Start Here

Close Menu

June 6, 2018

Welcome to the latest LIC review!

Today, we’re taking a look at another of the largest investment companies in Australia, BKI Limited.

As with the others, this is an LIC that we own personally and plan to add to over time.

You can check out my reviews of the other LICs on this page.

It’s also a good time to review BKI, given a recent announcement by the company which I’ll discuss in a minute.

BKI formed as a listed investment company in October 2003.

The company was created to take over the investment portfolio of Brickworks – an Aussie building materials business. In its early days, the LIC was actually called ‘Brickworks Investment Company’.

Brickworks had built the portfolio over a few decades with surplus cashflow from its regular business. The aim was to generate a growing income stream through long term investment in a portfolio of listed equities.

These days, BKI is one of the largest LICs in Australia, with a diversified portfolio of shares worth around $1 billion. The portfolio is made up of around 50 mostly-large Australian companies.

From BKI:

“BKI is a research driven, Listed Investment Company, investing for the long term in profitable, high yielding, well managed companies.”

“Our aim is to create wealth for BKI shareholders, through an increasing fully franked dividend and capital growth.”

The company does this by investing across a broad range of businesses. Those which are expected to be able to increase their earnings and dividends over the long term, as well as providing capital growth. And in turn, BKI can pass those growing dividends through to shareholders.

BKI avoids speculative stocks, and will invest only in profitable, dividend-paying businesses. Portfolio turnover is very low (meaning they don’t often sell shares). And the company also has a focus on keeping costs low.

Readers will notice a pattern here. Many of these old-fashioned investment companies are similar. And they essentially serve the same purpose – providing a low-cost portfolio of Australian shares focused on dividend growth.

BKI’s portfolio is smaller than the likes of AFIC, Argo and Milton.

At around 50 companies, it has around half the stocks of the others. But BKI does hold many of the same big-name dividend-payers. So the portfolio is simply more concentrated in nature.

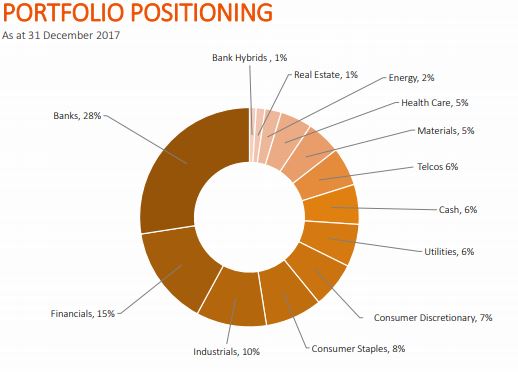

Here’s what the portfolio looks like by sector…

From this picture we can see a few things. Firstly, BKI is quite heavily invested in banks and financial companies, similar to Milton.

Also, they have very little exposure to mining companies, which comes under ‘Materials’. And, almost no investments in the real estate sector. This is very deliberate, and not without reason.

As I’ve mentioned before, mining companies tend to have a poor track-record of paying steady dividends. Their profits are far too volatile for that. And I suspect BKI has avoided real estate investment trusts (REITs) as many of them don’t have great dividend histories either.

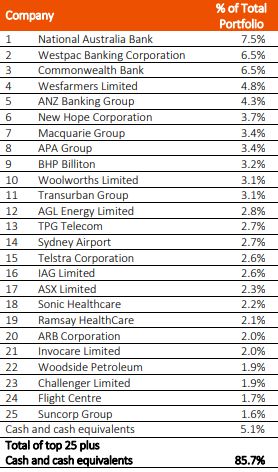

Now, let’s look at BKI’s top 25 holdings…

As we can see, some quite familiar names.

The difference with the BKI portfolio is, they tend to lean a bit towards shares with a higher yield. But don’t get me wrong, they still hold quite a few low-yield, high-growth companies too.

Because of this, the BKI portfolio naturally has a higher yield than the other LICs. Closer to 5%, rather than 4%, before franking.

We’ve discussed before, finding a balance between yield and growth.

Overall, the portfolio is slightly more concentrated, but it’s still a nice mix of dividend-paying companies.

