Close Menu

August 7, 2018

This post was created partly out of frustration.

And partly to highlight a couple of powerful points to help keep you (and me) on track with our investments.

I’ve seen more than a few comments on other finance websites, that assume Dividend Investing is only for retirees and those who have already reached Financial Independence.

Also, that it’s obviously the much slower path to wealth, because capital growth is king. I don’t buy either of these statements. I think they’re a little misguided.

While it may be boring, I’ll show you why I think Dividend Investing is not just for the later stages of our investing. In fact, for those with a solid savings rate, I believe it’s the best strategy for reaching Financial Independence as quickly as possible in Australia.

Sometimes short-sighted people will point to the last 10 years of Aussie sharemarket returns, as to why this country is a crap place to invest in shares, regardless of the dividends or not.

Nothing exciting seems to be happening here. And we don’t have the high-flying tech companies the US has, regularly setting share price records and making us giddy from the wealth effect.

The mindset reeks of recency bias.

Because the US has been much stronger over the last 10 years, many investors think it’s the best place to invest. It could be a wonderful place to invest for a whole host of other reasons. But recent performance should not be one of them.

No argument, the US has recovered far better from the GFC than Australia. But we had a huge boom in the previous decade, while the US had fairly low returns.

Over a longer time frame, returns are very similar, according to the RBA. And even since 1900, returns are roughly the same, adjusted for inflation.

So it needs to be put into context. Which market does better over the next 10 years is anyone’s guess. But history would suggest Australia has a slightly better chance (not that it really matters).

Sadly, some folks miss the point altogether and simply compare where the market was before, and where it is now.

Comparing a price index, or just the ‘value’ of an investment only tells half the story. But many times I’ve seen a comment like the following…

‘If you had invested $100,000, 15 years ago, your investment would only be worth $x’

Maybe because we obsess over house prices, so we think the ‘value’ of assets is all that matters. As a result, perhaps we drag this mindset over to the sharemarket.

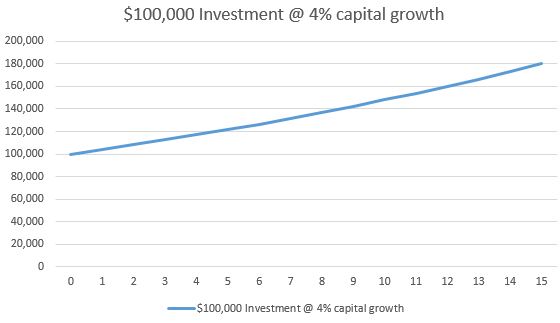

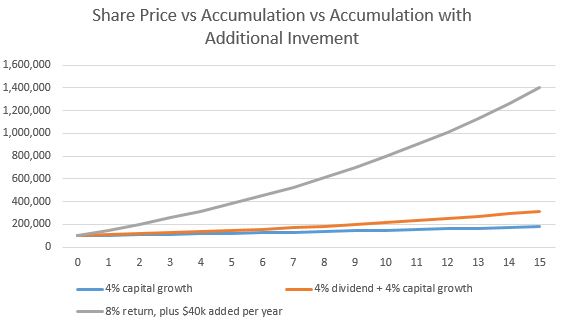

Let’s look at an investment of $100,000 and we’ll assume reasonable capital growth of 4% per annum.

So in this case, while the investment doesn’t sound (or look) like it’s done much, the investor is not too far away from doubling their money. The $100,000 turned into $180,094.

But this is only what the investment is worth, which in my view, misses the whole point of investing in shares. Dividends!

What’s this investor doing with the cash dividends he’s receiving? Spending it at the pub? Donating it to charity? I don’t know. But it’s insane not to include the cashflow in an investment calculation.

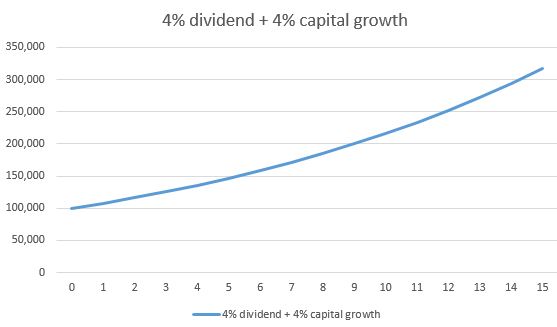

Now here’s what the investment return looks like when we (correctly) include dividends.

This time, $100,000 more than tripled, turning into $317,217. Now we’re getting somewhere. This is the power of reinvesting your dividends.

But somehow even this doesn’t feel like a good real-world example. Especially for us.

Since most of you, my readers, are striving for Financial Independence, your progress is going to look radically different to this.

Why? Well, because you’re not investing a stagnant $100,000. You are living efficiently, saving regularly, and constantly adding to your investments. After all, how else will you reach FI!

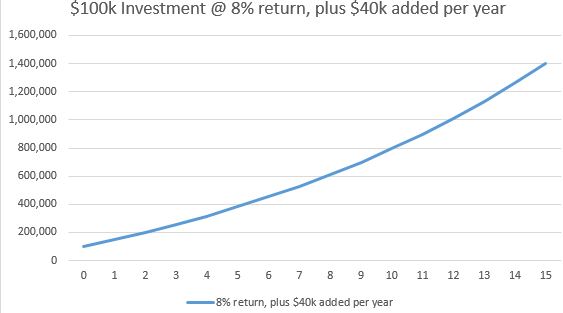

Rather than leave that lump of cash to work by itself, we’ll assume you keep adding to your investments, to the tune of $40,000 per year.

The end balance in this scenario reached $1,403,000. I don’t have to tell you again that saving is the key to building wealth!

For those unhappy with the starting balance, if you start from $0, the end balance still becomes over $1 million. Actually, $1,086,000 to be more precise.

This is a much more realistic view of what readers around here could expect when looking back at their portfolio after 15 years. Of course, the sharemarket doesn’t move in a straight line like this. Far from it.

But the point is, to just look at share price movements and the ‘value’ of an investment, is missing the point.

Now let’s look at the results all together…

The vast majority of wealth in this scenario was created by adding regularly to the portfolio.

