The first step is to get clear about why we’re investing overseas. People will have different motivations and goals when it comes to choosing an international index fund to invest in.

Maybe it’s to get exposure to tech companies? Maybe it’s to invest in a certain region? Or maybe we want to be more diversified in case something goes wrong with our Australian investments.

And then how do we choose? Do we want exposure to every market, or just one country in particular? Are we happy to have multiple funds or do we want just one? Do we want the absolute lowest fees, or do we want the fund we think will perform best?

As you can see, there are many factors at play. I’ll offer my thoughts on different options and explain which international index fund I chose and why.

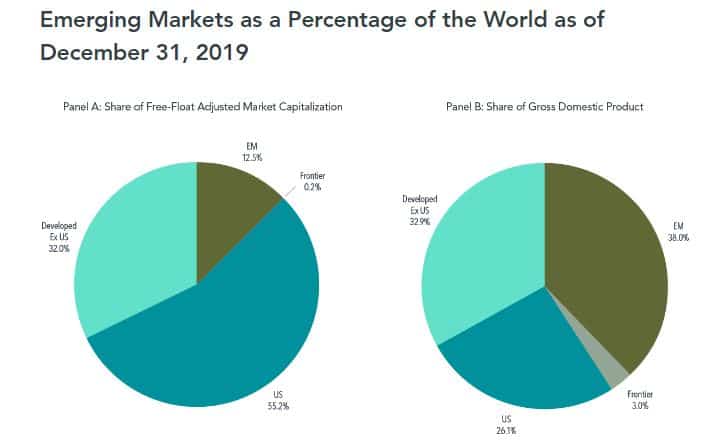

Developed markets make up most of the world’s equity markets (around 85-90%), with emerging markets making up the other 10-15%. In a minute you’ll see exactly which countries this includes.

So let’s focus on the most common index funds for investing in developed markets. The following two options give you an overwhelming amount of global diversification with just one fund.

What does VGS invest in? Vanguard’s VGS is an index fund which seeks to track the return of the MSCI world index, excluding Australia.

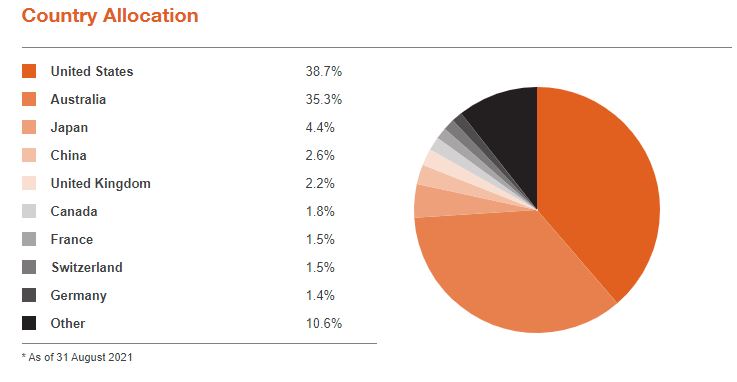

In plain English, VGS invests in over 1,500 medium and large companies from developed countries all over the world. Here’s VGS broken down by country…

Quite a heavy allocation to the US. That’s because the US has so many giant listed companies, much more so than other countries.

Quite a heavy allocation to the US. That’s because the US has so many giant listed companies, much more so than other countries.

And in case you’re interested, here is the breakdown of the top 10 holdings and sectors…

What’s not included? VGS does not include small companies. Nor does it invest in any emerging markets. Medium and large companies from developed markets only.

Management expense ratio (MER): VGS has a management fee of 0.18% per annum. That’s pretty cheap for how many companies it gives you exposure to.

Pros: VGS is a widely diversified index fund. Being domiciled in Australia, it’s simple and transparent. Because of this, there are no confusing tax issues (more on this below). By that I mean Vanguard goes out and buys shares of the underlying companies for you. Other index providers do it differently (more on this soon).

Cons: Other international index funds are cheaper. And if you want emerging markets or small companies, you’ll have to invest in other funds for that.

What does IWLD invest in? IWLD is an international index fund like VGS. It invests across developed markets around the world, with a few key differences.

IWLD also includes small global companies as well as Australia (at around 2% of the fund). So in this sense, it is a total market fund covering all developed countries. As you can see below, IWLD has roughly the same spread of countries as VGS…

What’s not included? IWLD does not include emerging markets.

Management expense ratio (MER): IWLD has a very low management fee of 0.09% per annum. Half the price of VGS. But there’s a catch: IWLD does not go out and buy the shares for you to replicate the index.

