Start Here

Close Menu

January 30, 2018

Welcome to the second LIC review in the series.

This time, we’re running the ruler over Argo Investments, another large investment company listed on the Aussie sharemarket.

Last time we took a look at Australian Foundation Investment Company (AFIC). For those who missed it, you can find that review here.

New readers may be wondering why I like LICs so much. For an overview, check out my article – LICs vs Index Funds.

Again, I’ll just point out my bias from the start – we’re owners of Argo and plan to be for a very long time. So with that out of the way, let’s get started…

Argo was established over 70 years ago, back in 1946.

Today, they’re the second biggest LIC listed on the ASX, just behind AFIC. Argo manages a diversified portfolio of equities that now exceeds $5 billion in value.

Safe to say, these guys have been around the block once or twice. And they’ve captained the Argo ship through some choppy waters over the years.

Their aim is to hold, and add to, a portfolio of high quality companies to provide attractive returns for shareholders over time.

Argo holds shares in around 100 different Australian companies and trusts, which it receives dividends and distributions from.

They’re a very long term focused investor and will hold shares patiently for many decades.

Here’s their stated goal from their website:

“Argo’s objective is to maximise long-term returns to shareholders through a balance of capital and dividend growth. It does this by investing in a diversified Australian equities portfolio which is actively managed in a low cost structure in a tax-aware manner.”

They place a strong emphasis on providing a relatively stable and growing fully franked dividend to shareholders.

Therefore, Argo invests for the long term in a big basket of companies it expects to provide increasing dividends over many years.

The company adds to their favoured holdings when the stocks appear to be good value and are trading at attractive prices, in respect to their long term outlook.

Argo holds a large portfolio of shares, around 100 companies in total.

Similar to AFIC and the other old LICs, the portfolio is heavily weighted to the largest companies on the ASX.

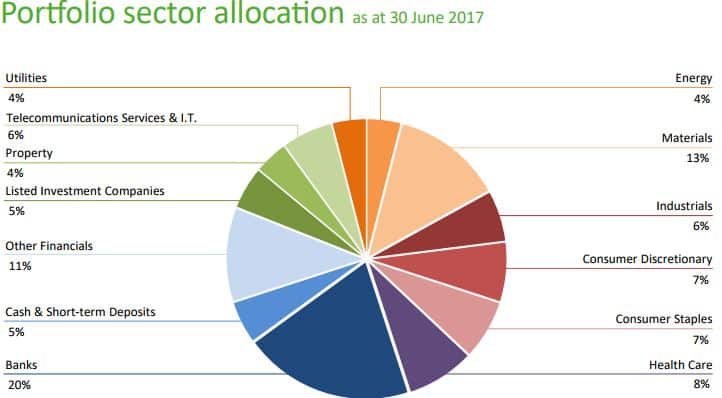

Here is a breakdown of the portfolio by sector:

So that makes for a pretty picture as far as I’m concerned!

Overall, I like the sector breakdown of Argo more than AFIC. There is less weighting to materials (often meaning mining) which tend to be less reliable dividend payers.

Often there is still some investments made in the largest mining companies because they do offer dividends, and can at times be very profitable.

It’s good to see some diversification away from the big banks, which dominate the index. While the banks are strong dividend payers, it’s better to be less reliant on any one industry for income.

Also their top 20 holdings only make up around 58% of the portfolio, which is more diversified than some other large LICs.

You can check out Argo’s top 20 holdings here.

The portfolio will change slowly over time. But not much. Argo will mostly keep adding to it’s portfolio of stocks when it sees opportunities.

As with AFIC, the portfolio is similar to the index. But it’s does differ in places.

Most of the older LICs tend to invest less in the property and resource sectors, given their poor long term performance. Sharemarket educator Peter Thornhill highlights this well in his teachings. You can see it clearly in this article he wrote.

Anyway, it’s the overall approach of Argo that I’m most interested in. That is, investing for a growing stream of dividends.

While it’s a fine place for long term savings, an Aussie index fund has no such goal. It will just replicate the largest 200-300 companies at any time, regardless of whether they pay dividends or not.

Since we’re taking the dividend investing approach, Argo is a better fit for us.

