Close Menu

September 29, 2018

Welcome to the latest LIC review in the series.

Today, we’re taking a look at an investment company that flies under the radar of most investors – AUI.

While it is similar to the others we’ve covered, it doesn’t get much love. But despite its lack of popularity, I think it’s worth considering for income-focused investors. And you’re about to see why…

AUI was founded 65 years ago, in 1953, by the late Sir Ian Potter, a prominent stockbroker, businessman and philanthropist.

Leaving most of his wealth to charity, today the Ian Potter Foundation is the largest shareholder in AUI.

The company listed on the ASX in 1974, and today is valued at just over $1 billion.

AUI is conservatively managed, with a strong focus on providing a reliable and growing income for shareholders.

This should come as no surprise, given the founder’s charity is the largest shareholder. A charity needs reliable cashflow, and as dividend investors, so do we.

AUI is an extremely lean company, with only a board of (well experienced) directors meeting monthly to make investment decisions. It invests for the long term and rarely sells holdings.

From the company itself:

“Our objective is to take a medium to long term view and to invest in a diversified portfolio of Australian equities which have the potential to provide income and capital appreciation over the longer term. AUI is an investment company which seeks, through portfolio management, to reduce risk and improve income from dividends and interest over the longer term.”

“Investments are purchased on the basis of the directors’ assessment of their individual prospects for income and growth. The directors do not invest by reference to any pre-determined policy that any particular proportions of the capital will be invested in particular investment sectors.”

In short, AUI invests where it sees good prospects for income and growth over time.

The company also uses a very modest amount of gearing. It has an ongoing bank facility, usually worth around 10% of the portfolio, to access additional funds for investment.

While this is unusual for an LIC, the interest rates are favourable and it’s managed conservatively. And in any case, it’s only a small amount of debt.

AUI has a medium-sized portfolio of between 40-50 companies – a similar amount to BKI.

While AUI holds a group of mid-cap stocks, the portfolio is heavily weighted towards the largest dividend payers on the ASX. The company also has tiny investments in 2 small-cap managed funds.

Clearly, the board of directors has decided to outsource the selection of small companies to others better researched in this area.

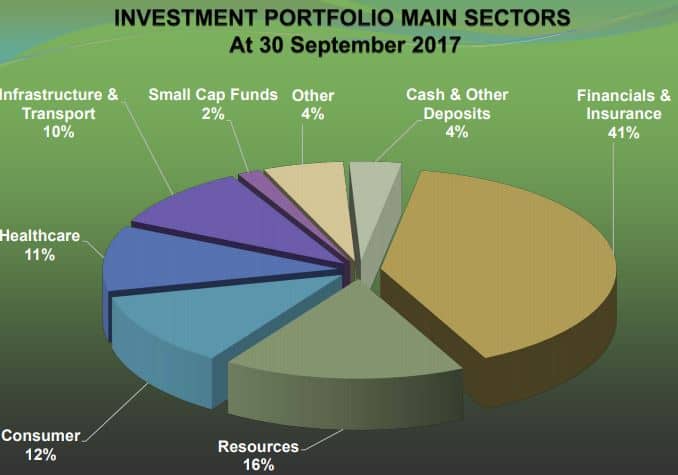

Here’s the portfolio breakdown by sector…

Similar to the other Aussie LICs, AUI is heavy on financials. But digging deeper, it’s not as concentrated as it first appears.

For one thing, this chart is from 12 months ago and banks have fallen since then.

As of AUI’s most recent annual report, banks make up 24% of the portfolio – (see here for full list of shares owned starting page 38).

Other Financials and Insurance is 11%. And 6% of that is their holdings in other investment companies, Washington H Soul Pattinson and sister-company DUI.

So the portfolio today is really about 30% financials in total. A decent weighting, but hardly nosebleed levels.

You can find AUI’s current top 25 holdings here.

The portfolio will likely change slowly over time, as it makes further investments and various companies succeed while others stagnate.