Even with lower investment returns, the result won’t change much. That’s because most of the wealth created in a 10-15 year journey to FI, comes from saving.

So even in a slow-moving sharemarket, you’ll still be making massive progress.

In addition, dividends are an incredibly important part of returns over the long term. This is more true in Australia than almost anywhere. So to ignore the power of reinvesting dividends is batshit crazy.

OK, so this goes for all sharemarket investors. What’s it got to do with a dividend investor?

Well, these chart examples simply look at the ongoing value of the portfolio. Yes, the example uses reinvested dividends and extra money added. But around here we do things a bit differently.

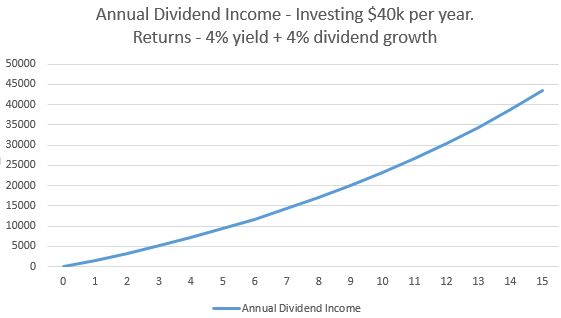

Rather than focus on the ongoing value of the portfolio, there’s another, more suitable way, for us to look at the portfolio’s progress. Income. That is, how much cashflow it spits out each year!

If you’ve been reading for a while, you’ll know I believe in investing for rising income, rather than rising asset prices.

As an investor, I prefer this strategy because it means investment success is more closely tied to the much less exciting, but more meaningful, company profits and dividends. Not to the endlessly talked about, but largely irrelevant, market movements.

This goes for whether I was starting today from zero, or I had $20 million in my brokerage account. Of course, with a massive amount of money, it’s more tax efficient to invest for a lower yield, with higher income growth.

For Aussie investors, I took a look at the yield/growth trade-off in this post.

Ultimately, I’m far more interested in the income from a portfolio, than the value of a portfolio. So here’s how StrongMoney would look at the early retirement journey starting today.

We’ll assume the portfolio starts at zero, $40,000 per year is added, and returns are 8% p.a – consisting of 4% dividend yield and 4% dividend growth.

This shows exactly how I would measure my progress.

It doesn’t matter what the portfolio is worth. The share prices will follow the earnings and income stream over the long term anyway.

After 15 years, the portfolio now throws off over $43,000 in dividend income per year.

And under current rules, assuming those dividends came with 100% franking credits, this would boost the income to around $62,000. Split between a couple, there would be very minimal tax to pay.

This is just an illustration, I can’t break down every scenario of returns, incomes, savings and tax rates into a smooth and concise blog post!

In practice, the progress with this approach is likely to be far less erratic than the other approach as measured by portfolio value. This is because dividends don’t move around anywhere near as much as share prices do.

In fact, you don’t even need to look at the value of your portfolio. Let’s simplify the investment process.

First, decide where you’d like to direct your investment capital.

That may be an index fund like Vanguard’s – VAS. Or it may be a couple of our old LICs, such as Argo and Milton.

Some of you might choose the LICs for the smoother, more predictable income profile, despite the risk of underperformance. Maybe even a combination of both.

Next, buy a parcel of shares! Don’t wait for the price to drop 2 cents to get it cheaper. Just buy the damn thing!

And next month, or the one after, when you have a wad of cash saved up again, repeat the process.

After this, you’ll receive a couple of dividends throughout the year. I must warn you though. It will feel slightly magical. You’re getting paid regularly to do nothing. Be careful, it can become addictive!

Of course, this extra cash isn’t for pissing up against the wall. Not yet anyway. Right now, it’s for buying more shares!

Reinvest the extra cash into your chosen index funds or LICs, while you keep adding regular savings to buy more.

— Every time you buy shares, your Annual Dividend Income goes up.

— Every time you reinvest your dividends, your Annual Dividend Income goes up.

— And every time Australian companies increase their dividends, your Annual Dividend Income goes up.

— Any time one of these things happen, your financial position becomes stronger and stronger.

This is the relentless progress of a Dividend Investor!

All of these factors are working in your favour, to bring your Financial Independence closer and closer. What could be more motivating?

Forget share prices. Focus on your growing annual income and the quantity of shares you own.

So why do I like this approach so much?

Because your passive income stream and reaching financial independence is overwhelmingly driven by your own efforts, plus business performance, rather than dictated by the mood of the sharemarket.

All that matters is your savings rate, and the rate of dividend growth from your investments. Let the price watchers worry about where the sharemarket will go next.

By measuring progress this way, you’ll be moving forward almost constantly, to a goal that edges ever closer.

And don’t worry about whether it’s a good (or bad) time to buy.

Just focus on constantly increasing your ownership in a large group of businesses. This means your slice of the pie gets bigger with every single purchase.

No matter how small it might seem, your stake is genuinely growing. In real companies, that provide goods and services, here and overseas, as well as creating new products and operating valuable infrastructure.

Looking at the ‘market’ too much, we tend to forget these things. But it pays to bring our minds back to basics to remember what it’s all about!

Thanks for the kick up the bum, Dave!

Like you, I am in the process of moving my real estate investments to dividend investing, and a large part of that is you and Aussie Firebug bringing to my attention Peter Thornhill’s advice.

Thank you both! (I assume Aussie Firebug reads all the way to the comments!)

The transition will likely take about 5 years or so, but all additions to investments will now be in LICs for dividend investing.

Hey that’s great news Niv. No problem at all, just passing on the information 🙂

Seems there’s quite a few people in the transition phase! I wonder what the main motivator is? They feel the housing market has had its run, or only just learned about or now feel comfortable with shares and dividend investing. Or maybe they just want to cash out, create a decent cashflow to retire early. Maybe a bit of everything?

Thanks for reading Niv!

Awesome post, totally agree and bookmarked for when I need to refocus. Personally I’m paying down the mortgage in the next two years then I will start this approach. As my family is growing I want security first and then start investing for FIRE. Can’t believe I didn’t find this site earlier!

Cheers Nick 🙂

Sounds like a solid plan to me!

