Start Here

Close Menu

August 24, 2024

A lot of effort goes into finding and buying a home.

Even more effort goes into paying it off over time.

Well, for some people it does. For others, investing becomes the priority and the mortgage just ticks along in the background

Regardless, most people aim to be debt free at some point.

In this article, we’ll look at a bunch of different strategies that leave you with a paid off home by the time you’re ready to pull the pin on full time work.

And no this isn’t the typical nonsense – pay weekly instead of monthly, use an offset account, blah blah.

Those are little tricks for the average person. I’m talking about actual strategies for the financially motivated, freedom-seeking individual.

First up, let’s start with the benefits of debt-free home ownership.

Having a paid off place to live is useful for several reasons.

1- Having no mortgage or rent to pay removes a significant monthly cost from your life, simplifying your finances.

2- Due to lower expenses, you then need far less investments or part-time work to cover your other bills.

3- The psychological benefits of not only being debt-free, but owning the walls around you, forever.

Depending on who you are, some of those will be more appealing than others.

I find the first two appealing, but don’t really care about the last one. Although, take this with a grain of salt, because I’m deliberately keeping a mortgage!

To me, the coolest part about a paid off home is that it gives you peace of mind and far lower ongoing expenses (which are often related). And if you’re still working full-time, that typically leaves you with a shitload of cash to direct elsewhere (like investing).

I also want to highlight here that there’s nothing wrong with renting. You don’t need to own property to retire early. But today we’re talking about mortgages and being debt free, so the conversation does kind of exclude renters.

Having said that, renters can also use some of these strategies to buy themselves a home later if they’d like.

Before we break down the strategies, let me explain why paying off all of a mortgage is much better than paying off some of it.

This section contains a cheeky excerpt from the Strong Money Australia book. It’s okay, I’ve got permission from the author to share it here

Many people like the idea of investing AND paying off their home loan. They find it hard to decide which to focus on, so they just do both.

And it’s an admirable plan. But as strange as it sounds, trying to do both things can be worse than focusing on one. Here’s what I mean (we’ll ignore compounding for simplicity):

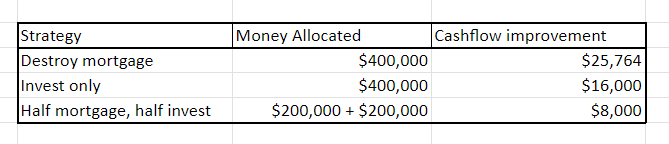

Say you start with a $400,000 mortgage. Your interest rate is 5%, and repayments are $2,147 per month, or $25,764 per year. To tackle this, you make extra repayments on your loan to the tune of $200,000. At the same time, you also save hard and build a share portfolio of $200,000.

By all accounts, you’ve done a great job. You’ve built investments and reduced your debt. You’ll be charged less interest and become debt-free sooner. But despite putting in $200,000, your monthly mortgage repayments remain exactly the same.

The investments are paying $8,000 in dividends per year (4%). But consider this: if you focused solely on your mortgage, that $400,000 debt would now be gone. And that means no more mortgage repayments, leaving you with an extra $25,764 per year. That’s $17,000 better than trying to do both.

(example has been edited using updated interest rates, which amplifies the effect even further)

What does this mean? Well, if your goal is to retire as early as possible, it’s often better to either maximise your investments OR smash your mortgage.

This helps you reap the biggest rewards without getting stuck in the middle zone of having a half paid-off home which doesn’t improve your cashflow.

Of course, investments come with a ‘growth’ component also. But I just want to highlight how this affects your cashflow. Because when you retire, you’ll be acutely aware of how much money is entering and leaving your bank account!

If you’re in this half-half situation, don’t worry. You can usually ask your lender to recalculate your repayments if you’ve paid extra. This will improve your cashflow by reducing the monthly payment required. You can also refinance to a longer loan term. But unless you do either of these, your monthly repayment will continue to be the same.

And it doesn’t matter if your dividends are higher than your interest rate. The principal repayments are typically what eat into your cashflow. It’s even worse if you’ve paid interest-only for the first 5-10 years of the loan.

This is what we did with our investment properties. Now we have four loans with pretty aggressive repayments which hammer our cashflow! I do have plans for these in the next few years that will improve our cashflow substantially, which I might flesh out in another post if you’re interested.

Alright, onto the strategies…

This one is pretty self explanatory.

You focus on paying off your mortgage as soon as possible, before building investments.

I find people are naturally motivated by seeing the balance go down every month. They often struggle with FOMO when looking at investing options, but other than that, this strategy is simple and it’s easy to monitor progress.

The downside is that if you’re not careful, your money management may become sloppy once the mortgage is gone.

People often want to treat themselves, which is perfectly understandable. But if not done in a controlled way, this can lead to investing far less than they initially planned, dragging out their timeframe to FI.

Pick a timeframe by which you want to be FI (or semi-FI).

Then figure out how much extra to pay on your mortgage to have it hit zero in the same timeframe.

As you can imagine, this one requires some fine-tuning.

Start by measuring your savings rate and using a simple calculator like this one, to get a rough idea on FI timeframe. Or for a more detailed version including super, go here.