Instead, it buys its US domiciled funds to create the same thing (using a handful of ETFs). This keeps cost down, but creates some tax issues. Multiple funds also seem to create more turnover when the fund is rebalanced.

Pros: The management fee is very low. Small companies are included. Also, the fund is domiciled in Australia so there are no estate tax issues which can be the case when owning US domiciled funds (more on this here).

Cons: Because the fund is not as large as VGS ($125 million versus $2.2 billion), the spread when you buy and sell is also quite large (the difference between the market price and the price you can buy). So although the management fee is half the cost of VGS, you’re losing that benefit to other inefficiencies. (see more detail in a comparison between VGS and IWLD here)

Because the US has the majority of the world’s major companies, some see the US as the only worthwhile place to invest outside Australia.

For that reason, many folks go for a simple US-only index fund like the following three options.

What does VTS invest in? VTS is a fund which tracks the total US stock market. There are around 3,500 US companies of all sizes in VTS at the time of writing. I won’t bore you with the names of big American companies as you already know them!

What’s not included: The fund is US-only, so it holds nothing listed in other markets.

Management expense ratio (MER): The management fee of VTS is mind-blowingly cheap at 0.03% per annum.

Pros: You get exposure to the entire US market, with small caps included at an incredibly low fee.

Cons: This fund is domiciled in the US, which means there are potential tax consequences down the line in terms of estate tax as mentioned earlier. And a form you’ll have to fill out every three years.

What does IVV invest in? As you might guess, this index fund invests in S&P 500 – the largest 500 stocks in the US.

What’s not included: IVV does not include small companies as it is only the top 500. Nor does it include anything outside the US.

Management expense ratio (MER): The management fee of IVV is very low at just 0.04% per annum.

Pros: IVV is ultra cheap and holds the biggest blue chip American companies, many of which are global. It’s also domiciled in Australia so there are no tricky tax laws or forms to worry about.

Cons: Smaller companies are ignored. And some would say this excludes too much of the world’s other equity markets.

What does NDQ invest in? This ETF invests in the biggest 100 non-financial companies listed on the NASDAQ stock exchange. Therefore, the number of companies in NDQ is much smaller than the above options. This makes it much less diversified. Take a look…

Holy cow! Half the fund is in tech stocks, with 25% in just two companies! This concentration has been the winning hand in recent times, but it’s unlikely to stay that way forever. It makes the Aussie market look like the epitome of diversification! 😉

What’s not included: NDQ doesn’t really include medium or small sized companies. And obviously, nothing outside the US.

Management expense ratio (MER): The management fee for NDQ is much higher than the other options listed here, at 0.48% per annum. Fans would suggest the higher fee is worth it.

Pros: If you think tech is going to eat the world and these companies are going to keep growing, then maybe NDQ is what you want. But history would tell us to be cautious of that assumption – quite often, today’s darlings end up being tomorrow’s disappointments, especially when they’re trading at expensive valuations.

Cons: Relatively high fees. Plus, NDQ is a very concentrated bet. If large tech companies run into trouble, or fall out of favour, this fund will be hit hard.

Outside developed countries like the US, UK, Japan, Australia and so on, there are lots of less mature markets to invest in.

Emerging countries account for a big chunk of the world’s economy, but only a small slice of global markets (see below).

Therefore, some say we should invest in these up-and-coming countries as they’ll grow to become bigger pieces of the pie over time. But that may or may not occur. Don’t assume that high growth economies lead to high returning stockmarkets. That’s actually not the case (see here and here).

Emerging countries have less stringent reporting standards, rule of law and transparency than we do. There’s likely to be less scrutiny over the way shareholder’s capital is managed.

And finally, corruption can be more common and governments are less predictable, making the investing environment more costly and less certain.

What does VGE invest in? VGE invests in an index of around 5,000 companies listed in over a dozen emerging markets. The fund is heavily weighted to China, followed by Taiwan, India and Brazil.

What’s not included: Developed markets are not included.

Management expense ratio (MER): The fee for VGE is currently 0.48% per annum. Much higher than broad international index funds like developed markets. But this should reduce as the fund gets bigger.

Pros: Access to companies from all over the emerging markets, many of which are dominant in their local countries. China has impressive tech giants of their own, just like the US. Maybe they compete and one day overtake the US giants, who knows?

Cons: Less stringent rules and investor protections than we have in Western countries. Fees are higher. And emerging markets can be less stable, politically and economically, with their markets being more volatile. Some see the volatility as a positive, whereas other investors won’t.

What does VAE invest in? VAE is an Asia-only index fund, which excludes Japan. So you could think of it like ’emerging Asia’. Like VGE it’s top allocations are China and Taiwan. But unlike VGE, VAE has decent exposure to Korea and Hong Kong. It holds about 1,300 companies compared to roughly 5,000 for VGE.

