Start Here

Close Menu

March 15, 2022

Man, time is truly flying these days!

It feels like only a few weeks ago I was writing the last portfolio update.

There are a few things that are different since last time, which we’ll get into in this article.

I’ll share what we’ve been doing with our money, future plans, and how it’s all going, as we continue to build our share portfolio and steadily transition from property to shares over time.

Let’s get started 🙂

At the time of writing, here’s where our net worth is located. We now have an absurd amount of cash, which will be gone in a few weeks after our house settlement goes through.

As explained in the house buying post, we had to sell a stack of shares to finance the purchase. This cash will be replenished when we sell our investment property (IP) in the next few months.

Shares fell a little before we sold, and have fallen further since then. While I’d love if the market tanked before we reinvested, I’m not really thinking about it since I have no control over the situation and am sticking with the plan regardless.

Another change from last time is that our peer-to-peer lending investment we’ve had using for the last 5+ years – Plenti – is gone. Why? Well, most of the loans were rolling off and we had gradually less invested on the platform.

As the repayments rolled in, I wasn’t reinvesting this money into new loans since the rates are now drastically lower than when I started. We’re talking 3-4% instead of 8-10%!

I did have a few thousand left on the platform after some loans were paid out early… but I just decided to take it out early (penalty free) since it was such a small amount.

I really enjoyed using Plenti as an investment, so I would definitely re-consider in the future. But the rates would need to be higher to get me interested again. If you’ve never heard of it, I explain how peer-to-peer lending works in practice in this article.

Everything else is roughly the same since last update.

Since the start of the year, Aussie and US markets are down around 5-10% as I write this.

It started with concerns around inflation, the idea of interest rates rising quickly, and now possibly war and general uncertainty.

Though if we zoom out just a fraction, both markets are up about 5% in the last 12 months, plus dividends.

Actually, let’s zoom out PROPERLY and have a look at the big picture….

Look at all the serious problems we’ve dealt with in the past. Of course, I have no clue how this one will play out, but this chart should be comforting to any long term investor.

And to be clear, this doesn’t even include dividends or franking credits! Yet look at the mind-blowing multiplication of the numbers on the left hand side of that chart. So this is actually a conservative picture.

All this to say, relax, and keep investing. If you start waiting until the uncertainty clears, prices will have already gone up. In shares, you earn higher returns because of fear and uncertainty.

Buying when prices are lower is your chance to be brave and earn higher returns than you would’ve gotten otherwise. Or, as Warren Buffett put it: “you pay a high price for a cheery consensus.”

From what I can tell, the property market has started off 2022 in pretty reasonable shape.

Prices are still rising on average, with Brisbane and Adelaide seemingly heading to the moon! Good market-timing huh… selling my Brissy property last year? 😉 Haha!

The Perth market (more important to us) looks solid too, with the right properties selling very quickly indeed. Three other houses have come up in our area as we purchased ours, both selling within a couple of days!

We’re also about about to get our investment property ready for sale. It’s starting to look a bit tired, so we’ll likely spruce it up a bit before the marketing begins (paint, carpet, etc.)

But the appraisals are indicating that the price has definitely increased over the last 12-18 months. The property itself is a spacious townhouse in a beachy suburb (Scarborough for those wondering), so there’ll be no trouble selling it.

I’m not setting my expectations too high, but it’ll be interesting to see how the sale goes. I’ll report back in the mid-year update to let you know how it went 🙂

In an odd turn of events… not much!

We started off the year buying shares regularly as usual. But our home purchase has meant we need to stop investing for a little while.

Once the IP is sold in a few months, we’ll be back to normal and buying on the regular. Can’t wait for that!

While our current portfolio is a fair bit smaller than before, the makeup is pretty similar to last time.

In terms of performance, our REITs have by far performed the best. And global shares (VGS) have performed worse than our Aussie holdings.

Since the last update, we sold our holding in Argo. Why? Well, because the price of the LIC was trading at a large 10% premium for no good reason.

I’ve cashed out on opportunities like this in the past with either LICs or REITs when they become quite clearly overpriced… and I probably will in the future too.

Anyway, most of this cash went into our Aussie index fund VAS given it’s a similar holding to Argo.

It’s a little frustrating not being able to buy. I really hope the market falls even further before we’re able to start buying again. Sorry, not sorry 😉

Here’s our running annual income for the first half of this financial year, up to December 2021. This is simply dividends + franking credits.

I don’t count rental income as our properties are basically neutral cashflow (net rental income equals interest). If you include principal repayments, they are still negative. Not to mention these are being sold off anyway, so are basically irrelevant for our long term passive income goals.