I’m wondering if the low global yield environment is driving the move to LICs? There is a not too outlandish scenario that says that Aussie dividend stocks have stellar performance over the coming decade as investors chase yield

I’m not sure about that. If that was the case, the chase for yield would have been occurring over the last 10 years since US cut interest rates to zero. But that hasn’t resulted in a flock to Aussie dividend shares or LICs from what I can see.

As for what happens over the next decade, who knows? I think it’s more likely that some local equity comes out of property and makes it’s way into the sharemarket (rather than global money). Either way it doesn’t really effect what happens to dividends, which at the end of the day, is the main game for us 😉

Do you look at REITS at all?

We do own a couple of REITs – Thornhill would not be impressed 😉

I think they can be ok if bought cheaply on a high yield with a history of growing income and solid increases built into the property portfolio. But I’d only allocate a small amount to them vs the rest of a portfolio. The LICs and our index in general hold a number of property trusts already – somewhere between 3-8% of the portfolio. I

But overall I would expect company profits and therefore shares as a whole to provide a more strongly growing income. Refer back to the Peter Thornhill post, to see his thoughts on it, as well as videos 5 and 6 on this page 🙂

Dave,

Your blog is one of my favorite one (I ended up there following a link from Pete Wargent’s one, another gold nugget) and I love the fact that you defend day in day out a seemingly “boring“ attitude on investing.

High to very high savings, buy diversified dividend growth LICs, compound until financially free. Spend the rest of your time doing what you are good at.

Less sexy than call/put trading or macro investing but damn, it likely works way better and is waaaay less time consuming.

I also like the fact that LICs, unlike ETFs, are still managed by humans. Better than a dumb program and still very low fee.

Sounds a lot like value investing to me, as described in Ben Graham “The intelligent investor”, although you subcontract it to the good old LICs.

The more I think about it, being c. your age and only starting now to build my nest egg, the more I think that the hardest part of the journey is slowing helping my spouse getting deconditioned from the consumerist propaganda she has been exposed during her entire life.

Thanks David, that’s great. I’m also a big fan of Pete Wargent – I generally just read his blog for finance/economic news and ignore the media completely.

‘High to very high savings, buy diversified dividend growth LICs, compound until financially free’. Damn, you summed it up so well maybe I don’t need to write the blog 😉

I like LICs, but I also like Index Funds – each have their benefits.

It can definitely be tricky to get the spouse on board, especially if they’re accustomed to the high-spender lifestyle. Just think of it as you trying to perfect the art of persuasion by showing her how much better life could be if you don’t have to spend most of your waking hours at work and you can design your own days!

Dave, Great blog.

However, one big thing i believe when comparing to realestate is the investmentment.

In Real Estate, we are investing with the bank’s money, and our investment is low, but the capital gains is high.

In Share Trading, we are investing with our money, and hence the investment is high.

in Real Estate, $20K can get you a $200K investment property. However, you do need $200K for a $200K investment in share trading….

“… capital gain is high”. Ah, the ever bullish property investor!

😉

Leverage works both ways. Can put down 20% deposit and house prices drop 20%. You loose 100% of your cash. Couldn’t happen to broad based shares

Thanks Nil.

Yeah I used to think this way too. But most of the time when you do the numbers – all the numbers – and have realistic expectations (!) the result is a lot less rosy.

It sounds very sexy and easy, but once you’ve included stamp duty, settlement costs, often negative cashflow for prime location property, or poor growth prospects for cheaper locations, plus repairs, maintenance, rates, strata, insurance and eventually selling fees, the numbers don’t really look great at all.

This is from someone who still owns a number of properties and spent many years convinced it was the only way. If you haven’t already, you should check out this blog post where I share my experience, and this post, showing why I think chasing equity is overrated.

Years ago I got really confused with dividend investing as the whole ‘system’ is geared to share growth investing from the TV news right down to our trading accounts which doggedly show daily share price fluctuations. I can remember years ago buying LIC’s and selling them because they seemed to grow so slowly or do nothing when everything else was seeing such growth (Oh, the heartbreak every time I reflect on that!).

I think the best piece of advise in your post today is “just buy the damn thing!”. This has only been a fairly recent light-globe moment for me (ever the control freak) as I fuss over NTA’s and praying for a market crash etc – next time I start fussing I’ll hear your voice echoing in my head “Just buy the damn thing!” Love it.

Your writings here and ‘other’ places (!) have been significantly instrumental in me incrementally and quietly converting nearly all my investments across to the Thornhill approach. The next hurdle I need to get over is moving away from my love of fully franked holdings (They work SO good inside super too).

I’ve popped this post link on my FB too so others can benefit from your writing Dave. I never miss a post these days.

Thanks a lot Phil!

Yes they’re deceivingly slow-moving beasts, but when we take a longer term view, and include the mountain of growing cash they pump out, it starts to make sense.

Congratulations on simplifying your approach – at least in your mind – and letting go of the micro-analysis! Really glad you feel this stuff has helped you, and thanks for sharing it 🙂

Such a concise explanation! I love this and completely agree with your analysis.

Thanks for reading Ali 🙂

I tried to explain this to my friends. They nod their head in acceptance but reluctant to carry out the idea. While I felt elation and peace when I realised that the LIC as an option for investment . The importance of cash flow from dividends is very vital for free and joyful living during prolonged life span after our retirement time.

I even want to borrow and invest because time is against me(40s) plus mortgage on PPOR eats up the savings as well.

But I cannot work out how debt recycle works (despite franking credits + tax deduction for LOC interest)if return in LIC is 3-4% dividend and Line of credit interest rate is 6%

I plug in these numbers in an excel chart , I get only deficits unless the LIC return is higher than the LOC interest rate.

https://www.investmentpropertycalculator.com.au/free-mortgage-debt-recycling-calculator.html

Haha never mind Gman. It’s likely they won’t join you – only maybe when you don’t have to work anymore they’ll ask some questions. But because it’s ‘shares’ it evokes too much fear and people shut down.

If you can, send them to Peter Thornhill’s videos series – that’s the first place I’d send shares newbies. And maybe even send them here, I do try to explain things in a simple way!

