Close Menu

May 1, 2021

Original post: June 2019. Updated: September 2021

A few years ago I wasn’t all that keen on investing in Australian index funds. In fact, at the time I wrote an article on why I preferred LICs over ETFs.

Yet fast forward and now the Vanguard Australian shares index fund (VAS) is the biggest holding in our portfolio.

So what’s changed? Well, my thinking has been evolving over the last couple of years. On index funds, and share investing in general.

This post looks at why my thinking on index funds has changed, the different options for investing in Australian index funds, some of the benefits and what convinced me that indexing is the best option for most people.

As of 2018, we started buying shares in an Australian index fund.

Basically, as the market was falling the LICs we own barely moved. Because this is a common occurrence (LICs regularly trade at premiums or discounts), and since I wanted to take advantage of lower share prices and higher dividend yields, I decided to buy an Aussie index fund instead.

This way, it gives us more opportunity to buy shares at attractive prices, versus holding LICs only. That was the primary reason, but it was also on my mind for other reasons which I’d been thinking about for a while.

The Aussie sharemarket gets a bad rap sometimes for being pretty concentrated. And to some extent, that’s fair.

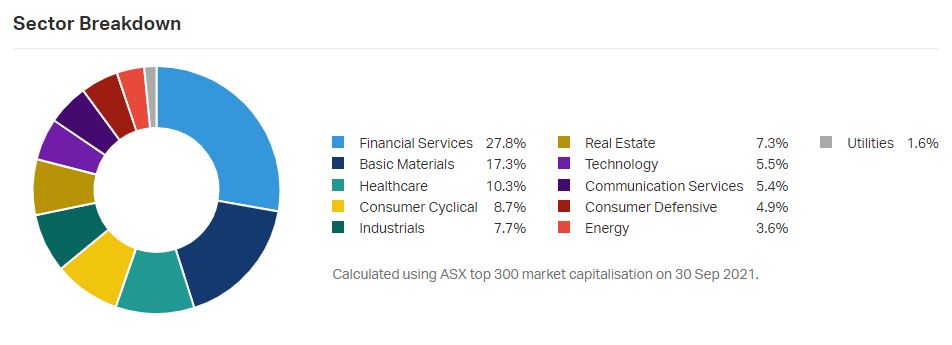

It was only a few years ago that over 40% of the ASX300 index was in the Financials sector. But today (September 2021), Financials are less than 30% of the ASX 300 index.

Traditionally, some old LICs like Argo and AFIC have made an effort to avoid being too exposed to one sector of the economy. And when you have a Financials sector at over 40% of the market, getting more sector diversification is appealing.

Not to mention, we have a small but growing technology sector, a sizeable number of fast growing small and medium sized companies which become larger parts of the index as time goes on.

But the next thing is what really convinced me of the power of index funds.

Every now and then I learn something that blows my mind. The skew of sharemarket returns is one of those things.

And actually, this factor, more than any other, convinced me of the power of index funds in Australia (and everywhere!).

Nicely summed up by Michael Batnick in this post called “The Skew”:

“It’s not just the fees or the competition, but rather, the simple reason why so many managers fail to beat the benchmark is because so many stocks fail to beat the benchmark. The biggest winners have an outsized impact on the index, and there is a steep price to pay for missing them.”

Batnick sites a study done from 1994-2016…

It shows the performance of the US sharemarket over that time was 7.3% per annum. But if you had missed the top 10% performing stocks each year, your return would drop to 2.9% per annum. And if you missed the top 25% performing stocks, your return would be -5.2% per year.

Another great example of this factor is this post from A Wealth of Common Sense, by Ben Carlson. Ben shows research from Longboard Funds using data from 1989-2015, with the following findings on individual stock performance.

Well, all of the gains in the S&P 500 came from the 20% best performing stocks. Incredible! Not only that, but 40% of all stocks during the period actually had a negative return.

Now, we don’t know if this is always the case. Or if this factor is the same with an Australian index fund. But I do think it’s extremely likely to be an ongoing theme of markets and is a similar story in many countries.

The harsh reality of business is this: many struggle, a few do reasonably well, and some are insanely successful. Essentially, the Pareto Principle, or the 80/20 rule in practice.

Despite the above being a major reason that convinced me to add index funds to our portfolio, there are other positives.

Simplicity. Having one holding which owns the market and knowing you can hold it forever is a pretty powerful concept. There is no decision-making required.

Owning an index fund today which holds the top 300 Australian companies is nice. But by owning the index for the next 50 years, you’re also guaranteed to own the top 300 companies in 2069, whatever they are… (space mining, alien communications, multi-planetary transport, time-travel companies?). That’s even cooler!

Index funds are self-cleansing. An Australian index fund will simply hold the largest companies by market value all the time. As companies grow and shrink, some will rise, others will fall out of the top 300 and are replaced with new, growing companies.

And as industries change over time, your index fund will change to reflect that. So it really is a one-decision investment you can own and accumulate over your lifetime.

Low cost and low turnover. Index funds are the cheapest, most diversified investment you can buy. Lower fees mean more dollars in your pocket as the end investor. And because index funds buy and hold, there is very little selling of shares, meaning they’re very tax efficient too.

We discuss the benefits of indexing in more detail in this podcast: Why Invest in Index Funds?

Here are some of the most popular choices for Aussies wanting to buy index funds which track the ASX 200/300.

VAS. Vanguard Australian Shares ETF (ASX 300).

This index fund is managed by Vanguard and owns the top 300 companies in Australia. The management fee is 0.10% at the time of writing, and this ETF has been running since 2009.

A200. Betashares Australia 200 ETF.

This index fund is managed by Betashares and owns the top 200 companies in Australia. The management fee is 0.07% (currently the lowest of any option), and this ETF has been running since 2018.

IOZ. iShares CORE ASX 200 ETF.

This index fund is managed by BlackRock and owns the top 200 companies in Australia. The management fee is 0.09% and the fund has been running since 2010.

All of the above funds pay dividends on a quarterly basis, and I would consider each of them an excellent choice for investors wanting to invest for the long term in an Aussie index fund.

The reason I chose the Vanguard Australian shares index fund (VAS) over the other options is for the following reasons.

1– VAS tracks the top 300 rather than the top 200. Those extra 100 companies are only a small percentage of the fund today. But as the economy broadens over time, those 100 companies may become a bigger part of the index than they are now. Plus, I figure why not buy the broadest index available?

2– Most index fund providers are profit-motivated (which is fine), but the parent company Vanguard US is essentially a not-for-profit company (by that I mean all profits are returned back to investors in the form of lower costs).

