Close Menu

January 25, 2020

A common assumption among the population, even among those aiming to retire early, is that you can’t build wealth and reach Financial Independence on a low income.

And the only stories you hear of lucky people who do manage it, are those with huge six-figure salaries and no kids.

Aussies with modest incomes simply haven’t got much hope in achieving much financially, let alone being able to retire at a young age. Is this actually true though?

In my view, no! It’s complete rubbish! And today, I’ll share my thoughts with you on why that is.

Unfortunately, we don’t yet have many case studies in Australia of folks reaching FI to draw on. So, at the risk of sounding like a self-congratulatory knob, I’ll use our story as one example.

Neither of us finished school. We both had relatively unskilled jobs. Mrs SMA was a travel agent and later moved to government admin. I worked for two years as a factory hand, and then eight years as a storeman/forklift driver.

Despite the lack of qualifications, our wages were quite healthy. On average, each of us earned $75,000 per year, before tax. That’s about the median full-time wage ($78,000), according to the Australian Bureau of Statistics.

To be honest, those incomes are very good for what are pretty non-technical jobs. So, this in itself suggests to me how good we have it in Australia. Certainly enough for two average people to become financially independent in ten years.

Yet how many people are earning these wages and feel like it’s not enough?

The funny thing is, if you ask people earning twice this much, they’d likely still tell you it’s not quite enough. It seems to be human nature to find ways to be dissatisfied. We always want more.

At both our workplaces, many were earning equal or more than us, but they had absolutely nothing to show for it. Wait, let me re-phrase. They had nothing meaningful to show for it.

Sure, maybe they had a brand new four-wheel drive in the car park. Or they’d just renovated their kitchen for the third time. Some even managed to avoid cooking altogether, and live on barista lattes, takeaway meals and junk-food snacks to the tune of a few hundred dollars per week.

But other than that, nothing. Two steps forward (income hits the bank) was routinely followed by at least two steps back (aaaand out it goes again).

The fundamental truth is that there’s no amount of money that can’t be spent. There’s no salary so high it can’t disappear into a deep sea of unnecessary purchases. That’s why falling into the mindset of thinking income is the barrier (or the solution) is so dangerous. For nearly everyone in Australia, that’s not the case.

In our case, we managed to avoid the traps most of our peers were making, live moderately and get our lives back in under ten years. And the biggest factor in that was having a strong focus on saving and priorities.

No tricks, no great investment payoffs, no inheritance. But a willingness to question how we were living, and an effort to live more simply, in harmony with our desire for freedom and control over how we spend our time.

It later turned out that a simple life, in many ways, is better than a chaotic, rushed, stressful, high-spending life. And that’s fantastic news, because it means your happiness doesn’t suffer with a reduction in spending. If you do it right, it can actually increase!

Okay, let’s look at some numbers. First, a base case scenario. We’ll take a couple both earning median full-time incomes (using the ABS figures) to run through a hypothetical time-frame to early retirement.

Household income before-tax: $156,000. ($78,000 each).

Household income after-tax: $121,500. ($60,750 each approx.).

Make no mistake, this is a HUGE amount of household income. And it’s here that a simple difference in perception leads people astray. Most households have grown accustomed to spending 100% of their available cash as their income has scaled up, so excess and waste has become normal.

Now, let’s suppose this couple is reasonably savvy with their cash and manages to burn through only half of their income. This is extremely doable and still lets them spend $60,000 per year!

With a 50% savings rate, starting from scratch, it will take them around 16 years to retire. That’s pretty damn good. So if they wise up in their mid 20s, they’ll be completely free by 40!

Of course, it’s possible to live a perfectly good life on much less than $60,000 per year. In fact, with our own level of spending at around $40,000 per year, this couple would be free in under ten years.

But let’s have this example be full of comfortable perks, like owning a nice home and overseas travel. I can already hear the moaners saying, “But my mortgage alone costs $60,000 per year, this just isn’t possible.” We’ll get to that later.

The main point of this article is whether Financial Independence is possible for low income earners. So let’s run some numbers on that now.

Now we’ll assume our couple are not only low income earners, but getting paid the minimum legal adult wage in Australia.

Even in traditionally low paying jobs, many people are earning more than minimum wage, as they’re paid ‘Award’ or ‘Agreement’ rates. Not only that, but it’s possible to earn a great income in Australia without a degree!

In fact, I wrote an article listing a whopping 55 jobs that pay $60,000 or more without high level education. Check it out here: The Best Paying Jobs in Australia Without a Degree.

But let’s be ultra conservative here. At the time of writing, the current minimum full-time wage is $740.80 per week. Or, $38,521.60 per year.

Household income before-tax: $77,043. ($38,521.60 each)

Household income after-tax: $69,335. ($34,667.59 each)

Can our couple achieve Financial Independence on such low incomes? What do you think?

Well, if they go splashing cash around like the middle-income couple above, they’ll save only around $9,000 per year. And actually, that’s a good example. In everyday life, people are often trying to keep up with those around them (appearance-wise anyway), burning through their entire salaries in the process.

And when folks try to live like others further up the income/wealth ladder (which many do!), their finances take a big hit. It’s ugly.