What’s not included: Other emerging markets like Latin America and the Middle East. And developed markets.

Management expense ratio (MER): The management fee is 0.40% per annum, so a little cheaper than VGE.

Pros: If you want to take a long term bet on Asia, this is the way to do it. You may also prefer the breakdown of countries compared to VGE.

Cons: Higher fees than a developed markets index. Plus, with VAE, you’re really taking a bet on a region which may or may not turn out in your favour.

What does VEU invest in? VEU invests in everything outside the US, including emerging markets and small companies. VEU holds almost 3,500 stocks from the following countries…

What’s not included: The US, hence the name!

Management expense ratio: VEU has a tasty low management fee of 0.09% per annum.

Pros: A great way to compliment a US fund like VTS (see above). Combining VTS/VEU gives you the entire world market, including emerging markets and small companies. It could also serve as an alternative international index fund for those who think the US market is too expensive.

Cons: VEU is domiciled in the US, so it comes with tax issues like VTS as mentioned earlier.

Enough of this glancing around. Here are the most common combos for international index funds for investors who want to get global exposure…

One developed market fund and one emerging market. This would be VGS or IWLD for developed, and VGE or VAE for emerging. For those who include emerging markets, a common allocation is about 5-15% of their total portfolio.

An alternative is to go with VTS and VEU for a combined and complete global exposure. With the US being about 50-60% of the global market, and VEU making up the other 40-50%, it’s a pretty neat combo. The problem is the tax issues mentioned, which are not ideal, nor are they easy to understand!

Okay, this one isn’t strictly an international fund. It’s more like an all-in-one fund which is heavily invested in international shares.

The veterans will know this option, of course it’s…

What does VDHG invest in? This fund holds a portfolio of managed funds. Together, they form a globally diversified portfolio, which includes Aussie, international, emerging market and small cap shares.

VDHG has 90% allocated to ‘growth’ assets, and 10% allocated to so-called ‘income’ assets, like fixed interest and bonds. Here’s the full breakdown…

What’s not included: …nothing as far as I know. Everything’s there in one fund.

Management expense ratio (MER): The fee for VDHG is 0.27% per annum. On the surface, that may sound expensive compared to other options here. And it is, but..

Pros: The simplicity of an all-in-one fund is pretty neat. For those who don’t want to decide where to invest, rebalance, or just take a 100% hands-off approach, VDHG is a solid option. Outsourcing the decision-making could be a mental and practical benefit worth paying for.

Cons: VDHG holds multiple funds and rebalances to stay within its target range of exposure for each holding. This means it may have to buy/sell each year to maintain the same weightings, making it less tax efficient than doing it yourself.

Ideally, you’d simply add money to the holding that is underweight and no selling is needed. It’s roughly the same in retirement, when it’d be better to sell the best recent performer from your portfolio to get some cash.

What does DHHF invest in? This fund holds a portfolio of 4 ETFs. One for Australia, the US, developed markets outside the US, and emerging markets.

In turn, this single fund gives an investor part ownership in about 8,000 companies around the world.

Unlike VDHG above, DHHF invests 100% in shares, with no money in bonds or cash, which will suit more aggressive investors. Here’s a picture of the portfolio by country…

What’s not included: …again, nothing is left out of this ‘all-in-one’ portfolio.

Management expense ratio (MER): The management fees for DHHF are 0.19%, though there is a small tax drag from the US listed fund it owns (long story, explained here) which ends up bringing the total cost to around 0.27%.

Pros: The simplicity of this fund is hard to beat. It has everything wrapped up in one parcel. Plus it’s nice that DHHF is all shares, with no bonds or cash in the portfolio, making it a pure high growth option. Because it holds ETFs, it’s also likely to be more tax efficient than VDHG.

Cons: If you’re someone who wants control over which investment you’re topping up in a portfolio to take advantage of what is underperforming, then this probably isn’t the fund for you. If Aussie shares are doing great, and US shares are struggling, you can’t simply top up your US shares. Not a big deal though in the grand scheme.

From all these options, I’m investing in VGS. The reason is, it offers fairly broad exposure (1,500 companies) with one fund at low cost, to sit snugly alongside our Aussie shares.

The goal wasn’t maximum possible diversification. Instead, I see diversification as insurance against the off chance that Australia does poorly over the next few decades.

I consider VGS good enough for my purposes. I could also add emerging markets, but given it would be 10% or less of the portfolio, I’m happy to just keep it simple.

