Close Menu

December 22, 2022

It’s crazy that 2022 is wrapping up already!

The middle of the year seems like just a few weeks ago…

As I’ve done for the last few years I’ll zoom out and give a little overview of how 2022 went for the Strong Money household, along with some observations and plans for 2023.

By the way, this is a little different to the ‘retirement’ updates I’ve been posting each year. You can find the recent one of those here: What Life is Like 5 Years After Retiring Early.

Anyway, there were some great things, and one or two things which weren’t quite as good. Let’s get started with one of the big events.

As I wrote about back in March, we bought a home on the same street where we rented for the previous 4 years.

While the piece of land is a decent size (800+ sqm), the house left MUCH to be desired. It was a 50 year-old rundown rental property, in mostly original condition. Stained carpet, dirty walls, brown vinyl, massively overgrown gardens, ad-hoc repairs and add-ons. Oh, and those old musty smells you get from an old property which is far from clean.

Despite all that, the reason we bought this masterpiece was so we could remain on this specific street. Because it’s here that the turtles come across from the lake 150m opposite (the rest of the area is open parkland).

Add to that, few houses come up for sale and many are an unappetising mix of pavement, patios, sheds and house. No good. We preferred a smaller house with more non-paved are for grass, trees, gardens and open space.

Shortly after purchases, we had the house freshly painted and tiled throughout before we moved in to freshen it up a bit. That made a huge difference!

And no, I didn’t do it myself. I’m not one of these DIY-everything types. For multiple reasons – laziness is only one of them 😉

In fact, I’ll probably write an article on why I prefer to outsource most things, despite being supposedly frugal! It’s quite an interesting topic really, and a somewhat contentious one in the FI community. Stay tuned!

Since then, we’ve recently had the bathroom renovated and a few other things done. It’s easily the fanciest bathroom I’ve ever had, it actually feels like a hotel 😁

Some before and after shots…

Of course, this year we also continued helping the local long-necked turtles, including at our new place.

Funny story: we actually kept our lease running for an extra few weeks at the old house because it was still turtle hatching season. So I wanted to be able to release the little hatchlings before leaving. Otherwise, they’d be left to their own devices, with a decent chance of being eaten by ravens or run over before reaching the water.

Yes, that means we effectively spent an extra $1200+ to help a bunch of baby turtles make it to the lake 😂 Luckily, there were about 50 hatchlings during that month, making it a very worthwhile endeavour!

It also gave us longer to move all our stuff and clean the rental, which was nice. The alternative, of course, is rushing to get it all done as quickly as possible to save cash. But again, peace of mind and the desire for a relaxed lifestyle trumped frugality.

Anyway, I totalled it up and turns out we’ve managed to release 302 hatchlings since moving here 5 years ago. Now, I’m not sure how many of those are still alive, but this would’ve made a decent difference given the turtle populations have been declining across Perth’s lakes.

So it’s turned into an awesome retirement hobby. When it’s laying season (as it is now), I often wonder if the mother turtles remember me. “Hey, this is the guy that carried me across the road last year.” Maybe…

At our new place, I also cut out the bottom section of our shitty fence. This way the turtles wander into our garden (like at the old house) and have a safe place to lay their eggs.

There’s already 7 nests at our new house, which we’re thrilled with. We’ve also connected with a few other interested locals who we liaise with if it looks like there’s a few coming out to lay 🙂

Another big change during the year was all the ASIC business. If you missed it, I wrote about the clampdown on financial content here and here.

This put a dampener on what creators are allowed to say in their content. Despite seeming like a reasonable response to bad actors, the rules are, frankly, quite ridiculous if followed to the letter.

I won’t get into a discussion about that here or the pushback against it (if you’d like to read more on that, go check out those two articles linked above). But suffice to say, this changed things a bit.

After much discussion and thinking, Pat and I closed down the FIRE & Chill podcast. I’ve been asked a lot if it’s coming back anytime soon. Until the rules change, when Pat and I would surely discuss re-booting the pod, the answer is no.

As far as the blog goes, I’ll likely continue to refrain from investing related content where possible, especially where specific investments are concerned. Thankfully, a partnership with Pearler opened up, where I’m able to discuss investing over on their blog, with apparently no warrants for my arrest as of yet.

Granted, I’ve been writing in more general terms than I’m used to, but I also don’t want to poke the ASIC bear unnecessarily.