Anyway, while earning $69k and spending $60k, this couples savings rate is around 14%. While that sounds respectable, it means 44 years of mandatory full-time work.

They’ll become financially independent around traditional retirement age. In one sense, that’s a healthy outcome. But I also see a massive opportunity for freedom, and a more self-directed and enjoyable life gone begging.

So, what if our low income couple really upped their game? What if they, you know, actually started giving a shit about where each of their dollars is going?

Let’s not beat around the bush. There’s absolutely no way our low income couple needs to spend $60,000 per year. Instead, I propose they can live a comfortable and contented life for much less, say $45,000.

How? By reading many of the ideas from this blog and other great sites. It first starts with a change in philosophy. Then, separating our spending from happiness. And generally, by learning to consistently make better financial decisions, until it’s effortless.

So, how do things look now with their spending optimised?

Well, their savings rate jumps to 36%. Because of this, they’ll now reach Financial Independence in 24 years. This magical effort of ‘giving a shit’ has brought their retirement forward by twenty years. TWENTY YEARS!

Despite their ‘low incomes’, they could now be wealthy enough to retire as early as their mid 40s. What is twenty extra years of freedom worth? For every sane person, it should be worth much more than a few holidays/extra bedrooms/car upgrades/etc.

Remember, this couple are earning minimum wage. The median full-time wage in Australia (which more closely resembles what Aussie adults are actually earning) is DOUBLE THIS AMOUNT.

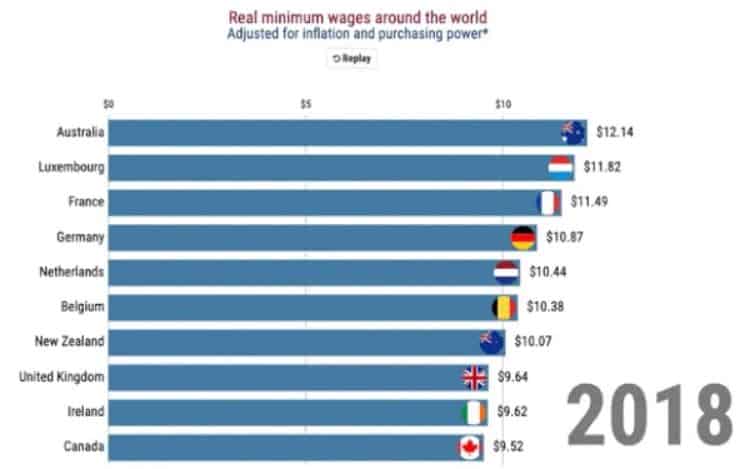

So this is a fantastic outcome, and shows how fortunate we really are in modern-day Australia. We don’t suffer the same level of income inequality that other places do. In fact, we have the highest minimum wages in the world, adjusted for inflation and currency. See here, and below.

And these figures are before the most recent 3% increase, which is more than double the rate of inflation. Some people struggle to accept points like this. Either they’re stubborn pessimists, or they’ve been conditioned by too many poor-bugger-me/life-is-so-expensive stories peddled by the media.

In the above examples, I’ve also assumed no bonuses, no penalty rates, and no overtime. All of which are possible, or even likely, in a wealth-building plan.

At this point, it’s quite easy to point out an issue with these case studies. These are dual-income households. Is it easier for a couple, than a single to retire early? In most cases, yes.

But I haven’t chosen couples to paint a rosier picture. They just tend to be more common than singles, and they have an even larger amount of spending they can reign in!

It’s true that many costs are automatically shared, including big ones like housing. But that doesn’t for one second mean singles can’t retire early. They may just have to be a little more creative.

Singles can still share costs like housing. It’s called living with friends, or in a share house, or renting a room out in a place you own. And that’s a perfectly fine way to live. In fact, you could argue it’s a healthier and happier way to live, due to the social nature of sharing and having company.

Of course, some people prefer their privacy and complete independence over everything else. But that’s a choice to make. Just like you’d prefer to have your life back sooner, so you can choose how you spend your time.

Which preference is more important to you right now? Sometimes these trade-offs are worth it, because the truth is, we can’t have everything.

And don’t forget, singles may be able to up their frugality game more than a couple, as they don’t have to compromise on certain expenses to keep household peace. Or, they can choose to work extra hours without worrying about it affecting the relationship.

So, our ‘optimised’ couple’s spending is $45k. For simplicity, let’s assume $22.5k is for housing and $22.5k is for everything else. How can our single improve on this?

For a start, he likely won’t need the same size housing as the couple. He’ll have less stuff and so is more suited to a smaller property. This should bring housing costs down at least a couple of thousand dollars per year (now $20k). At this point, he’s still living by himself.

As for his other expenses, again it might not be doable to halve these costs, but he can comfortably get these to $15k per year. So, our independent single ends up with annual spending of $35k per year – pretty luxurious in my book.

Assuming he’s a middle-income earner, he’ll have a savings rate of 42% and be financially independent in 20 years. But what if he got creative, decided to share housing, and either did some overtime or optimised his spending further?

