Start Here

Close Menu

July 14, 2017

Today, it’s personal!

The time has come for a bit of nitty gritty numbers on how people can earn and save their way to financial independence.

We’ll look roughly at our own journey in numbers, and how the numbers really work for early retirement and Shares.

Not that long ago, I was suggesting that compounding is king.

Today I’m going to argue with myself and tell you it’s not that much of a factor with an early retirement time-frame of less than 10 years. This is because compounding needs quite a while to really get going.

Retiring freakishly early is much, much more about saving than compounding!

Before we start I will just acknowledge, these numbers are rough guesses and averages at best.

I don’t have the details on every year’s pay and expenses. I just keep a running estimate of everything in my head. OK, some is on paper, but not much.

I’m definitely not a spreadsheet junkie by any means. To tell you the truth, I didn’t even know how to setup a spreadsheet, until last year. We don’t even track a budget!

I won’t lie. We had it good. We earned pretty good wages on our journey to Financial Independence, around 75k each before tax, in our final year of employment.

Not low, but certainly not excessive by any means. Actually, it’s right around the Median Full Time Australian Wage according to the ABS.

Although I put in a fair bit of overtime over my 10 year career, my wage still never reached six-figures.

Our combined household take-home pay averaged 150k, or around 115k after tax. In the earlier years, our wages were lower, but I did lots of overtime, so it averaged out to approximately this.

With our living expenses averaging around 45k, we managed to save around 60% of our pay over the years.

Saving 70k per year sounds impossible to most people. But, this was due to living comfortably within our means, and not allowing our dual incomes to inflate our lifestyle exponentially, as is the norm.

It’s not hard, it’s just different.

Funnily enough, I was originally planning on being financially independent in my early-mid 30’s solely through property, using some form of living off equity strategy to retire.

I feel so lucky for learning about how incredible the dividend income from shares can be. It really pulled forward our retirement date. Also, it’s a much more reliable and sustainable form of retirement income.

Many people can achieve this, but after all the excuses are thrown out, the truth is they just don’t even try.

It’s a bit under 900 bucks a week. $450 for rent/mortgage and $450 for everything else. That seems pretty reasonable to me. There’s even plenty in our spending that is optional, but we’re happy where it is.

To be clear though, it definitely didn’t happen by accident. Here are the juicy details of our household spending down to the last dollar.

Along the way, I analysed where all our cash went and optimised every single category of spending. We focused on living simply and happily. Over the years, our spending just got lower and lower.

We both knew of a few people at our workplaces, on the same, or quite often higher wages than us.

These people could only just pay their bills. It’s no coincidence they were either constantly buying a new car on finance or constantly renovating their house (yes, apparently some people need to keep modifying their house, I don’t get it?), in between their expensive holidays and phone upgrades.

Novelty is the new normal it seems. I wrote about this crazy phenomenon recently here.

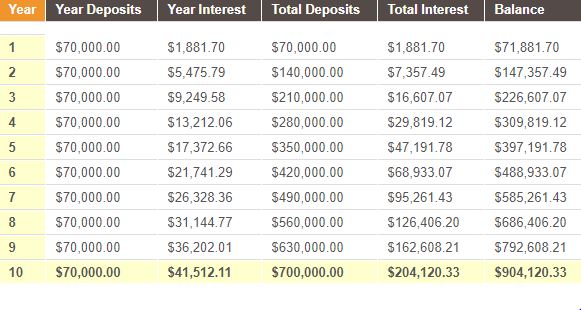

Let’s take a look here, at a grossly oversimplified version of how we were able to retire in less than 10 years by saving and investing around 60% of our pay.

As you can see, most of the end balance actually comes from cash saved, not from investment returns.

This is due to the short time-frame of our financial independence journey.

Compounding is awesome, but saving is awesome-er!

This Early Retirement Calculator is the best one I have found. I’ve used it a fair bit, to make many different projections. If I’ve done it correctly, it should even have the numbers from our own scenario plugged in already!

So you know, I have changed the ‘withdrawal rate’ to 6%, to account for the 6% dividend income generated by our portfolio of LICs/Shares to live on. This is just looking at an estimate of the income from our Aussie shares including franking credits.

In reality, we’re also going to keep a cash buffer for times when dividends are reduced, during a recession.

Have a play around with it to suit your own situation and see what you come up with by tweaking your savings rate 🙂

FYI, it makes a massive difference, and you can see immediately how lowering your expenses literally shaves years off your prison sentence!