Although Vanguard Australia isn’t the same as this, the fees are still flowing back to the ‘not-for-profit’ Vanguard US. Besides, I fully expect Vanguard and other broad index funds to end up at basically zero fees eventually.

3– Vanguard have a proven track record of indexing over many, many decades – longer than most index fund providers.

4– VAS has also started doing securities lending (letting traders borrow stock to sell – a very common practice that many index managers in the US do as well). This helps the fund earn some income and results in higher returns/lower net fees.

So that’s why I chose VAS. But to be clear, there is nothing wrong with the other low-cost index options in Australia!

After learning more about indexing (especially the skew factor), I have a much greater respect for index funds.

It’s the simplest way to invest for everyday people, and you can be confident that whatever happens over the next 50 years, your index fund will reflect whichever companies are important in Australia at the time.

Don’t get me wrong, I still invest in other things, like LICs and real estate trusts. But index funds will be a large part of our portfolio going forward.

They’re low cost, diversified, tax efficient, and you can comfortably own it and add to it forever!

How do index funds fit into your portfolio? Share your thoughts in the comments.

By the way, if you’re interested in the spreadsheet I use to keep track of my annual dividend income over the years, enter your email below and I’ll send it to you.

Great post on the trusty old VAS index fund. We have a very simple two fund portfolio, VAS and VGS, which up to this point has had a greater proportion in VGS but I’m in the process of now increasing the proportion of VAS due to the much better dividends that it provides. I do like holding VGS though for international exposure and for the same principles as that of VAS where it holds around 1,500 of the world’s developed economies’ best performing companies. And all for a very reasonable management fee of only 0.18%!

Thanks for sharing. Can’t fault your approach SOL Guy, sounds pretty good to me.

Another great article Dave. I too have become more interested in the likes of VAS & STW (yes I know, has higher fees & only asx 200),so good argument for VAS. Haven’t purchased any as yet, saw that great entry late last year,but was busy/dreamin’/whatever & missed it,so will just wait for the ‘next one’ I feel comfortable with, meanwhile happy to receive the income from my LIC’s & to top up on these as the occasion arises. But a good case for the index/VAS is watching the steady price rise from the low point late last year,a good learning curve for me. Keep up the good work.

Cheers Monk! Nothing wrong with STW – fees will probably come down over time to be competitive with the others. I think what you describe is a good reason to simply buy when we have the money, rather than wait and hope the market falls 🙂

Great to see you making the move to indexing Dave!

Excluding cash I’m currently about 95% indexed with the active stuff being one small cap managed fund and 3 individual stocks. One of these stocks is in an employee share plan from an ex-employer which hasn’t vested yet, another one is about to be sold off to harvest a tax loss, and the other one I can’t sell because I would have to pay silly amounts of capital gains.

Thanks for that mate. What is the small cap fund if you don’t mind me asking? Employee share plans seem pretty common these days? I’ve heard from a number of people doing this. Often it’s a great deal too!

The small cap fund is in my Super, its the Colonial First State Future Leaders Fund. I think small caps is one of the areas where active managers may be able to add some outperformance vs the index so I figured I might as well have a smallish allocation there.

Interesting. I tend to agree. The SPIVA figures show that Aus mid/small cap managers have fared quite well compared to every other category, with around 50% beating the index over 15 years from memory. No guarantees for the future but it does stand out as a point of difference.

Do we move in lockstep!

I’ve since moved back to investing in index ETFs.

In my case though I’ve felt compelled to add international stocks and am now plowing all spare money into VGS.

Any change of heart on international stocks on your part? I.e will you start accumulating them sooner rather than later?

Haha! Interesting stuff. So you will no longer add to LICs, or you’re simply concentrating on international at the moment?

No immediate changes planned. But I did recently stop stock-picking in my super and switched it to 100% international. So there is exposure but our FI portfolio will continue to be Oz only.

Just concentrating on international at the moment.

I think I’ll go for 50/50 Aus/Intnl.

LICs can take a back seat for now,

Though having diversity in investment structure does appeal to me, so I likely come back to LICs.

Fair enough mate. I do love the idea of 50/50 and the simplicity in it, and often think that may end up as my portfolio in the long run. The very, very long run 🙂

I’ve also gone 50-50 international and Oz, with the international component in super and outside-super investments being Oz. Paid off house with the balance sitting in offset waiting to pounce should Cheezel Dust Head do anything stupid to tank markets.

Not FI yet but my financial concerns for the past 30 years or so are now allayed thanks to the simplicity espoused on sites and posts like this. Cheers Dave!

LOL Cheezel Dust Head… can’t say I’ve heard that before!

Sounds like a pretty good approach to me Chris 🙂 And thanks for your support mate!

Hi @Pat, I would love to hear the reason why you move from LICs to VGS (and why International focus instead of VAS which is Australia focus)?

Like the idea of eft’s. It seems set and forget

Do vangauard have other eft’s that would provide good dividends for income in retirement

Hey Len. It’s definitely set and forget. Well, VAS provides around 4%ish plus franking credits, which is pretty good. Vanguard also has a high yield fund VHY which pays higher dividends, but I don’t like it for a few reasons. It’s too concentrated and it’s high turnover, so the dividends will be a erratic and not tax efficient.

Nice write up.

I have both an LIC and Index funds. I like the idea of going half and half while I continue my way to FIRE.

Cheers Houston! That sounds like a reasonable choice – thanks for sharing. I like both as well 🙂

Hi Dave, another great blog post.

I own 4 LICs (AFI, BKI, ARG, MLT) and have been thinking recently about the fact that they’re all actively managed investments and maybe I could add VAS to reduce the human factor in my portfolio. I have Vanguard in my Super so I thought maybe I keep that split: I buy LICs on my own and have Vanguard in my Super.

Probably because I recently finished reading “The Little Book of Common Sense Investing” and “Unshakeable” is why I’m considering VAS, so I’m waiting a few days in case I’m seeking for confirmation bias. But from looking at the numbers (cost, return), adding at least an index fund is still definitely still an option.

Thanks for the work you do.

Thanks Plutarch!

Love that book (Common Sense Investing) have recommended here previously! Haven’t read Unshakeable. I read Tony Robbins other Money book and it was just too long-winded with too many ‘perfect/bulletproof portfolio’ style claims in it. While I continue to think the old LICs are sensible long term investments, hedging against the human element is not a bad idea.

Which súper are you with?/how do you add vanguard to your super (is it smsf)?

Great article Dave!

I completely agree with you about the index being less impacted by those potential franking changes. They would be still affected though right? Just not as much as LICs? Could be wrong.

That’s the one thing the election really opened my eyes to was how drastic tax reforms can potentially be.

