Welcome to another LIC review! Before we begin, I must admit I’m cheating a little with this one.

Washington H. Soul Pattinson isn’t really a traditional LIC. Instead, it’s more accurately described as an investment conglomerate – we’ll get into the details soon.

If you haven’t seen the other LIC Reviews in the series, you can find them on this page. As with the others, we’ll run through the company’s history, investment portfolio, performance, dividends and management. Let’s get started. But first…

What’s the purpose of these LIC reviews?

For those unaware, the idea here is to look at various investment options in Australia that could be a good fit for those wanting to live purely off dividend income in retirement (as opposed to selling shares).shttps://strongmoneyaustralia.com/lic-review-whsp-soul-pattinson-asx-sol/

Some people (myself included) simply prefer to invest this way. We don’t have to look at the market or think about prices in retirement. We simply go about our days and watch the cash hit the bank account.

With dividends being more reliable than share prices, and more closely linked to earnings, this tends to take a huge amount of stress away from investing in shares.

And that’s where low-cost, long-term focused LICs can be useful in a portfolio – providing more reliable and steadily growing income than other options. But as always, consider your own circumstances and do what makes sense for you. OK, onto our review!

The History of Soul Pattinson (WHSP)

Soul Pattinson is the third oldest listed company in Australia, having been in business and listed on the ASX for over 100 years. Its full origin story is fascinating, and best explained in their own words (from the company’s website):

“Washington H. Soul Pattinson and Company Limited was incorporated on 21 January, 1903, having previously traded as two separate companies – Pattinson and Co. and Washington H. Soul and Co.

Caleb Soul and his son Washington opened their first store at 177 Pitt Street, Sydney, in 1872, while Lewy Pattinson opened his first pharmacy in Balmain in 1886. The men became friends and never opened in direct opposition to one another.

Lewy Pattinson used to ride around the shops in the morning, arriving at head office about lunchtime, and in those days used to tether his horse outside. One day in the 1890s, on arriving at head office, he found the whole block had been boarded up. There had been an outbreak of bubonic plague in Sydney. Washington Soul, Caleb’s son, was waiting for him and said “Mr. Pattinson, I have taken the liberty of moving your head office to our head office at 160 Pitt Street, Sydney. Please continue to use it until you are allowed back into your own premises.”

Some years later Washington Soul approached his old friend, Lewy Pattinson, and asked if Pattinson & Co. would buy him out. Pattinson agreed and after discussion with his partners, Pattinson and Co. bought out Washington H. Soul and Co., effective from 1st April 1902.

Out of respect for his old friends, Lewy Pattinson included the name of Washington H. Soul in the name of the new company, Washington H. Soul Pattinson & Company Limited. The first public offering of shares was in December, 1902 and Washington H. Soul Pattinson and Company Limited was listed on the Sydney Stock Exchange (now the Australian Stock Exchange) on 21 January, 1903.”

WHSP evolves

In its early days, Soul Pattinson was a chain of chemists in and around Sydney.

The company expanded into other areas over the years such as retail, mining, telecommunications, financial services, building materials among other things, including equities and real estate investment.

These days, Soul Pattinson is best described as a large investment company, spread across a range of industries. The amazing part is, multiple generations later, the same family still runs the company!

Soul Pattinson prides itself on its rich history and building a culture around truly long-term investment, supported by loyal long-serving staff.

It has paid dividends every single year since listing in 1903, including during the Great Depression. WHSP now has a market cap of over $5 billion and is part of the ASX 100.

Company Objectives and Philosophy

Athough it’s not a traditional LIC, Soul Pattinson’s objectives are very much in line with other investment companies.

“WHSP’s objective is to hold a diversified portfolio of assets which generate a growing income stream for distribution to shareholders in the form of increasing fully franked dividends and to provide capital growth in the value of shareholders’ investments.”

Its strategy differs from the typical LICs in that Soul Pattinson is a more concentrated investment company. It often takes a counter-cyclical approach and is very value-focused.

