Welcome to the long awaited review of Whitefield.

Many of you have asked for this since the LIC series began!

In case you missed it, I created a special page with all the LIC reviews so far, which you can check it out here.

We’ve covered a few so far, but I think this company is also a solid choice for long term dividend focused investors. Whitefield is actually Peter Thornhill’s favourite LIC, given it owns no resources stocks.

As always there’s lots to cover, so let’s get started!

Whitefield LIC (ASX:WHF)

Overview

Whitefield was founded as an investment company and listed on the ASX in 1923. This makes it the oldest LIC in Australia.

Today, the company has grown to be around $400m in size.

Whitefield is well diversified, having investments in around 160 different businesses. This makes it like an index fund in some ways.

The key difference from the other old LICs, is that Whitefield has zero exposure to resource companies. More on that below.

The company invests with a long term focus, to benefit from the broad earnings growth of Australian industrial companies over time.

Whitefield is run at a reasonably low cost and the portfolio has low turnover, which makes it tax efficient.

Whitefield Company Objectives

The key focus for Whitefield is to grow wealth for shareholders through holding a very large diversified portfolio of industrial shares. All while paying a reliable income stream via fully franked dividends.

More specifically, it aims to slightly outperform the ASX 200 Industrials Accumulation Index (XJIAI), with low chance of underperformance.

So by design, the performance will be very similar to this index.

Mostly, Whitefield uses a quantitative approach (lots of data and numbers) to make portfolio decisions.

Basically, they will overweight and underweight certain companies and sectors, based on the earnings outlook and valuations.

Whitefield invests only in ‘industrial’ shares, which in this context, means all sectors except for resources (mining).

Now, for those following Peter Thornhill’s approach and teachings, you’d be very familiar with this.

In the company’s words…

“The high cyclicality of the resource industry has seen resource stocks generate high volatility earnings and lower through-the-cycle investment returns over the long term. By eliminating resource stocks from our portfolio, we are able to deliver higher through-the-cycle returns with lower volatility (that is, higher risk-adjusted returns) for our investors.”

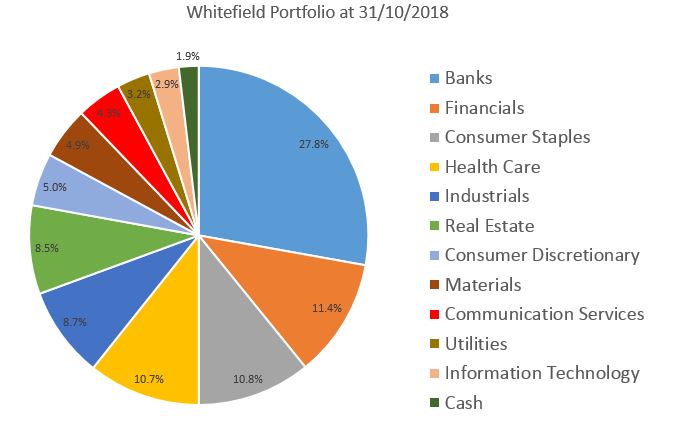

The Whitefield Investment Portfolio

Whitefield has a very large number of shares in the portfolio – around 160 companies.

As you’d expect, these are spread across many sectors, except resources of course!

Here’s the current breakdown of the portfolio…

So, we can see there’s a good spread of industries in the portfolio. But it’s still concentrated in some ways.

For example, Whitefield has a high level of banks and financial stocks. More so than the likes of Argo and AFIC. Even yield-hungry BKI has less banks in its portfolio these days.

Because of the exclusion of mining companies, it means a higher level of exposure across the other sectors.

Now that’s not necessarily a bad thing, with most resource companies being poor or unreliable dividend payers. But it’s still something to be aware of.

Most of the time, Whitefield’s portfolio will closely replicate the entire ASX 200, minus resources.

Basically, the portfolio is much more index-like than say BKI and Milton, who are more hardcore dividend investors, and build their portfolios accordingly.

You can argue this index-like approach is lower risk, in the sense that it prevents poor stock selection and decision making to some degree.

And because of this, there’s comfort in the fact that the portfolio will probably always be a good representation of the Australian industrial economy, now, and in 50 years time.

Also, by owning pretty much every industrial company, it means Whitefield is much less likely to underperform over the long term, by missing any huge success stories.

Overall, I still feel Whitefield is reasonably diversified. But I do expect (and hope) the portfolio will become more diverse over time, as the Australian economy grows and broadens over the next few decades.

If you’re buying shares

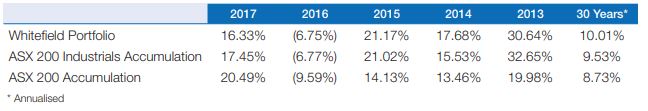

Performance of Whitefield versus the index

Let’s take a look at how Whitefield has done in terms of performance.