But speaking of simple, if I ever feel like becoming a completely hands-off investor, I would probably go with a fund like DHHF. It’s just so simple and effortless, which is really appealing, despite being slightly higher fee.

There are plenty of other combinations and options that we could point out, but these are probably the most noteworthy.

I’m often asked about my thoughts on other types of funds, which are usually more exciting and exotic. These are always higher cost, higher turnover, less diversified and less easy to understand! Not only that, but they’re often a specific bet on a sector, strategy or theme.

Call me boring, but I tend to not bother looking at many options these days. I’ll just stick with broadly diversified index funds, and buy-and-hold style LICs.

Free Resource: I created a spreadsheet to keep a running estimate of my dividend income and wealth breakdown. I’ve used it for years as a way to help plan my finances and watch my progress over the years. You can get it below.

We’ve come full circle now. We’ve looked at the main options and now it’s up to you to decide.

Clearly, my favourites are those which offer a balance of solid diversification, simplicity and low cost. But there isn’t a ‘best’ option!

Which option sounds like a good fit for your situation? Do you want maximum diversification? Or do you consider one international index fund good enough? Do emerging markets make you nervous? Or do you think they have great potential?

A quick word on fees: while fees matter to our investment returns, I wouldn’t simply go for the cheapest option here. That’s because fees for all these funds will likely keep falling over time, as they have since the beginning of index funds over 40 years ago.

There’s a psychological aspect to consider too. If you invest in markets that you genuinely believe are going to do well long term, it will be MUCH easier to stay the course during a nasty downturn.

But if you invest in something you’re less convinced of (maybe because you see other people own it), you can easily talk yourself into selling if that fund underperforms for a long time.

At the end of the day, it really comes down to how you want to invest. Maybe you only want to own Aussie and US shares. Maybe you want to copy the breakdown of the entire global market. Or maybe you just want the simplest option of all, in which case you might go with a ready-made fund like VDHG or DHHF.

Whatever you do, just keep it simple. Pick something you’re comfortable with and get started. As most people do, you’ll probably adjust your plan over time, so there’s no need to stress and feel like it’s a ‘forever’ decision.

What if I had to suggest something to get started with international investing? Pick a broad global fund (covering most international markets), or a US fund at a minimum (the biggest market) and go from there.

If you feel it makes sense to diversify more than that, then by all means go for it. But adding one of these gives you most of the benefits of diversification with just one fund.

I hope this article has helped you compare the most common international index funds. We covered a range of sensible low cost diversified options for long term investors.

It’s clear to me there’s no right answer, except what suits you and your personal circumstances. Don’t get me wrong, making sensible investments is important. But I think many people over-analyze and nitpick the investment world to death.

We spend too much time worrying about the unknowable future and thinking about all sorts of risks. Whichever path you take, I wish you all the best.

And remember, your input (savings) is more powerful than the output (investment returns), when it comes to building wealth and financial independence.

WANT PRACTICAL NO BS FINANCE CONTENT EVERY WEEK?

Join thousands of readers and subscribe to the Strong Money Newsletter below.

Hey Dave, any decent international LICs you’re aware of?

I was thinking WGB for example?

What do you think of that?

Thanks mate

Elliot

Hey Elliot. None that I find super attractive. I like some of the managers, but most have very high fees, or are very high turnover. WGB has high fees and likely to be very high turnover, considering the manager running that fund.

From AFIC latest chairman’s address to AGM, AFIC is dipping toe in the water for international investments, see https://www.asx.com.au/asxpdf/20201014/pdf/44nnhd7n2d6ldk.pdf page 3. Very small percentage initially, but might grow.

Brilliant piece here. Very well done! Very much in line with my own readings.

In fact, at the time I got the email notification re this post I am editing a video about my portfolio which includes VGE and IWLD.

Hi Dave

NDQ is unhedged. If you are concerned about currency fluctuations you can use HNDQ

Beside VDHG, Vanguard also have VDGR,VDBA and VDCO to suit different risk profiles

VDHG and chill.

great post. what is your asset allocation for austrlia vs international

Cheers Aly. Our latest portfolio update should give you an idea – about 80% of our net worth is invested in Australian assets (shares and property). https://strongmoneyaustralia.com/investment-portfolio-update-mid-year-2020/

Hi Dave if I have $300K to buy shares….

How many times a week should I walk my pet koala?

Every day! Spending time with animals is more fun than worrying about investments 😉

Nice

???? ????

Ah that sweet Saturday SMA fix 🙂

Thanks again for another great article. I am currently 100% invested in Australia, a by product of Peter Thornhill being my first influence in regards to investing.