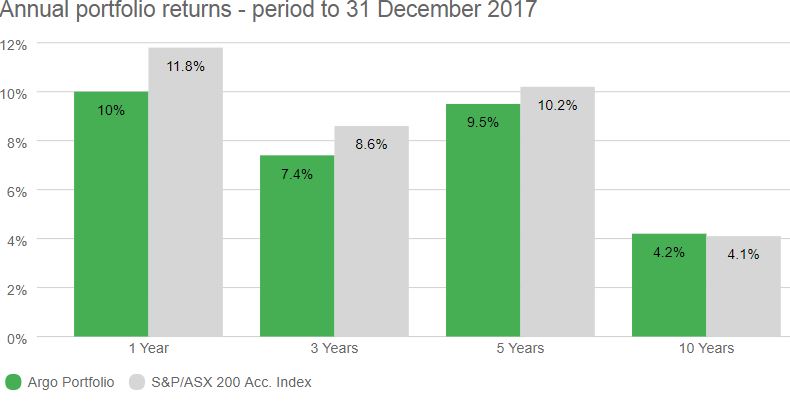

Over the last 10 years, Argo has performed roughly in line with the market.

The portfolio return has been 4.2% per annum. The return from the S&P ASX 200 has been 4.1% per annum.

Both including dividends. But not including franking. And not including fees or tax for the index.

Not exactly the most accurate comparison. The index doesn’t pay tax and fees haven’t been deducted, as would be the case for an index fund investor.

Since there was no capital growth over that period, the return was essentially all dividends. So let’s look at a more accurate picture of what the end investor would have received over that time.

Argo’s dividends are fully franked, which takes the return from 4.2% per annum, to 6% per annum.

The index’s dividends mostly come with 80% franking credits, taking the 4.1% return up to 5.5% per annum. After deducting fees for the index fund over that time, which were a bit higher than today, say 0.2% – we end up with a return of roughly 5.3% per annum.

I’m not saying this to try and show Argo is superior.

Simply, this is the most accurate way I know of for comparing returns. After fees and costs, with franking included. That’s what management can control and shows the true performance of any manager or index, from the shareholders end.

Wait, 5-6%? What? Why bother?

The last 10 years have been rough for Aussie shares. I discussed this a little in my review of AFIC.

Basically, it’s because the GFC was roughly 10 years ago exactly. So our 10 year returns include that 50% share price decline right at the very start! Very misleading!

By looking at Argo’s Annual Report, we can get a better picture of what proper long-term returns look like.

Over the last 15 years, it shows a total return (including dividends) of 8.4% per annum.

Including franking, it’s 10.2% per annum.

Remember, we’re not trying to beat the index. Sure, it’s nice if it happens. But personally, that’s not our goal.

What we really want in early retirement, is a strong and steadily growing passive income stream!

Of all the performance figures, this one is perhaps the most important.

As early retirees, we need our dividend income stream to keep pace with inflation over the long term, if we’re to rely on it. So let’s see how this LIC has fared.

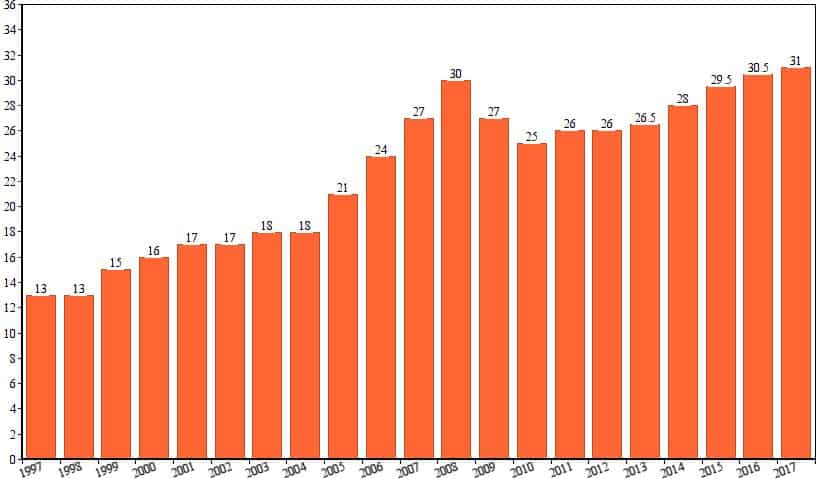

Over the last 20 years, Argo have grown their dividends to shareholders from 13 cents per-share in 1997, to 31 cents per-share in 2017. Dividend history can be found on this page.