Soul Pattinson is also not a passive owner like other LICs. Management is often involved in the direction of its investee companies and there is a long history of mergers, acquisitions and spin-offs across the board, which have been very beneficial for shareholders.

Soul Pattinson often holds large long-term positions in the businesses it backs. But it’s also involved in early-stage investments, providing capital and guidance to assist these small companies to grow.

Due to its history, investment approach, performance and other factors, WHSP is regarded by many as Australia’s mini-version of Warren Buffett’s investment company, Berkshire Hathaway. Now let’s take a look at the breakdown of the portfolio.

Investment Portfolio

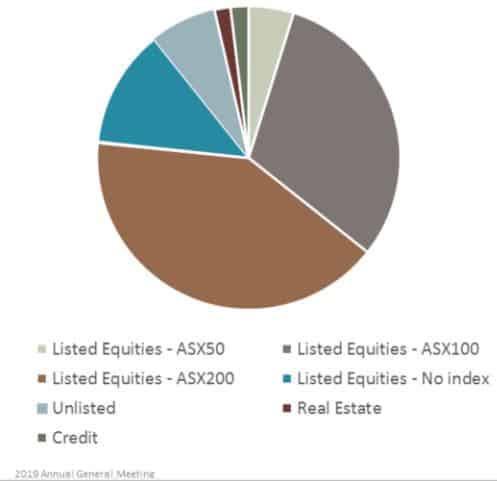

WHSP has diversified investments worth over $5 billion at the time of writing. You can see this broken down into various categories below.

As you can see, Soul Pattinson has only a small fraction invested in large companies.

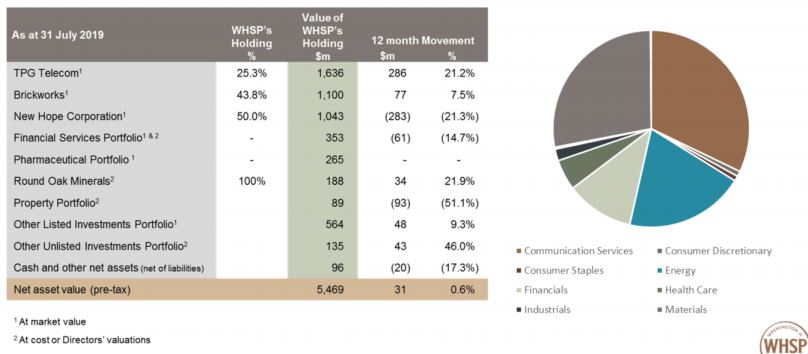

Most investments are in small and medium sized businesses, with a decent amount also invested in companies outside the index, private businesses, real estate and credit. Here’s the breakdown by sector, as well as a list of major holdings…

Doing the maths, around two-thirds of the portfolio value is held in its top 3 holdings. That’s partly because these investments have performed so well over the last decade or two.

But this means you’d have to be very comfortable with the management of Soul Pattinson, or those particular companies to invest today. And from those figures it’s clear that WHSP is a major owner of these companies, and therefore has a strong say in the direction of each.

Risks here are a concentrated portfolio and management. So let’s take a look at what management has delivered for shareholders in terms of performance.

Performance

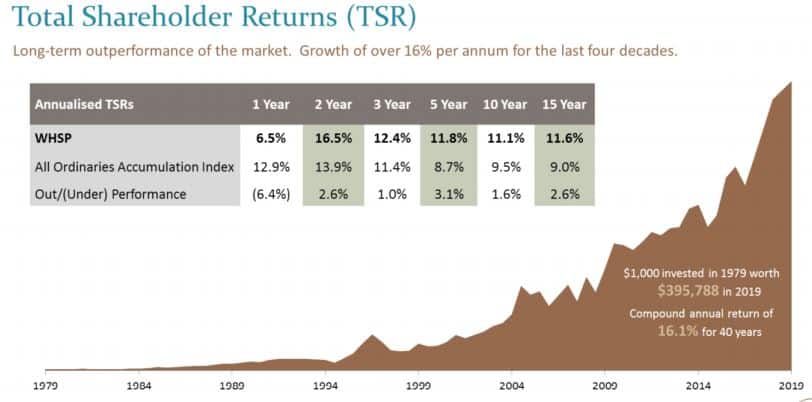

Rather than explain it to you, the performance of Soul Pattinson is best shown in a couple of charts from their recent presentation (which you can see in full here). Here’s the first chart…