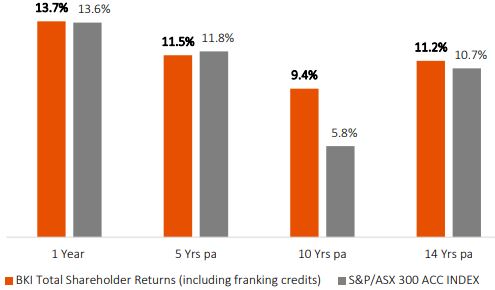

Despite being run privately for many decades, BKI has only been listed on the ASX for just over 14 years. So that’s all the history we have unfortunately. Here’s what the figures look like so far…

In truth, this makes BKI look better than it is. The 14-year figure is boosted slightly as BKI traded at a discount in its very early days.

Because LICs can trade at a share price that is different to the value of their portfolio (NTA), Total Shareholder Return is not the best metric to use (in my opinion). But since this is basically performance since listing, and shares are currently around NTA, it’s acceptable. And besides, I needed a fancy picture to use!

Once franking is included (as it should be), returns have been close to that of the index over the longest time-frame we have – around 10-11% per annum over 14 years.

It’s definitely not easy to beat the index these days. But regardless, many income investors are solely focused on the relatively stable and increasing dividends coming their way. Not so much whether they are generating ‘alpha’!

At the end of the day, we want a nice income stream, plus that other all important factor….

The holy grail of sharemarket investing is growing dividends. That stream of cash can be used to buy more shares to reach financial independence faster. And, it can be a vital source of cashflow to live on once you get there!

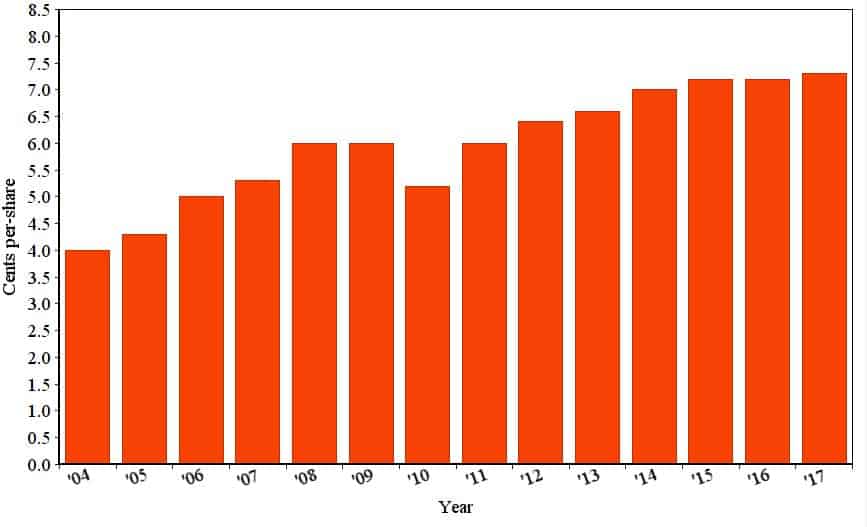

Let’s see how BKI has done since listing in 2003…

So you know, I’ve averaged out the first-year dividend. BKI only operated for 6 months of the financial year and paid a dividend of 2 cents per-share, for the half.

Here, we can see the dividend was only reduced for one year after the GFC, before recovering and increasing again from then on.

Since listing, BKI has been able to increase its dividend by 4.4% per annum. And over that time, inflation was 2.5% per annum.

Ultimately, BKI has done a pretty good job of generating a growing income for shareholders. They’ve also paid a few additional or ‘special’ dividends over the years, which I haven’t included here.

Going forward, I expect dividend growth to be slower than the other old LICs. The reason for this, is BKI has a bias towards higher-yielding stocks. And all else being equal, this will result in slower growth in dividends.

Total returns may be roughly the same. But, BKI may achieve dividend growth of, say 3% per annum, rather than, say 4% per annum. And that’s fine, because remember, their yield is close to 1% higher.

For its size, BKI is a very efficient company.