Here their dividend history in chart form…

We can see the huge increase before the GFC was a little out of the ordinary. In fact, dividends went up almost 70% in just 4 years! That’s quite extreme.

Since then, dividends were reduced to more normal levels and then resumed their steady march upwards, in line with the long term trend.

Anyway, these figures show that Argo has grown its dividends by 4.4% per annum over the last 20 years. And according to this RBA inflation calculator, inflation has been 2.5% per annum.

As we can see, Argo has managed to deliver an income stream to shareholders that comfortably grew faster than inflation. Hopefully, the next 20-50 years look very similar!

This isn’t a magic trick.

Profitable dividend-paying companies usually manage to increase their earnings faster than inflation, over the long term. By increasing prices, reducing costs and creating new products or services.

And from these growing earnings, they pay increasing dividends to shareholders as well.

So from Argo’s big basket of stocks, I think we can expect, on average, to receive a steadily growing income stream into the future.

Argo has one of the lowest management fees around. The company has a current management expense ratio (MER) of 0.16%.

Argo is internally managed, so there’s no fees going to an outside manager. Their expenses are mainly staff, administration costs and office rent.

Also, there’s no performance fees.

And since their costs are largely fixed, as the portfolio gets bigger, the expense ratio gets lower.

Essentially, this is as cheap as it gets. It’s around the same cost as an index fund. But for our money, we get a large portfolio of dividend-paying stocks, managed with a long term focus on providing a reliable and increasing fully-franked dividend.

I like Argo’s very long and fruitful history. Also, their patient and conservative investment approach.

Their portfolio is slightly more diversified than the other old LICs, which I view as a plus. This means their dividends are coming from a more even spread of sectors.

As an LIC, Argo has the ability to retain profits to smooth out dividends over time. This helps during downturns when many companies reduce dividends. Often, LICs will only need to reduce dividends by a smaller amount, or sometimes not at all.

Most importantly, I like the emphasis they place on investing for dividend growth. Obviously, they’ve done a good job at harnessing this strategy. And they have a very decent track record of paying increasing dividends to shareholders to show for it.

The low fee is a winner too.

Because they’ve been around for so long, they’ve gone through a few portfolio managers. This is actually a good thing. It shows that the company relies on their philosophy and investment process, rather than a hot-shot stock-picker.

Occasionally Argo will offer a Share Purchase Plan (SPP) to shareholders. Basically, it’s an offer to buy more shares of the company free of brokerage and often at a small discount to the current price. They do this to raise cash to increase their investment portfolio, in a cost effective and shareholder-friendly way.

Due to the small discount and no brokerage, it’s a great way to increase your holding. They usually offer a Dividend Reinvestment Plan (DRP) at a small discount too.

Also, Argo is a qualified Listed Investment Company in the eyes of the ATO. This means they can pass on the CGT tax deduction if they sell any shares in their long term holdings. So on the odd occasion, we’ll receive a tax deduction attached to our dividend, along with those franking credits. More info can be found here.

Overall, I like the steady and predictable nature of Argo. And their main goal closely aligns with ours. In fact, it’s the same!

While I could point out their recent performance as a negative point, I won’t.

Truthfully, it doesn’t really bother me. For various reasons, Argo will underperform the market for certain periods. Sometimes it might be ages.

Usually, its got to do with which stocks are in favour on the market. Since Argo has an income focus, they often miss all the excitement and steer clear of hot sectors and high-flying stocks.

Instead, they stick to the companies and sectors which are likely to provide reliable earnings and dividends.

Similar to AFIC, their portfolio size could become an issue. It’s harder for them to invest much in small companies. In other words, Argo has too much money! While it’s still possible, it does make it harder.

And given their long term ownership of some stocks, there would likely be a large tax bill triggered if they sold. There’s a chance this makes them hold on to companies with less-than-bright futures for too long.

Overall, I’m a big fan of Argo.

It’s one of the lowest cost ways to get access to a large portfolio of Australian shares.

I can appreciate they’re similar to the index. But with their dividend growth focus and the predictable growing income stream they provide, this is what I prefer.

With a portfolio of around 100 companies, those dividends are coming from a good spread of different businesses and sectors.

Argo has been getting it done for over 70 years. And I’m betting they’ll be around for a long time to come!

Personally, I feel comfortable having an increasing part of our net worth invested in Argo for the very long term.