No question, AUI has a less diverse portfolio than the likes of Argo. But that hasn’t stopped it providing a good flow of income to shareholders.

Long term performance data is frustratingly hard to find in Australia. But we’ll work with what we have.

I’ll just apologise now that I don’t have a clear one or two charts to show you. More like a collage of data!

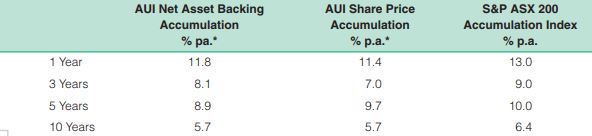

Here’s the last 10 years of performance from AUI’s recent report…

AUI has lagged the market a bit in the last decade. But this isn’t quite the whole story.

There’s fees for the index which aren’t included. Then there’s franking credits, which would be a bit higher for AUI. And finally, the fact that AUI regularly trades at a discount – more on that later.

Essentially, anyone who bought AUI over the last decade would’ve received a return close to that of the index.

As you can see, the numbers are still skewed downwards by the GFC bang on 10 years ago. In about 6 months, the 10 year figures will look a lot different, even though little has changed!

Since I think in time-frames much longer than 10 years, I went in search of more data. And I found this chart from AUI’s 2001 Annual Report (click to enlarge).

OK, so this runs from 1980 to 2001. And this compares the All Ords Accumulation Index and AUI. Both including dividends. A very large difference. Even if you pick different starting points on that chart, AUI still did better.

As luck would have it, 2001 is when the first index fund in Australia was listed. So we can compare against that using Sharesight. Here’s what it shows from 2001 to today (29 Sep 2018)…

These figures account for franking credits and fees for both.

So, over longer time periods, AUI has done pretty well. It’s beaten the index for most of the last 40 years. And only in the last 5-10 years it has started lagging.

But with the amount of fund managers and analysts in the market now, this could be the new normal.

Why? Because more competition between professionals tends to compete away excess returns.

The same goes for the other LICs we’ve looked at previously.

AUI may never return to its old performance. But at least we have more history and context when thinking about the company.

As you know by now, our focus isn’t getting the highest possible return at all times. It’s about the income stream!

And I think you’ll be pleasantly surprised with AUI in this area. I know I was.

Here’s the dividends paid each year going back to 1993…

Wow! AUI’s dividend history is a thing of beauty. There were no cuts during the GFC. Most years the dividend has increased, and other years it was kept stable.

If you’d owned AUI during the last couple of decades, you wouldn’t know what all the fuss was about. And recent underperformance? With an income stream like this, my bet is shareholders wouldn’t have cared!

Over the last 25 years, dividends have grown at a rate of 6.3% per annum. And during that time, inflation was 2.5% per annum.

As a side note, since 1992, capital growth has also averaged close to 6% per annum.

So AUI has done an excellent job of providing reliable and increasing income for shareholders. If this was your chosen source of cashflow in retirement, you’d be very happy indeed. Honestly, this is about as good as it gets!

AUI is a low-cost operator. Very low-cost!

The cost of managing the company is currently 0.10% per annum. And this includes the fees paid on the small-cap managed funds that AUI invests in.

Put another way, AUI is cheaper than AFIC, despite being 1/7th the size!

Also, AUI is internally managed. So as the company grows over time, the expense ratio tends to fall. And this means we can expect it to get a little cheaper in the future.

As mentioned, there’s no analysts or expensive research teams. The board of directors simply meets to discuss the portfolio and make decisions every month.

Another sign of frugal funds management, is their website. It looks older than the internet!

Now, I know some are turned off by that. But I think it’s a good thing. It shows AUI doesn’t spend a fortune on glitzy presentation material or marketing.

In any case, the dividend history speaks for itself!

As you might know, shares in LICs can trade at a price that’s different to the value of its assets. All depending on what price people are willing to buy and sell for.