However I plan to start diversifying internationally next year, even before this article I was thinking VGS was a great option also. The large spread of countries/companies and the large footprint of IT and healthcare (relative to Australia) coupled with it being domiciled in AUD makes it an nice first foray out of Australian equities for us.

Haha! 😀

Sounds good mate. Yeah, I think the different makeup of industries in the US really compliments what we have here in Oz.

What are your thoughts on currency hedging Dave? I have some international investments which are hedged (VGAD) as well as others which aren’t, with a roughly 50/50 split between hedged and unhedged.

Hey mate. It’s not something I’ve done much research on. Given I’m likely to remain more than 50% invested in Australia, I probably won’t bother with it. Having said that, I might buy VGAD if the Aussie dollar was very low, like in the 50c range, but that’s about it. And I’d probably look to get rid of it once the currency went back into a normalish range (60-80c) like what happened earlier this year.

Sounds a bit too active doesn’t it? Haha. As you know, it probably just depends how much someone has invested in Australia, whether hedging is likely to be desirable or not.

If diversification outside Australia is the intent (rather than trying to play the currency fluctuations theme), then unhedged version perhaps makes more sense. As the AUD is more or less a global risk appetite barometer, in falling markets non‐Australian exposures would do better in AUD terms, cushioning the portfolio a bit against the shock. This year, I was happy to see that VGS didn’t fall that low and recovered faster than VAS, which is still in red YTD. The opposite would be true in case of risk-on sentiment, but I’m ok with talking less upside but having a smoother ride in hard times. Again, it’s only a personal perspective…

“taking less upside” it was supposed to be 🙂

Thanks Alex. That’s my understanding also. I elaborated more on that in the following article on my personal strategy and deciding to buy VGS – https://strongmoneyaustralia.com/my-latest-thoughts-on-dividends-and-diversification/

Hey Dave, useful post.

I’m curious to hear your thoughts on VESG vs VGS. From what I can decipher, the fees are the same and top holdings relatively on par – can you see any downsides?

Cheers

Thanks Vanessa. The ethical funds are fine if that’s what you want to go with and fees are the same, which it is in this case!

The main issue is if the companies they’ve excluded end up having better performance than the rest of the fund, then the ethical fund will underperform. Then there’s the fact that it doesn’t really hurt those companies if you don’t buy their shares. There are other points but I’ll save them for a future post on ethical funds.

I found this post particularly good I like the product breakdowns

I only buy au domiciled and I too wish for some comparable products to be domiciled here

Thanks for the post your the man Dave

Cheers Patrick, very kind 🙂

Hi Dave

Im beginning my FIRE journey. Thank you for sharing the gyan to the world. Lots of good karma to you mate!

This may be a novice question. Why is there a marked unit price difference between VTS and IVV? (VTS and IVV are trading AUD251 and AUD493 resp.) Is it because VTS tracks the whole US market, whereas IVV tracks S&P500. Or is there something else to it? As a prospective buyer, I am puzzled at why Id buy IVV when i can buy VTS for half the price (ignoring tricky tax issues).

TIA,

Sam

Hey Sam. The unit price of each ETF compared to each other actually doesn’t matter. You’ll earn returns based on the dollars you’ve invested, not the number of shares you’ve been able to buy. If you invest $5,000 to buy 100 shares, and $5000 to buy 1 share, you won’t get 100 times more returns with the first one. If the underlying fund is basically the same, you’ll get the same return – one just has the pizza cut up into smaller slices.

The main difference is the one you point to – one tracks the top 500, the other tracks those, plus another 3000 or so. So it includes more companies (including small ones) and so it’s slightly more diversified. But honestly, they are likely to have almost identical performance over time.

Hi Dave – while in theory there *could* be US estate tax implications if you drop dead and have a lot of something like VTS sitting there, in practice I think it’s very unlikely Uncle Sam would go after it. They’ve got bigger fish to fry. This was once discussed by Scott Pape as well and he was of the same opinion. And so the only real hassle with VTS and VEU is the form that has to be completed every few years and a bit of extra number crunching for your annual Aussie tax return (which I am about to do tonight). So all up, not a deal breaker for those who want to own VTS and VEU and enjoy the rock bottom fees plus wide exposure.

Yeah I dunno Scott, it’s just one of those things most people would like to not have to worry about even as a remote possibility. It’s likely that Vanguard end up re-domiciling (is that a word?) those funds in Oz at some point anyway, so it probably is a non issue 🙂

I have purchased vgs over vts and veu because vgs offer drp. This was another deal breaker for me.

Thanks Dave, great overview.

Thanks for the write up Dave.

I am looking to expand out into IVV or VGS myself.

This post might help me decide 🙂

Incompetent Investor

Good stuff mate, glad it’s useful!