It’s clearly been a strong 20 years for the company. Look at that growth rate! Regular profit and dividends grew by 10% and 9%, respectively. And that’s resulted in the share price, profit and dividends each being 5x higher than they were in 1999.

Interestingly, the building on the left was (until recently) their iconic heritage-listed Pitt Street head office. It was the first WHSP chemist built in 1885, which the company has owned ever since.

But the company recently decided (with mixed emotions, I’m sure) to sell the property, after being offered almost $100m for the asset. Okay, so its been a solid 20 year run. What about the longer term? Let’s take a look…

Wow, a great example of compounding in action! 16% annual returns over 40 years is nothing short of incredible. For the record, Aussie shares returned 12% per annum over that time, according to Vanguard’s interactive index chart.

So it’s definitely not just a lucky short-term run for WHSP. The company has been making shrewd and sensible investments for many decades. But let’s see how they’ve turned this into cold hard cash for investors.

Dividend History

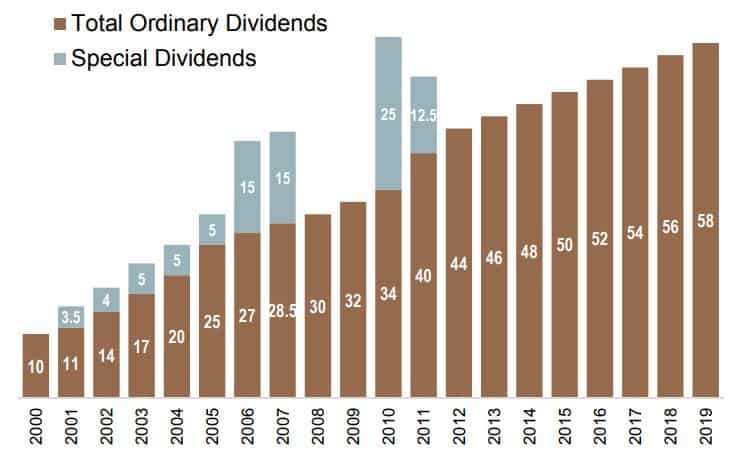

As always, my favourite metric. The other chart kinda gave it away, but the dividend history of Soul Pattinson is also very impressive. An income investor’s dream. Take a look for yourself…

Dividends have increased every single year since 2000. Only one other company on the ASX has managed to achieve this (Ramsay Healthcare). Over the last 20 years, dividends have grown at a rate of over 9% per year!

I don’t expect growth to be this fast in the future, but it’s still quite a feat. And Soul Pattinson is very proud of this history, so I bet they’ll do their best to keep this streak going.

Along with strong total returns, WHSP has done a great job of providing a continually growing income stream for investors. They also paid some large special dividends along the way.

This dividend stream currently amounts to 82% of their regular cash profit. For an investment company, that’s a conservative payout ratio. The rest is used for further investment, which makes the dividend more reliable and provides room for future growth.

Finally, some of Soul Pattinson’s major investments also have conservative dividend payouts. This means the income they receive is also well supported and has room to grow.

Management

As mentioned before, WHSP is a family affair. Robert Millner has been Chairman since 1999, having taken over from his uncle, Jim Millner, who was Chairman for the preceding 30 years.

Robert Millner is a prominent Aussie businessman in his own right, and serves as Chairman or Director of many other ASX-listed companies including Brickworks, New Hope Coal, Australian Pharmaceutical Industries, TPG Telecom and more.

Rob is the fourth generation to run Soul Pattinson. His son Tom is also involved in the company, as well as being the investment manager for BKI.