Most of the time, the older LICs we discuss, trade somewhere close to its net tangible assets (NTA). But in the case of AUI, shares trade at a discount almost all the time.

This could be for a variety of reasons. AUI is smaller and not as well known. It makes no effort to market itself or give presentations to analysts. Or it could be that people simply prefer the larger old LICs like AFIC or Milton.

Another reason might be the more concentrated portfolio. Or because it’s less liquid, meaning less shares are traded each day. It could also be everyone expects AUI to lag the market going forward, so buyers demand a discount to compensate.

These things can create a feedback loop of course and result in nobody wanting to pay full price, because it never trades at NTA!

Whatever the case, AUI tends to trade at a discount to NTA of around 0-10%.

The recent monthly portfolio statement shows AUI has a net portfolio value of $9.35 per share. And today (28th Sept) AUI shares are currently trading at $8.50. So you’re getting shares at a 9% discount.

Put another way…

Let’s say AUI traded at NTA value, $9.35.

This year’s dividend was 35 cents per share, which is a yield of 3.7%, or 5.3% including franking credits.

But because you can buy shares for $8.50, your gross purchase yield is actually 5.9%.

This yield is locked in on purchase. So whatever AUI’s performance is going forward, your return will be 0.6% higher.

Don’t get too wrapped up in the details of this. Just a point I wanted to make.

AUI has an impeccable dividend history. As an income focused investor, that’s very hard to ignore!

They’ve managed their earnings well, so as to not have to cut the dividend during leaner times. It has the most reliable dividend track record of any LIC I’ve looked at.

For some people, this factor will make up for any underperformance.

AUI is tax-efficient, doing very little selling. Because of this, they can pass on the CGT discount to shareholders when they do sell shares. So on the odd occasion, we’ll receive a tax deduction attached to our dividend, along with those franking credits. More info can be found here.

I like AUI’s long, successful history and the focus on keeping costs ultra-low.

Also, being able to buy shares on the market at a discount is a plus, as it boosts our purchase yield versus the underlying portfolio.

AUI has a slightly more concentrated portfolio than the bigger LICs. It’s more similar to BKI in this regard, having only 40-50 holdings.

The top 25 holdings account for around 80% of the value. So I’d prefer the portfolio was more diverse. But I can’t really argue with the income stream they’ve provided.

The lack of small companies is a negative too. While I understand medium and large companies tend to be better dividend payers, some small dividend-paying companies in the portfolio couldn’t hurt.

Also, recent performance could be chalked down as a negative. But as mentioned earlier, it’s not a dealbreaker for me.

I’d like to see more shareholder communication as well. Nothing much, just some extra commentary on the AUI portfolio and the market would be good.

Overall, I like AUI and we own it in our portfolio.

While it doesn’t get much mention, it’s been a very strong income provider for a long time. Think of all the ups and downs in the sharemarket over the last 25 years…and then look at that dividend history again!

It’s a little bit different to the other LICs we’ve talked about. But I think it’s worth considering as part of an Aussie shares portfolio.

Currently, AUI trades on a dividend yield of 4.1%, or 5.9% including franking credits.

AUI is well managed, low cost and very focused on providing reliable returns for shareholders. They’ve done a great job so far and I don’t expect that to change anytime soon.

A dependable and growing income stream for financial independence, what more could you ask for!

Enjoy this review? You can find all my other LIC reviews on this page.

You might also like my easy-to-use Dividend Tracker, which I use to keep a running estimate of our annual passive income after every purchase. Click here to get it for yourself.

Thanks SMA

I really enjoy your LIC series and this one is up to expectation.

I’m toying with just concentrating on AFI and WHF due to DSSP offerings whilst I am still earning in a higher tax bracket. AUI will be back on the purchase list when the time comes to scale back my job or if they decide to pension-off grey-beards like me 🙂

Cheers Phil.