Change the ‘withdrawal rate’ to 5%, to see how much you need you might need in total, including a cash buffer.

In this chart above and the early retirement calculator website, the savings are invested and compounding at 5% after tax and inflation.

This fits with what I think is a fair assessment of the likely return from Australian shares while you’re still working. To break it down…

Gross dividend (including franking credits) of 6%, plus growth of 3% = 9% total return. Less tax 2%, less inflation 2% = 5% after tax and inflation.

You could even work on a lower investment return. It wouldn’t change the end balance too much, because most of the end balance comes from savings, remember?

When making future early retirement calculations, it makes sense to account for inflation.

Although, once we reach retirement, we’re then dealing with the present time, so we only need to be concerned with any taxes we need to pay and whether our dividend income will continue to grow with inflation.

As the chart/calculator reaches the end of Year 9, the balance is around 800k.

This pool of equity in Aussie Shares will still be providing around 6% in dividends (including franking), which is 48k per year. This is pure cashflow you can live off, never having to sell down your assets.

You’ll need a cash buffer too, which I’ll get to in a minute.

You may still need to pay some tax too, depending on which tax bracket the income falls in…

But according to this income tax calculator, a couple can earn 41k of income (20.5k each) in retirement and pay precisely ZERO in tax, due to the tax-free thresholds and some other tax breaks for low income earners.

So, although it may suck paying a bit of tax along the way, I wouldn’t worry about tax too much in retirement.

Essentially, you can retire on around 700 grand worth of LICs, which would pump out around 40k of gross dividends and pay no income tax as a couple. (This is assumed the shares are owned equally between you)

Well, what about inflation…..

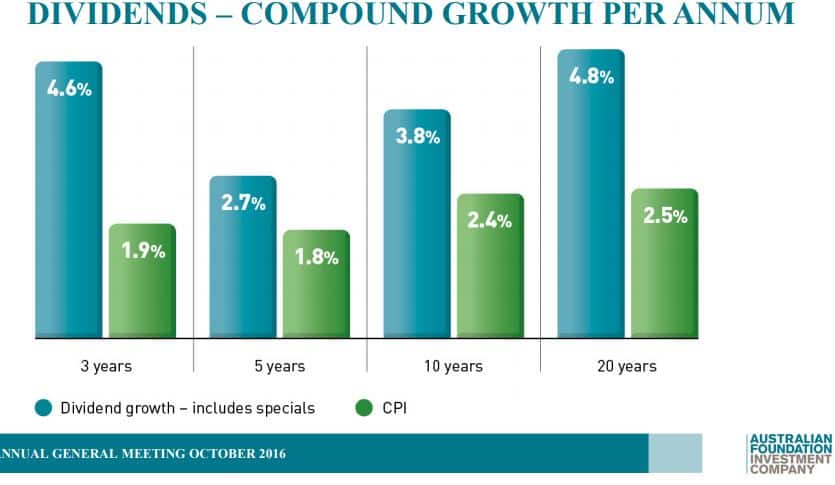

This is a chart from the 2016 Annual Report of the largest LIC in Australia, Australian Foundation Investment Co. (AFIC), showing dividend growth over the last 20 years.

As we can see, dividends have grown at around twice the rate of inflation for the last 20 years.

I’m not suggesting this will continue at the same rate, but I am saying if you’ve invested in good quality, diversified LICs or Index Funds, the dividends will almost certainly, at least keep up with inflation.

Historically, dividends grow faster than inflation, but it pays to be conservative.

I recommend having a cash buffer to smooth the ride, should dividends be reduced dramatically in a serious recession.

Interestingly, AFIC didn’t reduce their dividend during the GFC, though some LICs did. Retirees who were drawing down on the value of their portfolio by selling shares to live on, wouldn’t have had much fun at all, with share prices down 50%.

See my full review of AFIC and other LICs on this page.

Whatever your strategy or chosen investments are, I strongly believe many peopls are best suited to simply live off the income your assets generate. This makes for a smoother ride and a better sleep at night 🙂

So our 45k spending, required us to have around 900k in total to retire.

A shortcut to this calculation is, we needed about 20 times our annual spending.

Let’s break it down…

Essentially, to live on 45k will require a portfolio of 800k worth of Aussie LICs, paying around 4% dividends (which including franking credits, is 5.7%) and a cash buffer of 100k.

Total equity needed – 900k.