I know tax laws shouldn’t be too high as a deciding factor but I’ll be honest, I didn’t even think such a drastic change to the system was ever on the cards. I was completely naive but those refunds were part of our plan and I’m just glad to have been educated so early that major changes like this can not only happen but should be expected. It made me re-evaluate our strategy. Nothing major, just thinking about some tweaks to mitigate future changes.

Can you imagine if you’d retired and stopped working only to have the rug pulled out from under you like that?

I’d read about the skew a few times but this was a nice summary dude.

I can’t believe it’s been two years since you pulled the pin. I need you back on the pod to tell us all how it’s going.

Take it easy

Thanks Firebug!

Totally right of course, I didn’t word that properly, have gone back and fixed it up. It’s a good reminder that things can and will change and to be adaptable!

For the people less well-off, 100% reliant on franking refunds, and later in life with no real option to earn extra cash, it would have been a scary time indeed. There is always the pension, but that’s not really the point (you retire with a set of rules and a certain investment income and all of a sudden they’re changed). Luckily early retirees as a group I’d say are probably a pretty resourceful and resilient bunch and will just figure things out as they go!

Sure mate, just let me know and we can organise something 🙂

Hi I am thinking of buying some LIC’s for the first time, having only ever purchased ordinary shares in the past. I see that they charge management fees – might seem like a silly question but they do they charge you fir holding the units or do they fees come out of dividends before they are paid out?

Hi Kate – not a silly question at all. The fees are taken from the earnings of the company before they pay a dividend to you. And with an index fund, I believe the fee is deducted from the value of the fund each month in increments.

Thanks for the excellent overview. I’ve been living overseas for the past 6 years and will return to Australia in a year or two so great to understand what my investing options are.

Good stuff Mr Simple Life! Love that name by the way!

Hedging your bets – I like it! Are you looking at weighting more towards the index or keeping it 50/50 index/LICs?

We used to stock pick in our younger days so we’ve got quite a few individual stocks and LICs. Most have performed quite well though there are a couple that are dragging us down. These days I’m time poor and rarely get time to research stocks, so we’re now buying up indexes instead. Current weighting is about 40/60 index/active but looking to shift to 80/20 index/active over time.

Thanks for sharing your approach! Having investments that require zero effort and simply return cash to you is about as good as it gets!

I don’t have a set percentage in mind at this stage, I’ll just buy whatever looks attractive at the time.

Gday Dave,

Completely agree with you in regards to the simplicity of index investing. I’ve had investment properties before and they’re hard work, require attention and are time consuming. Index investing truly seems passive in comparison.

Ps. Many thanks for the SelfWealth link. Loving my free trades 😀

Awesome no worries Linc! I hear you on the properties mate – besides the pain they’re also very expensive to own too. The index or LIC approach is extremely passive in comparison – you buy the funds and sit back while your hundreds of companies work hard and the dividends roll in. Heaven on earth!

Not looking to add any global index tracking ETFs?

Hi Aleks. Later down the track we will, but not at this stage. Trying to build a higher dividend income first.

Wow, that perspective on the Skew is amazing, and something I hadn’t heard or considered before – and I can’t understand why given how important it is!

Indexing Ian is thrilled to hear all this by the way, as well as choosing his same index investment of choice, the Vanguard ASX 300 index fund 🙂

Great post Dave.

Cheers,

Frankie

Thanks Frankie! I know, it’s crazy the skew doesn’t get more airtime. We all know by now that low cost, low turnover, diversified funds are important, but this skew factor seems much less known.

Haha good old Ian! I’ll pop by shortly to catch up on the gang 🙂

So I just checked the annual dividend yield for VAS and it’s 4.63%… so it’s pretty much an exact net return to LICs ?

46k/ $1,000,000 on LICs

And the dividends are paid once or twice a year like LICs ?

Thanks

The dividend yield of VAS is usually close to that of the old LICs (except BKI which is higher). Distributions are paid quarterly. Basically whatever the ASX300 has paid in each quarter as dividends is what you’ll receive, so it’ll fluctuate than the LICs year to year.

Another great post Dave!

I just began the investing journey. I am investing in small quantities in VGS,A200 and ASIA (40:40:20).

Appreciate that George, and thanks for sharing!

Another great article thanks???? Have your thoughts on lics changed or are you still a fan? I had quick look but is there any data showing what percentage vas divs have increased/declined each year. In gfc situation I guess the divs would drop more than the lics right?

Hey Luke. Not really, I’m still a fan of the old LICs. Yeah you’re right, dividend cuts would be more harsh with the index and the LICs will provide a cushion to that. For this reason, if we held the index only we’d need to hold more cash as backup. I provided a chart of the dividends from VAS in this post under question #3 (similar trajectory to the LICs as you’d expect). I measured in financial year (for some reason), but calendar year shows a more lumpy trend. Hope that helps.

This will be one of your seminal pieces I think. Very good write up and given me cause to rethink a few things. Thankfully I already have a good chunk of VAS I bought back in early 2016 when the market was quite low so nice returns there (I’ve had DRP switched on all this time for it as well). I should have used the December 2018 flash-crash to buy more when it hit $69. I won’t make that error again.

>>> The index is also not at risk of franking credit changes, should that issue come back on the scene!

VAS is still partially franked (about 70% I think). Why would you say that it is not at risk? Didn’t quite get that.

In a recent post, you showed that your share portfolio was about 38% of your overall wealth. Of the 38% are you saying that VAS is now your largest holding? It would be interesting to know how you intend to proportion your LICs and VAS within the 38% — so are you thinking something like 50% VAS and 50% LICs?

Thanks again! Scott

Thanks for that Scott! Haha there’ll always be times when we wish we bought more (or less), hard to know in advance tho!

That franking credit bit wasn’t worded properly, have fixed it up now. I just meant index isn’t specifically penalised whereas company structure (LICs) are since they pay some tax. Both are affected if refunds are axed of course.

Our shares are roughly the same as in the update. Milton is our biggest holding. VAS is now second (mostly due to capital growth), then Argo/BKI shortly after. No plans in terms of percentages. I do like having a similar amount in each but will also buy whatever looks attractive to me at the time. So I don’t expect any big changes, but I wouldn’t be surprised if the index becomes the largest holding.

Nice post, and well researched.

Most of the data that you present relates to the US market, where the largest companies (like Apple, Microsoft, Amazon, Mobil, etc.) are dominant behemoths and the “skew” factor is more obvious and probably more persistent than in the Australian market.

I still prefer the old-style LICs for investing in the Aussie sharemarket, and I also like the idea of investing in LICs that invest in companies outside the top 20 – e.g. MIR, QVE: they do very well from a dividend point of view and I don’t believe that the skew problem is so big in Australia (I don’t have data to back that up). I also mix things up with some more actively managed and nimble newer LICs.