AFIC and Whitefield will likely do the job just fine mate, sounds like a pretty good plan to me 🙂

Hi Dave, thanks for another very interesting and informative article. You have drawn my attention to an interesting stock I was not familiar with. Thanks to you i will be adding this stock to my portfolio ASAP.

Glad you liked it Brian, thanks for reading!

I recently picked up AUI at a bargain price for the first time this month. I’m so pleased I did! They are exactly the stable boring type of income producer I’m looking for. I’ll be slowly accumulating more over the coming years! A great review on AUI.

Nice work willis. Boring and reliable it certainly is, although that’s the strength of these types of investments as you know 🙂

Hi unwillingwillis, 15 months on from your AUI purchase, are you still holding and happy with the dividend returns? I’m thinking of making it my 4th and final LIC in my current portfolio of AFIC, Milton and BKI. Dave mentioned liquidity is a bit slow, but apart from that, is it a ripper of a LIC? Cheers!

Hi Matt, I actually sold AUI and rolled it into IOZ. Like Dave I’m trying to simplify my overall portfolio. I had too many overlapping holdings which just isn’t necessary. I only sold AUI as it was one of my smaller holdings. Liquidity is poor but as a long term investor not really a big factor. It can have big share price swings at times, which can create buying opportunities.

Good stuff.

Any chance of a Whitefield (WHF) review?

Only one of major LIC’s your haven’t done yet.

Thanks Kieran. Yep Whitefield is the next one on the list, stay tuned.

And DUI please? Loving this … cheers!

Haven’t decided on DUI. There’s gonna be too many and it’ll confuse people!

Hope this isnt to personal but how many LIC companies to you actually have? I know your interview with peter said he only has 4. Seems you have 4+

My question is should you concentrate on building 2-3 lics up at one time or should you have 4+ and build them but at a much slower rate? Or it doesn’t even really matter?

The answer is ‘too many’ andy. I hold the 5 reviewed here so far, plus a few others. There’s no need to own that many, I just seem to overcomplicate things any chance I get 😉

Peter is clearly far better at keeping things simple than I am, but I’ll get there.

I think 2 or 3 is perfectly fine mate, just pick a couple you like and then you can basically forget about the rest!

The only thing I’d say is I would try to have at least 1 with a larger portfolio of close to 100 companies – like Milton, Argo, AFIC or Whitefield. It’s a personal thing but I’d feel safer owning at least one of those rather than just BKI and AUI alone since they hold around 40-50 companies. Hope that makes sense.

Too many choices, too man choices! Just when I think I have my portfolio all sorted out, you come along and offer another suggestion 😉

Thanks for insight into another LIC, I’ll consider it in my next round of investing.

Haha sorry!!

I questioned this myself, whether it would be helpful or harmful to offer more reviews. I’ve decided to write about the ones I follow and people can just choose a couple they like. I’ll just stress that while I think they’re all suitable, there’s no need to own them all. And to be honest I think it probably doesn’t matter which ones you choose.

Thanks for reading!

Thanks Dave! Interesting review. Looking forward to your review on WHF! Will that one be next?

Cheers Jacqui, and yes the Whitefield review will be next 🙂

I own AUI and as you say is a good consistent dividend payer that delivers every year and keeps rising. 4.1% is reasonable yield but its the franking credits that make it attractive IMO. You want to be getting 5% or over on your money when you are retired and the franking credits are important. If Labor do get in and take them away you would probably review AUI like a few other LIC’s and adjust your position IMO. Lack of small companies doesnt worry me in fact I prefer it that way. Agree that the portfolio could be more diverse and having 25 companies making up 80% of the Portfolio isnt ideal.

Like the management and its a LIC that I will continue to hold for a long time.

Thanks for the comments Mark.

I totally agree the franking makes the income far more attractive in retirement. But if the refunds are stopped, I wouldn’t be changing my investments any time soon. To reach for yields over 5% will mean taking more risk since you’ll be picking stocks or concentrated ETFs. It could mean overweighting banks which is already a large holding for LICs. Buying REITs. Or utility or infrastructure companies etc.