From the 2017 Annual Report…

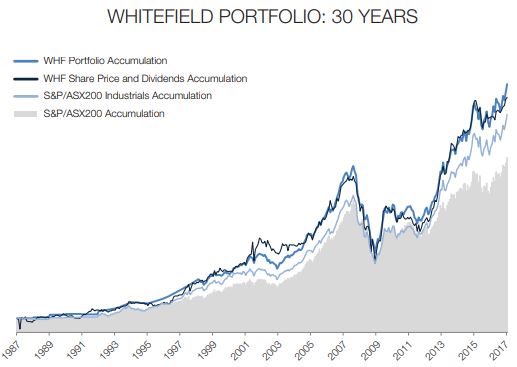

And now the same thing in chart form…

As we can see, performance has been pretty good over the long term. Slightly ahead of the Industrials index, which was also slightly ahead of the broad market ASX 200 index.

But this isn’t quite the whole story.

See, ‘portfolio performance’ often means what the return is, before tax. And for an LIC which has low turnover and keeps its holdings for a long time, that’s a good place to start.

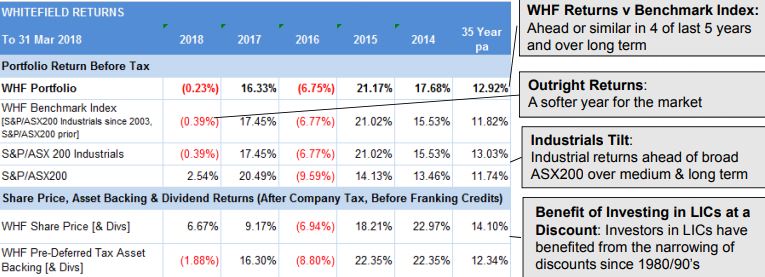

But I want to see the after-fee and after-tax return too. So here’s what else I found, from the 2018 Annual Report…

Now, there’s a lot going on there. But here’s what I’m looking at…

The bottom line. That’s Whitefield’s total returns based on their net asset value (NTA). After fees, after company tax, and before franking. 12.3% per annum.

So, after accounting for fees and tax, performance was a little lower than the Industrials index, but still ahead of the ASX 200, over the long term.

Some tax is unavoidable of course, as Whitefield must pay tax on any dividends it receives which are unfranked. This includes income from property trusts, infrastructure and companies with mostly international earnings.

Also, the portfolio needs to be changed slightly over time, which of course creates some capital gains tax events. But not all is lost. Because both of these things create extra franking credits to attach to the dividend.

Some of you may prefer to look at share price plus dividends instead. But this paints an unusually rosy picture.

Why? Because it seems Whitefield was trading at a huge discount back in the early 1980’s, boosting performance since then.

So, looking at the NTA figures above (or whichever you prefer), they’re pretty solid. And if we were to add in franking credits too, the long term returns would be quite high indeed.

Honestly, I’d be impressed if Whitefield outperformed the ASX 200 going forward. Especially on an after-fee, after-tax basis.

Whitefield Dividend Growth Since 1990

Now let’s take a look at this all-important factor. And we’ll see how Whitefield has done in terms of providing a growing income stream to shareholders over the long term.

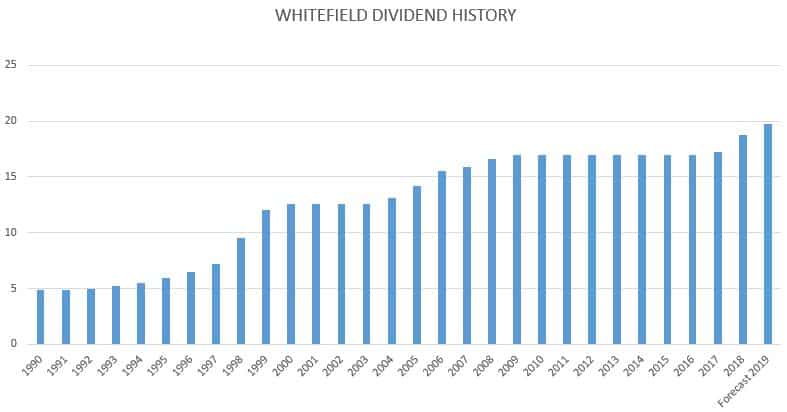

Here’s the dividends paid since 1990…

As you can see, Whitefield hasn’t cut the dividend at all over this time. That’s almost 30 years!

Clearly, Whitefield makes a point of providing a reliable income to shareholders, even when its earnings have fallen.

This includes the recession in the 90s, as well as the GFC.