I did these things myself in the early days when I was 18-19: earn low-ish income, work extra hours and share housing with mates, often managing a savings rate of 40-50%.

In this case, his after-tax income would likely rise to at least $65k (from $60k). And his spending would fall to $30k or likely even less (from $35k). Now he’ll reach FI in 15 years, at the latest.

But what if he’s earning minimum wage? Assuming he can manage the same as above (optimised spending and some overtime), he’ll be earning (say) $45k after tax and spending $30k.

This gives him a savings rate of 34% and a 25 year journey to early retirement. So, even starting at age 20 after spending all his income for a few years, he can still retire in his mid 40s. Amazingly, all this is possible without sleeping in a cardboard box and eating from the bin behind the local McDonald’s.

What if you want to spend more? Simple – it takes longer. That’s the trade-off.

Is all this harder with kids? Of course. But I don’t believe it’s as hard as many assume.

For example, a friend of mine in Perth (an early reader of this blog in fact), retired at 32 with a wife and two young children. You can read his story here. I’ve met two other couples in Perth who’ve also retired in their 30s and 40s.

Probably the most famous example, Mr Money Mustache, retired at 30 with his (then) wife, and managed to live cushy middle-class lives, raising their son and doing all sorts of enjoyable things while maintaining low spending. In fact, he wrote an article about this very topic – the cost of children – which I highly recommend you read here.

Not long ago, I was watching a Facebook conversation unfold about the cost of child-raising, after a scaremongering article surfaced in the media. You know, one of those stories telling you it costs $1 million per child or something equally ridiculous.

By far, the most common answer on how much children cost from experienced parents in that group was: “It depends.”

After reading some more views on this topic, and applying some common sense, this confirms what I had always suspected was the case. That, like every other category of spending, the amount we spend on child-raising is largely within our control. It can cost an absolute fortune. Or it can cost a modest amount.

A savvy household can ensure their children have all the love, attention, teaching and support they could ever need, stopping short of pampering them and lighting their cash on fire.

Now, admittedly I have zero experience here, but from what I’ve observed, a reasonable amount to spend raising a small human is in the region of $5k to $10k per year (with $10k being on the extreme end). Again, see MMM’s article on this for the correct way to think about child raising and its associated costs.

The beautiful irony is, the parents who spend a more reasonable amount on their kids (and elsewhere), are the ones who’ll be able to spend the most time with them, ultimately giving their kids something the high-spenders can’t. That’s worth thinking about for a moment.

I know what you’re thinking. “But it’s different here, houses are insanely expensive!”

But if we’re looking at things rationally, that’s not necessarily true. Australia is a huge place and there is an endless list of more affordable places you can live, outside of the wealthy suburbs of Sydney and Melbourne. In fact, I’ve written about this before: Rent vs Buy – The Aussie Housing Dilemma

So what’s the solution? Don’t live in an expensive area, or city. If you are, then you should be taking advantage of the higher income opportunities there. And if not, then it’s simply a self-imposed trap.

If living in a fancy area is important to you, then work harder at improving other areas of your spending to make up for it. Going car-free is one great place to start, as the more expensive areas tend to have great walkability, access to jobs, shops, transport, etc.

And don’t forget, there’s also that other crazy option… Renting! That’s right. It may sound strange, but you don’t need to own a house to retire early.

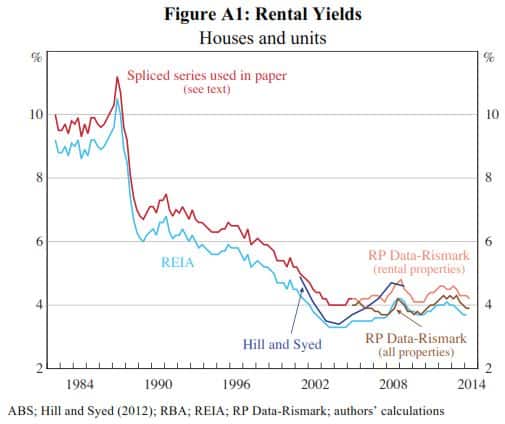

In fact, you might find that by renting instead of owning, and investing elsewhere, you could reach FI far sooner than you thought. Rents haven’t grown nearly as much as home prices over the last few decades, as can be seen in the declining rental yields below…

The chart is a bit old but you get the idea. On average, yields have declined further since 2014, with rents not moving much during the recent property boom.

In some cases, people are unknowingly choosing home ownership over their freedom, which is absolutely bonkers. Also, it’s sometimes assumed that you need to be debt-free to retire early. That’s not true at all. As long as you have enough investments to cover your spending, it doesn’t matter whether your house is paid off or not.

Of course, some people prefer to be debt-free, and that’s totally fine. But home ownership and having that house paid off, are both optional. So it’s a matter of priorities. For those who want to be hyper-efficient about their progress, investing tends to offer better returns than paying down a home loan. See here: Mortgage, Investing or Super – Where Should You Put Your Money?

Yes, interest rates are cheap, and for some, owning a home is a great form of forced saving. But property ownership comes with a long list of costs outside of mortgage payments! Having said that, house prices aren’t the big hurdle they’re made out to be. See this post: Do House Prices Affect Your Ability to Become Financially Independent?