I think what’s missing from the calculation is growth. The LICs have dividends of around 4%, plus franking credits takes it to 5.7%, plus growth in dividends/share price of (perhaps) 3-4% per annum. So total return may be something like 8-9% including franking.

Your scenario may look like this – gross yield 5.7%, LOC interest rate 5-6% = around casfhlow neutral. Meaning only excess return is from dividend/capital growth. If rates go up obviously that scenario is worse.

If you’re struggling to save with your mortgage, then perhaps a lower-cost house would be a good idea, in order for you to invest. Sorry I know that’s not a popular answer but something would need to change.

Well written article showing a different view to explain Dividend reinvesting. Keep it up. I suffer from the analysis paralysis. So between you, Peter Thornhill and old barefoot I seem to keep pushing past that barrier. How long did it take you to loose that fear of the wrong move?

Great to hear Houston. I think many of us suffer from this until we eventually let go and realise there’s no perfect strategy or timing. I see folks getting stuck in spreadsheet land debating whether this strategy is any good or not lol.

I just decided that this is the most sensible way for me to invest because I feel perfectly comfortable relying on a large group of companies being able to grow their profits and dividends over time. I never got caught up in timing the market because I realised quickly nobody has any clue what’s going to happen tomorrow, next week, or next year!

To minimise bad decisions, I’ve decided to mostly focus on investing regularly in LICs or Index Funds, but only own LICs right now. Both will provide growing income from a diverse group of companies. And I’ve let go of worrying about share prices, because with this strategy, it just doesn’t matter!

If you owned a cafe or a clothes shop, you wouldn’t get it valued every week to see what it’s worth. No. You’d only care how much profit it was producing and derive your income stream from that 🙂

Like others I am converting RE to lics. Having just paid rates and strata and then 2.2 % commission on a sale and remembering the stamp duty in cost plus legal fees…..yeap, I wish I read Peters book years ago.

Great post Dave

Cheers Ian! Man it’s getting hard to count how many people are switching from property to shares.

Even conservative cost estimates seem to still get blown out of the water somehow. Just finished paying special levies, carpets in two units, painting another, and now leaks/mould problems in another, along with a short tenancy and a vacancy to deal with. Good fun.

Before someone says ‘oh but that stuff adds value and boosts rent’, no it doesn’t, it’s just to maintain market rent and keep it tenanted, otherwise the property sits on the market empty, or rent has to be lowered because of the lower quality condition, relative to others.

Thanks for another great article Dave!

Thanks for reading Shannon!

Thanks for the great read David!

I’m new to the Thornhill method and am just finishing his book. I’m fully converted and excited about the future using similar methods to generate an income in retirement. But there is still so much to learn and I have Sooooo many questions that it all seems a bit overwhelming!

I’m 37 with a 200k mortgage and full time employment. To be honest I think I’ll only manage to spare about 5K for share investing each year at the moment until the mortgage is dealt with (Hopefully no more than 8 years away).

– Do I attempt debt recycling?

– Do I invest in LIC’s at my age or do I go higher risk/return ETF’s and then convert them to LIC’s for the dividends once I reach retirement? If LIC’s now which ones? I currently have only AFIC.

– Should I be putting this spare cash into super at my age rather than investing outside of super?

– Do I need to do anything in my tax return or similar to take advantage of franking credits or do they just occur as part of the dividend process?

Thanks Marc, glad you enjoyed it.

With a small savings rate like yours I probably would not attempt debt recycling as you’ll have little margin for error. I’d probably focus on going hard on the mortgage or just tipping spare cash into investments (whichever motivates you more to find extra savings).

I can’t tell you what investments to buy, that’s up to you. Poke around the blog and I’m sure you’ll pick up some more thoughts on it. For what it’s worth I like index funds/ETFs too. What I can say is, keep it simple, keep it low cost, there’s no best strategy or perfect portfolio. If all you do is save and regularly buy broadly diversified shares, through an index or LIC, here or globally, you’ll likely do very well.

If you are interested in early retirement, then I personally chose to ignore super and devote every dollar to investments outside super. Again though, it’s maximising your savings rate which will help you reach FI if that’s your goal. If not, then super is a great low tax environment to invest, provided you don’t need/want the money anytime before 60.

Franking credits will come on your dividend statement and then needs to be declared at tax time as tax already paid or tax credit.

Thanks for this and your other articles Dave. I’ve only become interested in investing in the last couple of weeks and your website has been inspirational.

That’s great to hear Mark, good stuff!

Another good article Dave!

Currently have about 9k invested in AFI, BKI and WHF. Hopefully adding one more(most likely MLT) in the next few months. Will look to keep this as my “core four” and add to it. Unfortunately I have a “keystart” homeloan with a horrible interest rate of 5.16. My main goal is to refinance that then i should be able to add around 10k a year to the portfolio!

Alternating between firebug and your blog has become my daily routine!

Cheers Luke 🙂

Sounds like a good plan, getting that home loan rate down will be a good saving!

Great post Dave. Fantastic to see such “wisdom” coming from one as young as yourself.

And yes it can be frustrating at times putting up with some of the rubbish one sees and at times gets thrown at you by others about the “shares for income approach”. I’ve been relentlessly posting all over the place about the wonders of the dividend focused approach and LICs for over a couple of decades and stupidly still experience frustration at times with some of the stuff that gets thrown back at me. Sometimes I wonder why I bother but because this “truely passive” simple strategy has been so life changing for us and enables us to to enjoy a wonderfully generous retirement lifestyle I can’t help but want to tell others about it in the hope that they might also experience the same. Ocassionally despite crap from others at times when someone gets it I still find it very rewarding that I might have helped in some small way.

Most investors are infatuated with the big name US authors / investors / billionaires / perceived gurus. A wise and wealthy local investor once told me “beware the well meaning American” when it comes to building wealth. Australia is very different in the opportunity it offers especially for the dividend focused investor. I looked for more ordinary local role models with Daryl Dixon getting me started on this path then later on Peter Thornhill and even completely unknown investors found on forums (eg Satayking who you know) who helped get me back on track when stupidity sometimes got the better of me.