When many companies and even LICs cut their dividends, Whitefield has continued to pay the same amount. Now earnings have caught up and they’ve begun boosting the dividend once again.

It’s been a long wait for shareholders, receiving flat dividends from 2009 to 2016. But is that better than a dividend cut, which then grows to catch up?

I’ll leave that for you to decide. But I expect that shareholders were very happy having no cut to income during the scariest financial period in a generation.

Recently, Whitefield has forecast a decent jump in the dividend for this coming year too.

So looking at these figures, dividends have grown at a rate of 4.9% per annum, over almost 30 years. And during that time, inflation was 2.5% per annum.

This means Whitefield has provided an income which has comfortably grown faster than inflation over the long term.

Despite the dividends being flat for multiple years at a time, I think the average is what matters. And the extra stability of income is definitely worth something. Especially if this is a person’s retirement income stream.

Given Whitefield’s diversified portfolio of 160 stocks, dividends should grow nicely over time. And this growth should be broadly in line with the earnings of Australia’s non-resource companies.

What fees does Whitefield charge?

Unfortunately, Whitefield isn’t as low cost as the other LICs we’ve covered so far.

As of the latest report, the management expense ratio (MER) is 0.40% per annum. There’s a couple of reasons for that.

Firstly, Whitefield is much smaller than the others, at only around $400 million in size. Quite different from the likes of Argo at $5 billion, and AFIC at $7 billion. Benefits of scale mean the bigger LICs have a cost advantage.

Also, Whitefield is externally managed, like BKI now is. So this means that even as Whitefield grows, it’s unlikely the MER will come down much.

Now, I could be wrong on that and the management decide to reduce fees over time to stay competitive.

But there’s also the chance they decide the costs are fair, given they have a company/product that is unique in the sense that it is pure industrials.

To be clear, management own a sizeable chunk of the company, so it’s not like they’re out to milk the shareholders.

But given fees are one of the only things we can control as investors, some people will rule out Whitefield straight away. And I wouldn’t blame them for that.

Others will be willing to pay a bit extra for an all-industrials LIC and the chance of outperforming the market. That’s up to you.

Resources vs Industrials

If you’re mainly interested in Whitefield for the resources vs industrials thing, and expecting permanent outperformance on that basis, I’m not sure that’s a slam dunk.

While the earnings and dividends from mining is volatile, there are valid reasons why the other old LICs own these companies in their portfolios.

The truth is, there’s a number of mining companies that have far outperformed the market average over the last couple of decades. BHP, Rio and Woodside are some that come to mind.

Australia has some of the largest and most competitive mining companies in the world. And whether we like it or not, it’s still an important part of our economy, so we should probably own a piece of the action.

Not to mention, when they’re profitable, they’re extremely profitable. So it’s quite clear that some resource companies are worth owning.

And excluding these companies, may actually lead to underperformance over time. Also, it gives your portfolio less diversification, because you’re excluding an entire sector.

If you prefer not to have exposure to mining for other reasons, that’s perfectly fine. But expecting all mining companies to underperform forever, probably shouldn’t be one of them.

Now, I wouldn’t buy these companies if I was picking my own stocks, simply because they’re too hard to predict and the income is less reliable.

But I’m quite happy to own some inside my LICs or an index fund, because the performance and dividends are levelled out by so many other holdings inside those funds.

Resources as a group may not perform as well as industrials well into the future, who knows. But hopefully this gives you another angle to think about it.

Does Whitefield have any debt?

Like AUI, Whitefield also has a small amount of ongoing borrowings – around 10% of the portfolio value.

I’m no expert in this area by any means. But basically, this debt either gets rolled over, or converted into new shares, or both.

Actually, this is one of the reasons Whitefield has flagged a large dividend increase for this year. Because they effectively refinanced this debt at a lower interest rate, giving a boost to earnings.

Of course, having some debt is an additional risk, albeit a small one. But Whitefield has been doing this for a long time. And given the amount is only small, it doesn’t concern me.

Whitefield sometimes trades at a discount

This could be because it’s a smaller LIC. So it’s less well known, and less shares are traded. Maybe the higher fee puts people off. Maybe people expect it to underperform. Or investors simply prefer the other old LICs.

Either way, shares in Whitefield often trade at a discount of between 0% and 10%.

The point is, investors are able to buy the income stream of those underlying companies at a discount. And this often means a higher yield and higher total return than would otherwise be the case.

Here’s what I mean…

Today (7/12/2018), Whitefield trades at $4.26 per share.

As of its last portfolio statement, its asset value was $4.76 per share on October 31.

Since then, the market is down almost 3%. So we can guess the NTA is somewhere around $4.62. This means we can buy this portfolio of assets for roughly 7-8% discount.

