Close Menu

October 6, 2022

“The Journey of a thousand miles begins with a single step” – Lao Tzu

When we first gaze down the road to financial independence, it can feel a little daunting.

You might think there’s too much to learn, or creating the freedom you’re after will take a hell of a long time. As such, you can lose motivation before you’ve even begun.

But I have great news: as someone who is on the other side, and know several others here too, I can tell you there’s nothing to be intimidated or put off by – it’s all upside!

To help, this article is all about getting started and building momentum. More experienced readers can sit back and smile as they nod along in agreement while we reinforce an important lesson for newcomers.

By the end of this post, I hope you’ll see how fantastically simple and approachable this can all be. To quote Marie Forleo, “everything is figureoutable.”

Before we move on to discuss solutions and practical strategies for you to implement, here are my quick-fire answers to some common initial concerns as cited above (after the well-worn criticisms of course!).

“It feels like there’s too much to learn.” It might seem like that, but I assure you it’s not very complicated. Simply start saving and learn the rest as you go.

“Financial independence feels like too big of a goal.” It is an incredible thing to achieve, but you could be equally as happy with semi-retirement or just paying off your mortgage, creating many of the same benefits in less time.

“This seems like it’ll take too long.” The truth is, good things take time. But this isn’t a race. You can go at your own pace, taking it as easy or hardcore as you like.

With the first layer of stress melting away and a sense of calm washing over us, let’s tackle the first hurdle in getting started on any new endeavor: procrastination.

Look, everyone struggles with procrastination in some part areas of our lives. I certainly do.

But regardless of the particular thing we’re putting off, the question never changes: how do we get ourselves to do a task that seems difficult?

You take the tiniest possible action in the direction you want to go.

This has been well documented as an effective strategy to beat procrastination and our initial resistance to getting started. It was highlighted nicely in this detailed guide by Mark Manson. For a short, more hilarious and sweary version of the same thing, watch this video:

Personally, I’ll often procrastinate on writing an article. Not because I’m actually stuck on anything, but because my mind likes to remind me that sometimes writing is hard. And if it’s hard, then there’s mental resistance against starting.

The way I trick myself into writing is thinking, “Oh, I’ll just do some of the outline today.” Then next time, “I’ll just do this one section and that’s it.”

Now, if I actually limited myself to this, then my writing would be even slower than it already is! But a funny thing happens – once I’ve started, the juices get flowing and I end up doing more without realising.

Once you’ve done a little, it’s easy to do a bit more. So, the trick is to do something – anything – no matter how small. Just do one thing, and the next thing becomes so much easier.

Related to this is the concept James Clear has written about and what formed the subtitle of his book Atomic Habits: Tiny Changes, Remarkable Results

I may do a whole article on this in the future, but it’s highly relevant to us since our financial results are simply an accumulation of repeated habits, seemingly small choices and automatic behaviours.

Therefore, we can achieve a dramatically different financial outcome by making a string of small changes, because consistent small actions compound into massive differences over time.

