Start Here

Close Menu

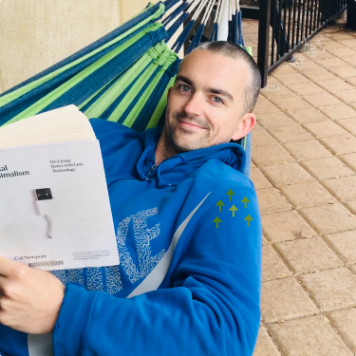

Here's a summary of my personal journey to Financial Independence.

I didn't keep records, so the numbers and timeframes are my best estimates.

Moved from country Vic to Perth for job opportunities. Started full-time work. Savings rate: 20%

Saw my future as a cog in the machine for the next 40+ years. Decided I had to do something to change that! Savings rate: 40%

Started saving aggressively into a high-interest savings account and learning about how to build wealth. Savings rate: 50%

Met and moved in with my partner. She bought into the idea of FI. Started learning about investing.

Savings rate: 50%

Purchased my first property. Optimised our expenses.

Savings rate: 60%.

Purchased my second property. My partner purchased one too. Our progress gave me extra motivation. I started doing more overtime at work. Savings rate: 70%.

Officially joined our finances and purchased an investment property together. Pay-rises and tax savings with no increase in spending. Savings rate: 70%.

Purchased two properties this year. Also rented out a room in our house. Savings rate: 75%.

Purchased one more property. Started investing in shares, focusing on dividend income. Also realised we didn’t need as much as we thought to retire.

Investing heavily into shares. Realised we could actually retire soon if our savings were in shares instead of property! Sold one property to begin this process.

Decided we had enough to retire and left our full-time jobs. Continued building our share portfolio using cash from the property sale and dividends to live on.

At age 19, I became disillusioned with work. I noticed how many people were just trudging along, unhappy and unsatisfied. Working week after week, just to pay bills, with no end in sight.

Frankly, this terrified me. After a while, I simply could not accept this future for myself. “There has to be another way,” I thought.

So I was determined to have a very different future to my colleagues. Then it occurred to me that the only way to create the life I wanted was to become wealthy. And the most realistic way to build wealth is by investing.

Since starting work, I’d saved some of my pay each week, purely through sharing housing with friends and having simple tastes. It was more a case of money being ‘left over’ than dedicated saving.

But now things had changed. I had a reason to save. A big one!

I started reading books on investing and decided that property investment was the right path for me. By age 20, my savings rate had increased. I was in a new, better-paying job, and still enjoying a low-cost single-guy lifestyle.

The next year I met and then moved in with my partner. I kept saving and by age 23, I’d purchased two properties.

That same year, my partner also purchased a property. Luckily, she also bought into the idea of Financial Independence.

After many talks about our future and our priorities, I put in overtime at work and we optimised our spending. Our savings rate shot up even further, even though we were still living a good middle-class life.

We earned healthy incomes – around $75,000 each on average, before tax. But the magic was keeping our spending modest – around $45,000 per year on average.

We still went for coffee and out to restaurants, bought an expensive dog and even had a few international holidays. But the secret is moderation. We optimised each category of spending to get the most benefit for the lowest cost, and cut things that added no value to our lives.

At the same time, we realised you don’t need an expensive lifestyle to be happy. This enables lots of saving, rapid wealth-building and Financial Independence in around a decade in many cases.

In 2016, I had a light-bulb moment. If our equity was in shares instead of property, we could retire soon and live off the income!

So we continued buying shares and in late 2016, decided to start slowly selling off our properties.

In 2017, we left work and finally got our lives back!

As we continue transitioning from property to shares, we use some of the money to live on, while the income from shares gets bigger.

We’re also earning part-time income these days too, doing work we enjoy. And funnily enough, that’s one of the best parts about Financial Independence.

It all circles back to my initial motivation: having freedom and choices in life.