Currently, it’s on a dividend yield of 3.7%. And a gross yield (including franking) of 5.3%. That’s lower than it has been in recent times. But still much better than most other assets at the moment.

Last year, I was buying a few parcels of Argo shares for our own portfolio. And this year I’ll be buying a few more!

Despite the price being higher and the dividend yield lower, I’m happy to keep accumulating shares for the long-term income stream.

Summing up – Argo is a low cost, diversified and income-focused investment company. And I think it’s a perfect fit for an early retirement investment portfolio!

If you enjoyed this LIC review, you can find my other LIC reviews here, including AFIC, Milton and some other favourites.

Enjoyed this very informative review. I wanted to know your thoughts about your price entry points for LICs such as ARGO. My understanding is that we should only buy when the price is at a discount to the post tax NTA? What price points do you accumulate at ?

Thanks Ken. Most LIC investors I know just buy whenever the price is around pre-tax NTA. There is little point looking at post-tax NTA (in my view) because Argo is not going to sell up the whole portfolio and close shop anytime soon. So pre-tax NTA (which is the value of their portfolio currently) is just fine I reckon.

There’s no magic to it. I simply buy whenever it’s somewhere around it’s NTA. The whole premium/discount thing usually evens out over time. Sometimes it’ll be at a premium, sometimes at a discount. I try not to worry about it too much. Holding the investment for 50 years+ means it won’t make much difference 🙂

Another engrossing read. I am also an avid Argo holder for all the reasons you have listed so well. Nice patient, boring, grandfather style investing makes me happy. I love how dividends keep quietly pouring in twice a year o matter what else is happening. When everyone else is panicking from a market down turn they all wish that they owned Argo.

I know it is not an LIC, but post on SOL (Washington H. Soul Pattinson) would be really interesting too ….. I think you too are a SOL admirer.

Phil

Thanks Phil!

You said it mate, boring old-man style. They say you should invest according to your personality, so that’s what I’m doing 😉

It’s very comforting to see that cash hit the bank account all right – with no effort on our part.

I’ll definitely be doing a review of Soul Patts, but I was going to sneak it in as a surprise. Damn!

Another quality post SMA!

People always have a tendency to make investing harder than it really is. I love how simple it can really boil down to.

Step 1) Hold onto a smattering of LICs that’s completely set and forget for the ultra-long-term.

Step 2) Turn off the news so you don’t freak yourself out and sell out during a market correction.

Step 3) Enjoy that reliable and growing dividend income stream.

Thanks a lot Jack, and very well said!

Sensible investing is actually very basic and easy to understand. It’s these bloody human brains that like to complicate things and think it needs to be complex to be effective. Simplicity is very under-rated.

Any review om MLT LIC? or BKi?

Hi Isaac. I’ll definitely be reviewing those LICs at a later date. Stay tuned!

Great post as usual SMA. Keep it up!

ARG is one of our favoured LICs, along with AFI (which you’ve already covered), MLT and WHF.

BKI and QVE are on our watch list.

Reviews of any of the above would be welcome!

Thanks for that MP!

Well, you’re in luck. Reviews will be coming for all those LICs at some point. I really enjoy doing them too 🙂

Nice summary, I dont own Argo but have a couple of their like for like competitors.

Jason Beddow is a good operator and have heard him speak several times and its always about safety first and preserving shareholders capital. They minimise risks

and keep growing dividends which is what a self funded early retiree wants from any LIC. 3.7% grossed up to 5.3% is fine with me and when you see the Directors buying ARG you know its a company well run and confident about the future.

I will probably throw a few dollars their way later in the year hopefully at a cheaper entry price as they are fully valued with a P/E of 27.

I view them as a solid foundation stock for any income portfolio and long term should continue to provide more of the same.

Thanks for your comment Mark. I will probably go to a shareholder presentation this year to see what they have to say. Can also watch it online now which is pretty cool!

The market has had a decent run over the last year or two, hence Argo’s price increasing too. But my crystal ball doesn’t work too good so I plan to keep adding to our holdings regardless of market conditions. Obviously if prices go down, that’d be great, and will try to buy extra!

Well said mate, I view them in the same light.

Great write up SMA, you make a compelling case for the income focused investor. I had never really considered LIC’s before, but you’ve definitely piqued my interest in this one! Will start keeping an eye on this one…

Cheers Frankie.