What else? Well, I finished my book! Overall, it was a really interesting process, which I thoroughly enjoyed for the most part. The last part of getting everything finalised and launching it was more stressful than I had predicted though!

Anyway, the level of support from readers and the finance community in general has been a special and unexpected surprise. I didn’t think it would go as well as it did. Seeing the book in people’s hands, hearing that it’s being enjoyed and is providing value makes all the stressful bits worthwhile.

As a personal note, I’m measuring the book by its helpfulness rather than its sales numbers. If only a few hundred people read it, but they find it genuinely useful and it helps them change their lives, to me that’s better than any other metric you could track for the success of a book!

Despite the sharemarket having a slightly down year, it’s been quite a profitable 12 months as far as our investments go.

Each of our properties increased in value, rents went up, handsome dividends were paid, and we continued adding to our share portfolio.

As you might remember, earlier in the year, sold off a bunch of shares to buy our house with cash. Later, we sold an investment property and repurchased these shares while transferring the loan to our new home. I went into detail about this unusual strategy called security substitution here.

Since then we’ve been keeping a low level of cash (2-3 month’s spending) and investing anything extra. I’m enjoying this fully-invested situation, after having high cash levels since retiring in 2017.

Our investment properties are still a drain on our cashflow due to expenses and principal + interest mortgages. This doesn’t bother me as much as it did, since our personal part-time income seems to be sticking around. Plus, our newly beefed up share portfolio is now generating about $50,000 per year in dividend income (which feels like a cool milestone!).

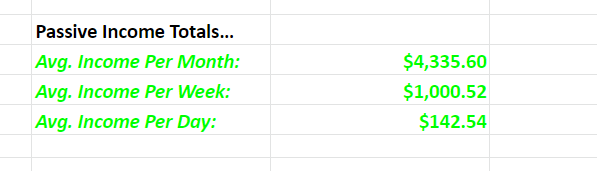

In fact, in my own spreadsheet where I keep track of our annual passive income, the ‘weekly’ tally just ticked over $1,000.

We’ll probably sell another property in the next year or two. Likely 2024, unless the market goes nuts next year and selling conditions are too good to ignore!

From what I’ve been reading, it seems like Perth property should do relatively well next year under the most common scenarios.

Trips: I took a trip to Victoria earlier this year to visit some family. Every time you see family you haven’t seen in a while, you’re confronted with the fact that time is passing rapidly and everyone is getting older. Which is bitter-sweet in itself. Life is kind of sad and beautiful at the same time.

While I was in Vic I even managed to catch up with Aussie Firebug. He lives about an hour away from my old town! So we met half way for a coffee, went wandering around and chatted about all sorts of things. Probably would’ve made for a decent podcast! Maybe next time 😉

I’m about to go and visit my mum in Esperance over the Christmas period too. It’s such an isolated beach town, but beautiful and peaceful. It’s holiday season though, so it may not be that peaceful after all!

Dog: Our british bulldog Boss is getting on in years. He’ll be 10 in April. During the year he developed a lump in between his toes which turned out to be cancerous. We had it cut out, but it had spread further to the nearest lymph node, so that was removed also.

The operation was a success, yet there was still a decent chance of the cancer having spread further. Given he was happy and healthy otherwise, we decided to proceed with chemo treatment to give him the best chance of beating it (cost around $10k in total).

Thankfully, chemo for dogs is much less intense than for humans. So the worst part was simply having to leave him at the vet each time. Anyway, his treatment finished a few months ago and he’s still doing great. No sign of any recurrence (which his good for this point), and aside from being a fussy old man, he’s a pretty happy dog 🙂

We’re very thankful to have more time with him, and we also improved his diet which I’m convinced is making a difference. Sadly dogs don’t live as long as we do, but hopefully he’s with us for a lot longer yet!

In case you were in need of some content for the holidays, let me share with you the most popular content from 2022.

Some popular investing articles I wrote over at Pearler…

And here’s a few older blog posts which people somehow found just as interesting this year as they did in previous years

Personally, I really like the end of the year. It’s a great time for reflection. You can think about what went well, what could be done better next year, and new directions you want to head in. All without the mental baggage of the current year!

On one hand, the mental reset of a fresh calendar year is arbitrary, but it’s also powerful. It’s a clean slate to reimagine your life and its possibilities. That’s how I look at it anyway… anyone else?

