Start Here

Close Menu

October 26, 2021

If there’s one thing that pretty much everyone agrees on, it’s this: when buying a house, using a 20% deposit (or more) is the way to go.

After all, it comes with several benefits…

Substantial interest savings. Lower repayments. No need to pay LMI (lender’s mortgage insurance). And it gives you a good head start in becoming a debt-free homeowner.

But is it always the best move? I mean, you might also be trying to rapidly build a portfolio of investments for financial independence.

What if you used a smaller deposit so that you could invest more instead? And what about using a smaller deposit so that you can buy your home sooner?

Let’s explore these ideas.

LMI is an insurance policy which is typically taken out when a borrower wishes to have a loan which has a loan-to-value ratio (LVR) higher than 80%.

This policy is paid for by the borrower, and is commonly in the range of 1-3% of the loan amount. Yes, that means many thousands of dollars!

And it’s to protect the bank, not the borrower. Why the bank?

Because high LVR loans are considered riskier. If the borrower defaults, the bank would sell the property to recoup their money. But if the property value has fallen, given the high LVR, the bank may not be able to get their money back. Hence the insurance.

While it sounds pretty crappy for a borrower, it’s not all bad. You’d only agree to it if you were happy with the trade-off. By borrowing more than 80% and paying LMI you can:

Let’s work through a few examples and see whether the benefits are worth the cost.

(Notes: Like most examples, I need to use some round numbers and basic estimates for practicality. I’ll assume stamp duty and other costs amount to 5%. First homebuyer benefits vary by state and LMI amounts and rules vary by loan size, lender, etc so it’s too messy to include these. Focus on the big picture, rather than getting stuck in the details.)

You’ve been saving for a few years and you want to buy a property for $600,000.

You have a 20% deposit saved up – $120,000 – as well as 5% for stamp duty and other costs. Here’s how the numbers look.

It’s pretty amazing to see how much interest is paid over the life of a home loan. And this is with extremely low interest rates! No wonder people want to get rid of it ASAP.

Overall, our homebuyer has forked out $832,769 over 30 years (cash input + total repayments).

But instead of this, what if they decided to buy with a much smaller deposit and invest the rest of their savings? Let’s see.

We’ll assume the same as before. $600,000 purchase price, and $150,000 cash available.

But this time, instead of a 20% deposit, they put in a 5% deposit ($30,000) and pay LMI. Using this LMI calculator from one of the big providers Genworth, this example give us an LMI premium of about $24,000.

Wow, okay. So a few things are different here.

The total repayments are way higher, and interest costs are about $40,000 more, or 20% more than when a big deposit was used.

Overall, our small deposit homebuyer has forked out $894,789 over 30 years (cash input + total repayments).

In total, they paid $62,020 more than our big deposit buyer!

On the other hand, their cash input was $84,000 instead of $150,000. This means they can start investing with the remaining $66,000.

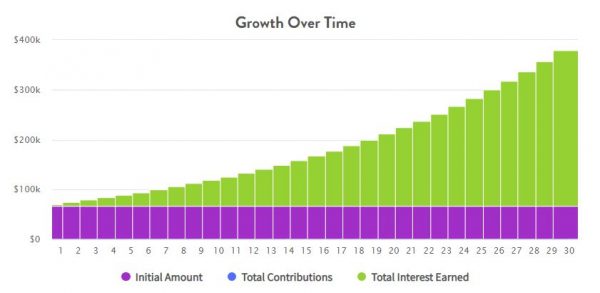

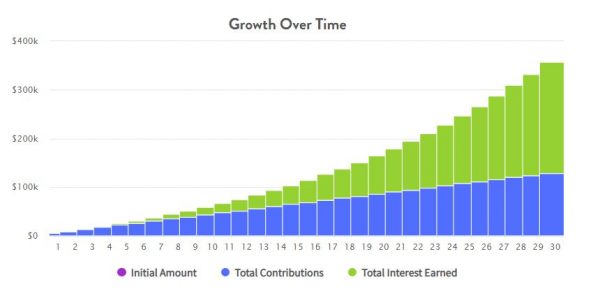

If we assume a return of 6% per year after tax, this chunk of money would compound to become $379,070.

So, even after accounting for the increased housing costs, our small deposit buyer is still up by $317,050.

But this isn’t quite the whole story. Because our large deposit buyer has lower mortgage repayments, there’s a monthly surplus available to invest, that our small deposit buyer doesn’t have.

As you may recall, our large deposit buyer’s mortgage repayment is $1,897. So she actually has $356 extra cash each month compared to our small deposit buyer, since his mortgage costs $2,253.

Over 30 years, this seemingly small monthly investment growing at 6% per annum becomes an impressive $357,608.

By the way, these sexy graphs are from the compound interest calculator at MoneyGeek. Alright, let’s take stock of all this.

After 30 years, here’s where we stand:

But that’s not to say using a large deposit is always going to be the best method. There are definitely other scenarios where the opposite could be true.

Something to note: In the current environment, higher LVR loans typically come with higher interest rates, which would act as a drag. But you can get the rate down as the LVR comes down.

OK, so that’s using two examples with the same timeframe. How about the idea of using a small deposit so you can buy your home sooner, even if you have to pay LMI?

First, because real estate prices increase over time, buying your home sooner means that, on average, you’re likely to pay a cheaper price.

Let’s say you’re saving up for a big deposit and you hit an unfortunate patch of strong property price growth. This has the following effect:

So it’s quite possible that buying sooner with a small deposit could save you money. The higher price means higher repayments, more stamp duty and more interest. Though it will obviously vary a lot by situation.