Between the two Millners, they own more than 15% of the company, valued at close to $1 billion. In short, there is a great alignment of interests between shareholders and the Millners.

The company invests with a strong focus on value, a genuine long term view and a culture of cost efficiency across the companies they own and invest with. Soul Pattinson is also disciplined and prepared to be patient, as well as make large counter-cyclical investments.

Given the impressive performance over the last half-century, as well as the business experience and culture, it’s clear that WHSP is a well-managed company and has created fantastic wealth for shareholders.

Cross-shareholding

In an unusual quirk, WHSP owns 43.8% of Brickworks, and in turn, Brickworks owns 39.4% of WHSP. This partnership was created 50 years ago and I believe it was to help prevent corporate takeovers, which were more common back in the day.

Recently, Soul Pattinson took time to correct the misconceptions about this structure here. Although uncommon, it’s hard to argue that the cross-ownership has been bad for shareholders, for either company.

Management has substantial wealth on the line, so interests are well aligned. And they make concerted efforts to disclose the value of the investment portfolio at each results announcement, even giving best estimates on unlisted businesses and real estate.

Deal-making and Adding Value

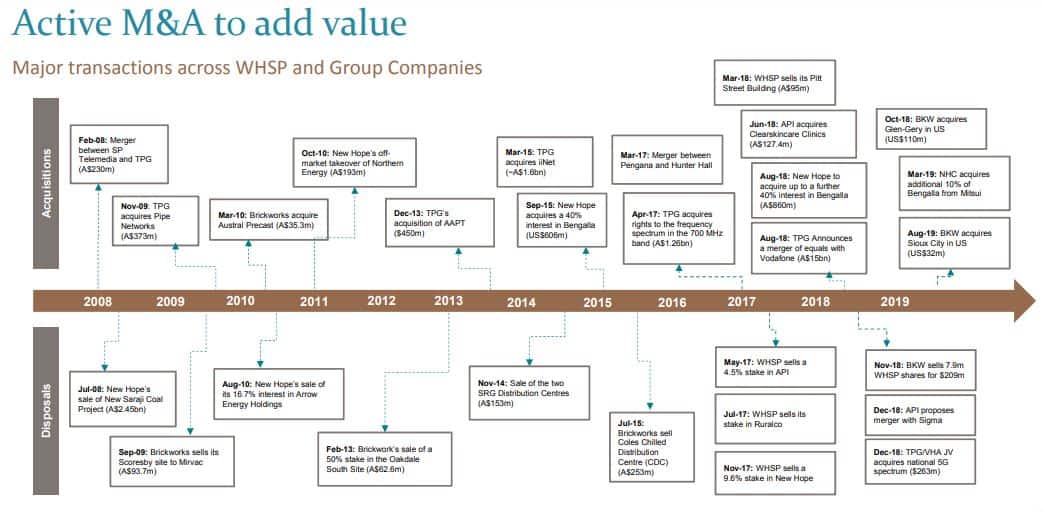

In contrast to traditional LICs, Soul Pattinson is heavily involved in the direction of the companies it invests in. And they have a long history of orchestrating mergers, acquisitions and expanding their current holdings.

Soul Pattinson does this where they see an opportunity to add or create value for the underlying companies, and as a result, shareholders. The following chart from a recent presentation shows they’ve been busy in the last decade.

In addition, Soul Pattinson aims to be the home or partner of choice for those who may wish to sell (again, like Berskhire), or those looking for an investment partner to provide capital.

A good example was the purchase of a large stake of Hunter Hall funds management business in 2017. Founder, Peter Hall, decided to sell his stake to Soul Pattinson at a substantial discount to market value, to ensure the company ended up in stable hands.

Because of their connections and reputation, WHSP will occasionally get access to advantageous deals like this, which is obviously good for shareholders.

What I Like

Firstly, the long term track record of wealth creation and dividend growth is simply incredible. The rich history and culture of this family investment company is also a rare positive.