I’ll think about this more over the holidays, but so far I’ve come up with a couple of things I’d like to focus on in 2023. By the way, I don’t really do ‘goals’ as such these days, more like ‘focus areas’.

Get back into blog writing. My content fell away a little as the book took up more of my time. But now I can focus on producing the articles I’ve been wanting to write, and fleshing out thoughts on different FI related topics. I’m really looking forward to this because the ‘ideas’ list has been piling up!

Exercise and nutrition. Again, I dropped the ball here in the latter half of the year. I got a leg injury while doing yard work (needle from a palm frond went into my leg muscle), and then an elbow issue while stupidly doing pullups without warming up properly. But I’ve also been lazy, so it’s time to improve in this area!

For advice on getting ready for the new year and making space in your life for improvements, this article is a helpful guide.

I’ll be taking some time off to chill and hang out with Mrs SMA’s family who are visiting us for a couple of weeks.

I’ll probably still post a few things on Facebook and Twitter if you want to hear some other musings from me. But otherwise you’ll hear from me in the first couple weeks of January with some fresh content!

Thanks again for your support this year. From the ASIC stuff, to the book, to my slack blog writing – it’s nice to have such a lovely community of readers who are cheering each other on as well as those who make content like myself.

Just know I genuinely appreciate it, and I look forward to bringing you a bunch of (hopefully) good content next year!

Wishing you a happy and safe Christmas and New Year period. Enjoy yourself, unwind, reflect on your progress in 2022 and think about how you can have an even better year in 2023 🍾

By the way, if you’re interested in getting the spreadsheet I mentioned earlier, you can get it below. I update mine every time I buy shares and find it super motivating!

G’day Dave ,

Congrats and well done 👍 on what’s been a full on year for you .

The book is a great easy no frills read and says it how it is …truthfully .

All the best to you and your loved ones and happy investing in 2023.

Cheers 🍻

Cheers Jimmy, much appreciated. Hope you have a great end of year mate!

Thank you for all of your content this year. I’m looking forward to getting a physical copy of your book. Best wishes for 2023.

Thanks for reading Chandon, you too! 🙂

Hi Dave,

Congratulations on your book success, and the progress on your home. I loved reading about how much care you take of the long neck turtles. Going so far as to extend your lease and make changes to your new property to welcome them, it’s just so heart warming. Thank you.

Sorry to hear about the needle from a palm frond. I have actually had this injury too (into my foot) and it was absolutely horrendous! So I hope you have healed up ok.

Best wishes to Boss and his recovery too.

My news is that I quit my job this year! We achieved FI earlier this year but the fear held me back.

I’ve been enjoying my free time and my hobbies and it has been a blast.

You have previously done a catch up / meet up in the past (which I missed) any chance you will do another?

Happy travels over Christmas and all the best for 2023!

Cheers Lin! And congratulations on quitting your job and enjoying your freedom, that’s incredible!

Can I ask what helped you overcome the fear around quitting your job? It’s a big issue that I’m going to write more about, so any thoughts from your experience are helpful.

There will be a catchup in 2023, probably in the first couple of months 🙂

I think it is safe to assume in the FI community we are all good enough at math to know when our numbers say ‘Welcome to FI!’ especially after years of preparation, tweaking, researching, reassessing etc… so what holds us back from taking that final action?

There was a few things that helped me. I did 9 weeks between contracts last year to see how I enjoyed the break. It was good but I wasn’t as productive as I thought I should be during my time off and when an opportunity to do another contract came up, I took it.

Unfortunately I didn’t enjoy the next contract at all. The culture wasn’t great and I didn’t enjoy the work. I realised my values had changed and I was deeply unhappy. In the past I would have been able to talk about this to my manager but that dynamic had changed too.

Instead I had a few sessions with a Psychologist and one day I put in my resignation.

I was expecting to feel a bit wobbly so having the Psychologist appointments booked in was very helpful. It gave me some stability knowing ‘I can address this concern at my next appt’ and then it would not bother me.

I should also add that I knew I was fearful about letting go of work and I have been actively preparing for this over the last 2 years with building up my hobbies, travel plans, exercise plans, social plans and researching how others overcame their fear.

One big thing is people associating their value to their work. If they are no longer a “Job Title” what are they? They lose their identity and feel a bit lost. For this reason I saw merit working with a Psychologist to clarify my changing values and needs and curate my ‘new’ identity.