There won’t be much to see to be honest. Argo is a pretty steady ship (you could say boring), but in a way, that’s what makes them appealing!

Only a handful of weirdos (like me) find them exciting 🙂

Is there a reason you invest in both Argo and AFIC? They seem to be pretty similar in objectives/returns/portfolio allocation. Is it just it just in case one goes belly up?

Hi Yury. You’re right, they’re very similar. It’s partly a case of spreading the risk between managers, although the company doing anything strange is very unlikely given their 70+ year history. Partly because I like both. Also one may perform better than the other but we don’t know which (not that it matters much).

They can only really go belly up if they take on a lot of debt they can’t repay, or are cooking the books in some way. Both of those things are extremely unlikely in my view.

They’ll likely both provide similar income and total returns over the long term. Owning one of them is just fine if that’s what you’d prefer.

I don’t see any advantage in just having one LIC. Best to spread your risk around by having holdings in multiple, as they do have slight differences in holdings, slight difference in payout ratios, etc.

Well it wasn’t really about holding only one LIC in a portfolio. I was merely saying out of AFIC and Argo, you don’t have to hold both. I agree it’s better to spread risk around. They’re very similar, but some subtle differences. Those differences probably don’t matter too much long term, otherwise we’d have a clear winner.

I’ve been an AFIC fan for a while and have only recently bought some ARGO as well. I look forward to watching how they perform over the next 5 years or so and longer term.

Thanks for another informative post.

Your welcome, and nice work! 5 years…I’m looking forward to that steadily rising income stream over the next 50 years 😉

I’m in it for the long term too – I just like to watch trends. AFIC vs ARGO and see if one does better than the other and why both short and long term.

Thank you. Very informative and easy to understand. I look forward to future reviews.

Thanks for reading Lisa!

Your reviews of both this Argo and AFIC have been really informative. We don’t currently hold any LICs as we have been going down the index funds route so far but these reviews plus other information I’ve read up on them definitely gives them a place for consideration to be added to our portfolio. Great post!

Thanks SOL Guy, glad it’s been helpful!

Love their steady nature and growing income focus.

All the best with your further research and investments.

Great review SMA! I am not a holder of Argo or AFIC and have previously bought index funds, however your reviews have certainly given me some food for thought. Thank you for writing these reviews, it’s very appreciated.

Cheers SSD! And thanks for the encouragement, I enjoy writing them too 🙂

Thanks for this, I enjoyed reading it. I guess I look at those firms and still have a few queries:

– how do we know that the results have come from superior active management, versus luck, running non-obvious portfolio risks, or survivorship bias?

– how can we be clear that the investment ‘style’ criteria for adding to their portfolio don’t inadvertently screen out or delay the inclusion of future good dividend paying stocks?

– how can we be sure that the firm is not engaging in ‘closet indexing’, but potentially taking greater risks than inherent in the broader diversification of the index approach?

I’d be a lot more concerned if there were high fees, I admit that the record is not bad (though would be interesting to see it for a longer time period than 10-15 years), and the fee is reasonable.

Thanks for the comment Explorer! Damn, some good questions there! It’s supposed to be simple investing 😉

Well the results are…the results. Given that most of these old LICs have similar results, meaning there’s nothing abnormal about them, I think we can chalk it down to just holding a big basket of mostly large dividend paying stocks which have done reasonably well over the decades. Of course there is survivorship bias in the portfolio, because that’s what happens with a buy & hold approach – is that what you mean?

They can definitely miss future good dividend paying stocks, but hopefully they miss some crap stocks too and non dividend payers, which is what shareholders want. Nobody gets it right all the time. A silly example, but Warren Buffett says he’s missed many great opportunities that were staring him in the face for years, such as Walmart. I don’t think we should expect any different here.

Closet indexing – well you could argue they’re doing that now, and some people do. The portfolio looks somewhat similar to the index, but with an income focus. As I said they tend to reduce or eliminate poor income producing stocks such as resources and property, which historically has been a smart move. Moving forward, I’m not fussed if this doesn’t match up to the index because the LICs and myself have a different set of goals.

What did you want to see? Longer performance? Going back to Argo’s 2007 Annual Report showed they’d outperformed the index by a few percent per annum over the prior 10-15 years, which gives us around 20-25 years in total to look at. Nowadays performance has moved closer to the index, similar to other old LICs. I wouldn’t expect the outcome to be too much different from the Oz index, obviously just with a smaller amount of stocks and a smoother income stream for shareholders.