Soul Pattinson is a genuinely different type of investment company than other LICs. I like that they can invest in any asset class – listed, unlisted, early-stage companies, real estate etc.

Although the portfolio is concentrated, it’s still exposed to many different investments which they consider ‘uncorrelated’ in terms of earnings. This helps Soul Pattinson generate a healthy amount of cash through the ups and downs.

I also like that they are constantly looking for ways to increase value through mergers, spin-offs, acquisitions etc. This is something they’ve done well for a long time.

There’s no question the Millners are firmly aligned with shareholders, with most of the family’s net worth tied up in WHSP. Management is conservative, stable and see themselves as ‘stewards of shareholder capital’.

The company is very value-focused, with an eye on cash-generation from the portfolio to keep increasing dividends for shareholders.

What I Don’t Like

Soul Pattinson is arguably a riskier option than the more diversified LICs we normally discuss. Because of this, it’s worth considering more carefully before buying in.

Personally, I’d make it a smaller amount in a portfolio. In fact, I’ve owned it in the past and it made up less than 10% of our portfolio.

Also, it’s fair to say that one of the main positives is also a key risk. Management.

If the culture goes off-track or Millner & Co. simply start making a few bad moves here and there, Soul Pattinson could suffer. To be fair, given the experience and history that does seem unlikely, but it’s possible.

The level of diversification could also be considered a negative. After all, two-thirds of the company value is in just 3 holdings. If you follow the presentation links I’ve included, management is clearly confident with the outlook for these companies.

Given the nature of WHSP, I’m convinced that they would reduce these holdings and/or invest elsewhere if their outlook changed.

Essentially, it’s a case of hitching your wagon to the company (and the Millner family) and going along for the ride, trusting the company will continue to be managed prudently, as it has been for generations.

Summary

In my mind, Soul Pattinson is one of the most impressive companies on the ASX. Being more than 100 years old, still family run and having created huge wealth over many, many decades.

It’s definitely a little bit spicier than old LICs like AFIC and Argo. But with its strong focus on value and generating growing cash from investments, it fits the bill for income investors. And that dividend history, wow… worthy of a picture frame!

Currently, Soul Pattinson trades on a dividend yield of 2.6%, or 3.7% including franking credits. That’s lower than other LICs, but with a conservative payout and long history of consistent and strong growth, that’s a decent trade-off.

Or, you can just keep it simple and be content that WHSP is currently Milton’s third biggest holding (for those of us who own Milton), and that it’s already part of the ASX 100.

So even by holding an index fund, you’ll still benefit from the growth of Soul Pattinson. That means either way, you’ll get access to the increasing dividend stream it pays, as you ride off into the early retirement sunset!

Enjoyed this review? Check out my other LIC reviews on this page.

Hi Dave, great review! I notice you didnt cover management expenses for this one?

Cheers Mark. Soul Patts doesn’t report MER as it’s more a regular business than LIC. I’d have to dig into the accounting and pick apart things to figure this out, wouldn’t be easy at all. But the culture (across their businesses) is around being low-cost operators in different industries so I don’t think auditing their expenses is necessary lol.

Great review. Do you have any thoughts on the takeover of URB (another Millner operated company which specialized in urban renewal) by TOT?

Thanks TK. Don’t have any thoughts on it as haven’t followed it whatsoever, sorry!

Hi Dave,

Back when I felt the need to continually make changes to my portfolio I sold SOL for 14 dollars to buy BKI.

Kicking myself!

Haha damn. Don’t worry mate, these things are only obvious in hindsight!

Ha ha true that 🙂

Nice article by the way as usual.