My exposure to VAS shares is very small, and I don’t see any real advantage in owning them instead of AFI and ARG (the returns are similar but these old LICs also give us the tax advantages of LIC gain deductions and more franking credits). And lately the LICs have been trading below NTA (VAS never does).

But I would find ETFs almost indispensable if I wanted international exposure.

As you say, there is no correct method in investing.

Thanks for the interesting comment Robert!

Yes I’m not sure if this skew is as strong in Australia but I would think it is still a factor. We do tend to have a large number of companies that have been in the index a long time (more so than exists in other countries) so perhaps that points to less skew and less companies falling by the wayside here than in the US.

Like you, I also like the old style LICs and fundamental focused managers who’ve been around a long time, especially for those of us who reliable dividend streams are important. Appreciate you sharing your thinking on the topic.

Thanks for another quality article Dave. I am also following a similar path, I purchased VGS and VAS late last year through my super fund Hostplus. I buy through their Choiceplus option which is similar to an SMSF but without the hassle. I also have a few LICs ARG, AFI and BKI, and I’m happy with this balance so far.

Cheers Cat 🙂

Glad you liked the article and that you’ve got a balance of investments which you feel comfortable with!

There’s a lot of logical problems with the positives listed for the extra 100 shares held by VAS vs A200 with it’s much lower fee, so I felt compelled to give back and help you guys.

Points:

1 The 201-300th share make up <3% of VAS, so the impact is tiny;

2 Any impact of tiny shares suddenly growing fast and being worthy of the top 200 is limited only to their growth before they qualify for the 200 by market cap, making the impact smaller again;

3 Tiny companies in the growth phase contribute very little to the yield part of the ETF return and often just go bust, do you have 2-3% of your holding doing not much at all;

4 In A200 you're holding the biggest by market cap, so you are more concentrated in productive stocks than VAS, small impact but still there;

5 A200 much lower fee causes much closer market return following and less fee decay over time, compounding makes this difference grow the longer you compare it to VAS;

6 The extra 100 stocks will constantly be filtered into the bottom of A200 and the bottom of a200 back out, so you get the benefit of the bottom 100 stocks that get productive enough to enter A200 index without holding extra that never make it;

7 200 vs 300 will have almost no mathematical impact on diversification, even 3-8 shares in widely varied sectors can become more diversified than an index fund, as you have little correlation with all passive index fund holders, who are in turn totally correlated to each other. The extra 100 stocks are probably also mostly mining and pipe dreams;

8 You get no ETF provider diversification of you hold VAS and VGS. I hold VGS, A200, IVV, and NDQ, to spread my exposure.

Hope that helps. Do your own research and don't rely on me at all, this is just my opinion. Take professional financial and legal advice before doing anything.

Thanks for your thoughts Simon. I’m not sure it’s all that illogical if one thinks about it, but of course I’d say that 😉

– I noted the extra 100 shares are small. My main point is since the broader index is available I just prefer it as I do expect the 200-300 to become more important than they are now, as our market hopefully matures and broadens out a bit more. Mostly a personal choice, but either way, I don’t see the point quibbling over a few basis points, because as I said…

– I expect all fees to head to zero over time, so it makes little difference. Happening already in US, bound to happen here. This means all projected ‘fee savings’ are out the window and you might as well choose the highest quality provider who puts investors first, has a long track record and a broader product. Projecting savings means assuming all fees stay the same forever. Ain’t happening.

– A200 has almost no record in index tracking so investors are just assuming they’ll be a good tracker. VAS has proven to have basically zero tracking error and now does securities lending which will bring in extra revenue to boost returns (not sure if A200 does this).

– New funds are at risk of closing down if they aren’t profitable for the provider. Unlikely to happen with A200 but still something to consider (last year when I was deciding).

– Given I hold only one index fund, provider diversification is a non issue.

Both are good options and people will decide based on which attributes are more important to them.

I have been quietly simplifying my investments outside of Super. I am now down to just 3 holdings – 25% AFI, 25% WHF, 50% VAS. After reading John Bogle’s little red book all the lights went on for me.

Whilst still accumulating I have switched on DSSP for AFI and BSP for WHF as it is tax effective whilst I am still earning good money.

Also, when we are ready to retire the above strategy will give a steady flow of income during he year as each three holding pay dividends in completely different dates (roughly every couple of months). Also, if we are earning too much I can switch DSSP/BSP on and off as required to regulate earnings with great tax benefits.

So, yes VAS is vital to this approach.

Now to tackle my Super holdings – ha!

Great stuff Phil! Fantastic book that one. Seems you’ve been bitten by the simplicity bug too? 🙂

Sounds like a pretty good plan to me mate.

Hi Phil, as I’m new to investing your response left me thinking. Could you please explain when would you switch on/off DSSP and BSP? I understand there’s a tax implication there based on income.

Thanks

Not Phil, but this post might help – https://strongmoneyaustralia.com/tax-efficient-dividend-investing-dssp/

Basically, you’d want to be paying well above 30% tax rate before switching it on, and then when you’re no longer paying that much tax (lower income or retirement) you turn it off. Hope that helps.

I pretty much employ the same strategy, except I also hold VHY ( to boost my total yield a bit). I hold AFI and WHF under my name as I am in >30% tax bracket with DSSP on for both and VAS and VHY under wife’s name. Currently AFI and VAS are my biggest holdings, planning to buy more WHF next.

Its a nice and simple strategy.

I like your style, Gene. I do like the DSSP of WHF. Currently have AFI.

I really must chat to my accountant about possibly investing under my wife’s name too. I have the option to do that OR through my family trust OR through my bucket company. I am a small business owner turning over $400k with bugger all overheads so having those facilities makes sense. She’s a beneficiary in the trust. The bucket company is new.

Hi Gene,

I’m looking at getting my first LICs, I’ve got some etf already. We’re in a similar position, I’d be >30% tax bracket and my wife under that. Just curious, what’s the benefit of having the lics under your name instead of having all shares under your wife’s name and earning those frankings?

Another great article. I love your take on the Pareto Principal and Positive Skew. Up until now I didn’t realise it would also apply to share market indices. Great work.

Thanks Joe. I can’t take any credit for this as I learned this concept from the two articles I linked! But happy to pass the information along 🙂

A200 is half the mer and has more franking then vgs. Also the extra 100 companies currently make no difference compared to 200

I think you mean A200 is cheaper than VAS, not VGS. VGS is an international shares index fund. A200 is a fine choice.

Great post, Dave. You’re good at this.

I’m rotating between AFIC, VAS and a Balanced Growth Portfolio with robo-advisor Six Park, which has Vanguard VGE, State Street DJRE, State Street STW, Vanguard VGS, VanEck IFRA and iShare IAF. I’d like to get into Whitefield at some stage for a bit of Thornhill industrials action.