The management expense ratio (MER) is currently 0.17% per annum. Yes, that’s a little higher than AFIC at 0.11%. But we should expect that, because AFIC is 7 times the size of BKI! So its costs can be spread across a way larger asset base.

In recent years, BKI has become externally managed. The investment team hasn’t changed, it’s just been separated from the company. The reason is, the managers have created another LIC, and they decided it made sense to have a separate management company, which manages the LICs.

Now BKI pays a flat 0.10% per annum to its investment manager, ‘Contact Asset Management’. In addition, they have other running costs which adds up to the total MER. And of course, there’s no performance fees.

While I prefer an LIC is internally managed, this is still a low-cost company with the same manager and strategy in place.

Essentially, BKI & Contact Asset Management are partly owned and run by the Millner family. The head honcho Robert Millner is the Chairman of many successful listed Australian companies. Some of these include Milton Corporation, Brickworks, BKI and the 115 year-old family-run investment conglomerate Washington H. Soul Pattinson.

His son, Tom Millner, is one of two investment managers at BKI. Safe to say, the family knows how to invest. Dividends and low costs are a focus for the Millners, and always have been. Here’s an old article which sums up their philosophy well – “the thicker the carpet, the thinner the dividend.”

Due to their long-term philosophy, BKI qualifies as a listed investment company in the eyes of the ATO. This means they can pass on the CGT tax deduction if they sell any shares in their long term holdings. So on the odd occasion, we’ll receive a tax deduction attached to our dividend, along with those franking credits. More info can be found here.

Also, in my view, the Millner family ties are a positive.

I like BKI’s low costs and obviously their strong emphasis on dividends and growing income. And the fact they don’t invest in every corner of the market, for the sake of it. They typically only add companies where a decent yield can be maintained over time.

Because they’ve mostly ignored REITs and mining companies, BKI’s portfolio tends to generate more predictable income. This makes it easier for BKI to provide a relatively stable and growing dividend.

But this also means they’ll underperform at times by avoiding these sectors (like now). Personally, I’m okay with that. For those familiar with Peter Thornhill’s approach, this is the ‘Industrials’ strategy in practice.

As an early retiree, the higher yield of BKI is also nice. And it means the portfolio is less reliant on growth to reach a decent total return.

BKI’s (relatively) small size – $1 billion – means it’s much easier for them to take decent-sized positions in small companies. This is an advantage the larger LICs don’t have. Whether they take advantage of it over time, is another thing.

Also, BKI’s shorter history means they have less capital gains in the portfolio. So making changes to the portfolio is much easier, with less tax consequences than the other LICs.

BKI has a relatively small portfolio in comparison to the others. I would prefer BKI was more diversified and held more companies in total. Hopefully over time, this is something they’ll do.

I’m not keen on the move to external management. But as discussed before, it’s not a deal-breaker for me. The main advantage of internal management is that costs come down as the company gets bigger.

Hopefully BKI’s costs will continue to trickle lower in the future. The new management structure is unlikely to result in fee gouging. I think the chance of the fee or MER increasing over the longer term is near zero.

Ultimately, the investment team are all large shareholders in BKI, so our interests are still aligned.

Ideally, I’d also prefer to have a longer history to better measure the performance of BKI, as we have with the others.

And finally, I’m not thrilled about the recent announcement by the company to offer shares to the public at a discount…

Overall, BKI is a solid, low-cost investment company.

Its portfolio is smaller and its history is shorter than our other favourite LICs. But it has developed a good track record of inflation-beating dividend growth so far. And the family behind it have many, many decades of success investing in Australia.

BKI owns close to 50 companies across many sectors, so the income stream is still diversified. For some who lean a little more toward higher-yield than higher-growth, this one may be the LIC of choice.

Taking part in the ‘General Offer’ is a great way to top-up or buy a first parcel of shares. Currently, you can buy BKI on a dividend yield of 4.9%. Including franking, the gross yield is 7%.

Looking around the investment world today, that’s a very attractive yield. And importantly, I think we can expect the underlying portfolio of shares to spit out a decent stream of income well into the future.