On emerging markets

https://www.etf.com/sections/index-investor-corner/swedroe-why-emerging-markets-matter

https://www.etf.com/sections/index-investor-corner/swedroe-emerging-markets-need-time

https://www.passiveinvestingaustralia.com/emerging-markets-is-crap-should-i-leave-it-out

EM also tends to zig when the developed world index zags (over long periods, not during short sharp corrections).

Here is EM vs World index since 2000

https://www.passiveinvestingaustralia.com/images/em-vs-world.jpg

And here it is going back a coulpe more years where total return over the period is even (rather than EM ‘s outperformance since 2000), and with log scaling added, so you can see the zig-zag nature that is useful for a diversification benefit.

https://www.passiveinvestingaustralia.com/images/em-vs-world-log-scaling.jpg

Thanks for that. Nice to see the correlation in overlapping graph form. I wasn’t saying people should ignore emerging markets (hope it didn’t come across like that). Just see a few people make the assumption (high growth economy must mean high growth stockmarket, sign me up!), but it’s not that easy.

The diversification/rebalancing benefit can be useful, but it’s probably fair to say many people don’t have the patience/stomach/discipline for it in practice, especially when emerging markets are naturally less familiar than developed, and typically more volatile.

Another great article Dave! I recently made my first foray into international shares by purchasing a parcel of VEU. I like the relative weighting of countries and the mix of developed and emerging economies in there. The low fees that go with VEU are a real plus of course. I’m of the same view that the US market is over-valued at present (scarily high CAPE ratio) so will keep my ‘powder dry’ for their next correction and swoop in and buy some VTS when there’s better value to be found. Something tells me we won’t have too long to wait…

Ahh…. timing the market. Good luck with that.

No not exactly. I’m actively putting my money into sharemarkets that I believe offer better value at the moment. The US market is overvalued at the moment so I am avoiding that particular market for the time being and investing elsewhere.

Cheers Jeff. Nice work! It’s good to start somewhere, and if you’re more comfortable with other markets for now since they appear better value, I think that’s fine. The key point is you still have more diversification than you did before, even if it’s not what others would do 🙂

Nice guide Dave. Hedging is also about what level of currency risk you’re willing to tolerate. For our portfolio we came to the conclusion (after going round in circles thinking about currency movements) that we wanted some currency risk but had no idea how the currency movements would go; so like AussieHIFIRE we ended up with a 50/50 split between hedged and unhedged.

Great stuff Dave.

Love the way you set it all out. Easy to read and digest.

That performance segment really opened up my eyes. Very interesting and yes, all depends on the periods one looks at or refers to.

For mine i recently (3 months ago) purchased VGS + IWD (and QUAL). Each to their own strategy but i think what is important is that one invests in whatever suits their long-term strategy. Do your research and invest. NOT investing can sometimes hinder wealth prospects severely.

Of course that doesn’t mean bet everything on black at the casino :).

Glad you found it useful! You bring up a great point – often people tie themselves up in knots trying to decide on the best way to invest, when really, the best thing they can do is just invest (provided they aren’t buying complete garbage funds).

Currently my international exposure is solely through super… let them worry about the hassles of currency and tax. It’s been the star performer for the last 10 years from all its investment options. Not that this will continue of course, but happy to bank the returns while they’re there.

What are your thoughts on VISM? No mention in your article or readers’ comments… I thought it would have been a major player in international shares talk..?

I dunno, maybe elsewhere it is? If someone wants to add small caps then nothing wrong with that, but I think most of the benefits of diversification can be had with just one or two broad holdings, so small caps is mostly tinkering around the edges. It’s ultimately only a small segment of the market.

It depends how ‘academic’ of an approach you want to follow. We can add international, then emerging, then small, then value, but where does it end? We can slice and dice it even further to get even more moving parts to add to/rebalance with, but I think this is just giving ourselves more work than is necessary.

Just a thought on VDHG and the other Vanguard portfolio funds.

Even if you don’t want to invest in a single fund their asset allocations provide a useful guide of how to structure your portfolio according to your risk appetite. For example, split between global fixed income and australian fixed income. International/emerging market/aussie.

This is the sort of stuff professional financial advisors will charge the man in the street a hefty fee for. My organization has a hefty portfolio ‘managed’ by a well known firm, their asset allocation models are almost precisely the same as those you can deduce for free from the vanguard funds.

That’s a good point Pierre, thanks. It’s certainly very cool that people can simply copy a pretty robust and well researched allocation if desired, without paying a fortune for it.

Great article.

