Start Here

Close Menu

April 5, 2022

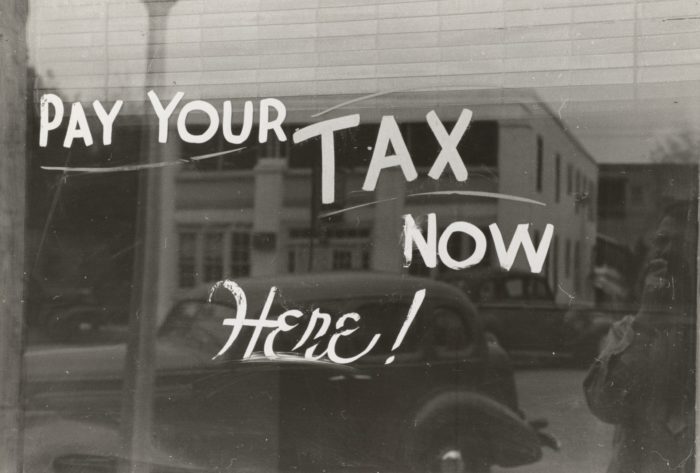

In today’s show, discuss the different taxes we face on our financial journeys.

We chat about taxes on our income and investments, different options for reducing tax, including deductions and negative gearing.

We also break down examples of what taxes look like when you’re living off a portfolio.

(or download the mp3 file here)

Check out our other episodes on the FIRE and Chill podcast page.

Thanks for tuning in! If you enjoyed the show, please share it to help spread the word.

Have something to add to this discussion? Share your thoughts in the comments below.

If you include the loss of benefits like family tax benefit and child care benefit etc there can be some really high effective tax rates on some members of society.

Hi Dave, you mentioned that that you can divide the income gained from dividends with your spouse (to take advantage of the ~20k tax-free threshold), thus further minimising tax. Can you please how exactly how you can “split” dividends gained as a couple? Do you need to set up a family trust to get this done? Thanks in advance!!

Hey mate, I got your email, I’ll reply to it shortly!