This result is actually higher than I expected!

Dividends have recovered very strongly since the corona crash last year. If that rate kept up, we would’ve been looking at over $30k for the year.

This chart is probably gonna look a bit strange in the next update or two, given we sold a large stack of shares to fund the house purchase.

All should be corrected again next year though, when the portfolio is replenished and back to normal 🙂

For new readers: If you’re wondering how we consider ourselves ‘retired’ if our passive income isn’t higher than our household spending, I explain how we manage our money in this article. Short answer: cash from offloading property as we transition into shares.

I mentioned a while back that Pearler was working on a few new things. The first cab off the rank is Pearler Micro.

I was told the reason they created Micro is because they found a surprising amount of new investors were investing small amounts at a time, like a few hundred dollars.

Paying full brokerage each time on small amounts is a pretty inefficient way to invest. So Pearler felt compelled to create a more suitable offering for this group of investors within the platform.

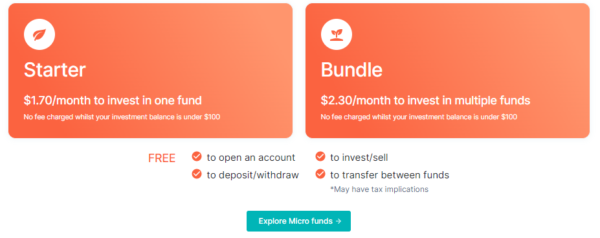

Here’s what they came up with:

And here’s how the monthly fees compare to the other two popular options:

Obviously ETF management fees are separate to this just like when you invest normally. Speaking of which, the fund options are below.

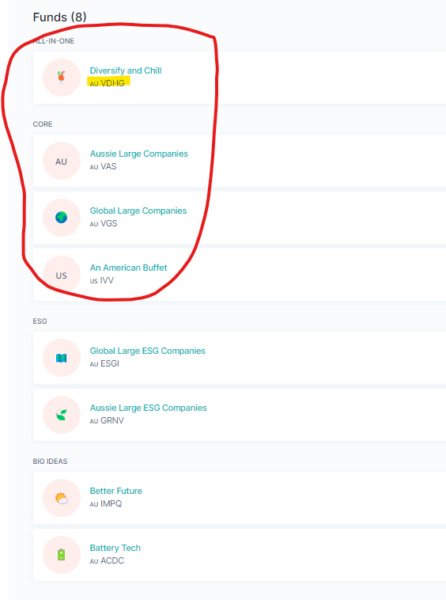

They may be tweaked or expanded in the future, based on customer feedback, but here’s the choices they’re rolling with at the moment:

It’s true, I’ve generally not been the biggest fan of micro investing apps. While it’s definitely better to invest than not, I never saw a micro investing app I really liked.

But what Pearler has created is actually pretty good. It has investment options that I would personally be happy with (my main gripe with the others), and the fees are very competitive.

If you want to start small, or maybe get your kids investing regularly without large amounts, this is a very decent option. Micro is currently open to existing customers, and the estimate for public launch is March 20.

For the rest of us, Pearler have extended their pre-pay brokerage deal until lower prices roll out. Basically, if you buy $100 brokerage credit and get $50 extra. So your $9.50 purchases effectively cost $6.33. When prices drop (in a few weeks apparently), that credit will stretch even further.

I’m really looking forward to the coming sale of our investment property!

We can then get back to the main game of building up our shares and growing that sweet income stream 😉

We may even turn our home loan into an investment loan by debt recycling before we re-invest that cash!

I think I’ve figured out a way to make everything as simple as possible on an ongoing basis while still getting the benefit. It does involve a few tweaks, but it’s probably worth it.

You’ll have to wait till the next update to hear more about that!

How’s your investments going in 2022 so far? Are you feeling nervous, excited, or indifferent about the sharemarket dip? Let me know in the comments.

Great read, I am happy for the dip but have also just bought a house in Perth and compared to renting am finding there’s it’s harder to get money together to buy. Good feeling having your own house but set up is costly! Will also be revisiting debt recycling.

Cheers Bel. Congrats on your own purchase. Home ownership has its perks, but definitely comes with a long list of ownership costs which surprisingly pile up 🙂

Great post. Sold a few shares and are now ready to enter the housing market in Canberra… Unfortunately not a very cheap market to get into, but we think it’s the best option long term so we can start paying off a mortgage rather than renting. Almost feels as though my FIRE journey is starting new, but I’m excited 👍

Thanks for sharing mate. Yeah I heard Canberra is quite a pricey city. As you said, it’s still probably a good long term move if you’d rather own than rent.

All the best with it!