Total dividends (including franking credits) from 800k of LICs – around 45k, covering the expenses. Plus 100k cash buffer is a few living expenses to cover any reductions in dividends.

Again, have a play around with the calculator, to suit your own situation.

Our numbers are much more complicated than the example above, because most of our money is still tied-up in property.

Also, when we joined forces, we used existing equity in my partners house to buy an investment property.

Our end balance is higher than the example, due to the initial equity in my partners house, and the last 5-7 years have been quite good years as far as investment returns go in Australian Property & Shares.

We also have higher cashflow due to the room-rent-out situation, which is equal to having an extra 120k.

I could actually make a case for being able to retire even sooner, with less savings than the example. But I’ll save that for another day.

In the end, we reached financial independence at the same time, as if we had just bought shares from the start.

As you can see, with a strong savings rate, you only need moderate investment returns to retire in less than 10 years, starting from zero.

There’s no real need for leverage. You can keep it simple!

When it boils down to it, we really just want to be able to replace our work income, with investment income.

As I mentioned in this article, ideally we want to get a decent income stream for our dollars. And the strongest income we can achieve in the shortest amount of time, is with Australian Shares.

And to achieve this, I generally prefer LICs over Index Funds, as I explained here. But I do like index funds too, for different reasons I mention in this post.

Importantly, the dividend income must also keep pace with inflation, which quality LICs have definitely proven it can.

I’ll go into more detail in future posts, but in the last couple of years, my opinions have changed a lot on investment strategy for early retirement.

I now believe, to retire as early as possible, investing for income must take priority over capital growth.

If I had my time again, I’d do it this way entirely. Every month, quarter and year, you will be replacing more and more of your income. As you throw more savings into LICs/Index Funds, your dividend income grows and grows.

Financial Independence will be reached when you have enough dividend income to cover your bills. So you can track your progress by how much of your expenses you have covered with dividends.

The best part is you will never go backwards. Even if the market drops, you are still collecting dividends and buying more shares, so your dividend income increases, covering more and more of your expenses!

What a strong and happy position to be in! Update: I wrote a post about this called, The Relentless Progress Of A Dividend Investor.

I wish I knew back then it could be this simple!

Live sensibly. Save heaps. Pick some slow and steady type investments with a strong income like diversified LICs. Rinse & Repeat. Retire on the dividends.

Everyone’s journey is different. This article may have given you more questions than answers, but there it is. Perhaps a rough guide and a helpful calculator is all you need!

Plug in your own numbers into this calculator and enter how much you are going to spend from the portfolio each year. Adjust the figures to suit your own scenario. Have fun 🙂

When I first realised that compound interest needs at least 10 years to be effective, I was really depressed. We are mid-forties, so for compound interest to have any effect at all, really, we’d be looking at retirement at 60. Not exactly early. What your post shows is that if we wanted to we could still achieve it in 10 years. That puts the ball entirely back in our court. It can be done, we are choosing not to do it. For some reason, this actually makes me feel better.

Great way of looking at it. I think it’s a powerful realisation. You get to choose which is awesome. Puts the power back into each individuals hands. An empowering thought, that your in control of your own retirement date! Excellent comment Mrs. ETT 🙂

Hey Mate,

First off, thanks for sharing your story and all the learnings. The write up is really good and easy to follow as well. Please continue your work as I enjoy reading them and learning a lot from them.

Just a question though, the hindsight comment about investing in LIC’s instead of properties. With LIC, you will be buying them with after tax dollars from your salary right? So it will take longer to get a $1m asset base of LIC from buying them using after tax dollars from my salary.

Whereas I get the power of leverage with properties. Unless I am missing out on something here.

Thanks for reading JayVille.

Great to hear you like the blog. I’ll keep writing as long as I think people are getting something out of it!

The property vs shares debate will never, ever end. There is no right answer, just peoples preferences. Here’s some of my thoughts…

Yes, it will obviously take longer to reach $1m in shares, than borrowing $1m to buy property. But any cash invested is creating positive income from day one, which can be used to buy more shares creating more income and so on. Since Oz property in general has very low yields after all expenses. Leveraged property in Oz tends to be very negative cashflow. To retire quickly we want more income and less bills, not more bills and less income.

Sure you get a tax deduction, but you’re losing real money waiting for a capital gain, which is far from guaranteed. So borrowing $1m to buy property will likely result in very negative income. What I’m saying is too many ppl just focus on the size of their asset base, rather than what the asset is actually providing them. Sure you might get big capital gains like has happened recently, but you also might not get any gains for a fairly long period.