Maybe it’s 7 years, maybe it’s 23 years. Doesn’t matter.

Use an ‘extra payments’ mortgage calculator to see how much extra you’ll need to pay to destroy that loan in your desired timeframe. Play around with different scenarios to find one you’re happy with.

In some ways, trying to line all this up is a bit silly. Any calculations are almost certain to be wrong. That’s why I’m far more of a rough back-of-the-envelope kinda guy, and don’t really bother with modelling in spreadsheets.

Side note: with spreadsheets, you end up having lots of precise figures which have 99.9% chance of being wrong. But because of the precision, you get a false sense of accuracy. I find general estimates and rough ranges are far more useful, and less misleading. I’m also just too lazy to bother

Your income will change. Your expenses will fluctuate. Investment performance will vary. Interest rates will move up and down. Tax rates will change. Unforeseen things will happen. And your personal circumstances will probably be different in 5 years than they are now (let alone 10 years!).

Yeah, good luck modelling all that shit.

My point is, don’t stress too much about figuring it out. Just pick a rough timeframe, and start heading in that direction, balancing extra mortgage repayments with investing.

With this strategy, you make your regular mortgage repayments and invest elsewhere.

Whether that’s a diversified share portfolio, rental properties, or your own business. I say that now knowing a number of you are business owners, thanks to the recent Strong Money Survey

Towards the end of your journey, you sell some assets to pay off your remaining housing debt.

The benefit to this strategy is that your money typically works harder in the meantime, while you still end up with a paid off home at the end of it.

Of course, there are taxes like CGT to consider. And the timing of sales can also affect the outcome. But as a broad strategy, it makes a lot of sense.

Obviously this one works better for late starters and those closer to traditional retirement age.

Aiming for FI in your 30s and hoping to pay off your loan using super… ain’t gonna work. Not for a while at least

People in their 40s and 50s, however, have a unique advantage that the youngins don’t have: Super is accessible relatively soon.

If you expect to reach FI or retire at somewhere close to age 60, utilising super to pay off a home loan can be an effective strategy.

You can take advantage of tax savings and higher returns from super, compounding your money over the next 10-20 years. Then later, you can tap that big tax-free pot of money to pay off your loan.

Some younger folks might wonder, “But why wait so long to pay off your mortgage?”

Well, many people start their wealth journey a lot later. Many times they buy a home later in life. Or maybe they were just uninformed or not financially motivated earlier in life. So, doing it this way may be the optimal choice with the circumstances and resources they have.

An alternative idea is to invest your money elsewhere, then sell your home upon retirement to get rid of debt.

“Why the hell would someone do that?” you ask.

Well, there’s a couple reasons.

1- Downsize or relocate to their desired retirement property. By moving to a lower cost home – likely further away from the city – the retiree can remove their mortgage while leaving their investments/super untouched.

2- They could sell the home, invest the proceeds, then go caravanning or travelling for the foreseeable future. Maybe they even end up settling in a different country. This isn’t for everyone, but it can definitely work.

If you want to explore different places, styles of living, or experience a bit of adventure, you can do so in a debt free position. Many people will prefer the security of keeping the home and renting it out instead, which I understand. That’s a fine option too.

But for those who want to simplify their finances and experience more freedom, this strategy is worth considering. The extra money gets invested and will grow over time, so it’s always possible to buy a home later if desired.

Keep in mind the obvious risk that some of you are probably yelling my way right now: yes, if housing prices go on an insane tear over the next 10 years (and stocks don’t), you probably won’t get a home quite as nice.

This surprises some people, but it’s true. If you simply don’t care about having debt, feel free to ignore these strategies.

You might actually prefer to keep debt, since it means you get to have more money invested, and it provides tax saving opportunities.

Again, because of principal-and-interest loan repayments, this often makes your monthly cashflow worse.

Here’s why: If a share portfolio provides 4% per annum income, and your mortgage rate is 6% plus principal repayments… then your cashflow is much improved by removing those repayments.

Even at a 4% mortgage rate, those P&I repayments are still more expensive than the equivalent amount invested in shares will provide in dividends.

But like me, you might be confident it’ll create stronger wealth gains over time. On a personal note, if we didn’t have any part-time income, I’d be much more interested in simplifying and getting rid of debt to optimise our cashflow.

Since that’s not the case, I’m happy to keep a mortgage for the foreseeable future. In fact, I can see a scenario where I even increase the loan to invest further when our borrowing capacity allows. Not everyone’s cup of tea, but I like it

Anyway, hopefully this answers the question many of you will have right now: “If he’s writing about this, why doesn’t he do it?”

Long time readers are probably sick of me saying a variation of this, but again, it fits…

As long as you have a solid savings rate, it doesn’t matter which option you choose.

I get a lot of questions around “what’s the best way to do X” or “which of these options are better?”

But the ‘best’ option (assuming it exists) depends on what outcome you want. And you don’t all want the same thing!

Some of you want to maximise total wealth, even if it means working a bit longer. Others want to be out of debt quickly, even if you’re forgoing returns. And some are open-minded – you want to balance the benefits of everything while building a nice cushy situation.