Cheers

Hi Dave. My understanding is that SOL doesn’t have a dividend reinvestment plan. Is that something that is likely to change in the future do you think? Cheers

Hi Lloyd. We really can’t know, companies can begin or take away a DRP program at any time. So at this stage, I wouldn’t bet on it, and would instead just reinvest your dividends manually 🙂

Hi Dave, Great review again. Enjoy your articles. Now on SOL….I am just wondering with SOL being quite expensive and dividend returns around 3% is it really worth it? Perhaps the people that got in years ago do not worry too much about the dips SOL has had over the years. But those that got in perhaps over the last year or so are not doing well. This brings me to my next point: For those eg Got in on SOL $20,00 and higher, perhaps it would have been better to have traded them instead of holding. Its easy to say after its happened and no one can actually predict the highs and lows. But perhaps trading them would have returned more than the dividends? I know its only been a short while but looking at the charts over last couple of years where it has reached up around the $30 mark twice and then has had big falls.

If your holding for long term depending on what you paid you may eventually see the $26-30 range again, but like me, who probably paid too much as it was climbing, well….not looking good…LOL

For what SOL is worth i am thinking would i have been better to have got the likes of AFI and ARG. They seem to be consistent, cheaper, i would have had more shares. i guess they have more diversification in their port folio. Oh well, we are always learning….fingers crossed SOL gets back up there before im too old….LOL

Hey jdc, thanks!

What makes you say SOL is expensive? I hope you’re not looking at the dollar-price per share… which is largely irrelevant and was covered in the last Q&A session here 🙂

Yes it has fallen heavily in the last 12 months or so. The price got a bit ahead of itself after having a huge run, and some of its holdings also got hammered. It’s only obvious in hindsight. Look at the other commenter, he’s upset he sold, and you’re upset you bought lol! Simply based on the short run movements of the price. Soul Patts looks much more attractive now than it did 12 months ago in my view, but still all that matters is the future.

All I can say is look to the long term. If you still feel confident in the company looking out 20 years, then hold… if not, maybe sell. But year to year stuff, even big drops, are irrelevant for a long term investor.

Don’t get too hung up on the yield, Soul Patts has always had a lowish yield, but look at the phenomenal dividend growth it has delivered – that’s generally the way these things work.

Hello again .

l have SoulPat’s on my to buy list at ~ 1 9 0 0 cents , being the mean-reversion level if one believes in statisticals .

Please note , the above comment is just for the record and thus has no meaning whatsoever otherwise !

Take care , Ramon .

Hello,

Which Brickworks does SOL have – is it BKI or BKW?

thank you

Brickworks Limited (ASX: BKW)

Sorry, i was a little quick. the correct answer is Both.

https://www.whsp.com.au/current-operations/

Hey Frank. As Matthew said, the large ownership stake is in Brickworks (BKW), but they also own a much smaller amount of BKI. Hope that helps.

Coal ( New Hope ) a good investment ?

Hmmmm…….

Yeah I’m not a fan of it either Carlos. But they went into some detail in the presentation I linked on the future of Australian coal and they think even in the worst case scenario it still makes sense to own New Hope. Soul Patts management know more than I ever will, so… 🙂

so they know more than all the scientists saying coal will be our doom if we don’t stop it ?

It’s not a matter of knowing more. If you read the presentation I linked to their view is that while renewables are growing, under every likely scenario certain types of coal will be used over the next couple of decades.

Saying something is bad for us and saying it’s not going to be used/needed is not the same thing.

You could argue that junk food (dirty fuel for our bodies) is still being used despite healthy alternatives and this creates a large and costly public health problem. In a similar way, clean energy is growing and I can’t wait for it to be 100%, but it does seems likely that less healthy types of fuel (coal) will be used for the next 10-20 years in some capacity in certain parts of the world.

BKW (incidentally also a conglomerate in its own right) also has not wavered in its dividends for over 40 years with a decent dividend growth too. BKW has recently expanded into the USA and thus is now globally diversified. These benefits thus also flow onto SOL.

Absolutely Phil, well spotted and worth mentioning. Great history there at Brickworks. Thanks!

Hi Dave,

Thank you for your summary and ongoing posts. Recently you posted that REIT’s make up about 8% of VAS/IOZ, do you know how much of these ETF’s are made up of LIC’s?

It may be that by holding IOZ/VAS we are already holding a fair proportion of the major LIC’s which in turn hold a fair proportion of the ASX50/100 so essentially we could be doubling up on our holdings……

Regards, jdp.