It’s likely we’d end up creating a messier, riskier, frankenstein looking portfolio trying to juice the yield a bit, so I’m not sure that’d be a great idea. It’s quite possible many LICs will start trading at discounts regularly (meaning slightly higher yield) in that scenario as people look elsewhere for higher yields. I don’t mind if that happens, we’ll see what happens 🙂

Thanks for the reply Dave and look I wont be risking my money on anything that creates a lopsided portfolio just for extra yield and I would certainly wait and see how it all pans out if Billy boy gets the top job. His plans may not get through the senate anyway.

Be great if some of those LIC’s do come down in price and we get a bit more bang for our buck with slightly higher yields….

Looking forward to your Whitefield’s review and if you ever get time maybe running your ruler over a few AREITS as well and discussing what proportion they should make up of your portfolio.

Keep up the good work here and over at MF……

We’ll find out soon enough I guess!

I think reviewing REITs is pushing it a bit – I don’t want to confuse people into thinking they need to own so many things, it’s simply unnecessary. You can probably find a few REITs I like by reading some of my articles over at The Motley Fool – https://www.fool.com.au/author/dgow89/

As for allocation, I wouldn’t feel comfortable with more than 10% of my portfolio in property trusts. Because the LICs also own a small amount of them and the index is 8%, so your % would actually be a bit higher than that. Like everything it’s a personal choice though.

Thanks for reading my various content mate 🙂

Another informative and fantastic LIC review SMA! 🙂

I have been considering AUI for a lil while now and thought it was quite attractive! Comforting to see others share the same view 😀

Thanks again and looking forward to the next article!

Cheers mate, glad you like it and thanks for reading!

Thanks for another great review Dave.

Thanks Mark 🙂

Another outstanding LIC review Dave. Very well done! I echo the sentiments of other readers when I say the LIC reviews are a real highlight of your Blog. And they make for multiple read throughs as well. I must have read the other LIC reviews 3-4 times each.

AUI’s website looks like it was made c.1995 and never changed…. The only other website that’s comparable is of course Berkshire Hathaway’s… I’m always reminded of Buffet’s comment about carpet thickness and dividends…Could just as easily apply to flash websites!!

Appreciate that Jeff thanks!

Hope you’re reading them again because they’re so enthralling, rather than hard to understand? 😉

Haha yes I never thought of that comparison, thanks for the reminder. Berkshire’s website makes AUI’s look like a glitzy masterpiece! It’s all about results at the end of the day, they’re in the investment business, not the marketing business.

Thanks for the details analysis Dave. BTW I found out recently from one of my clients that you are Perth based – small world!

Cheers Greg. And yep I’m up in the northern suburbs – actually having a small meetup for Perth readers this coming weekend!

I hope nice things were said… 😉

Of course nice things were said! I am running a seminar in Illuka for the full day on Saturday so unfortunately cannot make it. Feel free to let me know if you have another one as I would be interested in coming along.

Ok sounds good, I’ll put you on the meetups mailing list so you get the heads up in the future 🙂

Excellent review Dave.

It’s been a real pleasure watching your knowledge, writing skills and wisdom grow at an exponential rate and to see your blog go from strength to strength.. Won’t be long and PT might have you presenting his courses????.

Keep up the great work.

Cheers – Nodrog

That’s really kind of you to say, thanks mate.

Haha no, I don’t think presenting is my thing. Being a quiet blogger is better suited and much easier to

brainwashreach more people about simple living and the dividend approach for financial independence 😉Appreciate you stopping by!

Thanks Dave. I’ve enjoyed your reviews as well and they have been influential in my rejigging of my portfolio to LICS including AFI, ARG, MLT and BKI. Would you review one like Pl8? Interesting one because it pays monthly divs. but certainly doesn’t meet your criteria of being old. Is that an automatic out for you?

Thanks,

Steve

Cheers Stephen.