So make your own decision here. But don’t be swayed by peer pressure or the fear of being ‘locked out’ of owning a home. For those who can manage their money well and invest regularly (which is hopefully everyone who follows this blog!), you have absolutely nothing to worry about 🙂

If you’ve followed this blog for a while, then you know how important saving your money is. And this is even more true for those on lower income levels. Because there is simply less cash available to waste!

As a side note, from all the reader emails I’ve had since starting this blog, only one person has been in a genuine low income scenario that would make becoming FI very difficult.

On the other hand, I’ve had more emails from people with HUGE incomes and/or wealth who are having trouble retiring early. Why? Because they’re either completely wedded to their high spending, reluctant to sell their investment properties, or fearful of not having enough money.

Back to my point. Low income earners should always be on the lookout for ways to earn more cash. Whether through overtime, getting higher-paid work through training/education, finding a better company or simply through promotion. And if that doesn’t happen (or even if it does) then becoming a King/Queen of optimising your spending will be the best skill you ever develop.

Think about all the people you know. How many of them earn middle-income wages and save absolutely nothing? Hell, how many people earn multiples of that and still get nowhere? And how many believe that more income is the solution?

That’s right, almost everyone. But lack of income is not the problem. Their attitude, habits and desires are the problem. Their desires grow one step ahead of their income, no matter what. Kinda like this…

More money is not the solution. It won’t give people the breathing space they want. It will only create more desires.

Instead, these people need to think about how they’re living and where it’s taking them. In short, they need to adopt a more sensible and healthy way to approach life and money.

That’s where the FIRE Philosophy comes in. And instead of comparing their lives to the prosperous few above them on the income and wealth scale, they need to compare their lives to the less fortunate masses below.

As we can can see, achieving Financial Independence on a low income in Australia is totally possible. Yes, it’s easier for couples. Yes, a higher income helps. And there are people out there with genuinely difficult situations for whom this stuff isn’t going to work.

But luckily, the majority of Aussies are not in that camp. Being brutally honest, most of us just suck at managing money and are quick to rule something out as “too hard,” or reach for excuses to why it’s not possible.

Achieving FI on a lower income just takes more effort, more conscious spending, more creativity and yes, a bit more time. But the bottom line is, if you want to live a free, self-directed life, you can make it happen.

Let’s assume you buy into this idea. You really change how you spend money, and where you derive happiness from. What happens?

Well, for your peers, the first decade or two of their careers leaves them with a lifestyle and bills they can barely keep up with. In contrast, your decade or two spent working and learning leaves you with 50+ years of freedom to enjoy.

Now that’s what I call a damn good return on investment! If that isn’t motivating, then what is?

If you know someone on a low/middle-income who doesn’t believe FI is possible, please send them to this blog so we can put them on the right path! 😉

Great article and i completely agree. As a single income household with 2 kids I can say this is definitely possible. We are about 10 yrs away but have been able to hit yearly objectives consistently and are well on track. Thanks for topping up my motivation again, time to review the numbers and tweak things…

That’s great to hear Anthony, nice work!

Maybe one day Mrs SMA might be kind enough to write a post for benefits of readers life partners. I’m pretty keen to hear her view on things too.

Another paradigm shifting read Dave. Thank you

Cheers Phil! Actually we discussed this recently – doing an interview with Mrs SMA. Sounds like we should get cracking on that soon 🙂

Totally agree with all of the above. Before we had our son, all I heard was how expensive it would be. Not true. We’ve even got child care fees down to a reasonable figure complete with government subsidy of course and still we are blazing a path to FI as the savings snowball grows at an almost exponential rate over time (this compounding thing is absolutely true and I have over 4 years of monthly data to prove it).

I like the idea put forward by Paula Pant of “growing the gap” between earnings and savings to increase the rate to achieving FI. Be frugal but think of other ways to generate income. The book “The Millionaire Next Door” tells us that the average wealthy person has developed multiple income streams (e.g. salary, interest, dividends, capital growth, selling stuff you don’t need … etc). Cheers.

I love this comment Scott! It’s fine for me to say “kids don’t cost that much” but to have actual parents say it is way more powerful!

So good to hear about your rapid progress. I haven’t heard Paula’s concept but sounds good to me. And nobody can go wrong with the lessons in the Millionaire Next Door book! Cheers mate.

Lol at “self-congratulatory knob”!

You are totally right about all these points though. Even if you don’t earn the average wage for Australian’s (like I don’t), FI is still doable if you just stop caring about spending your money on useless shit.

This was a great read btw, I really enjoyed it!

Thanks for the comment Kalli. Great to hear you’re making it work without the high earnings! I love getting this real-life feedback on the blog confirming the points I’m trying to make, from people who are doing it! Makes my day 🙂

Hi Dave and Strong Money Australia community,

Thanks for all the articles you make a lot of good points. I am very early in my FIRE journey (22) and have just graduated from uni with a commerce degree. I worked throughout at the uni throughout my degree and loved studying economics.