The technical aspect of investing as interesting as it is to some is far less important to the outcome. Simplicity, saving as much as you can and the ability to stick with the strategy no matter what is all that matters. Seek out others who can offer you “wisdom” not only in regard to investing but life in general. That’s way way more important than all the technical skill under the sun.

Dave it’s great that you’re providing this Blog as an avenue for others to learn about this wonderful way to invest. Keep up the great work.

Thanks for the kind words Nodrog, and fantastic comment!

There’s always a flaw to point out, or another way that sounds more intelligent or academically correct. I see some getting caught up in spreadsheet land trying to prove this is wrong and inefficient compared to capital growth focused investing, not sure who they’re trying to convince?

I hear you mate, it gets hard going over the same ground again and again with naysayers, but I guess that’s just part of it.

Then for some people it just clicks, and it all starts to make sense, and it’s great to be able to have helped someone find a way of investing that really feels right for them.

More than happy to pass on this information that’s been so useful to me and whatever I’m regularly learning/realising. And thanks again for all that you share. Great to have people like you around, makes me look like I know what I’m talking about and boosts the ‘wisdom’ on this blog tenfold 😉

Dave, just wanted to say thanks so much for the work you put into the blog. I only discovered it a fortnight ago, but I think I’ve read just about every article!! I live in Perth too and was very close to buying my first investment property in late 2017 with interest rates/prices at ‘rock bottom’, and being 25 years old it seemed the way everyone was headed. It didn’t feel right to me to put so much of my savings into something I wasn’t completely set on. After a lot of reading I instead put the spare cash into shares using the Thornhill approach. It’s still early days for me, but discovering your blog has been a massive reassurance ???? just wanted to say thank you and keep up the great writing!

Wow, thanks so much Leandra 🙂

It’s awesome that you didn’t just follow the herd/your peer group and instead did your own research. Glad this blog has helped you find a way of investing that feels right for you, and I appreciate you reading all the posts!

Yeah I know what you mean Leandra. I saved up my 20% deposit but after I achieved that, I realised that I had no idea where to buy or even if I wanted too. The FIRE community has been great because instead of just using it to travel the world for lack of a better idea I have something biggerto aim for. The best thing about the 20% D was the discipline to achieve it, and now I can keep moving in that direction

Hey Houston! It’s always reassuring to know that there are people out there with similar experiences. This FIRE community is excellent for that. It’s interesting that you mention travel, it seems the norm in your 20’s is to blow all your savings on big trips. Although I still love taking (smaller) holidays, seeing money added to my portfolio is too exciting to pass up. Everything in moderation, right?

Nice post. I am currently waiting for Thornhill’s book to arrive in the mail…

What is your opinion on ETFs vs LICs ? Does Thornhill give recommendations on appropriate splits between LICs?

VAS is appealing to me with the 4.12% yield, but there is still the worrying thought at the back of my mind about lack of diversification outside of Australia. This would obviously still be an issue with LICs. Hopefully his book alleviates my concerns over diversification.

VAS and the old LICs are very similar in many ways and each have their own pro’s and con’s. Pick whichever one you feel more comfortable with.

Peter doesn’t give portfolio advice, but my guess is he would say keep it simple and don’t think about it too much. If you like 2 LICs or 4, then you could just hold equal amounts in each.

If you don’t feel comfortable with just Australia, you can always look at adding an international index fund like VGS. There’s no perfect portfolio, whatever feels right and something you can stick to. The core message of Thornhill’s book and many of my blog posts is to focus on the earnings/income stream from your investments and don’t worry about the market.

I remember attending a presentation that Peter Thornhill gave in 1998 (in fact I still have my notes from that presentation). His message has not changed in the intervening 20 years just more data points on his income charts. Good to see people like Dave continuing on the good work. Excellent blog!

Haha that’s awesome Steve!

Some people tire of the same old messages, but I think it helps to regularly drum in to our heads good investing principles, because the most important lessons don’t change over time.

You might just have to put up with me repeating these same messages over and over again on this blog 🙂

When you are swimming against the tide of popular opinion, you never get tired of hearing messages such as yours – its refreshing to be a contrarian in the modern world but the discipline required to operate this way never dissipates.

Nicely put Steve, and thanks 🙂

Thanks for another great article Dave. Love reading your articles and the comments. Good to see that you are really helping people understand the power of income investing and some comments from income investors who are actually living of their incomes and have been doing so for years (@Nodrog). The advice and wisdom from them is priceless.

Cheers Fergy.

Yeah definitely, I’m humbled by it, and it’s great to have lots of thoughtful comments from people who are also happily following this approach. Maybe there’s more people doing this than I thought?

Just spreading the love and putting it out there since it’s been so helpful to me 🙂 If people pick up on it and it makes sense to them too, then that’s great!

Great article Dave.

I just sent the link to my wife as it is the most succinct version of how I would like to invest moving forward whichI have read online.

One question – how does this all fit in with paying off a mortgage?

Is this something which you would strive to do while paying off a mortgage, or would you recommend waiting until it is payed off altogether?

I get confused about the interest savings of making extra home loan repayments (and thus paying off the home quicker) versus the compounding gains of dividend investing over time.

Thanks again.

Pete.

Thanks Pete.

It’s a completely personal choice, can be debated either way. I personally prefer to invest rather than pay down debt because I believe the total return after tax will be higher than the mortgage rate. Simply using the current environment, a sharemarket return of 6-7% after tax is likely to be higher than the guaranteed mortgage interest saving of 4%.

There’s no right answer, you can do both if you like – pay off a bit extra mortgage as well as invest.

Franking credits aside, remember that if you are still working, if you invest in LICs or shares that yield 4% before franking credits are taken into account, you will not be actually getting a yield of 4% on your investment, as any dividends will be taxed at your top marginal tax rate i.e. you will lose 32.5% or more if you earn above $37,000 per year (i’m not accounting for the franking credits to keep it simple). I think this is a point a lot of people who are still working forget about. I advocate using an offset account to smash down your mortgage if you can as fast as you can, as its tax effective to do so.

It’s not hard to pay only 30% tax (so clear 4% net yield) if you really want to, some will have a lower income spouse for example. There’s also the option of using the BSP/DSSP offered by Whitefield or AFIC which means no tax to pay but no franking. Or a more expensive option is holding shares in a company structure.