Hi Dave,

How’s it work selling a large chunk of Shares and the effects of Tax ?

I would have liked to sold Soul pats ‘SOL’ when they were trading at 40 bucks! But, as I am working fulltime! would there be major Tax implications involved overall for Myself?

Thanks again Dave

Brad

Hey Brad. It depends entirely on the size of the capital gain, how long you held it, and your tax rate. So that needs to be weighed up with how badly you want/need to sell and what else you’re planning to do with the money, to decide whether it’s worth it.

The tax implications are maybe less than you think. Most people tend to overestimate it. If you have other holdings sitting at a loss that you’d like to get rid of, you can also use these to reduce your tax CGT bill.

Thanks for the update, a useful reminder to stay the course amidst the current volatility.

Quick question re your current share strategy – is your aim still ultimately 50% Aus, 50% international? Or happy to have the majority in Aus?

Thanks Gabriele 🙂 Still basically heading in that direction, but not in a major hurry to get there. Just steadily over time. I have no concerns about having most of my investments in Australia.

Hey Dave,

I might have missed this in your strategy along the way, but why are you not holding an income stream LIC/ETF like WAM or SYI (I have these in my portfolio).

Would it not be beneficial to have these stocks so they give you the income you need to fund your lifestyle, complimenting the growth type stocks (VAS, VGS) that pay a smaller dividend?

Over time, they’ll not generate large capital growth but if you have a good split you can use the income to buy more index funds…

It seems like if you had 200,000 WAM shares (worth $440k), your income per year would be $31,000 (200,000 x $0.155). Plus the 100% franking credits you could claim back at tax-time.

I’m more biased towards income over growth myself, so just wondering your thoughts there.

Hi Andrew. I understand the appeal of ETFs like that, but basically the index funds are simpler, more diversified, lower fee, and come with expected higher performance because of these reasons.

WAM is a very active trading LIC reliant on the skill of a manager to trade to produce large capital gains which are then paid out as dividends. WAM has come very close to running out of capital gains to pay out on multiple occasions (GFC was a previous example). I also don’t want my money invested in a hyper-trading kind of way, tho I did own WAM many years ago.

SYI is a income-chasing ETF (I owned VHY in the past), and I also don’t like how these ETFs operate. They often buy shares with high yields because it fits the criteria even when it’s clear the dividend is going to be cut (my experience with VHY). As for SYI, this one in particular is horribly underdiversified (40% in 3 stocks).

I personally don’t see the value in using these to then reinvest into other index funds, when I can just use the index funds in the first place. I get the yield approach and I love income myself, but these days I prefer to have more diversification and mostly simple holdings I know I’ll be happy with basically forever that I don’t need to check on or worry about their performance.

My portfolio generates a pretty healthy yield already, so no need to try and juice it even more. I can always harvest a little gain by selling a few shares if I want extra cashflow and still come out ahead given the expected higher overall performance from the index funds vs other stuff. I wrote a bit more about my changing thoughts on dividends and diversification here. Hope that makes sense.

Just keep going strong with the ETF / LIC’s – even in these uncertain times I’m confident the ship will keep steady.

All the best with getting your IP ready for sale – can’t see it easy to nail quality tradesmen down without paying an arm and a leg.

Absolutely mate. And thanks! We did a lot of planning in advance for our reno, so we’ve got a couple people lined up already 🙂

Hey Dave,

Great post thanks. Been going through all your content and just wondering how many IPs you started with and how many you have left? I am following a similar strategy right now from 3 IPs.

Hey Brendan. We ended up with 7 and our previous home. After this upcoming sale, there’ll be 3 left.

QVE really ?

A very poorly performing LIC

Have owned QVE for multiple years. I like their value focus (20+ year record of doing a decent job at it) and it’s something different from my other holdings. Obviously would prefer if performance was better, but it hasn’t been.

To be clear, every single strategy and fund performs poorly at certain times. Most people blindly chase manager performance which turns out to be the worst possible approach. So there’s a half decent chance QVE actually outperforms as we may be entering an environment where value does better than growth.

Hi Dave,

Thanks I enjoyed the update.

What REIT’s are you investing in?

Thanks

Neil

Glad you enjoyed it Neil! The REITs I own currently are Charter Hall Long WALE (CLW) and Centuria Office REIT (COF).

Hi mate

Great article as always. Curious to know the strategy for the Pealer aspect of the portfolio? Just investing spare change?

Cheers

Tom

A very wise property investor mentioned Perth as a good option at the moment. My only pause for concern is the underweight on international given your property, VAS, QVE etc are all in Australia. I’m sure you have a good reason as a much more knowledgeable investor than myself.