Another thing I discovered was that my previous overworking was a tool (coping mechanism) I used to avoid addressing some specific life problems. I always labelled it as productive and looking after my future self. But there was an element of overworking that was not healthy, meaning that when I was not working or being productive – I was uncomfortable and didn’t know why.

Again, that is where the Psychologist helped shine a light and work through these things.

So now I am very comfortable with my newfound time! I feel I am finally living my best life. I have a healthy balance and some new, healthy coping tools – not that I need them so much now!

I think a lot of people think you need to be messed up or depressed or anxious to see a professional. Actually they can be incredibly helpful just helping you navigate yourself, have a better understanding of your thought process and improve your self awareness.

Having a connection with this professional helped me have conversations to make this decision out of power instead of fear. It gave me confidence to trust myself and I think that was the catalyst for me making the move.

Thanks very much Lin! Such great experience here, I really appreciate you taking the time to share it. This is very valuable, and I know it will help other readers coming across this!

Enjoy your new life 🥳

Just started reading your book last night. So far so good.

I didn’t expect it to be so big.

Is it just me or do others finds someone’s personal financial story more interesting than most finance books that just talk about the money. I love personalised stories.

I didn’t realise it at the time, but I was staying around your way earlier this year. Maybe if you are up for it next time I come down I might see if you are keen for a coffee.

Good work on the book & look forward to reading the rest.

Cheers mate, hope you have a fantastic end of year!

Yeah it’s a decent sized book, but I also cut stuff out – it’s hard to balance packing it full of useful stuff while keeping it a simple, enjoyable read 🙂

Sure thing, let me know if you’d like to grab a coffee next time.

Oh WOW, what a year! How fabulous to be able to support local wildlife and provide treatment for Boss – I reckon that’s what I love most about FI!

I appreciate your sensible, no nonsense info, and look forward to more of the same in 2023. Merry Christmas.

Thanks Em, I’m glad you’re enjoying the content. I agree, that’s the magical bit about FI – being able to allocate your time and money where it’s most important to you.

Hi Dave.

I have enjoyed reading your book. Would be good to have a Perth review/lunch for those who are interested? I live in North Coogee

Kind regards Rachel

Hey Rachel. That’s great!

I’m planning to do a meetup sometime in early 2023. Not sure on location, but it’ll most likely be around my area (Joondalup).

Wow, 300+ turtles! That’s a seriously impressive effort :). Can’t wait to read more on the blog next year!

Thanks Jed 🙂

Congrats on a great year – and all the best for 2023! Sorry to hear about Boss’s medical issues, but glad he is looking clear at the moment! We have a French Bulldog, and I’m curious to hear what you’ve done to improve Boss’s diet?

Thanks, you too!

We now make all of his food as opposed to feeding him half processed biscuits / half home made. He gets sardines, cooked oats, steamed veggies, chicken mince and soybeans. It’s a healthy lower carb type diet, which is full of good stuff and much less inflammatory. It takes some time, but we feel it’s worth it, he’s in better condition than before (even though the vet regularly said he’s one of the best conditioned bulldogs they’d seen). Hope that helps.

Rennos to the new place looks epic Dave!

Great work on the book, just finished reading during isolation (picked up covid in Phillipines ugh) and my missus is making a start on it now!

Cheers mate!

Sorry to hear about iso, a good excuse to hunker down and read a few books I guess 😁

Great article Dave. It warms my heart to see your love and care for Boss. Many people wouldn’t fork out $1k let alone $10k. Much respect to you sir. We are all God’s children after all.

On another note, you mentioned last year that 2023 would be no different for you investing wise, and that you would continue to invest without any fear regardless of the ‘doomsday’ predictions.

I’m curious to know if anything has changed given the banking collapses and current economic outlook?

Cheers Brendan!

Yes that’s true. No nothing has changed regarding my investment stance. I’ll invest whatever I can afford to at the time. The outlook has changed, and that’s why prices are now lower. It seems unlikely that banking collapses will be as big of a deal as they were in 2008, because the regulators etc have been working for quite a while to reduce the possible future damage of something similar.

There’s nothing I could know right now that would help me decide what to do next. I’d be playing a short term market timing game in that case. I simply think the next 30-50 years are largely unaltered by short term events. I appreciate that others may see it differently or simply be more comfortable ‘doing something’ instead of continuing to invest. But the focus is to continually add to my assets, so that’s what I’ll do 🙂