The only problem is I am now having a little bit of trouble finding full-time work. But I love working hard and producing work to a very high standard. I am also lucky enough to still live at home so I am not in any financial stress, but I want to start paying my way in the world!

I know a lot of the readers of Dave’s work are slightly older, but my question to you all is where would you be applying? I do love finance and investing, but I know some of those roles can be ruthless.

Simon

Thanks Simon, great to have you here.

I can’t pretend to know much about the uni-to-job process, but as Kalli said, I would be applying everywhere that even seems half-interesting! Once you get your foot in the door at one place, it will be much easier to get any other job since you’ll have had the workplace experience. And there’s a good chance you’ll need to try a few jobs before you find something that is a good fit for you.

Thanks Dave, good point.

I did economics and loved it too, but the reality is there aren’t many pure economics jobs going around, unless you got top grades for something like the RBA or Treasury, or Goldman Sachs etc.. There may be broader prospects for commerce, depending what you studied.

If you are finding it tough, a graduate program in government may get you a foot in the door (this is what I did) – it may not be your first preference, but there are lots of options and many places like ASIC or the ATO provide a good springboard into the private sector. Unfortunately they generally advertise in the latter part of the year to commence around February the following year.

Hey Simon,

Ever considered teaching economics/commerce? Maybe checkout Tafe for free teaching courses (if you are in VIC) as a start and take it from there. Might not get you a job in economics right away but will surely open up a few doors in the future for you.

Cheers

Hey Simon,

I was just in a similar situation—I’m twenty, just graduated from uni (property-specific business degree, though).

Having just found a full-time job, and having struggled before that, the best advice I can give this this:

— apply for free work experience, two-three days a week, in as many places as you can possibly find. This not only gives you a guaranteed degree-specific job on your resume (and call it a job later, lmao, don’t say it was work experience), it gives you a higher chance of being hired at the end, but also, I’ve heard heaps of stories from my friends of people being hired on the spot, just because they show this initiative.

Also, instead of wondering, like you are, about what jobs are like, you’ll get to experience it—and this is when you can more easily tell what you like.

—call up all of your uni lecturers and tutors, ask to meet for a coffee, and just have a chat about their experience. 100% of the time, you will walk away with, at the very least, a reference, but also literally everyone I’ve ever done this with has offered to recommend me to their old company, their current company, etc. Also, they’re probably aware of who will start to look for a new hire, and let you get on it early. Massive advantage.

That’s what I’ve done, anyway, and it worked for me. You sound like you have your life together enough that if you follow these things (as well as apply for each job that you see), there’s no way you won’t find work, and find work that you like.

Cheers,

Katherine

Hi everyone,

Thanks for all the comments they were very helpful, I got some great advice from each one. I have a few interviews coming up, so hopefully, I can convert one into an offer. 🙂

Awesome stuff Simon, thanks for coming back to let us know! All the best 🙂

Personally, I would be applying everywhere. I wasn’t able to secure work once I graduated in my respective field so now work full time in something completely unrelated. I highly suggest getting into any full time job and continue to apply for where/what you want to do. This will also get you started on your way to FI.

Gee Dave,you said you and the missus earnt approx 75K each that is not a modest income by any means,I am out out of the full time workforce now after having run a small building business for many years and never got to an income of that huge amount, I am now a General Assistant at a local school and the pay rate is 27 Bucks an hourwhich works out at $1026 for a 48 hr week so multiple that by 52 equals 53352 a year with tax to come out of that and believe me there are a lot of people earning a lot less than that,unfortunately Australia is becoming a nation of very wealthy but the majority getting less ,not saying it is impossible to achieve an early retirement but is getting far harder for the average joe blow

Regards

Paul White

P.S by the way keep up the good info I have learnt a lot ,but unfortunately I have left my run too late as I am over 70 and still working,a divorce did not help one bit 😉

You’re right Paul, we had very healthy incomes. That’s why it blows my mind the amount of people earning that much or often more and finding it hard to get by because ‘life is expensive’.

I don’t share your view that it’s harder for the average person now. I just think the average person gets caught up spending on their money here, there and everywhere and ends up stuck. You’re still educating yourself in your 70s so that in itself is commendable… many people don’t want to learn anything new once they start working lol.

Hi Dave love your work. I wish I had found FIRE years ago. I retired at 58. I only ever worked part time 3-4 days per week. I always worked weekends for the penalties and the most I earned was $55000. My partner would renovate our house and we would sell it on. I wish we had found shares years ago but we are very lucky in that we own our home and are able to retire early. We live in a beautiful spot on the river, have rainwater, solar power, grow our own fruit and live a simple but happy life.

Thanks for sharing Tracey. Congrats, sounds like you guys have done well – and your living situation also sounds fantastic!

I have read that the cost of ‘essentials’ in Oz has increased disporpotionately to wages over the past couple of decades, which certainly aligns with my own perception. So it is great to highlight the importance of finding ways to share those costs as a key lever in lowering one’s cost of living. Either being part of a couple or living in a share house, there is great power in sharing costs.

Conversely, and this is my own experience, being in a couple can be deadly to lifestyle inflation and FU moments which burn cash. I have been much more successful at moving towards FI post-separation than as part of a couple. Frogdancer Jones has a brilliant post on this https://burningdesireforfire.com/the-single-advantage/.