Thanks for the kind words and for sharing your holdings! I have looked at Six Park funds before and like their automated low-cost offering.

Hi Dave

Thanks for another thought-provoking post. Your posts have influenced a lot of the reading I’ve done – especially the Peter Thornhill stuff – and the actions I’ve taken. I’m now holding AUI, ARG, AFI, BKI, MFF, STW.

Why do you think ETFs are so often index-based and LICs strategy based? I like the closed nature of LICs. Why isn’t there an index-like LIC? Something with the human-error removal of ETFs but the tax efficiency of LICs?

Simon

Thanks Simon – glad if any of it has been helpful!

ETFs started as plain vanilla index trackers but now they come in all sorts of flavours because providers know there is money to be made offering lots of exotic choices. So tons are created and some of them are bound to stick, because lots of people want to invest differently, and many products are popular where you can show a backtest of outperformance for a certain made-up index, or style or factor etc.

LICs have always been strategy based because they are, by nature, ‘investment companies’ – their job is to invest for the benefit of shareholders. You could argue the LICs are somewhat index like – low cost, low turnover, diversified etc. But to be clear, ETFs are often just as tax efficient (the broad market ones like VAS) – essentially the underlying stocks just come in a different wrapper.

Great post and Blog

I enjoy reading each post that you make

The below is also a great read on a similar theme

https://www.bloomberg.com/news/articles/2017-04-09/lopsided-stocks-and-the-math-explaining-active-manager-futility?cmpid=socialflow-twitter-business&utm_content=business&utm_campaign=socialflow-organic&utm_source=twitter&utm_medium=social

Thanks for following Redwing, always good to hear from you mate 🙂

Really great article, Dave. It’s really pleasing to see that someone such as yourself is always re-evaluating and evolving your strategy. Many people don’t.

I have a mix of ETFs and LICs, set up like this:

– A200 – 20% (DRP)

– ARG – 20% (DRP)

– AFI – 20% (DSSP)

– BKI – 20% (DRP)

– IVV (US top 500) – 13% (DRP)

– VEU (global index excluding US) – 7%

The eventual aim is to have 2 year’s worth of living expenses in cash, so that’s what my IVV/VEU holdings are for. When they reach a certain value I’ll sell them off, cop the CGT and then that’s my cash buffer. The other 4 holdings won’t ever be sold and are the golden-egg-laying geese.

I have ETFs and LICs combined because, like you, I like both types and the different features they offer. I enjoy dividend smoothing from LICs but also enjoy the diversity of an index tracker. Best of both worlds.

I must admit, I initially bought into A200 because of the ultra low fee. I didn’t even consider that in the future fees are likely to be reduced / abolished entirely, and you’re right, it’s better to go with an overall higher quality product such as Vanguard.

However I’m too deep into A200 now, I think. I’ll just keep going with it. It’s not like it’s bad.

Hey Nick, great comment and thanks for sharing mate! There’s no perfect answer for everyone in regards to portfolio and different indexes etc in my mind, so we each choose something that feels roughly right and can later adjust as we go. Nobody starts and ends with the same portfolio 🙂

There is a fine line between sticking to your strategy and being too stubborn to make changes when you learn new things. I try to keep learning and stay open minded, while keeping my personal goals and investing style in mind.

Nothing wrong with A200 mate! I just think people can get a bit too religious on the fee thing and ignore everything else for the sake of a couple of basis points in the short term. The main point is we’re all investing in low cost diversified funds regularly, so it’s a very much a first world issue, so to be at that stage we’ve already won!

I do use index funds at times, but never as my sole or main sharemarket investment.

one area of the market where fund managers have often recorded great outperformance is in small caps. I have done really well with a number of them.

eg Smallco investment fund has delivered 22% p.a nett of all fees for the past 10 years and 14% p.a

since inception in 2000, despite the GFC in 2008 and the Dot com crash in 2001-2002

also OC dynamic fund, has delivered 12.6% p.a since Dec 2000 net of all fees,

Hyperion small growth companies ( 15.5% p.a since 2002 ) , Fidelity future leaders,

Ausbil Microcaps ( 24% p.a since 2010 ) , Ophir High conviction fund ( now a LIT on the ASX ),

and the WAX LIC.

Some fantastic returns far greater than the index.

yes small caps suffer more in bear markets, but the returns quoted are LONG TERM and included the GFC crash.

So by sticking only to the index, you are missing out on much better.

The Aussie index is better diversified than it used to be , but is still terrible compared with say the S&P500. Far too heavily weighted in 4 banks, 2 miners and some large cap chronically poor performing very mature businesses such as Telstra, QBE, and AMP.

I’m OK with using the global index funds for international investing but I believe we can do better in Australia than our index. For a start, mining and oil/gas stocks are far too cyclical for long term investing. They are price takers, not price makers, with no control over the price of the product they sell , and are very capital intensive with enormous costs in exploring for and building mines . Also there are some obvious duds such as AMP, QBE and Telstra who have performed just miserably and it was obvious 10 or 20 years ago that they would. Glad I sold Telstra for about $6 almost 20 years ago. where is the share price now ?

25% in banks ( used to be 30% which was insane ) is still much too high. Their golden era of growth is over for a fair while. They face increasing scrutiny, regulatory hurdles, compliance costs, falling property market, distrusting public, etc etc.

I only hold CBA, the best performing bank over the long term.

NAB share price is lower than it was 20 years ago, yet in that time CSL, Ramsay and REA group have risen by hundreds or thousands of %.

I understand the desire some people have for dividends.

But the thing that they forget is that companies with strong growth also grow their dividends.

so CSL and Ramsay have continually grown their dividends, whereas NAB and Telstra dividends have stagnated for years and then recently fallen. I read somewhere that people who bought CSL at IPO in the 1990’s have now received more $ in dividends than Telstra shareholders have. Also Ramsay, not thought of a as an income stock, has grown its dividend every year for about 20 years and now pays out $1.46 per share. That equals only 2% yield on the current price but for people like me who bought them back in 2006 for about $10, when it was obvious the business would do well long term, they are now paying a 14.6% FF yield ! as well as 600% capital growth. how does that compare with NAB, Telstra or the Index ?

CSL growth since 2000 has been so many thousands of % that it makes me dizzy to even try to calculate. Same with REA group.

so it is a furphy for people to concentrate too much on the dividend yield that a stock gives only today.

it’s the future which counts !

and we can do much better than the index.

Hey Carlos, thanks for sharing your thoughts mate.