The buying/selling costs of property are underappreciated and the holding costs are usually underestimated also. All in all, when all the numbers are crunched, it doesn’t make for a very suitable early retirement investment. I will expand on this in future articles. Hopefully that helps a little bit for now!

Hey buddy,

I love reading your blog and have read everything here so far:). I also enjoy your contributions on property chat.

Reading this post my original thought was “you need both high income and high savings rate to retire early”. But then I had a play with the calculator and plugged in some more realistic scenario: 78k total house income (after tax), 45% saving rate. The result is still impressive – FIRE in 20 yrs on 43k py.

The only problem here is how much you need in retirement and whether you’re happy to live off 43k py.

Cheers!

Thanks mate, glad you like it!

Sure high income helps, but it’s really your savings rate that does the trick, regardless of income. The savings rate percentage is the magical ingredient.

Looks like you’re using a 4% withdrawal rate. Oz LIC dividends being around 6% would bring that 20 year date down to 15 years. But cash buffer needed too though!

And sounds like starting from zero too, which I know you’re not 🙂 Anything to bring income up a little bit or spending down a little bit would bring that date closer too.

You may need more or less in retirement, that part is up to you! Maybe could retire in 10 years and live very well in Montenegro 😉

Hey mate,

Thanks for your reply.

I just can’t get my head around it as yet. I understand that once it reaches a certain point, then comparing Properties and LICs on a like per like basis, then LIC would top it.

But what I am trying to understand is that, if someone is to start now on a low income. Setting aside $1k per month to purchase LIC, compounding effect won’t really do much even if a dividend reinvestment plan is in place.

I was thinking more of doing it this way. Buy one investment property, sell in 12 months and the proceeds would be used to purchase LICs. That would give you a better position for dividends. Happy to hear your thoughts.

If starting with a small amount, and adding small amounts.. over a short time frame, the likely outcome is small compounding. If you buy a property and sell it within a year, or even a couple of years… the cost of stamp duty, settlement costs, selling agents fees etc. you will be lucky to break-even to be honest. Leverage is more attractive to low income earners, since it is harder to have a high savings rate. But in truth it’s a leveraged bet on capital growth so you would want to be quite confident of the future growth to jump on board.

Timeframe for investment property should be more like 10 years if going this path, since the buying/selling costs are so large. Personally I would prob just stick with trying to earn/save more and keep it simple with shares. Happy to chat more if you want to throw me an email via my contact page. Thanks JayVille

I wish I knew this 10 years ago, I could be retired by now!

I’m going to have a play around with your calculator and consider a few scenarios. My main concern at the moment isn’t savings rate, it is timeframes. My current income level is likely only to be a thing for the next 2-3 years so I’ll need to look at replacing that with a more flexible job, or save even more in that time. Weighing up the options is always fun. Thanks for a great post 🙂

Thanks Miss Balance!

Great to be considering options. Yes, it’s super fun. I love brainstorming 🙂

Looks like you have a very good savings rate currently. Hopefully you can make the most of the current income and find a way to keep that going with your next job. Wish you all the best!

I like how simplistic this calculator is – thanks for sharing it with us all! It’s a great tool to get the basic figures and ballpark to test the plan, sometimes those calculators are way too complex and it takes too long to tweak the results to test different scenarios. I have bookmarked it 🙂

Mrs DDU

My pleasure Mrs DDU 🙂 Very true, simplicity is underrated!

Thanks so much for taking your time to set up and write these posts. Only recently came across the concept of FI/RE and have been consuming any / all blogs I can find since, you’re way of putting things resonates well with me so I have decided to comment to tell you and to keep up the good work. I’m 29, married with our first bub on the way — have definitely made some poor decisions (bought a brand new car on finance a couple of years ago). Quite silly really when I look back at how much money we’ve wasted. I am glad I found your blog, car is almost paid off and we are working on upping our savings rate. When looking at what expenses we can cull, and realising how conditioned we are to our need for COMFORT, it is a big smack in the face. Thanks for that!!!! Cheers.

Thanks so much for leaving this comment Big Trev!

Awesome job on turning things around so early in life, really, great job. Sounds like your future financial decisions are going to be heaps better moving forward which is the most important thing. It’s quite powerful for anyone to be able to look at their life and realise how accustomed they’ve become to certain things.

Congratulations on looking for a better way, that’s all you! And your efforts will pay off handsomely!