On the top rate of tax you will clear roughly 3% net dividend, so the worst case scenario is hardly terrible. Using the above techniques will see that stay around 4% or somewhere in between.

Not sure why you’d say ‘franking credits aside’ to calculate how much income you’d receive? This is a bit like estimating you pay 62% tax at work instead of 32% or something.

Yes the offset account is a solid option but don’t forget there’s no growth from that option, so comparing interest savings vs dividend yield is misleading. Even with only a 3% dividend after tax you’re looking at perhaps a 6-7% total return after tax, versus mortgage rate of currently 4% or so tax free. Both options are good and can even be done at the same time 🙂

Dave just want to say I don’t intend to sound like I am against your strategies, I just wanted to highlight the numbers behind how offset accounts work. Your blog has been very helpful to myself on planning my portfolio. I guess I am just a bit more cautious about some assumptions you have than others. As you have said many times, its about finding the balance of what works for you personally when it comes to portfolio risk, and this is what I am still working out.

Anyway, thanks again for all the great information your blog provides.

That makes sense Ben, thanks. Sorry I didn’t mean to argue with you either, just pointing out the misleading nature of looking at a 10 year performance figure without putting it into context.

All good, thanks for reading and commenting – much appreciated 🙂

One thing to note if your mortgage interest rate is 4% then this is paid in after tax dollars. Assuming your marginal tax rate is 30% (can insert whatever figure your marginal tax rate is) then in before tax dollars you will get a return of 4/0.7 = 5.71% by paying off your mortgage. This is the figure that should be compared with the overall expected returns from shares. Also note if the share dividends are not fully franked you are then up for paying tax on some of your returns! If dividends are fully franked like LIC’s it becomes very easy to do a direct comparison as the return above can be directly compared to the LIC return. But all up and as you mentioned long term you would expect to get a better average yearly return than this in the share market albeit by not the biggest margin. I think either way will work out fine. Who’s to say you cant do both!

Good comment. It’s the interest rate PLUS the tax rate you need to calculate this at. I’ve got about $500k in my offset account that I can either dip into if I ever want to or allow to sit there so I’ve got free rent forever. To generate free rent forever in a place that costs as much as mine I’d need more than $500k, so I’m coming out ahead on pure mathematics alone. Add the psychological benefits of not having a mortgage or rent payment each week and the benefits keep compounding.

Thanks for the comment Chris – care to elaborate on that?

I mean, if someone has a house worth $1m, a mortgage of $500k, and $500k in the offset, then they have $1m equity there as the house is effectively paid off. Yes this generates ‘free rent’ forever, but you should measure the opportunity cost of the total $1m in this scenario, not just the cash.

The psychological benefits are another thing entirely and can’t really be measured as it differs in importance from person to person. Some people say they love the psychological benefits from renting – completely free, not tied down, flexibility, no ownership costs, no transaction costs, scale up or down cost/lifestyle easily. I can see both sides.

Thanks Kieran and Chris. This was exactly the point I was trying to make.

If you have the option of putting money into an offset account or investing, unless your investments can beat the (interest rate)/0.7 = Value, then you are better off just leaving the money in your offset account. (And this assuming the house does not appreciate/depreciate in value.)

So as most Aussies have an mortgage interest rate of ~4%, this would mean an effective rate of 5.71% as Kieran states above. The interesting thing I find is the 10 year total share holder returns of the big LICs like Argo are only around the 6% mark. So even at all time low interest rates, an offset account is nearly exactly the same. Just something to keep in mind as everyone seems to miss this important point.

I agree with the point, it’s 5.71% effective, but in real life it means 4% after tax, so your shares return needs to be higher than this, after tax.

Why would you choose the 10 year return to compare the LICs. Hmm, what could have happened 10 years ago to distort these figures? Maybe the GFC?

Looking over 15 and 20 year periods which is a more sensible view, returns are more like 9-10% per annum, before franking.

The funny thing is, if you look again in a year or so, the GFC will be erased from the 10 year figures, and the shares returns will look incredible. And you know what, neither data point is very accurate, they don’t tell the whole story. This stuff needs to be put in context and then make a common sense expectation of the future.

Looking at it simply, your gross dividend yield is 5.7%, after tax say 3.5 to 4% net dividend. Then you add on earnings growth of say 3-4% per annum, and you get a total return after tax of 7%. Now compare it to your mortgage offset of 4% after tax. Long term (100 years) sharemarket returns are around 10% per annum so I’m not being overly optimistic.

This is where people get lost. It’s not a comparison of simple dividends vs interest saving, there’s a growth component to shares. You’re getting paid more for taking the risk. You don’t get this with an offset.

I’m not pushing anyone to choose which way, but just to look at it from a more broad angle and know what the numbers mean. By all means if you prefer the offset then go for it.

I agree with dave.

But i read this ,

To quote from the book ‘the simple path to wealth’ – JL COLLINS

‘avoid debt at all cost’ if possible

If the interest rate is 3% – pay it off slowly and route the money to your investment instead

Between 3-5%,do whatever feels most comfortable.

More than 5% – pay the debt off ASAP

Great write-up!

Thanks for sharing – I’m still relatively new to LICs but it’s interesting to read about them since most people I speak to come from the Boglehead camp.

Thanks for stopping by, glad you liked it!

The bogleheads are an intelligent crowd, much more-so than this simple dividend investor 😉

Although they probably wouldn’t agree with my investment approach, I noticed that old LICs still rank a mention on the Bogleheads Wiki-page.

I’m completely with you about 90% of the way here Dave – and love the impact you’re having on others judging by all the comments above!

You’ll well know by now that the other 10% of me is an avid value investor that DOES care about asset prices. I don’t want to blindly throw my money at a dividend paying investment if the price I’m paying for that asset doesn’t seem to reflect the value I’m getting. Yes, in the short term it’s hard to know what asset prices will do, but I’m a firm believer that the value of assets gets distorted in the short term for many reasons, including the ‘herd’ behaviour you’ve mentioned many times here, and provides some great opportunities to buy great assets as a discounted price, which can ultimately add to that annual return and resulting cash flow you receive.