Some of us try to beat the index for a few years and fail (I have). Some of us simply can’t be bothered because we don’t know where to start or we’d rather be doing other things. So there’s lots to be said for very simple investing like indexing I think. If you can regularly get better results, that’s awesome, but those results aren’t typical of the average investor.

Quite often the small cap funds you’re describing have high turnover, so you end up receiving large capital gain distributions which creates lots of unnecessary taxes which lowers the after tax return, so that even with out-performance, the investor may be behind the index after tax, versus something more tax efficient like a low turnover index/LIC.

The reason the high performing companies stand out as amazing examples is because they’re in the minority. What are the future CSL’s and REA Groups? The market is trying to figure that out everyday. It’s obvious in hindsight, but in real time it’s not so easy. But honestly, if you have an eye for this stuff and can do better than the market average, that’s fantastic!

You’re spot on that it’s dangerous to focus solely on dividend yield and forget growth. Growth in income is extremely important. I guess that’s why many investors who like growing dividends are attracted to LICs, because the portfolio is balanced with a group of higher yielding slower growth companies and lower yielding higher growth companies, and some in between. With the result being a decent yield and dividends which grow at a decent rate over time.

Anyway, all the best with your investing Carlos!

I just checked smallco and it says 18% net of fees since inception which was 2008?

This was a timely article, I’ve been sitting on the fence about VAS for a while.

I have a portfolio of AFI, MLT, BKI and VGS as a core foundation which I’ve been averaging a lump sum into since the beginning of the year. I feel pretty comfortable with it but I do like the idea of 1) owning the whole index 2) the quarterly dividends to stack with VGS. 3) as a hedge against the active management of the LIC’s.

I’m still unsure but I definitely see the appeal. I’ll probably come back to this post again!

I have 20% cash left to invest.. so it’ll either be spread between the LIC’s or i’ll consider VAS.

I always find the comment section here fascinating, everyone has their own approach to investing and the more I learn the more I realize it really is unique to each person’s goals, risk appetite and time-frame. I get bogged down in the details over the best vehicles to use but I think as long as you’re buying a broad range of quality companies for the long term.. you’re fine.

Thanks again, Dave!

Thanks for reading Scott!

I also love the comments section too – it’s great to have so many supportive and like-minded folks on here sharing with each other.

Totally agree with your summary. It’s too easy to get bogged down in nitpicking and ‘optimal’ portfolios (and many people do), when the main focus is to save lots and invest regularly in a low cost diversified portfolio of shares, which will pay increasing dividends and grow in value over time. All the best putting your cash to work 🙂

Great post Dave, I really liked your summary of ‘The Skew’ – best one I’ve come across and love that you’re continually evolving your strategy.

It’s a bit surprising to see that you opted for VAS over A200 – 50% more cost for ~3% more market cap! I get it though and I do love Vanguard’s ethos and ownership structure…

Is there anything I can read about why you’ve chosen 100% domestic?

Cheers!

Thanks very much Kurt, glad you enjoyed it!

This post might explain a bit more thinking on the topic – International Shares for Aussie Dividend Investors. Oversimplified summary: good cashflow without having to worry about selling shares and no currency issues. I have super setup as 100% international.

Great article! Currently listening to the little book of common sense investing by John Bogle audio book which points out skew so elegantly!

Quick DRP query: Lets say the index is $100 per share and i buy 100 for $10’000. It gets to DRP time and they have paid 2.5% so i receive $250 in dividends but i have DRP switched on. Lets assume the share price is still $100, what happens with the part share?

Do i receive 2 more shares only and it gets added to the next DRP time? I would be missing out on part share compounding effect in this scenario every time?

Do i actually receive 2.5 shares and my value sits at $10’250 meaning i earn my next dividend on the half share also?

Always wondered this with larger price per share stocks. Thanks

Cheers Paul! That’s a good question. My understanding is the excess DRP funds are kept aside until next time.

What do you think of the Bogle book, Paul? I have it queued up on my Kindle after I finish The Subtle Art Of Not Giving A F**k which isn’t a bad read. I was an avid Audible listener but then I found podcasts.

Yes that’s correct Dave.

Leftover dollars after each dividend payment accumulate until there is enough to buy a whole share. If you sell out of the holding the company will refund the remaining amount at the next dividend date

Interesting post. As appealing as the LIC’s are for income investing and smooth dividends etc. I still find myself drawn to a diversified portfolio of index funds. Currently I have a VANGUARD WHOLESALE FUND ACCOUNT with automatic direct debits coming out of my bank account each fortnight. I find this option very convenient, and I just set and forget. Obviously a slightly higher MER but I am happy with that extra cost (very minimal) for convenience. I have chosen to invest into the following funds (Vanguard Australian Shares Index Fund, Vanguard International Shares Index Fund (Hedged), Vanguard Emerging Markets Shares Index and Vanguard International Small Companies Index Fund (Hedged). A mix of high risk high growth, value, income and broad diversification.

I think when I can I will still invest into LIC’S also for their benefits to income investors, but this will be closer to retirement.

Thanks for another great post SMA.

Thanks for sharing your approach Fergy!

The Vanguard Wholesale accounts are pretty convenient with the Bpay option for set and forget style investing, for those who can meet the minimum required. It sounds like you have roughly replicated the High Growth Fund (VDHG), without the bonds part, is that right? Sounds like a fine setup mate 🙂

Cheers!

Yeah I love the convenience of bpay and set and forget. Yeah exactly. Don’t see the point of owning 10% bonds ????.

I just don’t like saving cash for a few months then buying a share when I have enough saved. If I ever get a lump sum or decide to use the debt recycling strategy I will put a large one of amount into some LIC’s etc.

Thanks for a great post. We have been considering altering our approach from LICs to incorporate an ETF (looking at VAS, STW or A200). Our only concern has been how much of our invested capital gets paid back to us under the trust structure of an ETF and then we get taxed on that. Effectively paying capital gains tax on our own invested capital.

I have read this somewhere before and heard Peter Thornhill talk about it (once I think on Aussie Firebug’s Podcast). It is hard to get info on this and not having EFTs have no real understanding on the potential issue.

Do you or any other readers have any thoughts or understanding on this?

Thank you again for your informative blog.

Cheers Az!

The concern over getting paid capital gains and having capital returned to you entirely depends on how much turnover (buying and selling) the fund does. With broad index funds like VAS etc, turnover is very very low (typically less than 5% of the portfolio). So the vast majority of the distributions are dividends from the underlying companies, like with LICs.

With more actively managed funds though, it can be exactly as Peter stated, having large capital gains paid out as distributions. But the index fund is very much like LICs in terms of broad long term ownership of a huge basket of companies, and tax efficient distributions with high levels of franking. Hope that helps.