Hey Jim, thanks for reading. Good question. But the index does not contain any LICs at all, this one is the exception as Soul Pattinson is not really an LIC, but a conglomerate of all sorts as mentioned in the post. A bit like Berkshire Hathaway is included in the US index, but no managed funds are. Hope that helps.

Thanks SMA for the review.

I’d love to hear some thoughts and breakdowns on this article

https://www.evidenceinvestor.com/lic-or-etf-which-is-best/?utm_source=Stockspot+users+and+subscribers&utm_campaign=97893dd7c1-EMAIL_CAMPAIGN_2019_03_19_06_17_COPY_01&utm_medium=email&utm_term=0_2551a04bd7-97893dd7c1-98917257

Cheers mate. No issue old LICs have underperformed in recent years because they avoid stocks like Afterpay etc. with little earnings and no dividends. Is that a good or bad thing? Maybe bad short term, long term who knows.

Stockspot have a vested interest too despite pointing the finger at LICs. The piece is overly negative because of a few bad actors in the industry. I can see things from both sides (other people don’t seem bother trying that). No interest in arguing back because the people who don’t like LICs won’t invest and the people who do will likely still invest, so it’s all largely a waste of time.

It depends on your reason for investing in them (or not). If it’s for a reliable retirement income which grows over time, then the low cost old LICs will still give you that. If you were hoping them to beat the market, then you might be out of luck as that’s much harder to do these days (that’s never been my reason by the way which I’ve mentioned several times).

Yep totally agree. It comes down to investment style and objectives etc. And no doubt Stockspot CEO has a vested and bias view based on his own interests.

Cheers dave

Great Article!

Would you happen to know if SOL have dividend reinvestment plans? I had a look through their website and did not find a thing about it. I also did not find anything regarding management costs!

Thanks btran. I think it has in the past on the odd occasion, but no it doesn’t look like it does now. See my comment to Mark on management costs.

The milners have not addressed the nhc elephant in the room. No one will touch coal in the years to come. It is likley to drag down the capital valve of this stock. Shutting down the agm over coal questions seems to be like an old dead duck head in the sand approach.

Hey Craig. They share their views on this in detail in the presentation I’ve linked in the review, and obviously don’t share the same view. But going by their preso they’ve definitely thought about the risks.

Saying no-one will touch coal is fair if they’re looking to sell these assets. That’s a very different thing to what the Millners are probably asking, ‘how likely is it that parts of the world want our coal over the next 20 years?’ So I think they’re considering how much cash it’s likely to generate, not what other people are going to ‘value’ the stock at.

Do you really think it’s likely they’re simply ignoring the risk when their family’s entire wealth is on the line?

I’m not a coal fanboy by any means, just trying to offer some realistic thoughts.

Hey Dave

Been meaning to ask you about SOL for a few weeks now but REITs and your car purchase didnt seem an appropriate place to ask!

Now you have an entire article on it, thanks heaps.

I have been drawn to SOL as they have been doing the podcast rounds. Chris Judd did an interview with their CEO that was quite good and the motley fool boys have been spruiking away on their show.

I can see you are getting a heap of questions about coal and for what its worth my thoughts are; Berkshire have owned many unpopular but profitable business often buying them when they are out of favour. Its hard to see the image of coal turning around but the need for it will be here for decades. Basically they have bought a 50% share of an unpopular cash machine.

I ended up just buying VGS for what its worth.

Cheers for the article!

Hey Joel, thanks.

Yeah I have to agree with you there mate, even if a business is unpopular, I’m sure they’re solely concerned with demand for the product over the life of the asset.

In any case, an investment in SOL is trusting the management to steer the ship in the right direction. So by buying shares, it’s really about letting them figure out what makes sense and sticking those shares in the bottom drawer. But it’s totally reasonable if people avoid SOL due to simply not wanting to be invested in coal.

Nothing at all wrong with VGS, nicely done 🙂