At the end of the day, almost all of you want to hit semi-retirement or FI in a debt-free position. Hopefully this post helped you think about how you want to go about that

Thanks for reading!

While we’re on the topic of mortgages, if you happen to be looking for a mortgage broker, I can recommend mine.

I’ve used More Than Mortgages for 10 years now, and always had a great experience. If you need help shopping for loans, refinancing, or figuring out what the best setup is for you, they’ll help you out.

Just so you know, if you end up using MTM to get a new loan, this blog may receive a small commission as a thank you.

I’m interested to hear what you have in mind for the investment property loans that will improve cashflow in the future.

Paying down/off the loans. Refinancing to a longer loan term (lower repayments). Refinancing to interest-only. Getting a lower interest rate. Getting higher rent.

Another option that can be considered is Rentvesting. This sort of goes across all of the 5 options you mention.

Rentvesting involves renting a home in the area where you want to live and buying a property elsewhere to build wealth. This approach offers tax benefits, as investment properties can come with tax deductions.

Although I have not personally tried this method. I think it would be an attractive option for folks who wish to live in expensive locations, such as Melbourne or Sydney, but cannot afford to buy in these markets. They can invest in a property in a more affordable area, which matches their borrowing power and then they can consider moving or selling when they retire.

Yep that’s definitely a valid investment strategy

What a wonderful article Dave

There are so many options for people nowadays in this wonderful country

Thanks for your content and effort in educating people about all the different avenues in which you can go forward

Cheers Mick!

Hey dave love your articles as always, wouldn’t debt recycling your ppor loan be a solid strategy, the debt on the PPOR will end up fully tax deductible against your investments, then you can continue to invest aggressively. When you choose to FI you can get rid of this tax deductible debt via multiple options such as down sizing PPOR, selling down investments, potentially receiving an inheritance or even accessing super, cheers!

Thanks Stefan.

Sure, debt recycling is more optimal than just paying the home loan as per normal. But that’s more a discussion related to being on the journey rather than at the end here.

For these examples, it doesn’t really matter whether the debt is investment related or not, these strategies still apply if someone wants to optimise their cashflow for early retirement.

Great article Dave! I’m with you in not minding having debt. I have a loan against my PPOR used 100% for investment and the repayments are in my FIRE budget for after I retire early which is imminent – between now and the end of the year. When I hit preservation age in 5 years, I intend to immediately open a super pension account. Depending on how things work out, I may withdraw anything over the transfer cap and use it to pay the loan off but I’m just as happy to keep the loan going indefinitely.

Nice work, sounds good to me!

It really depends on the person and situation. I can easily see a scenario where I would have preferred no debt, but in this case I didn’t mind.

“Side note: with spreadsheets, you end up having lots of precise figures which have 99.9% chance of being wrong.”

Why are you attacking me like this Dave>

More seriously though I agree, you’re never going to get all the variables right and things change and your spreadsheet won’t be precisely right. You’re much better off using it as a rough guide and to model different scenarios and see the impact that changing things can have, but keep in mind at all times that it’s not going to be 100% correct.

As a wise man once said, “All models are wrong, some are useful.”

Absolutely mate, very well put.

Good read.

We are debt recycling. Paying an extra $1k/ft off our home loan and then withdrawing from a split loan we created with equity. The $1k withdrawn used to buy ETFs.

Will have our home loan paid off and enough ETFs to fund us at retirement at 55 for 5yrs until we access our super.

All these plans and strategies came about after reading your book!

Awesome stuff, thanks for sharing!

Hope this is permitted but I would love to here more about this strategy you mentioned here Cara.

Hi Anil. I’ve written about debt recycling in detail here: https://strongmoneyaustralia.com/debt-recycling-ultimate-guide/

I’ve just done a 2-part podcast series about it also, here (see ep 19/20): https://open.spotify.com/show/6dovtoi26Hopway71ZdWGK

Hey Dave, thanks for the article.

How do you manage having an interest only loan long term? Do you just continually keep refinancing indefinitely?

Cheers

Hey Cameron. To stay IO for the long term you need to keep refinancing, unfortunately. It used to be easier where the bank would just give you an extension, but these days you need to do a full application again. This makes it a real pain, plus essentially impossible for those who retire early and live mostly off a share portfolio.

Damn. I will be converting to P&I then I guess.

Thanks for that mate

Yeah it sucks, I’ve got multiple home loans now with huge P&I payments and can’t refinance to IO or longer terms at this stage.

Thanks Dave, very well written great explanation. Before I discovered FIRE I was on strategy 1, now I am on 2. The three reasons have been weighing on me lately and oddly the psychological reasons seems to be giving me more sway. I will probably blog about it sometime and make reference to your article. Love the Excel comment so true!

The only problem with not focusing on your mortgage and investing only, is the assumption by everybody that your invested money will only ever go up and also by more than what your repayments will. This is not guaranteed and if you happen to choose to not focus on your debt and invest instead and choose a dud investment you could be far worse off!

I paid off my house by 38, and have been pretty much debt free since then. It certainly let me take more risks and travel more in middle age when it made sense. It can be a scary place to have big debt and pressure to keep the income up – you’re a slave alright.