It seems like you’re uncomfortable with a lot of the unknowns with LICs, which makes sense. At a certain point people either have to decide they like this dividend growth approach, are prepared to have faith in the management and are happy with it regardless of what the index does. Or instead they prefer the security of the index approach.

People much smarter than me can shoot this approach down and point out the many flaws vs indexing, but this is what I feel most comfortable with 🙂

Nice Article

You going to do a review on SOL ? I see them as a concentrated LIC with an impressive dividend record and stable management.

Not many company can beat 17 years of consecutive raise in dividend and they seems to be reasonably priced compared to other Lics.

Cheers

Thanks Jack.

Yeah I definitely will do a review. Soul Patts is a great company with an outstanding track record. We’re happy holders for the long term.

You’re spot on – although they have a lower yield, they’ve produced much higher dividend growth and total returns over time. I think the only other company on the ASX to have the same number of dividend increases in a row is Ramsay Healthcare.

Couldnt agree more on Sol Patts, we own them and while 3.3% isnt the greatest yield going around they are reliable and that divvy keeps heading north. They also give you exposure to a few different sectors/stocks etc that you dont get with some of the other LIC’s…

You hear fund managers banging on about stocks with good management but they hardly mention Soul Patts but its probably the most solid management going around with 5 generations of family management from the Patts and three generations from the other family owners…you compare that to basket case companies like RFG and thats why you own Sol Patts and bank on their divvies each year…

You might have guessed I own RFG……I hear you all laughing…….guess I’ll just have to eat more donuts and drink more coffee…!!

When franking is included, grossed up yield is 4.5% or so, not too bad.

All great points Mark! It’s interesting, Soul Patts is quite boring you could say, which is why it’s probably not talked about much. But a massive wealth creator over the last 40 years. More of a business conglomerate, bit like Buffett’s Berkshire Hathaway.

Haha funny you say that, we held RFG until recently. It had an incredible track record for dividends and as a company…until it didn’t. Always a risk of the unknown with individual stocks, even those with a good history.

Good comparison with Berkshire Hathaway, wish the share price was the same!!

Lucky RFG is a very small position in our Portfolio and we can afford to hang onto them for a while and hope they come good or get to a position where we can sell them.

Good point about Individual stocks, they are more of a risk, even when they tick most boxes. TPG is another example, they have plenty of upside/hype but continue to disappoint IMO and I am glad we never bought them after choosing Dulux instead.

I’d rather get exposure to TPG through SOL and let them average out any losses with their other stocks rather than me take a hit.

I don’t. I’d rather be buying Soul Patts (or any investment) at as low a price as possible to be honest. Doesn’t that make sense as a buyer? Or you mean buy Berkshire for $17 lol – that would be nice!

TPG will probably not look too good for a couple years as they’re spending mega bucks to build out their own network – so that will take time and resources before seeing a return on it.

The other benefit of Soul Patts is, it trades at a hefty discount to it’s investments. From memory, their business interests and investment portfolio are worth around $20 per share, and their share price is around $17 – so we’re buying TPG, Brickworks, API and the rest of their businesses at a 15% odd discount.

My wife always argue with me as she prefers property over shares, and I say to her, Find me a house that:

1. Rent always pay on time for over 100 years and most likely go up every year.

2. Never worry about nightmare tenants, never deal with incompetent property managers, never worry about never ending rates and maintenance or vacancies

3. Can sell and get your money within 2 days

4. when buy or sell, no need to pay stamp duty or agent commission

If you can find me such a house, then I’m happy to buy instead of my Lics or Sol patts.

Haha some nice points Jack. The expenses are what does my head in. There’s always bills and something needing done, I estimate costs are around 35-40% of the rent. And with yields around 3-4% to start with, it doesn’t leave much. Ah yes, the stamp duty and commissions – they’re enormous.

Just out of curiosity, what’s her reply?

She thinks I’m over-confident and stubborn.

But I believe knowledge is power and if I had realised this 10 years ago, I will be FIRE (financial independent retire early) by now. One down side to investing in shares is coping with the volatility in price, which once accepted will give you long lasting returns.

I explain to her why shares are superior to property and if our house was put on auction every minute, you will panic as well if you see the price fluctuation (Especially given we are in Perth which see a steady decline over the past 10 years).