One factor not mentioned is that the US based funds that hold Ex-US equities suffer from lost level 1 withholding taxes (IWLD, VEU and VGE) and franking credits (IWLD and VEU).

As a result, what looks like a low cost MER, in real terms costs about the same as VGS which holds assets in Australia.

VAE similarly holds assets in Australia unlike VGE which wraps NYSE VWO leading to a wider differential than 0.40% vs 0.48% at first glance.

Cheers Rob. I mentioned there are tax issues and pointed to an article which explains it further – including the tax drag, even though I didn’t point that one out specifically. Maybe I should have.

Wasn’t aware of the VGE issue though! Do you have more info on that?

Sorry, missed the link, yes that’s a good summary of the issue.

VGE suffers from exactly the same issue investing in 23 emerging countries. These countries withhold level 1 taxes on dividends which could normally be offset against your Australian income tax as Australia has double taxation agreements (DTA’s) with most of these countries. https://treasury.gov.au/tax-treaties/income-tax-treaties

Except because VGE wraps the NYSE VWO ETF which holds the assets in the US, these level 1 taxes are lost to the tune of about 0.35% based on the latest annual report and you have to pay full Australian income tax on the distributions.

Fascinating, I hadn’t read that before but it makes sense, thanks. Wow, when you add the fee and the tax drag, it’s getting up towards 1%! That’s really off-putting. Definitely makes the Australian based funds more attractive, but there’s a tradeoff with everything I guess.

The frustrating thing is the MER on the underlying VWO is 0.10%. 0.10%+0.35% would be quite reasonable.

Vanguard Australia is just taking profit with VGE as there is no low cost competition unlike VTS vs IVV. The nearest competitor to VGE is IEM @ 0.67% but also suffers from the same tax drag wrapping the US EEM ETF.

Hopefully that money eventually finds its way back into lower fees for its broad products rather than creating new ones, which is getting a bit silly now – there is far too much choice

I’ll also add, this effective MER on VGE may be high (0.48% + 0.35% tax drag), however giving it is usually only around 10% of a balanced portfolio it lessens the impact.

In my mind VAE was a good enough approximation at around half the cost (0.40%), although misses out on Brazil, Russia, South Africa and a few other countries and also doesn’t include China A shares found in VGE.

Sorry to rehash an old thread, taking into account exchange rates for during buy and sell and dividends, is it more attractive to invest in VWO itself rather than VGE? Will this reduce the effect of the tax drag?

I may be misunderstanding it, but the tax drag comes from VWO owning international companies and being domiciled in the US for us as Aussie based investors. VGE doesn’t suffer from that, the downside is higher fees, but most opt for VGE I believe if looking for emerging exposure. There’s no benefit buying the overseas domiciled fund due to exchange rate as it’ll all be factored in when our money converts.

Hi Dave,

A question more about the general strategy to minimize tax. Now that you are passed FI line, do you consider utilizing all your 25K yearly cap Super contribution? Anyway you will reach 65 years old at some point, and you would have some investment either through Super or not, but do you want to pay less tax by going through Super? No need to mention, I am asking to get a better understand so I could decide my strategy better, however, I don’t have any plan for FI yet.

It’s all about the numbers I’m afraid.

A 25 yo on $81,500 pa. After Tax = $64k. SG Super = $7,740 pa (before internal tax of 15%, $,6282 after 15%). Amount in super after 35 years at 60 yo = $219,870 before any earnings.

Same person salary sacrifices $17k pa. Take home pay = $52,900 pa. Amount contributed to super $736k after 15% tax but before any earnings.

First task is to live well on the $52.9k. Second task is to moderate dreams of reaching $1.6m in super.

And/or attempt to also build up investments outside super. Say it’s sufficient to generate $10k pa. Hmm, once retired it’s below the tax free threshold and, if fully franked, you drag back $4.2k in excess franking credits under the current taxation arrangements.

There is zero need to look at ways to minimize my tax because I’m not paying any. Tax rates are so low ($20k income each, zero tax), combined with franking credits mean we’re still receiving tax refunds, and will be for quite a while. We also have properties that are still slightly negative cashflow which also reduce any tax payable.

For us, super will end up being used for excess wealth we don’t care about having access to, which won’t be for quite a while yet. I’m going to do a post on tax after retiring early soon because it keeps coming up – the amount of tax people assume you’re paying once living off investments is massively overstated. Hope the above makes sense.

Yes it does make sense – to me at least Dave.

I’ve always had trouble over the fixation about paying tax especially when it seems to drive their investment decisions. However, I’m a capitalist with some socialistic tenancies and although I don’t suggest writing a blank cheque (that’s old paper stuff for the younger generations) to the ATO I do consider paying tax is a societal concept and contribution. After all, I, like many, would prefer receiving the occasional Medicare rebate or subsidised costs of pharmaceuticals and the funds for those subsidies have to come from somewhere.