Enjoy this post? You can find my other LIC reviews here, including AFIC, Milton and others.

I totally love these LIC review posts. Thanks for yet another great write up Dave. BKI is a keeper for me too.

Cheers Phil! I enjoy writing them. And it’s great to have a few enthusiastic readers like yourself 🙂

Another great review! BKI sounds O.K! I might purchase some of these!

Whatchu talkin’ bout willis!? Haha, yeah they’re not a bad LIC…I’ll send ’em a few bucks too 😉

Awesome . Thanks for another great review.

No worries Luke – thanks for reading!

Another quality LIC review! Was originally only going to take up the entitlement offer, but got inspired by your post and updated my BPAY payment to purchase additional shares beyond the entitlement offer!

For those wanting a more detailed review of BKI here are two links:

https://bkilimited.com.au/investment/wp-content/uploads/2017/08/IIR-Report-BKI-2017.pdf

https://bkilimited.com.au/investment/wp-content/uploads/2017/10/Lonsec-BKI-Report-Final-2017.pdf

Credit to Gordon

Thanks Jack – I’ve now linked to those reports at the end of the post.

Haha you know this stuff is just general chatter from a random bloke on the internet right? But I’m glad if you feel it helped you 😉

Thank you for your review. It reminds me of why I invested in BKI in the first place.

Cheers Sharon, glad you enjoyed it.

Good review Dave, great to have a local boy blogging about financial independence.

I’ve been a BKI holder for 8 years and been very happy with performance and the philosophy behind the investment strategy.

I’m taking up my full entitlement plus some extra, I think $1.50 is a good deal.

Thanks for reading Brem!

I’d imagine 8 years ago was an excellent time to buy – wish I knew about dividend investing back then! Agreed, I’m applying for extra too. I think in 30 years time we’ll be glad we did 🙂

Great review Dave!

Does ASX 300 ACC INDEX in your chart include franking credits?

Cheers Saad, glad you liked it. And yes, both figures are including franking credits.

Thanks Dave, Always look forwards to your reviews.

Thanks Jason!

Good Post.

Lots of conspiracy theories around about BKI’s capital raising but some private information that’s come to hand suggests that BKI’s intentions are shareholder friendly. Countinued dividend growth is a strong objective. Think long term, ignore the chatter.

As usual not advice:-).

Cheers Nodrog 🙂

Appreciate you stopping by and dropping these handy reminders. Easy for some to get bogged down in negativity and not act. I always try to focus on the big picture. And after thinking more about it recently, I’ve applied for a bigger parcel than I originally expected.

Any chance you can elaborate on that information? Could be quite helpful.

Unable to elaborate further sorry.

Looking at things generally the Millner family through their various companies (eg SOL, BKW, MLT, BKI) have looked after their shareholders well over the decades. I don’t think that is going to change in the future.

BKI being a decent size but much smaller than the likes of AFI / ARG / MLT has plenty of room to grow and going forward has opportunity to be potentially less Index aware. The largest LICs due to their huge size and accumulated unrealised gains (turnover restrictions) are likely to remain more Index like. What you see now is unlikely to change much well into the future. Unlike the older LICs BKI has more opportunity to look to the future rather than being hamstrung by the past.

Hopefully BKI invest the proceeds from the capital raising well so that investors can continue to enjoy a reliable rising dividend stream. BKI appears to be a very driven in maintaining that objective.

Not advice????.

Thanks for those points and agree with your sentiment regarding the Millners.

Yeah hopefully BKI can take advantage of their smaller size which the other LICs can’t really do. I also noted a comment you made (I think?) regarding franking changes in that BKI has less gains in the portfolio so could more easily convert from an investment company, to an investment trust, if it was deemed desirable. Interesting point nevertheless.

Definitely – let’s hope BKI finds some good income opportunities over the next few months for that cash.

Good well balanced review Dave. And good points you raise there Nodrog. I have been a bit critical of the BKI raising. We have now already seen the negativity weigh on the current BKI price a little. I am not personally seeking more index like ASX type exposure just at the minute. But if I was weighing up seeking such exposure now I would give BKI some consideration (versus an index ETF) for the reasons Nodrog just outlined. I might be inclined to just go with an ETF though rather than AFI or ARG.