I’ve looked at the Plato LIC a couple of times, but I don’t like it. It’s more of a trader approach versus long term holding of companies, has higher fees and I’m not really convinced it’s going to work that well. There’s some trader-style LICs that have proven themselves able to add value like WAM and WAX and offer something different from the old LICs. But with PL8 you’re basically holding the same large cap stocks and trying to juice the yield while paying high fees and hope the ‘dividend stripping’ strategy works – I’d rather go with the old fashioned true investment companies for large Australian shares exposure. Hope that makes sense 🙂

hi Dave, Love the LIC Reviews. Any chance of mixing it up with one that doesnt concentrate on just large caps? Maybe AFI stablemates Mirra or AMCIL? Will definitely read Whitefield review though!

Thanks Michael. Yeah there’s a few more coming but hopefully not too many or it’ll be overwhelming for people trying to choose! I don’t really follow AMCIL much although it’s a decent company. But Whitefield and Mirrabooka I’ll do.

Thanks Dave, Good points and I will take them on board!

Cheers,

Steve.

Wow Dave you obviously have the influence to move the market ,AUI closed up .06c higher today!! Great review.

Hahaha! Maybe we just have some very wealthy readers here pushing the price up?!

Another nice review. I feel the same way as others, the LIC reviews are a highlight for me.

There are obviously a lot of great LICs out there, plus ETFs etc. Many of the big LICs have significant overlap, but there are also many ways to create huge diversification if that is something that appeals..

Have you set a limit on the number of your holdings? Or a target degree of diversification?

eg? proportion ETF/LIC, or AUS/overseas or small cap/big cap

Obviously maintaining the primary principles of dividend earnings growth, buy and hold, low fee with a strong track history.

Its sometimes like being a kid in a candy shop with so many options. Discipline in keeping to plan can be hard.

Thanks again.

ps. on another post you gave your selfwealth nickname. Was that a REIT I saw. If so what would Thornhill think? 🙂

Thanks SJ. There’s way too many out there (LICs+ETFs) it’s kind of ridiculous. I didn’t set a limit but I probably should have! Now I have more holdings than is necessary and am starting to come around to the ‘less is more’ mindset here. So the portfolio I have now is likely to be simplified over time if anything.

No magical proportions or set number of holdings. I could give you a number but it’s just plucking it out of thin air! Whatever you feel comfortable with and can stick to is the best portfolio for you.

Yes we hold a couple of REITs that I like. Thornhill would not approve of course, but that’s ok, we can’t all be the same 😉

Yay! Looking forward to it! 🙂 Appreciate the effort you put into these reviews!

Bit off subject of this post, but when are you going to offload the last of your properties and pump that money into LICs? Do you think of the opportunity cost of waiting for the Perth market to comeback?

Good question. It’s a slow process and we’re of course trying to optimise the outcome. We’re selling one in Melbourne early next year, then there’ll be 4 here and one in Brisbane. It’s a pretty messy picture, but based on how much equity is in the Perth properties (not much), our cashflow picture and market conditions, we think it’s best to leave the Perth ones till last – and we can afford to wait 5-10 years. That may prove costly or clever – we won’t know until later! But we’re expecting it to work out better than selling them now.

Basically there’s not that much cash in some of them to put into shares, so there’s less opportunity cost.

Most economic data for Perth is improving quite a bit these days so I’m cautiously optimistic the next 7 years will be better than the last.

Although when we get notified of some works that need done, tenant requests or a flood of expenses, it nudges me to reassess lol.

Sounds like a good plan, end of day you guys don’t need the money to reach FI or anything, it would just come down to convenience. We aren’t in as good position as you guys we still owe money on our PPOR so we sold both of our IPs in WA earlier this year. Yes we lost some money but that has freed up a lot of cashflow due to repairs, tenant vacancies etc. Inflation has been rising but since we purchased our first in 2009 and second in 2012 the house prices and rents have dropped at least 20%.