This depends entirely on what sort of partner you have in terms of them being “spendy”. Are they frugal like you or do they think they need retail therapy every 2 days? I read the linked article and disagreed with a lot of it. I’m in a couple scenario and my other half used to waste money. I did too. When I sat her down in 2015 and explained my FI vision for us, she slowly got on board. Now that she’s seen the jaw-dropping results (I track our progress by the month), she’s now more frugal than I am.

The article states that couples will invariably get sucked into lifestyle inflation. Not true. It’s a decision you make together. My advice is find a partner who shares your values then track your progress to show how you are progressing. I was lucky that we both have the same values about minimalism and not buying shit we don’t need. Also, if you read “The Millionaire Next Door” you’ll see that one of the strong factors millionaires shared was having a frugal partner if in a couple situation.

‘She’s now more frugal than I am’… Haha that’s awesome Scott! Amazing how people’s actions change once they can see a different future for themselves. So powerful.

Thanks for the comment Girt. That’s very interesting you find it easier as a single, great to hear!

I’m not sure I buy that story (about essentials growing faster than wages over decades), though I have seen it thrown around a bit in the media. Some things have, no question, but many other costs have fallen, or grown very slowly, so it evens out and we’re left with low inflation. The costs are accounted for in the inflation figures, and those figures are typically over-stated to be conservative too, which I went into in this post.

My wages have not grown and my general expenses have each year. My expenses have increased more than inflation. In saying that I have stopped all spending on unnecessary things. At my age My luck at finding a job with higher income is next to nil. Reality is people don’t hire older workers

Sorry to hear that Amy. That would mean that you’re also earning more than minimum wage, otherwise it’d be illegal to not be getting a pay rise, so that is a positive. Kudos to you for checking out your expense column to proactively improve the situation!

Thanks Dave. I earn above minimum wage but also significantly less than the average income, currently renting. I still aim to be financially independent. What would be the mini to invest on a regular basis. I have no plans to retire for at least 10 years

Are you asking what would be the minimum to invest? I’d aim to invest in lumps of at least $1k, and simply invest as much as you can afford, as soon as you can, to get that money working for you 🙂

Hi Dave. I really like your writing and life philosophies. Although I think you might be a bit on the low side for estimating the cost of kids per year. Our daycare fees alone are around $12 000 per year. This is after the government subsidy and for a part time place for one kid! I can’t wait until school starts, much less expensive.

Thanks very much Rachael 🙂

It’s different for everyone I guess. But one view is that childcare is a completely optional expense. Yes, it can help couples save more and people often want to keep their career going etc. but it’s not mandatory. That place sounds like a rort by the way lol. And like you point out, childcare is only temporary anyway.

One alternative is for couples to become at least semi-FI first before having kids, which doesn’t take anywhere near as long. Not everyone gets to make that decision though as they already have kids!

In our budget we allocate $500 per fortnight to our “Kids” category, and it’s basically always empty. We’re probably not as frugal as we could be, but nor is it immediately obvious how we can significantly cut this.

Also, and this is probably the big one for us (and debatable for others), is the lost income because my wife has reduced her workload by one day per week so she can enjoy parenting rather than outsourcing that work to someone else. This cost is obviously dependent on the person’s job, but in my wife’s case it will exceed $1m over 20 years without factoring in opportunity cost, lost super, etc. Just pure wages lost will exceed a million bucks.

One of those things it’s pointless to put a dollar figure on because everyone is different… but I come down firmly in the “kids are freakin’ expensive” camp on this.

Thanks for your thoughts Chris. Luckily, you guys are in a fantastic position so there’s little need to optimise. Perhaps if you were just starting out or times were harder, some solutions or ideas would quickly present themselves – sometimes that’s the case.

Great article!

I’ve been single for over 20 years, with 4 kids as my souvenirs from my marriage. I achieved FI on a teacher’s wage. I made the deliberate decision to pay off my house before I started investing, which I vaguely knew wasn’t mathematically sound. However, when you walk away from a relationship with 4 kids under 5 and $60 cash in your hand, security becomes extremely important to you and I wanted to know that the boys and I would always have a secure base. It took me 17 years, but I made it.

I’d add the internet to your list of what low-income people can use to get ahead. So much education is available for free and it’s possible for anyone to jump online and learn about finances. I fully credit my 6-year trajectory of paying off my house with $10 leftover in the bank to now being FI to all the different ideas and strategies I read about and listened to… and then acted upon.

One huge advantage I had as a single parent with a large family was that no-one expected me to be able to lavish money on the boys, so I wasn’t ever expected to ‘keep up’ with anyone else. I was able to run our household on the smell of an oily rag. Sure, kids are exxy, but not until their teenage years and even then they don’t have to cost the earth.

Nice work Dave! Keep it up! 🙂

Great comment FDJ. ‘Souvenirs’ from your marriage lol I love that!

Good point on the power of the internet, deserves a post in itself really. The advice, ideas, connections and opportunities it gives us nowadays is nothing short of amazing. And also the lower expectations that were placed on your seem to have been an unusual blessing, that’s interesting!