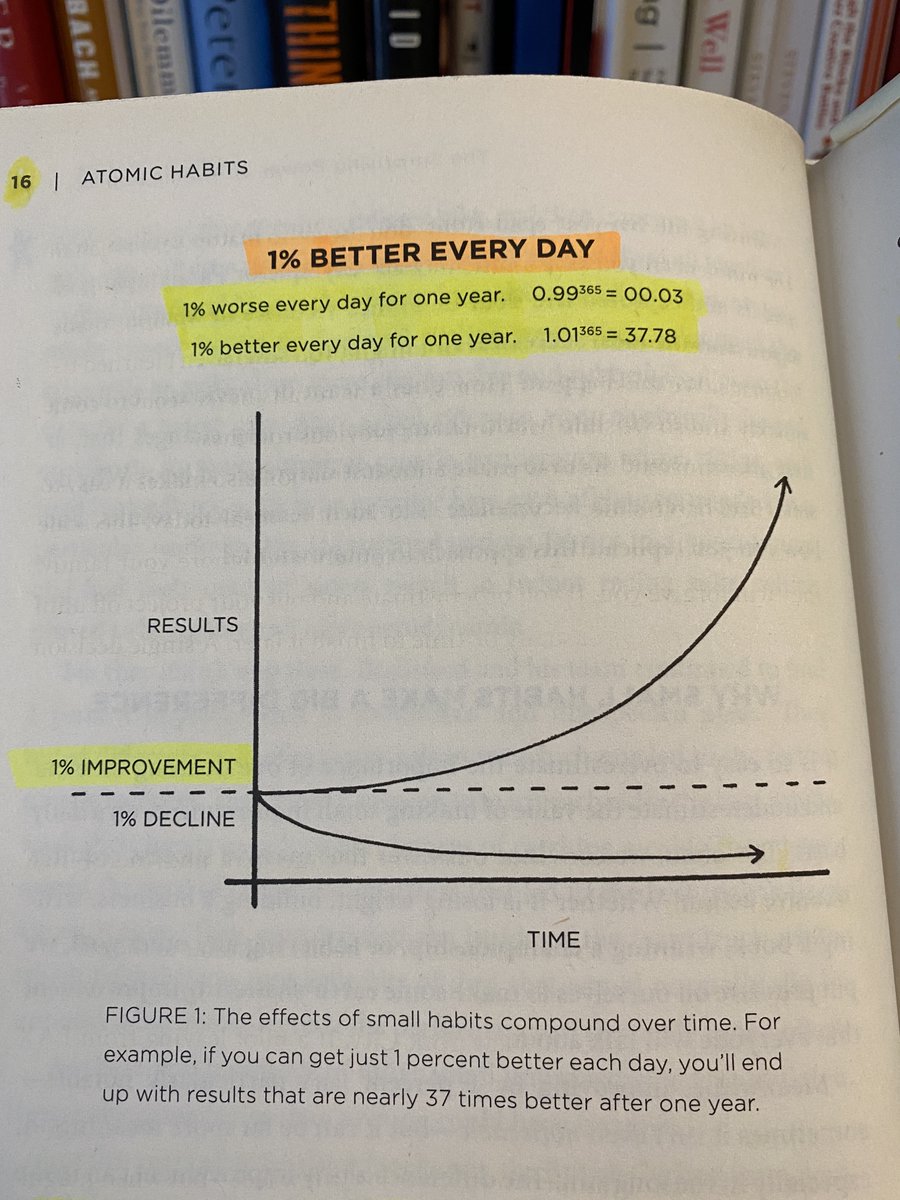

In his book, Clear shows how what would happen if you were to become 1% better each day:

Now, let’s put aside the practicality of becoming 37 times better in a year. The underlying process is what matters and I would sum it up like this:

Make a positive change > consistent application > keep improving > gain momentum > huge compounding result.

In financial terms, imagine you start out like many people saving 0% of your income. Each week you find a way to reduce your spending by $10 per week. These savings are then invested or used to pay down debt. You steadily stack one improvement on top of the other.

As you do this, you create new savings to add to your ongoing savings, and the money you’ve already saved starts compounding too, creating a beautiful snowball of wealth creation, leading to ridiculous results, like being able to type a blog and play with turtles in your 30s, rather than putting up with the inevitable shitty workplace politics and various brown-nosing nonsense for another 30 years.

Alright, we’ve got a solid understanding of how important those tiny first steps are, and how to use the incredible power of momentum to propel us forward in our new direction. Now let’s look at how we can put all this into practice.

The below is an admittedly basic mixture of ideas – both one time actions and ongoing habits – that you can work with to get your financial snowball rolling.

It’s not an exhaustive list, but it should get you started 🙂

Remember, you don’t have to do all of them now! Just one little thing at a time. You can even pick whichever you think is the easiest item and go from there.

The beauty behind making tiny changes is you will barely notice the difference. You get to experience for yourself that you’re not less happy than before – in fact, you feel kinda awesome for taking actions that you know are creating an exciting future.

As I’ve said before, a large sum of money is simply lots of small amounts bundled together.

Over time, you can continue making tiny changes that are barely noticeable, and the difference in your financial outcome will be startling. Because you barely even felt like you were changing anything at all.

You can also think of each little action like putting reps in at the gym. One challenging rep by itself isn’t going to do anything, but the accumulation of hundreds and eventually thousands of these reps over weeks, months and years is how people end up with incredible physiques from seemingly simple habits which are refined, improved and built up over time.

I hope you now see how uncomplicated, and non-intimidating this all is!

It seems hard to believe at first, but saving a small amount across every area of our lives adds up to a surprisingly large difference across our spending as a whole.

That’s exactly how people like myself are able to escape the rat race decades earlier than most people. By earning healthy incomes and then piling up lots of little savings strategies until our spending is way less than our earnings. It’s our very own version of the graph from earlier…

We make positive changes, apply them consistently, keep tweaking/improving our spending and savings rate, gain momentum by investing, and this compounds into a hugely beneficial result.

In short, get started by taking the tiniest action you can manage, then another, and another. With each action, you’ll build confidence and momentum as you start seeing those dollars pile up, which will motivate you to do even more, adding extra snow to your snowball.

This snowball will begin at just a few flakes, until it gains pace and takes on a life of its own, barreling down the mountain towards financial freedom. Then, you can hop off and have fun playing in the soft, fluffy white snow, while everyone else is still trudging along with soggy boots and frustrated, wind-burnt faces.

Thank you. Well written. A good strategy for motivation that can be broadly applied

Thanks Charlie, glad you enjoyed the post 🙂

Highly entertaining writing and so positive about common sense ways to live and not be distracted by the constant fiscal friction of the noise around us, and couldn’t stop myself chuckling frequently towards the end. Thanks again strongmoneyaustralia!

That’s great to hear, much appreciated!

Great article. Thanks again for all your work.

Quick question – why prepaid phones? (I have a BYO Sim, post paid)

My pleasure Foti, thanks for reading.

Well, for one, you’ll never be charged extra for going over an allowance. But postpaid plans are a lot better than they used to be, so it can be fine. I use the word ‘prepaid’ as a catch-all to get people to stay off expensive plans which, amazingly, seem to come with a brand new ‘free’ phone.

G,day Dave.

Been reading your blog etc for a few yrs! And it has helped mold my mindset surrounding the Fire community and all the Information you have provided over this time in regards to Finances etc etc..

I can only say Thanks in Appreciation for your website Dave

Thanks Mate

Brad

That’s fantastic Brad, glad you’ve found it helpful!

I appreciate you reaching out with that feedback, and thanks for reading 🙂

Enjoy the articles however will the POD make a return?

Hey Greg. Not at this stage, unless the rules around what content creators are allowed to say changes.