We do need the money, just not yet. But we do need that equity into shares eventually to generate the income we need to remain FI. Although at this stage we’ve both started earning some income which means it’s less urgent I guess. Hope that makes sense.

That’s a bummer mate, but at least you’ve got more cashflow now to throw on the mortgage and less bills to worry about! Rents have fallen more than prices for us – down around 25%, but prices down around 10%.

It’s a good lesson learnt. Leverage works both ways, diversity is extremely important, passive investing suits us better.

Had AUI on the watch list for some time. It seems to have price dips a few times a year. But the dips haven’t yet coincided with our regularly timed buying. Oh well.

I’m quite happy to have a few more holdings at this point – still in accumulation but not too far away from pension mode. I see the simplicity for me is in having a small number of allocation “buckets” and am not too worried if a bucket has 3 or 4 holdings in it. E.g. 1 bucket might have BKI, MLT, AUI & ARG, so I tend to view them as 1 rather than 4.

Yeah I don’t think too much about prices – AUI regularly trades at a discount so you could argue it’s never ‘expensive’. That sounds like a pretty good plan mate – I tend to think of the large LICs and even the index as the same basket too – simply broad-ish Australian shares. They all do a similar job 🙂

I’ll have to write an article about what a portfolio might look like as I think it’s easy to make it more complex than it needs to be 🙂

Eddie here. On the subject of selling of properties, wife and I have 2 *2 bedroom units in Brisbane ( Ascot and Taringa) which we have finally paid off so can start to get the benefit of positive rental income. After coming across a number of blogs similar to yours, where you are selling yours asap. Our share portfolio pretty well covers our income at this moment in time. Trying not to have all our eggs in one basket and with good long term tenants would you still be in mad rush to sell? Bearing in mind CGT and selling costs?

Hi Eddie. Nice work getting to the position you’re in, excellent stuff!

I’m not in a mad rush nor am I selling them all asap. It’s a pretty systematic approach but they’ll all be gone over the next 10 years. Everyone will feel differently about diversification so that’s an individual choice. But for me, if ours were paid off I would still sell them – in fact I’d be selling them much sooner. The rental return after all costs is extremely poor on capital city property in Australia. The income generated from shares is likely to be at least double that of property, and dividends are likely to grow faster than rents over the long term as they have for the last 30 years.

I’d spread out the sales to reduce CGT of course but I’m happy to pay those one off costs for the much higher, hassle free income stream. But if someone has a mixture of property and shares both throwing off income and it’s enough to pay the bills, and they’re happy with that, then that’s really all that matters 🙂

Hi Dave,

Another great report. One question I’d like to ask; Do you ever consider buying some individual company stocks with the view to boosting the overall dividend growth of your portfolio ?

For example, if you look at some of the stocks held by a lot of the LIC’s, they show a significant level of dividend growth, for the last 4 or 5 years, above that of what the actual LIC as a whole is achieving. Some examples are : TCL, SYD and MQG.

I’m not suggesting a significant portion of ones portfolio and I appreciate that this is a deviation from the mantra, but would appreciate your thoughts.

Keep up the good work !!

Regards

IanB

Thanks Ian!

We do have a number of individual companies but they’re mostly held in our ‘choice-plus’ style super as a 10 year experiment to see if we can do better than the market.

It’s true that a number of names in the LICs portfolios will have strong dividend growth – that will always be true. But the average is important, because in the next 5 years it could very well be a different group of companies which have better dividend growth. And quite often the higher growth companies tend to be lower yield, so by buying more of those you’ll likely (not always) be diluting today’s income. It can definitely work well if one wants to go that path but then you’ll end up with a large and somewhat messy portfolio with many holdings overlapping and lots of extra admin, weightings to manage/stocks to think about.

Again, if one has the desire to give it a go then sure, but I think it makes sense to mostly keep it simple and stick with diversified funds who do the hard work for us. Hope that makes sense 🙂

How much did you move over to choiceplus? did you buy more likes or no point at all?