Cheers, Frankie

Thanks Frankie, and it’s good to have other passionate investors like yourself here to liven up the place and add to the discussion!

Haha yes you love your value stocks I know 😉

You make some solid points that are no doubt true, though hard to quantify and judge at any given time for the average investor. Given the ‘return drag’ from waiting for investments to look attractive, I’ve just decided to simplify and buy. Hey, ‘Simplify & Buy’ can be my new slogan haha.

I suppose if the market drops I’ll try to buy more (somehow), but in the meantime just regular purchasing will even the prices out for us.

Appreciate your comment as always mate!

Simplify and Buy is definitely one of the best investment strategies there is – great slogan too, might make a good spin-off blog!

Hi Dave

After reading your blog and then Peter Thornhill’s book and videos, we have made the decision to move 60% of our Super into LICs (Argo, AFIC and Milton). When I mentioned this on another forum I received some flak for doing this within super. We are 2 years away from retirement and have almost 2 million tied up in super so to us it seems like a no brainer. Would love to hear your thoughts.

Cheers

Hey Starbuck!

Hmm, the flak could be to do with the fact that it’s not the classic ‘globally diversified index funds’ approach. It’s completely up to each of us how we invest, I don’t think there’s a perfect way. The tax-free environment is (obviously) a heavenly place to invest for income.

I can’t advise of course, but if I had that much and about to retire I’d probably feel fine about it. I mean, the income alone from that will be over $100k including franking credits. If you were nervous about lack of diversification you can always put 50% of it in an international index fund and overall still generate dividends totalling $80k including franking.

Hope that helps the thought process at least. (not advice!)

I think one of the most important things I am learning is that it is all about finding the best fit for our own circumstances. What is great is that there are people like you out there who are willing and happy to share their knowledge and help people like us learn about investing :-). It definitely is a process.

This is a great article, Dave. It demonstrates in a clear and simple way just how powerful regular saving, investing and automatically reinvesting dividends can be to create an ever growing snowball effect on your total net worth. We’re still in the early stages of accumulation but already seeing how those dividends just keep growing with every new amount of savings we invest in the markets (index funds in our case).

Interesting also reading the comments about greater numbers of people in Australia moving away from property and into the stock market instead. We were so very close to purchasing an investment property but the more I read and educated myself on investment strategies, property just didn’t make sense to me in terms of all the ongoing costs, time involved and having such a large pool of funds attached to a single asset. Everyone is different with what they’re comfortable with but index fund investing definitely feels like the right path to financial independence for us.

Thanks SOL Guy, and great comment!

Awesome that you’ve found the right strategy for you and you’re feeling motivated by the snowballing income/portfolio 🙂

Thanks for another great article. I didn’t know whf offer dssp for dividends that’s appealing to me.(do any of the other lic’s offer this?) I also like that they pay dividends in December and June . (Totally different months to Afi,arg,mlt,bki) the only thing I did notice and wasn’t keen on was their fees. 0.40 I think of the top of my head. Is this a deal breaker?

Cheers Luke. Yep, Whitefield call it a ‘Bonus Share Plan’ here’s the link.

None of the others offer this unfortunately, aside from AFIC of course. The fees are a little higher, but the company is a little different too – 100% industrial focused (no resources), 160 stocks rather than 70-100 for the others. Also offers attractive discounted buying opportunities most years and haven’t cut their dividend in 25 year or so. No need to own it if you own a few of the others, but another decent option. But obviously if lowest fees possible is an investor’s goal they won’t choose WHF.

Ok thanks for the reply. I think I might buy it for dec/June dividend. ???? When buying lic’s do you bother looking at the yields ? im wondering if it’s a good strategy to go with the Lic with the highest yield when topping up. Or to do an evenish split between 4/5 lic’s?

I do look at the yield but I don’t necessarily buy the one with the highest yield. It always tends to be BKI because it has more banks in its portfolio.

An even split is the simplest choice and helps avoid over-thinking it 🙂

Love love love this article Dave!! After an SMPC in July, (Strong Money Post Crash) where there were just 2 blog posts, a record low, haha, I eagerly awaited this one. Luckily for me, or should I say “foolishly”, I’ve found your new stomping ground 🙂

Absolutely brilliant post, I appreciate your thoughts and keep up the good work.

Haha good one, thanks Linc!

I’m trying(!) to go for quality rather than quantity 😉 No promises there though. The Peter Thornhill post took me quite a long time as you can imagine and I left 2 weeks after as I wanted to leave enough time for people to absorb it and enjoy the discussion/comments, rather than publish something soon after.

Glad you liked it, and thanks for the nice feedback. p.s. this blog is always my home base, where all the most important stuff gets written!

Thanks for this post Dave, we needed this post once in a while as this journey to FIRE is boring and sometime we ask ourselves if we are really doing the right thing.

This FIRE journey completely transforms our way of life and it is never easy.

We try to reward ourselves for every milestone reached like every 10k or 100k mark.

If I may suggest that you post some kind of motivation on our boring journey every once in a while.

Cheers Tarly, I think many of us have doubts from time to time whether it’s the right thing to do.

From the other side, I can honestly say it’s worth it to get your life back and start spending more time on things that are more important or rewarding. It’s good to celebrate the milestones and what you’ve achieve along the way, well done for that!

Hi Dave,

Firstly, love the blog, great work.

I have a small home loan of about 100k. What are your thoughts on pulling out say 20k a year from the loan to invest in LICs, assuming I’m paying off about 40k (20k after investing) a year off the loan and dividends are at least greater than interest rate?

This way I’m building up my portfolio at the expense of taking longer to pay the loan off. Or would it be better to pay the loan of as quickly as possible and start investing later?

Cheers,

Peter

Thanks Peter!

Probably no major benefit either way as the loan will be gone soon anyway. I’d personally start investing sooner but I don’t think there’s a right answer for everyone. Choose whichever one you feel more comfortable with!

Great Article Dave,

I have only just started off my journey with my first purchase of AFIC last month and cant wait to purchase more!