Cheers Steve!

I always wonder whether these reviews seem incredibly biased or not – hoping that’s not the case. I do aim for a well-rounded take while still pointing out my attraction to them.

Not sure whether the negativity is weighing on the price or the fact that this is what usually happens with a capital raising? As you know, the price quickly drops to the level new shares can be purchased at. We saw this with the Argo SPP not that long ago.

Thanks for sharing your thoughts and adding to the conversation.

Thanks Steve.

Was just re-skimming the IIR Report on BKI. More professionally sums up what I was trying to say earlier :

“There are several aspects that differentiate BKI from its most directly comparable ‘old school’ LIC peers. Firstly, we believe it is in something of an FUM sweet spot, benefting from scale in terms of a low MER and excellent market access but not that big as to compromise investment / portfolio nimbleness. Furthermore, BKI does not have significant embedded capital gains tax liabilities in its portfolio as some LIC peers do, which can potentially compromise sell disciplines. Finally, key members of the investment team and committee are materially invested in BKI, both financially and reputationally, creating a strong alignment of interest with shareholders.”

Fantastic review Dave, really well presented. So much so that BKI is rising up very high among my shortlist of next investments…. seems like a pretty good opportunity to buy in.

Some really great quality businesses in that top 25 holdings, and I like that it’s still relatively small and nimble.

Keep these great reviews coming!

Cheers, Frankie

Thanks for that Frankie!

Sounds good mate, but I wouldn’t expect BKI to shoot the lights out or anything. In fact, they’ll do well to beat the market – most likely scenario is probably to keep up with or even slightly lag the market. It’s more a good holding for income investors focused on a reliable and growing dividend stream.

Was it for your personal portfolio or for your value/performance-aimed fund?

Great review Dave, BKI is firmly on my LIC shortlist. But tell me, does the 0.17% MER include the 0.10% Investment Manager fee? Or are the total fees 0.27%? I’ve checked their website but it’s not exactly clear.

Cheers

Andy

Thanks Andy – yes the MER is including the fee paid to the external management company, so the total is 0.17%.

Hi Dave, have you already received the shares from the public offering? The allotment share date on the prospectus is 19 June, however I cannot yet see them on my account.

Hi Jak. I’ve received some – the Entitlement Offer (for existing holders) has been completed and new shares have been allotted on June 19. The General Offer (for anyone) and the Shortfall Offer (for shareholders who wanted extra) – those shares will be allotted on Monday the 25th I believe.

Dave,

I’m confused. Is the total fees we pay BKI 0.17% or is it 0.17% plus the 0.1% to external management company meaning overall we pay 0.27% instead of 0.17%?

Thanks,

Kieran

0.16% is the current total MER as of BKI’s most recent report released today. It’s just highlighting the fee that goes to the external management 0.10%. The remainder is just some running costs I would guess.

Ok thanks more reassuring the fee is not 0.1% more as over time that’s quite a bit! Means BKI is in line with other major LICs as regards fees.

Hi SMA, loving the LIC overviews!

Is there any place to find out when LIC’s make special offers to buy in? I am looking to get into the market and wouldnt mind stepping into something like BKI offered a little while back.

Thanks!

Thanks Milky.

What BKI did is actually quite rare, in terms of the level of discount and making it available to the public. Usually these offers are only for existing shareholders and a much smaller discount. So it’s probably best to choose and investment you like and later on I’m sure there’ll be another small discounted offering.

Hey Dave,

Purchased few BKI shares today but can you guide me how many would be best to buy off, is there a limit do i start with?

Hi swara,

Do you mean how many LICs to buy? Or how big a parcel to buy – $1k, $2k etc?

Hi Dave was wondering why the total returns for bki have been so poor for the year? Iv been playing around on google but can’t find anything. Any info or opinion would be great. Also are the 4/5 grandfather lic’s absolute long term holds or do you need to keep an eye on them and maybe consider selling sometimes? Been loving all your latest posts mate keep up the good work????