All of it, though stopping work at 28 there’s not a lot there. No, I think maybe there’s 1 LIC in there but almost entirely individual companies. If after 10 years our returns have lagged the market (or I can’t be bothered anymore) I’ll quit and put it all back into a set and forget style super!

I been putting 20 extra into super since i first started working (15 years old) my old man liked the idea of the govt matching extra contributions. Have 110,000 in there now (now 32)

Just bought 10k of argo and 10k or afi in choiceplus. And set them both to reinvest all dividends. Looks like currently all lics are trading at a discount.

Just finished reading peters book and he says when it comes to retirement instead of selling it off you keep it as a dividend paying stock.

I am guessing/hoping you can merge it with what is going to be accumulated in selfwealth in the next 15 years when we go to retire.

hopefully this strategy will hold out until that day

Sounds like a pretty decent plan to me.

Yes Peter’s approach is to simply live off the income from the portfolio and ignore the price fluctuations. I couldn’t agree more. Regular saving and investing into long term dividend focused investments is likely to lead to a happy outcome in a couple decades time. All the best with it 🙂

Hi Dave, great posts. Really enjoy reading your blog.

Cheers

Thanks Essen, great to have you here!

Thanks for another great review and looking forward to whf. If lic’s do continually underperform the market do you think there’s a chance they could slowly die out. As people just buy ETFs that track the market instead?

Cheers Luke. Good question. They can’t disappear because unlike a managed fund where you just pull your money out, if you sell your LIC shares on the market, somebody else has to buy them. The most likely thing that would happen if they really fall out of favour is they start trading at a large discount. And people who bought them would receive a higher return than the actual performance of the LIC due to buying it at a higher yield. You can probably imagine there would be some type of middle ground where the discount mostly compensates for the expected underperformance.

If anything there are more and more LICs being listed all the time, rather than less! Much like ETFs there are now way too many and I much prefer the plain vanilla variety 🙂

Looking forward to the WHF review, any ETA Dave?

Haha Paul. If I had a dollar for everytime someone asked that I could buy Whitefield in its entirety 😉

It’s coming soon. Ok, let’s put a deadline on it – within the next month. It’ll be my Christmas present to the readers who’ve waited so long!

I really like the look of aui for its dividends. Bearing in mind it’s not as disversified as the others, do you think it’s ok to hold it equal to say afic ,arg, whf , mlt ? Or even instead of some of these? Or would it maybe be better to have aui taking up a lower % of total portfolio ? Or maybe I’m overthinking it????????????. Happy Ozzy day by the way????

Thanks Luke – Happy Aussie day to you!

Definitely overthinking it! No right answer and doesn’t matter that much. Equal, or instead of another would be fine since you have a few. I do prefer the LICs with larger portfolios though because of greater diversification 🙂

Haha thought I was over thinking it. Sometimes just need a little nudge. Now I need to decide on before or after ex div????

G’day mate loving these LIC reviews! Just wondering how you did that sharesight comparison? I’ve got sharesight but I haven’t figured out how to do that yet. Thanks!

Hey Rob. From memory, here’s what I do…

I simply go to add holding, and select a date way back in time, like 2005 or something, and Sharesight usually comes up with the share price the company was trading at on that specific date. Then enter 100 shares as a dummy purchase and it should spit out a performance number.

It could be that the ‘compare to benchmark’ option is in the premium plans which I have. But either way you can still enter dummy trades one at a time and compare them that way!

Thanks mate I’ll give it a crack!

Really grateful for you bringing AUI and DUI to our attention. We’d only heard of AFIC and Argo (Barefoot) before reading your site. We’ve purchased both AUI and DUI recently and are very pleased that they’ve both managed to maintain their previous dividend given the current extreme economic conditions.

We’re not retired yet, but it is great to know that LICs like these really are doing everything they can to maintain their dividends for shareholders. That will be a great comfort when economically difficult periods occur once we stop working.