Yes, LMI is arguably a horrible cost to pay. But it’s an interesting option which does give you the ability to ‘lock in’ your house price a couple of years sooner and protect against a possible runaway housing market.

Some people point to the large deposit as a reason why housing is unaffordable. But clearly a 20% deposit is not the only option available. And for those who build a solid savings habit, it’s not too much of a hurdle. House prices alone are not the destroyer of dreams they’re made out to be.

Of course, you could also pay LMI and then prices fall after you purchase, thereby making it a painful cost you didn’t really benefit from, aside from being a homeowner sooner.

Look, I’ll be honest. I expected to find that using a small deposit and investing the surplus was going to be the most profitable option. So it was quite surprising to see the end result.

Maybe this is an overly simple example. We haven’t considered debt recycling, extra repayments or anything else. But this felt like an interesting experiment to play out, since I haven’t done it before.

All in all, using a 20% deposit seems to be a pretty solid approach in most cases. But as you can see, there’s more to it than that. In my view, the best aspect of using a large deposit is the lower monthly repayments, making life a little easier and your expenses lower.

Of course, for those that aren’t great at saving, a 20% deposit could take a frustratingly long time. But if you’re switched on and optimise your finances, it should only take a few years depending on where you live.

After that, it’s simply a case of paying down that loan or investing in a portfolio of income producing investments. Or both!

What are your thoughts on the ideal deposit size? Do you think it can make sense to pay LMI and buy sooner? Let me know in the comments.

Home loan recommendation: If you need help with anything home loan related, like finding the right lender or refinancing to a better interest rate, feel free to check out my personal mortgage broker More Than Mortgages. I’ve used Deanna and her team for many years and they’ve been fantastic.

Note – this blog may earn a small referral fee if you use MTM. I only ever recommend things I use myself and genuinely believe in.

I think the difference in the math is you haven’t allocated the difference of time for saving up the larger deposit. If you did the math on a time comparison from both starting at zero I think you would get closer to your expected result. Could be extra 4 – 5 years of movement in numbers that aren’t being shown.

Hey Rohan. You’re right. That was done on purpose to show an example of investing vs bigger deposit, since I found that to be the most interesting comparison. Of course prices grow over time which can make the calculations very different as mentioned, with a range of outcomes possible.

Great article Dave. I really dislike LMI but in saying that I did pay for it in my first home when I was 23. I was pretty naive but as it turned out I used part of the money I’d saved for a trip to India which was really beneficial at that age and also had money on my return. Thanks again, I love SMA and the podcast with Pat. This feels so odd to say but I hope to meet you guys one day. Have a top day.

Cheers Sarah! That’s interesting, thanks for sharing your experience and appreciate your support too 🙂

I think most of us would agree that LMI is a painful cost but can definitely be worth it in many cases.

Hi Dave. Really surprising outcome!

I can’t speak for using LMI and then investing the difference. But from our own personal experience we chose the LMI route to get in to a property sooner, as you mentioned. It sucked dropping $15K on it but we capitalised it to the loan so it didn’t hurt as much. The most important thing to us was wanting the security of owning our home. It was an acceptable price to pay to have that. And also to avoid renting any longer. Which also freed up cash to pay off our loan instead of the landlord’s. And since then we have both increased our salaries a nice chunk so we’re steadily paying off more of the home loan and investing.

Yes I know of all the comparisons of rent vs buy and invest the rest etc. We chose home ownership for security and lifestyle knowing it may not be the best financial outcome. Australian real estate amiright?

Paying LMI isn’t fun but I have no regrets from doing it. It’s a fine trade off.

Thanks for your thoughts mate. It’s definitely a trade-off worth making in many cases. And yes, capitalising it into the loan is not quite as painful!

This is mostly what we did too.

Another benefit of LMI.

Some times it takes people years to save a deposit. Say they have 10% but it would take 2-5 years to save another 10%. By the time they have 20% the house prices have increased again and therefore need to save for longer again.

Paying LMI means they get in the market now at todays prices. They may pay 5-10k in LMI but they have secured a house and could get a capital increase.

Thanks Nicole. Yep 100%, that’s the biggest benefit, and it can save a boatload by locking in a price now (think this was mentioned). It could also go the other way though (less likely). I did start playing around with scenarios, but it quickly becomes very messy to try and portray in an article in a non-complicated way which would capture an ‘average’ situation.

What about using an interest only period and then investing the extra cash?

Hey Sam. This would probably just amplify the outcome in both cases, as each person would be investing more sooner. This then gets into the discussion around different strategies of paying off the mortgage vs investing rather than the deposit size itself. I wrote about 6 different strategies in this article. Interest rate would also be higher though so it starts to get a bit messy.

All these calcs works only if the monthly or lump sum surplus is getting invested at the rate of 6%. I wonder how many do that. Personally I know people where money is just sitting in their banks. Without that 6% compounding, it’s 20% deposit calcs winning clearly.

Very interesting article. The thing that can make it a little bit tricky to gauge is the variability in the factors used in the calculations.

For instance, in certain parts of NSW and Victoria, you would struggle to buy a house for under $1M. This would then drastically increase a whole range of things such as the interest that would be paid over the course of the loan and the money required for a deposit.

Nevertheless it was a great article and you have created an effective framework for comparison .

Haha yes, absolutely right – you can see the dilemma in creating examples for an article that everyone will be happy with 😉