Hi Luke. BKI’s underperformance is very likely due to the fact that small and mid cap resources are up 40+% during the 12 months, as well as a few other more speculative type stocks which drove the market higher. This is fine by me as these companies typically pay no dividends or very erratic dividends. And people are generally chasing anything with growth these days, so dividend stocks, especially higher yield ones which BKI focuses on, are underperforming.

Also they don’t hold CSL and a few other larger growth companies which have really shot up in the last year – that part is disappointing since there is some great companies with strong dividend growth. I believe they’re concerned about valuations for the higher growth companies so tend to avoid. I would like BKI to build the portfolio out a bit more – they’ve added a couple of new holdings recently which is a good start.

No they’re all suitable for long term holds. The only reason to sell is if one can’t stand to underperform the market (for long or short periods) and therefore will be happier in index funds.

In any case, the only figure I care about from year to year, is whether the dividend has increased 😉 Don’t get me wrong, the long term results are still important though.

Personally I’m happy with the income stream so far (which is the whole purpose of investing in them ) and think they will continue to deliver a solid yield and steadily increasing income over time. Whether it is a higher or lower return than the market remains to be seen, and is less important to me overall. Hope that helps Luke.

Yeah cheers Dave that answered my question very well. Just need to pick up arg and mlt and il have my 5 lic’s . Sod it , I might end up geting vas at some point too . ????

Hi Dave

This week the price of BKI dipped to $1.49 which is below the $1.50 “General offer” entry price earlier this year. Does this alarm you or do you see it as an opportunity to buy more?

No it doesn’t alarm me at all. The market is down lately which is the reason, even though company profits and dividends are increasing – go figure! As a long term accumulator I’m not looking to the market to ‘reward’ me with higher prices. In fact, being a long term buyer, it’s in our best interest that the price goes nowhere, while earnings and dividends steadily grow 🙂

You have 5 free share trades coming your way Dave as my SelfWealth account was established today!

I plan on purchasing some more LICs and topping up on the ones I currently have with my 5 free trades.

Looking forward to your review on WHF!

Thanks Jacqui, good stuff. Haha seems there’s a few people waiting for that one 🙂

Haha I’m not surprised! Your LIC reviews have been very interesting! I already own WHF however I’d love to hear your thoughts!

Hi,

Just received the latest BKI annual report. It used to be a tiny three page foldout, and now it’s a mega production with profiles of the directors and all sorts of disclaimers. Must be the new external management?

Hey Arlo. Not really sure what you mean. I just read the results and presentation online, and that doesn’t seem to have changed much.

Hi Dave,

We recently found your blog and are avidly working our way through all your posts.

We like the LIC/ETF approach, and began our “investing for financial independence” journey by purchasing some BKI shares just last week 🙂 (Thank you for your LIC review series – it was VERY helpful!)

I’ve been reading BKI’s monthly reports and other publications and I have 2 questions I’m hoping you can answer:

1) I’ve noticed that the % Total of Portfolio for the Top 25 holdings changes each month. For example, Macquarie Group has gone from #6 (5.1%) in March 2020 to #1 (6.8%) in May, while Commonwealth Bank has gone from #1 (6.7%) in March to #3 (6.2%) in May 2020. From what I can tell, BKI don’t do a lot of selling of their holdings. Are these changes in position/percentage mainly due to buying/selling or just natural fluctuations in prices of these holdings that therefore affect the percentage of the portfolio that they occupy?

2) Do you know where I can find the full list of all BKI holdings (not just the top 25). I’ve been searching but haven’t found it yet.

Thanks in advance

Hey Miranda, glad you like the blog 🙂

Those changes are most likely down to the fluctuation of the underlying shares. They will buy more or sell some from time to time, but given how volatile the market was during those months I would guess it’s likely to be just the values moving around.

And to find the total list of holdings, best to read the annual report which you can find on their website here. Hope that helps.

Awesome! Thank you so much.

How much better would this be with a DSSP? Whack one of those in and see the tears well up in those pre-FIREys on a decent wicket who keep wading into VAS land.