Thanks for your thoughts as always 🙂

Hi Dave, good article and agree with most of it, but I would agree with Rachel that you have underestimated the costs for raising kids. My wife and I both work full time, so our two kids (4 and 2 years old) are in daycare five days a week. This costs us $70,000 a year. Nearly twice your yearly budget! So yeah, just want to point out that some families who have both people working can have quite considerable childcare costs.

Okay fair point mate. You can see my reply to Rachael, my view is it’s optional. Not saying you’re doing anything wrong at all, but it’s a choice that’s all. So that’s not what kids actually cost, that’s what you’ve decided it’s going to cost, because both parents want to keep working.

To be honest, I don’t think I’d have them in childcare personally. Unless I was making at least double that to compensate for missed family time, it just wouldn’t feel worth it to me, despite possibly being able to save more. And that cost is only very temporary too, so over 18 years it averages out to far less.

Interestingly it was actually the opposite for our family, our children preferred to be at daycare and stimulated all day than stuck at home with us! They craved the social interaction and activities that daycare brings them, something that is very hard to replicate at home. Everything is a choice you are right though.

I already stated in my reply to Scott, but luckily for us we earn enough that the $70,000 is not a financial issue, but I was just pointing out I think kids cost a bit more money than you are accounting for in your article, especially at the start (childcare) and end (secondary school/university). Luckily for us we are already FI and are now working towards a fatFIRE lifestyle to give our kids a great life.

Thanks for clarifying mate. I just wanted to play devil’s advocate as I’d hate for someone to read ‘kids cost $X because childcare is $X’ and end up assuming FI is not possible for them and they’re ‘stuck’, when that clearly isn’t true.

I have to admit this comment caused me to nearly fall off my chair. We are a couple living in the Eastern suburbs of Sydney (not cheap) and renting near the beach at Coogee. We have one toddler in child care at a cost of $110/day. We receive the child care subsidy which means we pay about half or around $7500/year. We choose to have our son there for 3 days/ week and my wife has negotiated a work schedule so that she can spend Monday and Wednesday at home with him. She also works on Saturdays, a day I cover and get quality time with him. Through all of this we are saving 62% of our income and moving towards FI faster than I ever imagined. I can see this is the case because I have been tracking our monthly progress since July 2016. Combined, we earn the median.

To me $70K annually on child care is way way off the charts and I would seriously rethink your approach, above all to be able to spend more time with your kids. Before you know it they will not be kids any more and you will never get that time back.

I’m glad you didnt hurt yourself Scott!

I appreciate your comment, but I guess what you need to consider is that you don’t really know our circumstances at all. We are both high income earners, and collectively we make over the $350,000 a year, so get no childcare rebate. My partner and I both took 6 months off work each for the first year of each of our childs life to be there for the full first year, so we got plenty of time one on one with our kids in the important first year. We then transitioned them into daycare starting 3 days a week and built it up to 5 days a week over the first year in daycare. Even with this $70,000 expense of daycare per year we will still have a savings rate of 66% this year, so even better than yourself. We are excellent savers, and were FI at the age of 31 and 29 respectively.

And just one point I would also make, we personally believe it is best for our kids to be at daycare once they were older than 1 year old, as they were just bored at home with us and needed the social and development stimulation that daycare brings.

You pay $70K a year because you can afford $70k a year. Do you think dole bludgers are paying $70k a year? No of course not.

The title of the article has something you and your partner are very very far from…. ‘low income’ 🙂 which you should probably take into consideration when deciding to comment on the article methinks.

For low income earners there are many government incentives which reduce the cost of kids, subsidized day care, subsidized school fees, Tax A and B payments, $1000/year free dental and more.

If you are smart and use hand me down clothes and hand me down pushers and a hand me down cot then kids are pretty cheap. If you go and buy Jeep brand strollers for $1500 and brand new clothing every few months then you are just flushing money down the toilet.

Agree so much with all of this. I remember when I hit $50k and felt like I’d made it! ???? unfortunately it didn’t last long (cut to 4 days then health issues) I haven’t worked FT in 3 years now but we keep going.

I read Millionaire next door, in high school I think, and also now work in insolvency so I’m quite used to those concepts. I think that helps, along with generally not being very interested in spending anyway.

FI or FIRE isn’t a new concept to me but I’m looking at it more seriously now. I’m also in the camp of paying the house off first so we’ll see how that goes.

It’s interesting to me that we’ve never been large Income earners but never felt deprived or even necessarily considered ourselves low income. One year I was surprised I got the low income offset on my tax return ????. Even knowing some people earn 6 figures I felt like I was doing so well at $50k. I put that mostly down to our mindset (which has become more obvious lately) and we realise that we live in a great place and time. I always have tracked and budgeted which I believe helps greatly as well, a budget is a plan for your spending and shows your priorities. So no point wishing you had something else.

I also like Paula’s work. Afford Anything (you can afford anything but not everything).

Fantastic comment Angela, thanks for sharing that!