Based on the this year’s forecast dividend of 19.75 cents, the yield would be about 4.3%. Or 6.1% including franking credits.

But because Whitefield is trading at a discount, our purchase yield is actually 6.6%, including franking. A whole 0.5% per annum higher.

By locking in this discount and higher yield, it means a higher total return than whatever Whitefield produces with its investments.

This goes a long way to making up for any shortcomings of the company.

Share Purchase Plans

Whitefield also offers shareholders Share Purchase Plans (SPPs) on a regular basis. Usually each year.

Shareholders can top up their holding, brokerage free, up to $15,000 worth.

And these SPPs are usually offered at a discount to the market price (yes, a further discount).

Some shareholders love it, some hate it. And the rest are either conflicted or couldn’t care less!

Why the difference?

Well, some people love a discount. But issuing more shares at a price lower than the NTA, actually dilutes the value of each share slightly.

Here’s roughly how it works…

If a company raises 10% more capital, at a 10% discount to the current NTA, then overall each share is diluted by 1%. (A tenth of 10%, is 1%)

Despite this, smaller shareholders can actually be better off when this happens. Naturally, there’s a break-even point with these types of things.

Using the figures above, an investor with $150,000 in shares will just break-even, even if they take up the offer in full.

Reason being, $150,000 shares being diluted by 1%, will be worth $1,500 less. But taking advantage of the SPP and buying $15,000 shares at a 10% discount, will mean an extra $1,500 of value for the investor.

So investors with holdings smaller than this, are the ones who reap the benefit.

Obviously, if the discount or the capital raised is only 5%, then the dilution is halved. So anyone with a holding under $300,000 would benefit by participating.

My apologies for taking you down that rabbit-hole, but I felt compelled to mention it!

Some investors hate this type of dilution, simply out of principal. And I have to agree with them. But I don’t think it means Whitefield has poor management or makes it a bad LIC.

Long term performance has been good despite these capital raisings. And some investors are quite happy to keep topping up at a discount and not worry about such issues.

So it’s really a personal thing, and I’ll let you decide how you feel about that!

Whitefield’s Investment Strategy

Whitefield didn’t always invest the way it does today.

In the last 5-10 years, the company has really increased the number of holdings it has.

Back in the mid 2000’s and before, Whitefield was more of a value focused investor. It owned a portfolio of around 50 companies, focused more on stock selection, aiming to provide superior returns.

These days it’s much more of an industrial index fund, with some tinkering round the edges. Or ‘enhanced index’ is the correct term.

Certainly, the current approach is lower risk overall. Since they own pretty much every company in the index, there’s little chance of underperformance, but also less chance of outperformance.

And I think most shareholders are happy enough with that.

So, we’re really looking at an industrial index LIC, which aims to outperform and provides a dependable and increasing income over time.

Maybe Whitefield can use its data-driven quantitative approach to squeeze some outperformance. We’ll have to wait and see on that one.

Either way, I think the Industrial index should perform pretty well over the decades and prosper with the Australian economy. And that’s what I’d be focusing on.

Remember, owning shares is about generating wealth and a growing income stream. And that’s done through regularly investing in a big basket of companies for the long term. Not through fancy footwork.

What I Like about Whitefield

I like Whitefield’s long track record of shareholder returns.

Also, the dividend history is quite attractive. That reliable income stream has been paid whether the market is experiencing rain, hail or shine.

I like that Whitefield provides a Bonus Share Plan, similar to AFIC. For those on a high tax bracket, accumulating shares in Whitefield and/or AFIC could be extremely tax effective.

In addition, the company is considered a long term investor in the eyes of the ATO. This allows them to pass on the Capital Gains Tax Discount to you, when it pays out dividends which are sourced from capital gains.

Despite the fancy sounding strategy (if you’ve read about it), Whitefield is still a low turnover, long term investor. So I do feel this LIC suits investors like us. That is, those who approach the sharemarket as a long term business owner looking for the income stream.

Lastly, I do like the industrials focus. Though I’m not quite convinced it will always outperform. But in general, it’s still true that resource companies are more volatile and pay less reliable dividends.

So for those of us who prefer to invest for income, a focus on industrials makes sense.

What I Don’t Like

As mentioned before, I think the higher fee than its peers is a negative. And the external management means that costs are unlikely to come down much.

Also, the fact that Whitefield seems to raise new capital every year at a heavy discount.

Whether you participate or not, and whether you like it or not, you’d have to admit it isn’t a great practice. At least in principal.

I’m not overly keen on the high level of financial companies in the portfolio.

But given this roughly matches the industrial index, that’s just the way it is. So this ex-resources strategy gives Whitefield less diversification overall.