Although its hard to save when your only 20 haha

I would like to know your opinion on the debate of DRP vs DSSP for the tax advantages on our investments. I believe when you reach the 32.5% bracket you should switch to DSSP as your franking benefit is not giving the possible refund being over the company tax rate of 30%? Please correct me if I’m wrong, only been researching that factor in investments briefly for the past few days.

Keep up the great work!

Thanks Matt. Congratulations on your first purchase!

I started saving heavily when I was around 19-20 (your age), that’s 10 years ago now – makes me feel old 😉

Keep working on your spending to try and boost that savings rate a little higher over time, there’s usually plenty of things we can do to improve it.

You’re correct, mathematically anyone paying more than 32.5% tax would be better off with the DSSP. But it’s not as simple as that because you’re giving up flexibility of income now and larger CGT if you sell to do it. I’ll write about this soon, but I’d be more keen if my income tax bracket was 37% and above. If you are convinced you will never sell it for any reason then it’ll work out better – hard to have that foresight though, things can change.

This is something of interest to me also, I will be in the 37% bracket at the start of the next calendar year. Could you shed some light on the differences in tax outcomes and CGT if possible 🙂

The CGT calculations are an absolute nightmare to figure out in this scenario to be honest, but I will post some thoughts on this in the next month or so.

Absolutely loved this article as it fits my profile perfectly also. Sometimes it’s hard not to drift slightly and get interested in potential side roads but reading this has put me firmly back on track! So for that, thanks a lot!

Slightly off track I do have one question that may even get you thinking something you haven’t before. Purely hypothetical but could be fun for you: If you had to gather all your invested funds and drop all of it into only one stock/LIC, which would it be currently?

Thanks again and keep up the good work. I’m not a regular commenter but am a reader and I’m sure there’s many more like me so keep inspiring us all!

Thanks for the comment Paul!

There’s a lot of distractions out there with the market commentary, daily movements and unlimited choice of what to invest in. All we need is one approach that really makes sense to us and the discipline to stick to it.

Jeez that’s a tough question, something I haven’t thought about before. Most of the low cost LICs or the index itself (VAS) I’d feel fine with – lol is that cheating? 😉

Hey Mr. strong money,

Loving the articles and all the great content your providing, awesome job!!

I’ve been buying 1k parcels of the LIC DUI, I first chose it because of there small allocation(15%) to international ETFs and my small purchase size “trying to get it all done in the 1 trade”

(For now)

Every time I scrape up 1k I just keep buying it, I want to add more Lics & index funds.

I’m over complicating it for my self with the dream portfolio.

Would be great to hear your thoughts on DUI

Thanks mate

Thanks Heath, great to hear you’re enjoying it!

Someone asked me this the other day lol, I think on the Peter Thornhill post. I do like DUI – very low cost, low turnover, long term income focus, excellent dividend history. I don’t own it though, have too many LICs already. I think it’s a good choice 🙂

Whatever you do, just keep it simple, there’s no perfect portfolio!

Thanks for replying, Lol just found it. Just need that little reassurance from some random dude on the interwebs lol. I bore people discussing this topic Lics/ETFs.

Dui looks a great Lic, raised there dividend once again this week, there small knock is they borrow 10% of there capital to invest each year (best of my understanding) same as there sister company AUI.

Will be mortgage free within 2 years, then plan to invest larger sums more regularly.

Haha what…you mean not everyone gets excited by these investments?!

Yeah that’s right, they keep their borrowings at roughly 10% of the portfolio. You can tell they keep costs low from their website and annual reports 😉

Awesome work on the mortgage!

Showing the impact of income returns, capital gains and further contributions illustrates the magic of compounding. Great analysis.

Australians are heavily property focused. Having both property and shares helps with diversification and smoothing out returns. People also forget about the value of their time. Buying and holding shares requires hardly any time at all. But renting a property has a time commitment that is required. This needs to be taken into account.

Thanks for sharing your thoughts Greg 🙂

Hi Dave,

Love your articles.

Do you have a strong opinion on this method of investing for people with a lower savings rate, say 30%?

Thanks Kevin, appreciate it 🙂

Actually I think it’s even better for lower tax rate investors. This is because you’ll get franking credits refunded currently and you’ll earn a higher after tax return than those on higher tax brackets.

Hi SMA,

Great article and I love the level of detail you’ve gone into. I originally set out in shares picking stocks through the recommendation of the blueprint and Scott Pape – but I fast learned that for every success I had an equal amount of flops, and I just underperformed the index. When I figured this out, through reading yourself and Aussie Firebugs blogs, I sold all of my individual equities, cashed out, and moved into ETFs. I still hold VAS, A200, VTS and VEU index fund ETFs, but since discovering your comprehensive guides to LICs I have begun purchasing LICs AFI, MLT, ARG and BKI to compliment my ETFs. I follow strategy number 5 which is the ‘hybrid’ one where I pick the most undervalued, but not to the detriment of stressing out or overweighting the portfolio. Thanks again for the great content and look forward to digesting more of your posts. Cheers, CaptFI

Thanks for the comment Captain. Stock picking is hard and can consume quite a lot of mental energy which surprised me, even with a buy/hold approach. Much easier to leave the work to others (LIC) or simply own all the stocks (index) and spend time doing other things 🙂

This was great to read a second time as a handy refresher! I wonder, Dave, if you might have a link to the calculator you used for the 3rd last graph? Did a search but couldn’t find one that included all 3 inputs (growth, dividends, added funds). Thanks again for the blog mate!

Thanks James! I’m 90% sure the calculator used would’ve been MoneySmart compound interest calc – https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/compound-interest-calculator

You don’t need the 3 inputs, simply funds added plus total return will do the job. I just broke it into 3 parts for the chart so that it was clear what was happening behind the scenes and where the return came from.

Hi SMA,

This is by far the best post on your site. Worth its weight in gold, or should I dare say it Dividend beats GOLD. Getting dividends from LIC’s – a Thornhill approach – I follow this on my journey. The power of saving and combining this with the magic of compounding. Good examples.

Well done.

PS I like the new website. Keep up the good work.

That’s very kind of you to say mate, thanks!

Oh yeah, saving, investing, and seeing those dividend payments get bigger each time is super motivating. Cheers 🙂