As time goes on, the mindset stuff and how we think about things seems to make the biggest difference in where people’s lives end up – quite fascinating really. Sounds like you’re living a happy life and continuing to strengthen your financial position, all on a “low” income – love it 🙂

Great post SMA!

I really think you have highlighted something important there on the housing side. The flipside of the increase in the capital value of property, is falling yields (rent).

To the extent that house prices reached unsustainable levels, there was a signal there to rent rather than buy. This might not work for many people for a range of personal circumstances, but it is the not often discussed implication of housing values.

Over time, you would expect the market to move back to some kind of equilibrium – but with some scarcity value of proximity to global cities factored in.

Cheers mate, and thanks for catching that!

Totally – just because house prices have grown faster than income for a certain period, this isn’t ‘proof’ that it’s more expensive/unaffordable as a whole with no other option.

Yeah I agree with your summary there. Hard to say what will happen, nobody knows of course. If rates stay low for a decent period, yields are likely to remain low too. Given the love of housing in Oz, it seems likely that most will continue to opt for owning vs renting, regardless of the numbers as it’s mostly a lifestyle/consumption choice. But for those focused on FI, it obviously makes sense to ALWAYS crunch the numbers 😉

G’day Dave,

You really hit the nail on the head right at the start when you talked about mindset. I think a huge part of achieving FI and generally achieving success in any of your endeavours, is having the correct mindset. When it comes to wealth generation, an abundance mindset is extremely valuable – no making excuses, no worrying about fear, no tall poppy syndrome. A true growth mindset where you work out exactly how you can achieve your goal, and help others to achieve theirs in the process. Great read and I think the more people that see this post, the less personal debt we will have and the better our country will become.

This is an interesting comment… I’ve been reading the Greater Fool blog daily for a while and in Canada, where the blog’s author is based, there’s growing resentment towards the “haves” from the “have nots”. The blog provides almost daily evidence that when it comes to personal finances, most people have no clue. As a result, they’re falling behind. They’re doing all the ‘right’ things like extending their personal finances to purchase property — just like their parents did, and now they’re rich! — but they’re falling behind all the same.

The argument is that the rich are getting richer and the rest are getting poorer, however the cause of this is financial literacy. Or rather, illiteracy. Property prices have stopped escalating so people are only “saving” rather than “investing”, and hence go nowhere or in many cases, go backwards once inflation is factored in.

People’s sheer cluelessness when it comes to personal finance staggers me. So I wholeheartedly agree with this: “the more people that see this post, the less personal debt we will have and the better our country will become”. Problem is, without the right mindset most people will look at this, go “save how much? I can’t do that!” and continue doing what they’re doing which is plowing straight towards financial oblivion. And eventually it will be up to the likes of us, the independently and hard-working “rich” to bail them out.

Cheers mate. Thanks for your thoughts. The tricky part is, mindset is the hardest thing to help people change. I suppose if they’re exposed to the right information for long enough, some beliefs may begin to shift, but it’s a long road. Will keep me busy here for a while 😉

Great insights as always Dave.

I’m one of those childless singles who has no intentions of raising a family or even getting into relationships(too many reasons for making that decision and none is financial) and i have to agree that being single is a major advantage if one is after being Financially free.

Nevertheless, and as you showed above, being financially free is still doable while raising kids and having a family; it simply takes longer and maybe more dedication.

Parenting and raising a family comes with a a lot of extra costs but at the same time, mosts costs can be cut or be completely removed. Main issue is mindset as mentioned many times above. Most i know live week to week wondering why they can’t make it while doing school runs in BMW and Audi SUVs …

Interesting stuff Paul. I think many assume it’s always easier for couples, so it’s great to hear some singles argue back against that point!

Haha good summary 😉

Hi Dave

Great to read Michael’s story (FIRE with kids also) , divorce can be a killer to the financial plan also as Paul mentioned above

$100k in savings at a 4% return is only $4k per annum in dividends, even grossing that up with franking doesn’t add much more to the kitty,. Step up your savings to $500k and 4% is $20’000 and you’d be lucky to get 4% on many of the Older LIC’s at todays prices (looks like most are mid to high 3’s at present, not considering NAV here)

Rent alone at $300 p/wk is $15’600 per annum

Another article that i’d like to read is a strategy for your older readers who may have left their run a bit late, Barefoots Donald Bradman strategy was an interesting read https://barefootinvestor.com/barefoot-steps/step-8-nail-your-retirement/

Cheers Baz. Looks like you’re pointing out that it takes a lot of savings to retire, no arguments there! But you raise another good point… those who are doing it much later in life have the added bonus of being able to access super and/or a pension too.

So even a small/moderate pot of savings, combined with some super and pension, and even part time work, will be plenty for a nice life in Oz (as Barefoot points out).

It was awesome to hear about your own story. Good on you for bucking the common misconception that you can’t reach FIRE without being an engineer/banker/doctor/insert-other-high-paying-role-here. Congrats on reaching Financial Freedom! What are you up to in your retirement?

Haha thanks! I went into some detail in this post what our life is like a while back – Life After FI

Just enjoying the free time, doing a few productive things like this blog/podcast and volunteering, as well as keeping healthy and spending more time in nature 🙂