This means when mining companies are doing well, Whitefield will underperform its other LIC brethren. But if you expect industrials to continue beating resources over the long term, that’s only a short term issue.

Summing up this Whitefield Review

Despite not owning Whitefield, I do like it as an LIC. And if I was a high tax bracket investor, I would strongly consider using Whitefield and AFIC as a core part of my portfolio for reasons discussed here.

Overall I expect Whitefield to perform well over the next few decades, alongside the Aussie economy.

I think they’ve proven to be a reliable LIC over the years. And they’ve managed to deliver on that all important criteria – providing a reliable and growing stream of dividends over time.

Currently, Whitefield trades on a forecast dividend yield of 4.6%. Or 6.6% including franking credits. That’s a very attractive starting point. And that dividend should continue to grow over the years.

Whitefield is a long term, diversified, tax efficient vehicle focused on wealth creation through investing broadly in industrial shares.

So if you’re sold on the industrials approach that Peter Thornhill teaches, this is the most targeted way to carry out that plan. And maybe Whitefield is the right LIC for you!

While it’s a little different to the other old LICs, it’s worth considering. I think it’s still a solid choice for anyone looking to build a dependable stream of dividend income for early retirement.

What are your thoughts on Whitefield? Let me know in the comments.

If you enjoyed this post, you can find all my LIC Reviews on this page.

I would pass on Whitefield because of the 0.40 fees being too high for me. Also I do believe our big miners are some of best in world and I would like a piece of that profit as part of a diversified fund.

That’s a fair call mate, and makes sense to me 🙂

Wow, bet alot of people are waiting for this! good job.

AFB would get angry with us if we bought it due to the mer.

I was going to buy more afi today but its annual return has only been 1.7%,, why would this be?

Thanks Andy. Haha yeah the higher fee wouldn’t please Firebug at all.

You’re probably looking at the 12 month return? Likely every old LIC and the market itself has had poor 1 year returns, because it has fallen recently, wiping out previous gains. That just means we’re getting a cheaper price today than we were before. Dividends have been either been stable or increasing, so lower prices are a positive for us buying. The next 50 years of business and economic performance is what matters.

Have recently bought yet another chunk of WHF (quite accidentally and fortuitously during a recent small dip in price – always nice) and in time for its latest dividend due on the 12 Dec. I am regularly buying pretty much only WHF and AFIC now that I am in a higher tax bracket and DSSP/BSP both.

Nice accidental timing Phil!

That sounds like a pretty good approach, and even more hands off because it’s automatic reinvesting. So simple and laid back you could do it in your sleep 😉

Excellent review . I like comparing the Share Price chart with the Dividends chart. The Share Price falls off a cliff during GFC while Dividends continue paying out smoothly as though nothing has happened. 6.6% payout seems nicely respectable.

Cheers Hunter!

I love comparing those as well. Offers pretty good peace of mind going forward being invested in LICs. Not that a crash won’t be scary, but that we can focus on the more reliable income which hopefully won’t have fallen by anywhere near as much as share prices.

Hi Dave,

Great write up! You’ve really established a great resource for dividend focused investors. In particular I love the graphs of dividend history. I buy LICs if they’re at a discount to NTA but if they’re at a premium or the dividend yield of VAS is higher I buy VAS. One idea I had was that it would be interesting to compare the LIC dividend history graphs to VAS over time.

I have a fair bit WHF, that discount to NTA really gets me hot under the collar.

Great article!

Thanks very much Andrew!

That’s a pretty good way of doing it, I mostly approach it like that too.

I’m keeping a track of VAS dividend history for the purpose of comparing. Hopefully it becomes an interesting comparison later. I do expect VAS dividends will be more lumpy for a few reasons, but should be interesting to look at anyway.

Haha, I’ve never heard someone express their love of the NTA discount in such a way before! 😉

Great write up Dave, love reading the blog

FYI also Intelligent Investor has a list of WHF dividends going back to Nov 1979 below and also shows Franking when dividend imputation was introduced in 1987

https://www.intelligentinvestor.com.au/company/whitefield-limited-14131/dividends

Thanks for that Baz, glad you’re enjoying it!

Hey Dave,

To help me recover from my work Christmas party hangover I did some mild spreadsheeting:

https://docs.google.com/spreadsheets/d/e/2PACX-1vSuKckzzxMWeL-9LZfGQdtZsGbh_fOjRlGGtlqc3FPGtB2eqqG-dMb_h9PLNv87CgPJYVxWAOowNY1w/pubchart?oid=1908723049&format=interactive

Here’s the working:

https://docs.google.com/spreadsheets/d/1c0zYcB7-noDqFtoeKsE8HwRrGdOegtQ0wNxKtwpv0Yc/edit?usp=sharing

Nice work mate. More effort than I’ve gone to!