Thanks for the quick reply Dave,

That makes sense. I was finding it hard to find out historical info on how much of distributions were capital gains and how much were dividends. Also how much the EFTs turn over their holdings (VAS publish their turnover in a easy to find place).

The other thing that I guess I need to consider is how important franking credits are to us, and if LICs or ETFs fit the situation best (and who knows if or when franking credit refunds will change). I guess STW has a higher franking focus than VAS.

Thanks mate

Just to be clear, no index has a higher ‘franking focus’ than another. STW holds the top 200 companies regardless of franking levels, and VAS holds top 300 regardless of franking.

Franking credits are important in the sense that they increase after-tax returns, but both LICs and ETFs are the same really. Only difference is LICs pay some tax which is why dividends are 100% franked, rather than VAS at 80% or so, as ETFs don’t pay tax. I would purchase whatever you feel the most comfortable with, rather than which has the highest franking. Both yield a similar amount at the end of the day, 4% plus franking, so I wouldn’t let tax drive your decisions too much.

Hi Dave — were you aware that the management fees are dropping for VAS? From 1 July the fee will change from 0.14% to 0.10%.

https://www.moneymanagement.com.au/news/funds-management/vanguard-cuts-fees

Cheers – Scott

Thanks Scott. Yes I did see that, a very welcome change 🙂

Hi Dave. I’m still struggling to understand your reasoning behind investing heavily into etfs after reading so much here about lic’s. I’m very new to this and will only soon be starting to make my first of many purchases on lics so I’ve probably missed something. If the etf pays less franking but a similar return of 4% on dividends would it not be more productive to just stay in lics and take the extra benefit of franking? Is the reasoning behind it that your hoping the etf performs a better capital growth which then gives you a better return in future? I’m sure it’s something simple I’m missing but I just can’t quite get my head around it.

P.S. I’m glad I found your blog. It’s rare to be able to get the views of other people on investing at my age (mid 30s). Amongst all my friends everyone is busy spending all they earn on the things they don’t need rather than looking towards the future, so it’s great to have somewhere to turn to hear the views of other financially literate people.

Haha thanks Glen – great to have you here! Sadly there aren’t too many long-term thinkers out there, but quite a few hang out at this blog which is nice, and hopefully we can convince many others to join us too!

The main reasoning is the appreciation I’ve developed for the power of indexing. Probably the biggest factor for me is the skew effect described in the blog (huge winners driving returns). Don’t get me wrong, I still like LICs and happily add to them in my portfolio.

The reason LICs have higher franking is because they pay tax. ETFs pay not tax, and just pass through all income they receive. LICs pay tax, which reduces the cash yield, but then they’re able to attach 100% franking, rather than the index which is 80% franked.

Dave,

Can you please post on “Managed Funds” in Australia? Vanguard is also offering them and fee are little more than ETF fees. But for investing small amounts continuously (Vanguard Retail management fund requires initial deposit of $5000 but second time on wards as low as $100).

VAS ETF has 0.1% fee but trading costs min of $9.50 (SelfWealth for e.g.) each time. So for $1000 investment it is $1 + $9.50 = $10.50 total cost.

Equivalent retail fund Vanguard Australian Shares Index Fund (VAN0010AU) costs 0.75% fee + $0 trading cost = $7.5 total cost.

I agree that for first $5000 deposit costs $37.5 fee with fund whereas only $14.5 with ETF. But the difference of $23 is easily recovered in subsequent deposits (assume the small deposits continue in painless way to many with simple BPAY option).

Interested to know your thoughts.

Thanks,

Ratnakar

Thanks for the suggestion Ratnakar. I don’t have a lot to say about it though. The managed fund option is fine, because they’re very convenient and it’s easier to ignore the market, though I think this option is a bit expensive.

The part you’re missing is that the brokerage is a one-off cost for each parcel. So that $5k purchase you’re using has 0.75% fees on it, effectively forever – wheras the ETF version charges only 0.10% ongoing. The fees and therefore the difference compounds over time. Less in fees means higher net returns. So the difference is not recovered.

But if someone wants to use the managed fund option for the ease of use, automatic investing through bpay and peace of mind, that’s totally okay by me. But I do think it makes more sense if one has $100k saved to get a wholesale account which charges 0.18%. Hope that helps.

Thanks, Dave.

G’day Dave,

A couple of months down the track, are you still thinking VAS is your preference over LICs such as AFIC? I understand the passive income generated down the line by the LICs are what we’re after but AFIC just continues to underperform compared to the market.

And while I’ve got you, at what stage in your investing life did you really start to notice your investments were starting to work and take off? While I’m in no rush, I compare the early stages to paying off a mortgage. You really feel like you make no in-roads for a long time and I’m yet to see any influence of compounding interest as yet. But as I say, I’m in no rush.

Kind regards,

SOL

Hey, yes nothing has changed in the few months since I wrote this! LICs may or may not underperform going forward (that’s the risk) but will provide more reliable income and always be conservatively managed. Only a few years ago they had long records of beating the market (that was not my reason for buying), but in the last 5 years value investing has really underperformed as everyone’s been chasing growth stocks. Nobody knows if that will continue.

Your second question is interesting. Compound interest is not all that powerful over a period like 10 years. Saving is overwhelmingly what drives the growth of your net worth over that time. Just play around with a compound interest calculator and you’ll see what I mean – https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/compound-interest-calculator – Investing $40k per annum for ten years at 7% return gives you $550k… and only $150k of that comes from investment returns. So focus on saving and buying sensible investments. In my case, I didn’t notice any compounding effect, simply lots of savings built up and half-decent investment returns.

Interesting calculator.

Currently at $40,000 (an additional $20k parked for the kids), I’m depositing $2000 per week, 7% interest rate over 10 years = $1.5 mill with $435k of it being interest. Seems like the more you tip in the quicker the compounding effect takes hold.

Just unsure whether I’ll be better off rotating through AFIC, WHF and Six Park’s diversified ETFs as I currently am or to just go full ETFs? Bang for my buck is key as while I do ok $$ wise, there’s got to be more to life than work. Got to be pulling the pin by 55. That gives me 10 years. That should tide me over and then supplement my super.

Thanks again, Dave.

Looks like you’re on the right track – again those numbers show how much of it comes from saving! As for which approach, they’re all low cost diversified options, albeit different. Decide how much you want in Oz vs international shares first, and go from there.

It also depends which you holdings you feel most comfortable with and what will be the easiest to stick with. Only you can answer that. But given the sharemarket will have lots of ups and downs, consider which option you’ll find the least stressful.

I’m convinced of the benefits of holding both LICs and ETFs now so thanks!