Think from asian background makes people very wary of shares but I’m 100% comfortable.

Ha! We’re in Perth too. I think property has lost it’s shine for a few folks here.

From what I’ve read, asian stockmarkets are often treated like casino’s – full of speculation, not as a place to buy/sell businesses. Perhaps it’s the cultural love of gambling?

Volatility is the hardest part for most people to stomach, myself included. The easiest way to combat this, in my view, is by focusing on the dividend income, which is much more reliable. And by learning to see lower share prices as a good thing, being able to buy companies and the income streams at a cheaper price!

Haha, so good to know you are in Perth ! do you live NOR or SOR ?

Absolutely, I always think if there is another GFC, I will be able to retire much earlier, who wouldn’t want to buy when Dividend yields are at 10% + ?

You should do a review a WAM, yes, their fees are high but justified.. and Gross dividend yield of 9% when the company holds 35% in cash ? Very impressive

NOR – was living in PPOR, now rent. How about you?

Couldn’t agree more mate, that’s how I look at it – lower prices means higher yields. That’s providing it’s not a nasty economic downturn where dividends will certainly be reduced, albeit less than prices drop. Still, it’s likely to result in many buying opportunities!

I will be reviewing WAM/WAX in the future. We hold both, although I prefer WAX. They do things a bit differently in the sense their dividends are from capital gains from them selling stocks regularly once they’ve reached their valuation target – as opposed to Argo etc. who just hold stocks, collect the dividends and pass them thru to us. There’s a higher risk with the WAM approach and dividends are perhaps less certain, but they’ve done an excellent job and continue to perform quite well, even after fees.

Live in Mindarie area, not sure how far you are!

Once you establish enough people in the blog, you should start a member meet up in Perth

would be nice to meet like minded people

hahaha

Oh cool. I’m in Wanneroo – not far at all.

Haha that’s actually a great idea! Hopefully we can get enough ppl interested. Will have to keep that in mind 🙂

Hello .

Well , l might be well out of date by now , but the only way to make head -ache -less money out of real estate is to hold empty land and just pay the rates . No ?

Head-ache-less , Ramon .

Yep, rather have paid $17 for Berkshire!!, for sure I love buying as cheap as possible and last weeks correction allowed me to top up a few stocks at a cheaper price which put some gloss on the carnage.

Look forward to the review on WAM/WAX, we own both and I might take Geoff Wilson up on his Global offering and get in before the herd. One of the smarter fund managers is GW and you can’t knock his recent results with WAM, love his attitude to holding cash too.

Love you to do a review on HVST sometime too…..keep up the good work…

Haha yeah for sure.

Interesting. I won’t be investing in WAM Global since they have zero track record in that space and there’s so much large funds in that space already looking for undervalued stocks, making it harder for them to be undervalued and therefore outperform the market. If they do a good job over the next 5-10 years after fees, as they’ve done for almost 20 years with small caps here in Oz, then I’ll look at it!

They’ve done very well here in small-caps, and so have lots of managers. The market is pretty inefficient in this space it seems, with lots of crap companies and mining explorers who never make a profit.

I won’t be doing a review of HVST, unless I write a warning about it. I strongly dislike that fund and their returns have been woeful. It’s a classic yield trap in my view. But thanks Mark, really enjoy your comments 🙂

Fair enough on Global, I dont usually go for IPO’s especially with no dividend attached but I thought I might dip the toes in the water with this one with a few spare dollars I have from some profits on another stock.

My asking you about HVST was exactly what you ware talking about, warning others not to go near it…I had a dabble and then saw my capital

disappearing and the figures dont ad up to what is being promised.

Got out of it with most of my money back but its gone down quicker than the Titanic since and I cant believe investors are still putting money in.

I reckon its worth a warning as I have run into a few Divvy Investor’s who has been caught and we are talking big amounts of money..

That sounds reasonable Mark – they may well do a good job o/seas too.

Oh sorry to hear that. Yeah when looked at on a total return basis, the performance is horrible. And that’s in a generally rising market!

It’s sad, many will be caught up in the lure of the massive yield. In that case, maybe I will do a review at some stage, but it won’t be pretty 🙂

Hi Dave@StrongMoneyAustralia, I’m really enjoying reading all your reviews! Are you able to please do a review on Whitefield Investments?