I used the financial year figures as opposed to calendar year, not sure why. And didn’t bother with franking, just assume about 75% franked on average. Will be interesting to watch over the next 10-20 years how it goes.

Hi SMA,

Excellent review. I already hold AFI, MLT, ARGO, & BKI and therefore wont add anymore. That being said, as stated, excellent information here.

Cheers

The Incompetent Investor

Cheers mate. That’s fair enough, I don’t hold it for pretty much the same reason. Thanks for reading.

Possibly the most awaited post yet! There must have been some huge excitement in your readers when they saw the title pop up.

A great take on it and in some ways that I hadn’t considered before. I really like your take on the fact that there are so many holdings plus the industrial focus making it particularly index like (more so than ARG, AFI etc – or possibly just a different ‘index’) So if you want industrials only then this is for you – with the associated considerations.

I had a quick search through ETFwatch to see if there were any actual ETFs based on an industrial index which I couldn’t find. I imagine an ETF would likely come in with a lower MER. So WHF have definitely managed to differentiate themselves from other LICs.

I think their MER has dropped a bit over time. But I would hope that such regular capital raising would result in increased funds under management and hence lower fees. Their market cap hasn’t seemed to increase substantially over time and their share price seems to be a bit below pre GFC level now. This probably applies to many similar LICS I suppose.

All that aside, the steady and increasing dividends through ups and downs and the BSP to me are a great reflection on quality.

Nice post, thanks!

Thanks SJ. Haha, one can only hope readers are excited, rather than eye rolls when the post comes through!

Yeah there’s definitely no other industrials product, so this is the one for people who strictly want to follow that approach. Would be great fees did drop over time, but given the external management charging a fixed %, I’m not sure that’ll happen. Have to wait and see.

Great comment mate, cheers.

I really enjoyed your review, you have a fantastic ability to discuss the financial world in a way that’s easy to digest for those of us with thicker heads than most…

What I found interesting was the ‘Strategy’ paragraph whereby WHF changed focus about 10 years ago. I guess this could highlight one of the ‘cons’ of investing in LICs. You would have assumed back then that the oldest LIC on the market would continue to operate as it had. Assuming an investor ploughed a sizable chunk of change into the company thinking it would invest in a certain way, which may have aligned with the investors approach, then to shift focus as it did, (disregarding the performance since) if the investor didn’t agree with the new investment approach WHF has taken, I’d assume they’d be pretty disappointed.

Thanks oddshapes, that’s nice of you to say!

Yes it could definitely be seen as a negative, if shareholders were hell-bent on the way Whitefield was investing before. But mostly I don’t think they would care, because the portfolio just got bigger over time and the dividend has been reliable – that’s all most owners would worry about. It’s only recently I think Whitefield has started explaining what it does differently these days and has been working on in the background. I read about it and just shrugged my shoulders – partly because the language used is confusing and partly because I don’t think it will make much difference. This approach is arguably lower risk than the old approach given it’s more index-like, but it does highlight a risk in LICs that they can make changes the investor doesn’t like.

Been looking forward to this one for a while as on only hold AFI & WHF with BSP/DSSP! The simplicity of this strategy has been perfect for me to build up my core portfolio. Instead of just looking at NTA i tend to just try and reduce my cost base wherever possible as i feel the NTA will fluctuate and is actually paying attention to the nonsensical movements of the market. Currently great opportunities on both!

I’m currently still researching my satellite aspect of my portfolio and would love to be able to get my broad range of international diversification for just a few ETF’s for this aspect. I know a lot of people go VGS VAE VGE VTS etc but since VDHG came to the party recently what are your thoughts on a simple approach pairing this with VAE? Missing anything significant here?

VDHG Allocation:

Percentage

Vanguard Australian Shares Index Fund (Wholesale) 35.9%

Vanguard International Shares Index Fund (Wholesale) 26.4%

Vanguard International Shares Index Fund (Hedged) – AUD Class (Wholesale) 15.9%

Vanguard Global Aggregate Bond Index Fund (Hedged) 7.3%

Vanguard International Small Companies Index Fund (Wholesale) 6.4%

Vanguard Emerging Markets Shares Index Fund (Wholesale) 5.0%

Vanguard Australian Fixed Interest Index Fund (Wholesale) 3.1%

Paired with VAE Country allocation of:

Market Allocation VAE Benchmark

China 32.7% 32.7%

Korea 15.6% 15.6%

Taiwan 13.5% 13.5%

Hong Kong 12.0% 12.0%

India 11.2% 11.2%

Thanks Paul.