Currently I am playing around with individual shares within Super (Choice Plus). I have turned DRP OFF and each quarter I look for which shares I believe are trading at a discount to their intrinsic value and point any accrued savings and dividends to those shares to take advantage of the greater yield possibilities.

Once our house is payed off, we will be instigating your index-based model of a few LICS (probably AFIC, ARGO and MILTON) with an ETF (VAS).

Each quarter we will ascertain which (if any) LIC is trading at a discount to its NTA and deposit the savings accordingly. If none are trading at a discount, we will put the savings into the ETF.

My question is – with this indexing model (and with a view to maximising yield) would it be best to turn DRP on or off within the LICs/ETF?

As my partner and I both have an annual income of approx. $100,000 I presume that it would be worth employing the Dividend Substitution Share Plan (DSSP) through AFIC (until we require the dividends later in life) at the very least?

Thanks very much.

Peter

Thanks for sharing your approach Peter.

In terms of DRP, it doesn’t really matter, most DRPs are offered at no discount so there’s no major benefit versus taking the cash dividend and adding to your savings to buy. Especially so if you attempt to be opportunistic, which it sounds like you do.

As for DSSP, that tends to suit high income earners like yourself. In such a situation where I was going to invest in AFIC anyway, I’d likely take advantage of the DSSP until hitting retirement, then switch to receiving dividends + franking. Hope that helps.

Like you I used to be all aboard the LIC train. I still do have a large proportion of my (still fairly small) portfolio in AFIC due to their bonus shares plan and not having to pay any income tax on the dividends thereof. But I wanted to also diversify outside of Australia and am trying out VGS to get Vanguard’s international exposure… not the most tax efficient but hopefully will be a more balanced and stable portfolio in the long term!

Thanks for sharing. Having overseas diversification definitely helps offset the chance that Australia has a terrible economy/stockmarket over one’s investing life. That’s how I look at international investing anyway. Not as tax efficient but the low dividends from VGS means it’s not too highly taxed I guess!

Yeah international being more growth and less dividend return, but just to offset the riskiness of the portfolio overall. I still don’t want international as my *main* portfolio since Australian shares are such great dividend payers and tax effective. Plus ideally I want to live mainly from dividends in retirement, not selling down the capital and Aussie shares are just so good in that respect!

Dave,

Just trying to understand the best platform to purchase these Index funds, VAS, VGS as an example.

Having moved from England where i was using the Aviva Platform trying to get my head around whats the best way to purchase the above.

Hi Anil, one of the cheapest stockbrokers in Australia and the one I use is Selfwealth ($9.50 per trade, unlimited size). You can sign up with this link and get 5 free trades (1 month expiry). You could also check out CMC markets which I’ve used in the past and been happy with. Hope that helps 🙂

Thanks Dave,

I guess this method would not work if you are looking to ‘drip feed’ maybe a few hundred dollars a month the charges would mount up.

That’s correct. I try to make sure it’s at least a $1k purchase to keep the cost under 1% of my purchase.

Hi Anil

Commsec has a new product out call Commsec Pocket where you can buy IOZ (ASX200) for $2 up to $1000 trade – worth a look.

Great advice. I purchased VAS recently. Computeshare says that no DRP is available? Instead direct credit for dividends. Is this something you have encountered?

Hey Dan. I don’t do DRP so I didn’t notice that. Seems strange it’s not available. Maybe give Computershare a ring and find out if that’s correct or not?

Thanks Phil will look into that.

Hi Dave,

Absolutely love the content on your website, I first stumbled upon the A-REITs article, found it really informative and I have been buzzing around your website since.

I’m curious about your decision to focus on an Aussie index fund for a growing dividend income stream. I had recently completed some basic financial projections based on historical dividends and price growth for various ETFs (mainly Aussie & US indices, and real estate), to discover that VAP, due to its historically high dividend yield, would significantly overtake VAS in terms of dividend income 10, 20 years down the line. VAP itself is beaten by individual A-REITs, albeit with the risks you had mentioned in your other article.

Based on real estate generally providing a higher dividend yield relative to an Aussie index fund, I’d be really keen to hear your thoughts on why you chose to focus a good portion of your investment in VAS, if you’d be happy to share. Thank you!

Thanks Krishore!

That could be true (not sure tho, I haven’t done the numbers), but as you say, VAP is extremely concentrated in only a handful of property trusts. And for times like now, when those trusts (many retail) are getting hammered, that’s not ideal at all.

The idea behind simply using index funds is for the huge benefit of diversification – if property struggles, shopping malls or office blocks become less relavant over time, owning just VAP would be a very scary place to be. An Aussie index still has a solid yield, franking credits (which VAP doesn’t), and 300 companies from a spread of industries.

Plus, as various industries prosper or decline over time, it will be reflected by the companies in the index, automatically booting out those which fall out of the top 300, being replaced by new up-and-comers. That gives a lot greater peace of mind, to me anyway. Hope that helps.

Hi Dave. Thanks for the great article and content on your website. I often see it stressed how the management fees of index funds is cheap but I’m wondering if you take into account the price of the index fund and how it affects when or if you buy. When you buy an LIC you can use the NTA as a guide to value, is their a similar thing with index funds or you just buy regularly regardless?

The other thing I’m trying to get my head around is the actual cost of each share. LICs are a lot cheaper per share to buy than an index fund. This seems like it would help with dividend yield and DRP whereas it seems like you would need to hold a lot of something like VAS for it compound on itself through dividends because the price is a lot higher. I’m not sure if that makes sense at all haha. I’m hoping it does and you can shed some light on it for me.

Hi Marcel. An index fund trades at exactly its NTA all the time, so you won’t be buying at a discount or a premium. So its always the ‘correct’ value in that sense. Market valuations are a different matter and affects LICs and other investments in the same way.

And price per share seems like it matters when comparing options but it’s largely irrelevant. Here’s why: Company A’s shares are worth $1 each. It pays a yearly dividend of 4 cents – a 4% yield. Company B’s shares are worth $100 each. It pays a yearly dividend of $4 – a yield of 4%.

One is no more ‘expensive’ than the other. However much you invest in each option, you’ll receive the same level of dividends on the amount you’ve invested: 4%. Don’t worry about comparing the price per share, one is just cut up into smaller slices that’s all. Just because you can buy 10 times more shares, you won’t get 10 times the return! Think about that for a minute – your returns are based on the number of dollars you’re investing.

Hope that helps!

Hi Dave,

Great Article. I was wondering why VTS, IVV, IJH, NDQ, IOO are not included. I have invested in them for last 3 years and so far has given me good returns. One should also consider Capital Growth instead of Dividends alone if looking for Long Term.

Regards,

Hi there, thanks! This was an article about Aussie index funds more so than all index funds. I wrote another post about international index funds which you can find here.