Forgot to add that it doesn’t take much effort to work out $30,000 pa in fully franked dividends results in a refund of about $8k of excess franking credits.

I think it was Ralph Waldo Emerson who said “I like paying taxes; with them I buy civilisation.”

One only has to look at those countries that don’t raise sufficient money through taxes to see the problems their society has. People need to change their mindset. You can’t have it both ways. The reluctance and unwillingness of citizens to pay tax has profound consequences. Many recent economic woes around the world are caused by an inability to raise taxes, or perhaps the reluctance of citizens to pay income tax…

Haha yes, it’s a funny conundrum. We want all the benefits while giving up nothing. I have a post sitting in my drafts about all the contradictory expectations we seem to have… the list gets longer each month 😉

In addition to my previous post I should have mentioned that when the SG contribution increases (assuming it actually does,) unless the concessional contribution cap increases (it’s supposed to be indexed to the average weekly ordinary time earnings – the $25k limit does not increase until the accumulated indexation exceeds $2,500) it does result in the amount able to be salary sacrificed being reduced to some extent until then.

What about WXOZ ?

Isn’t WXOZ basically the same as VGS except with a higher MER (0.30% vs 0.18%)

As far as I know yes, WXOZ is not a very attractive choice in this space.

HI Dave, I really enjoyed this post and appreciated the breakdown of all of the options. I am just about to dip my toe into some regular passive investing and had thought I would go with a VAS50%, VEU25%, VTS25% split for diversification. I’ve been reading up as much as I can to understand the basics.

However, reading about VDHG in this post and having seen it mentioned various times in other blogs and forums I’m wondering if it might be a better way for me to go given my lack of experience. Would VDHG essentially give me a similar coverage as what I mentioned above? It just seems too simple to be true haha. My mind keeps wanting to overcomplicate things.

For a newbie starting out, looking to regularly invest monthly with a goal in mind of 10+ years to buy and hold until retirement and probably beyond…….would you suggest sticking to the “keep it simple” method of just sticking with VDHG? or a little into VAS as well?

Any thoughts would be so appreciated. I’m overthinking it all like crazy and honestly just want to decide and put things in place.

Glad you found the post helpful! Honestly, VDHG will give you a pretty similar level of diversification than the three funds you mentioned. The only catch is the higher fee (but still reasonable for what you get). And the fact that 10% of the fund is in cash/bonds (low return investments). But I don’t think that’s such a big deal given the diversification and simplicity benefits it offers.

If you go with VDHG you really don’t need anything else – Vanguard has basically designed it as a one-fund portfolio. I do think it’s a very good option for regular long term investing for those who want to keep it as simple as possible. Hope that helps.

Thanks for this article Dave.

Love your content.

My wife and I are complete investing beginners.

She wants to get started as soon as possible though haha.

I was thinking of going

VGS

VAS

Whitfield and Milton for LICS. (Peter Thornhill motivation).

I haven’t a clue what I am doing yet but I thought this could be a good start.

John.

Thanks John – great to hear you and your wife are keen to start investing, that’s fantastic!

Those are all fine holdings in my book. Having said that, the LICs are similar to VAS so if you wanted to keep it simple just leave those out (or if you prefer LICs, leave VAS out). Get started and keep adding whenever you can 🙂

Hi Dave

Is it possible to implement Peter Thornhill’s strategy using a wholesale fund such as VDHG or even VDBA?

I’m currently using VAS/VGS and implementing Peter’s strategy as I’m not a fan of LIC’s anymore.

Kind Regards,

Hey Anorat. Well it’s a bit different, but in my view yes. The fundamental point of Peter’s strategy is to focus on the income being paid from your investments. You can still do this with an index fund portfolio.

Hey Dave, great info.

I currently have VTS invested in my name, but am starting up a family trust trading account. Thinking of going VGS in the trust. Unsure though whether to also continue adding to VTS/VEU in my original trading account or now just put all new funds in to VGS (along with VAS). Mainly being put off by the whole tax implications and form thing of VTS which I assume will have more impact the more $s in, but like the returns of VTS.

Any thoughts or recommendations?

Thanks Lisa. Well, the returns of VTS won’t always beat the returns of other global funds, so I wouldn’t worry about ‘missing out’ on higher returns. You are getting more diversification with VGS which protects against the US doing poorly long term. I would just pick whichever option you feel is the simplest. It’s probably not going to make a huge difference either way, so I wouldn’t overthink it.