You can definitely just go for VDHG, but then you’re doubling up on Aussie shares and getting bonds with it too, probably not what you want. I think VDHG is more suited to be a ready-made portfolio as opposed to being blended with other stuff. You could have a portfolio just VDHG and VAE and that would be fine. But considering you’re still going to have mostly Aussie LICs, I’m not adding both of those makes sense.

I’d probably just go with VGS as it’s very broad already, and if you really want more Asia, then you could add VAE in a smaller portion. Given this won’t be a large part of your portfolio I would shy away from adding more bits and pieces as it’s not going to make much difference to overall returns/diversification. There’s an infinite number of ways you can slice it so I would just say keep it as simple as you can. You’ve already experienced how good simplicity is, why not continue that theme? 🙂

Thanks for doing this Dave! I’m an owner of Whitefield and recently bought more during the SPP offer. I’m a Peter Thornhill convert though 😉

Thanks for reading Jacqui!

Great blog! Enjoy your work.

Dave, would you know the comparison with the other older LIC’s on performance after fees and taxes over say 30 years. Have a guess that WHF would still fair well even after the higher MER is taken into consideration. Would you know if this is true?

Thanks again.

Thanks for reading Rich!

Nah sorry I don’t have any data going back that far. We can only take a guess on that, but I think they wouldn’t be too far apart from each other. The figures I focused on in this article are after fees and they seem pretty decent. I suppose future returns matter more than past returns, and I would expect them all to perform similar – somewhere around the market return, give or take a bit.

Rich, not exactly what you’re after but the link to the chart below compares WHF to ARG & MLT being Thornhill’s LIC holdings except for BKI which doesn’t go back 20 years in it’s current form.

https://cuffelinks.com.au/lics-vs-berkshire-imputation/

PS: excellent article as usual Dave.

Good stuff mate, thanks for that! Can’t believe I forgot about that chart – 20 years is still a decent comparison.

Smashing new logo, your design or outsourced

Oh thanks! Outsourced of course, I have no idea what I’m doing haha 😉

What a great review Dave, I’m so glad I stumbled onto your blog. I’ve never seen another place where LICs get reviewed so thoroughly!

Pardon the selfish request – do you have any intention of review the WAM portfolio of LICs? Given most of them have high dividend yields, yet with high performance fees, I would imagine many of your readers – myself included – would be interested to see how it fares next to the best of the rest.

Cheers Mike, great to have you here!

Thanks for the suggestion. Haven’t decided how many other LIC reviews to do. It’s pretty likely the more I do, the more questions and confusion it’ll create over how many to have, which ones, building a portfolio etc, so I’m pretty conflicted there. The last thing I want to do is confuse people, so out of simplicity’s sake I won’t be doing a lot more. So it’s a maybe 🙂

That’s fair enough. Decision fatigue is certainly a thing – something I get when I try and get my friends into the long game, the first question is ‘I don’t even know where to start’.

I guess a better post would simply be to inform people what to look out for when actually choosing an LIC, which you’ve more or less covered in several posts. Things like real rates of return (after fees & expenses), NTAs, and whatnot.

Keep up the good work in any case!

For a little bit more Whitefield info;

Peter Rae from IIR included a Spotlight on Whitefield segment in his latest LIC update for 2018.

https://cuffelinks.com.au/final-monthly-lic-update-dec-2018/

Main thing to note is that their investment strategy has changed a bit from long term to medium to long term objectives.

Interesting to see how it unfolds.

Howdy Dave.

I was checking ShareSight tonight. I was curious as my accountant (a good mate of mine) gave me a bit of shit a week or two ago about AFIC not beating the market. Anyways …..

Total dividends since March 29 ~

My Six Park ETF portfolio has been comparatively ordinary = 4.70%

The following ETF darlings in that time:

A200 ETF = 11.64%

VAS ETF = 11.93%

And AFIC = 10.3% so not far off but including that big dividend pay out in June

But good old WHF (Thornhill industrials-style) = 14.45%.

Can that be right? If it is then that’s pretty cool.

I was starting to drift away from the idea of having LICs in my investment rotation and leaning towards ETFs instead. But this little find has me enthusiastic about them again. And the Bonus Share Plan is excellent.

Thoughts?

Hey SOL. My first reaction is who cares? Whether it beats the market over 1 year or not is irrelevant. Short term performance should not be how you decide what to invest in. You decide what to invest in by finding suitable investments that match your investment philosophy and how you’re happy to invest long term.

The fact that Whitefield performed better than the index over a year means nothing to me. Sorry to be blunt but it’s really important to build a portfolio you’re happy with and not try to find the ‘best’ option. Otherwise you’ll be second-guessing yourself every 6 months and wanting to change your portfolio as different investments do better than others. Only knowable in hindsight by the way.