Hi Jacquie, great to hear! Yep will do, it’s on the list 🙂

Oh fantastic! Can’t wait to read it! 🙂 Keep up the great content!

How do you know when its trading around NTA?

Hi Andrew, every month the company releases an NTA statement to the market. Pretty sure you can sign up on the company’s website to receive it each month or find it here. Then compare that figure to the share price it’s trading at.

You can also find some intra-month estimates on this page where it says ‘indicative NTA’. Again compare that figure to the current share price. Or you can just ignore it like Peter Thornhill and your purchase prices will likely average out over time. Sometimes you’ll likely buy at a premium and other times at a discount, all without knowing and never having to think about it! Up to you. Hope that helps!

I saw your answer to a similar BKI question regarding recent share drop. Argo too has dropped recently, seemingly in excess of the general market drop and proportionally more than the other large cap old LIC’s.

Profits were up on recent reporting and dividends increased. I feel that their exposure to the large banks is possibly less weighted than the other large cap LICs – a good thing!

Any thoughts or insights, it doesn’t make obvious sense to me. Or am I just asking the market to be too rational?

As you know LICs can move around independently from what their portfolio is worth (the NTA). It’s likely a case that the share price of Argo has moved more than the portfolio, meaning Argo is now trading at a discount to NTA. I wouldn’t read any more into it than that.

You’re right – profit is up and the dividend was increased. That’s pretty much all we really need to look at to see how the company is travelling. The rest is noise. From what I’ve been reading, company profits and dividends are increasing this year also, so another pleasantly boring year of increasing income seems to be on the cards.

Just like if you owned a corner store – if your profits are increasing steadily, who cares what somebody (the market) says your store is ‘worth’.

Thanks for such informative posts. I have never seen such a detailed analysis on web. I am exploring options to start my investment journey. Could you please suggest some low-cost brokers? I am aware of Selfwealth, but they charge $9.5/trade. If I want to start with a small amount, what could be the best strategy?

Thanks George!

Selfwealth are about the cheapest in the country. $9.50 for an unlimited size trade is as good as I’ve found. I also have an account with CMC who charge $11, which is still very cheap. Many brokers still charge $15-$25. I’d save up at least $1,000 and buy a chunk of shares in whichever investment appeals to you the most. Then repeat the process, hopefully with larger amounts over time. Hope that helps.

Thanks, Dave for the reply. I have taken the first step by opening an account with Selfwealth. Let us see how it goes.

Hi , was just reading over some of the old Lic posts. Do you think it’s a huge concern that arg, afi ,mlt are so big? Also I’m thinking is it a good strategy to concentrate on afi, aui, whf who didn’t cut their dividend in the gfc? Bearing in mind we’r due for a crash?

I wouldn’t say it’s a huge concern no. Some people say it means they can’t invest in small companies, but that’s not entirely true. All still have a number of investments in small and mid sized companies. It just means they probably can’t take large positions in them (which is fine). I think the main thing is they’re more constrained by large capital gains they have in the portfolio and are unlikely to sell some of their largest holdings, even if the outlook isn’t great. I don’t really mind this aspect as I’d prefer them to hold onto long term investments and let the market value them. They can always invest more into other companies over time where they see better prospects, even from a small amount of selling, which some (like AFIC) have been doing lately.

I’ve thought about choosing the non-cutters too. But there’s no real guarantee it’ll be the same LICs which don’t cut dividends next time round. If those LICs are the ones you feel more comfortable with for that reason, I think that’s completely understandable.

Ok thanks so much for the super quick reply. I’m thinking about a little purchase so I qualify for a feb/ September dividend so mlt/arg/aui are on my hit list haha

Haha, or you could wait till the ex-dividend date when the price drops? Higher purchase yield. Or just buy monthly like I do (or whenever you can afford it)…

Is there somewhere that publishes a chart of LIC price and NTA? – to avoid having to go to each LIC’s website? Happy for it to be ony the grandfather/top ones (especially with DRP).

Thanks

I’m not sure if you’re after a long term comparison, if so, I’m not sure one exists. If you want an up-to-date estimate of share prices vs NTA, then this estimator created by a fellow blogger might be of use – https://lifelongshuffle.com/2018/10/28/pat-the-shufflers-lic-discount-estimator/

Hello .

l think Bell Potter run the ruler monthly over all the Lics .

Try their site .

Cheers , Ramon .