Thanks for the post. One question I have about this is did you choose the Dividend Reinvestment Plan (DRP) for all investments you entered or did you take the cash, pay the tax and reinvest in the best opportunity you saw at the time?

We get paid dividends in cash and invest into our chosen investment each time. Absolutely nothing wrong with reinvesting dividends though, great way to increase your holding, average out the prices – only negative is all the small transactions if you ever sell.

Hey just wondering how you structure your ownership? Did you just buy everything in two broker accounts ie one each? What are your suggestions is one partner has a higher tax bracket? Would you looks at a trust? Or would you like to avoid the complexity and additional costs? Cheers ps loving your blog, only found it last week following listening to your podcast with Firebug!

Thanks for reading Paddy!

We have a joint broker account but also have one in my name as it appears my taxable income will be lower than my partners for quite a while at least. It’s not super optimised but we’re both at low tax rates so doesn’t matter all that much.

I prefer to keep it simple where possible so not overly keen on having a trust. For one partner with a higher tax bracket I’d invest more in the lower tax partners name. Or if wanting to keep the ownership fairly level, the lower tax partner can own half the assets and the higher tax partner could look into investing in AFIC or Whitefield and take advantage of their Dividend Substitution Share Plan – which allows them to receive no dividend but bonus shares instead. This is different to a dividend reinvestment plan and it effectively means it caps tax at 30%. As soon as you want to receive the income stream you simply elect to stop the DSSP and you’ll receive dividends plus franking as normal. More info can be found on their websites here and here – and I did mention it a bit in this blog post and in my review of AFIC.

Hope that helps!

Dave@StrongMoneyAustralia, Thank you!

I kind of just assumed it was the DSSP was just another name for DRP but this just reading file:///Users/patrickhalpenny/Downloads/132138DSSP_Tax_Ruling.pdf and it is great! Super simple, no extra costs, and perfect while I’m still earning an income! I love that I can grow my LICs in a 30% tax bracket while my marginal rate is so much higher.

I am really enjoying your blog, so again, thanks!

My partner and I are just setting out on our FI journey, and when there are a million ways to go, your blog and story is a really nice guide to have.

No problem Paddy. Of course tax is a bit trickier if you choose to sell after using the DSSP, but still worthwhile in my view and ideally no need to sell.

Great job getting started, how exciting! That’s nice of you to say, glad you like the blog 🙂

Hi Dave, is the 45k income from dividends that you mention based on the savings of both you AND your partner? Ie accrued from a joint savings/investing effort?

Just trying to get my head around my circumstance as a single, would it be half the invested $$ for half the dividend return over the same period?

You can find a more detailed account of our saving and journey in this post – where I talk to Aussie Firebug and have an article printed by The Motley Fool and elsewhere.

Basically yes, if you have half the savings, half the expenses and end up with half the amount of dividend-paying shares, it’s the same outcome – freedom 🙂

Wow, this is amazing. I can’t imagine how you achieved this! I have a 45K annual ‘essentials’ budget as a single living at home with my parents! Additional 20K which is on elective spending that I can quite easily cut out if I wanted. (My savings percentage is very well on track despite this but the spending amount I have no idea how you managed!)

Thanks for the comment. I didn’t think it was anything amazing to be honest – here is our complete annual spending if you’re interested. We live a pretty simple yet enjoyable life and now are able to spend our time as we choose which is priceless and better than anything else you can buy, in my opinion.

Great job having a solid savings rate, and by the sounds of it there’s an opportunity to bring your financial independence forward plenty, by trimming away some of that excess and juicing the savings rate further 🙂

Thanks for the link! It was definitely helpful to compare where your spending is going. On correcting my additions (I included personal contribution to super initially) its actually 41K and of that 10K is going towards indemnity insurances and professional registrations. No getting around that unfortunately! Another difference I realised is that you guys are renting – and don’t seem to count investment property interest in the count? Or do you not have an investment property anymore? If I disregard that interest it then goes down another 21K… I definitely do need to sort out my car insurance though because I know I’m overpaying there. Thanks for the reply again!

Oh I see. So around $10k is related to your business, and would be tax deductible? I think it’s fair to class that as business expense and not personal living costs, which puts you at a more reasonable figure!

We’re now renting yes. We still own a number of properties which are rented out. But since that is investment income/expenses, I separate those that from our personal expenses. We’re slowly selling these down over time to put the funds into shares.

(also, comments don’t show up until I ‘approve’ them) 🙂