If you’re concerned about LICs underperforming and that’s a dealbreaker for you, then don’t buy them, or you’ll keep wishing you didn’t if they lag the market. But if you’re happy with the features they offer – consistent growing income, and Bonus Share Plan in this case, then choose them based on that. Either way, this looking at short term recent performance to create a portfolio is a recipe for disaster (and stress) no matter what asset you’re investing in.

Another point to consider, and Dave please correct me if i’m wrong here.

I remember reading something last year that AFIC’s coverage ratio is around 2.80x with some 100m in franking credit reserves, so in the event of a market downturn they would still be-able to maintain their dividend payout for a couple of years before needing to cut which is pretty valuable to a dividend growth investor.

AFIC demonstrated around 26% less volatility than the index ETFs during the GFC. Perhaps you could mention this to your accounting friend!

All excellent points, Dave. I guess I was pointing out that while many FIRE types seem to be jumping off LICs in favour of ETFs, including yourself if I remember correctly, they still hold their own compare to other investment vehicles regardless of your end goal. I had considered going with VAS, etc for a while but I suppose I was just reinforcing to myself that there is nothing wrong with having these old listed investment companies as part of your long-term portfolio. So I think I will continue to do so. I am in it for the long haul and a passive income from these investments is all I’m after. Thanks for your thoughts.

Sounds like your reasoning for holding is still valid. These old vehicles aren’t going away, their popularity will wax and wane through the cycle, often depending on what type of stocks are outperforming. Currently high growth and speculative stocks are doing better, so managers who focus on value and income aren’t keeping up with the market. At other times value/income stocks will outperform. Overall, it’s important to be invested wherever you feel most comfortable. Hope that helps 🙂

To be clear, I’m not ‘jumping off’ LICs, most of my portfolio still comprises LICs. Others can do what they like. Either way, it should be a decision one comes to by themselves, not based on what others are doing. My reason is I now have a greater respect for index funds because of the ‘skew’ factor I mentioned which is an important distinction. But I have no intention of removing LICs from my portfolio or changing my strategy.

I share your philosophy, Dave. Thanks for your thoughts.

Hello Everyone …

Thanks very much for the discussion on WHF as it has helped me to remain ” on target ” with my new outlook on the market in which l hope to set up a ” Permanent / Unbreakable / Never Sell / ” portfolio

for my family to inherit .

By way of interest , whilst l hold WAM myself , l would not recommend it as a hold because of its lack of sound fundamentals and its Performance Fee of 1 % !

Additionally , a lot of trading takes place in which the win: loss ratio is less than 50 % which reminds me of the ” Turtle ” [ gambling ? ] method of trading rather than investing in a rational way !

Take it easy , Ramon .

Thanks Ramon. WAM is a very active manager that’s for sure, though they do have a solid track record in the small/mid cap space.

These days I do tend to prefer the simpler approach of the old LICs that mostly collect dividends and pass them straight onto us!

Another great review! I love this series. Even though it’s a couple of years old, there’s still heaps of useful and relevant information in there.

I’m interested in Whitefield, but the MER is putting me off at the moment. It’s 0.42% now, as at the 2020 Annual Report, so it’s not exactly coming down.

BUT my current intention (at this early stage of the FI journey) is to buy a decent chunk of Whitefield towards the end of the accumulation journey to ensure income is coming in regularly throughout the year, because they pay dividends in different months to most other funds (paying in early-mid June & Dec). Being used to a fortnightly salary for so long (or weekly if you factor in hubby’s salary, as we get paid on alternate weeks), I like to know I’ve got regular income coming in and their timings will help with cashflow between quarterly ETF dividends 🙂 Don’t worry, I plan to have a cash buffer as well, but wouldn’t it be great to not need to use it!

The dividend timing alone is not enough reason to buy it, but if they maintain their history of not cutting dividends and historically good performance relative to their benchmark, then they will probably still be a solid performer for an income investor and the dividend timing is the icing on the cake to make budgeting just a little bit easier (especially as we currently have a number of larger expenses due in June and then obviously Christmas).

On the other hand, the seemingly fairly regular SPPs (they’ve just completed the 2020 one) are a positive for growing the investment over time (the BSP isn’t of much value to us), so maybe I need to think about it earlier than intended…

I keep coming back to the higher than ideal MER, but their performance has been pretty good over a long period of time, so maybe it’s worth a bit extra in fees??? It’s still not exorbitant like some managed funds (or even WAM and friends).

Loving this journey so far, despite the myraid of options to choose between! Thanks for all the info 🙂

Hi Dave , was just wondering if your sentiments on whf are still the same ?

Hi Luke. Pretty much. Still a suitable LIC for long term investing and a reliable income stream, but I’m not really a fan of the fees or the slightly fancy strategy they seem to be running according to their presentation. Does that help?