Start Here

Close Menu

September 8, 2020

In Australia, we have a somewhat unusual sharemarket, economy and tax system. All of which make for some interesting discussion around investing.

If you’ve even glanced at this blog, you’ll know I believe in investing for a growing income stream.

Investments which can grow alongside us throughout our lives and provide us with increasing amounts of cashflow.

But as sexy as that sounds, there’s a nasty side to this ‘heaven on earth’ mental image…

Tax is a seemingly nasty side-effect of making money. One of the first arguments that comes up when talking about investing for income, is tax.

Clearly, dividends are a form of income and therefore, subject to tax. So the assumption is, dividend growth investing is not a very efficient way to invest.

There’s a number of ways we can take this topic. One of those being, the mass hatred of paying tax and the unrivalled fetish for tax deductions.

But today, we’ll just focus on what matters most to us – how tax affects our investment returns and specifically, our journey to financial independence. Hint: For dividend investors, the tax bogeyman is not nearly as bad as it’s made out to be.

By the way, you can keep tabs on your annual dividend income using the spreadsheet I created. I’ve used it for years as a way to help plan my finances and watch my progress. Get it below.

Remember, the people often complaining about tax on investments, are often the same ones complaining about paying tax on their salary. The best way to educate these people is this…

You want to pay less tax? Easy. Just make less money. Offer to take a pay-cut. Or get a lower-paying job.

What, that’s not appealing? Then suck it up! And let’s learn how to make more money and optimise things, rather than having a moan about it!

For simplicity’s sake, calculations in this article will be based on using Listed Investment Companies (LICs) for an investment journey. If you’re just beginning investing, you have a few options.

The first thing to consider for couples is, which spouse will have the lowest taxable income throughout your journey. It makes sense to invest more heavily in this spouse’s name, as less tax needs to be paid on dividend income.

In fact, a couple with a spouse earning under $37,000 per year, will be entitled to a franking credit refund (under current rules). This is because their tax rate is 19%, much lower than the franking rate of 30%.

OK, what if you’re single, or a couple both earning more than $37k?

Before your eyes glaze over or you choke on your coffee and say ‘what the hell is he talking about’, just bear with me.

This stuff may well save you a ton of money, and/or earn you higher investment returns due to tax savings, so try to take it in.

Well, essentially, this is a plan offered by AFIC – our largest investment company – which allows you to forgo your dividend and receive extra shares instead.

You are substituting your dividend, for additional shares. (I mentioned it in my review of AFIC here)

No. It’s very different.

With a DRP, you receive extra shares instead of your dividend, but you need to declare that amount as income and pay tax on it. You also get to use franking credits to offset your tax. But in the eyes of the ATO, you’ve still earned that income and tax needs to be paid.

In the case of a Dividend Substitution Share Plan (DSSP), AFIC has a special ruling from the ATO, where you can receive these additional shares and no income needs to be declared.

And it’s fully legit! You can check out the documents and ruling on AFIC’s website here.

The catch is, you also don’t get the benefit of franking credits. So this means, it doesn’t make sense unless you’re on a tax rate of over 30%. This is the break-even point.

Because in a normal situation, you only need to pay the difference between your tax rate and 30% (the value of the franking credit).

Currently, if you’re on a higher bracket, you’ll owe tax, if you’re under 30%, you’ll get a refund.

Since the average Aussie earns a pretty solid full-time wage, they’re comfortably bumped into the 30% and above brackets. More on the ‘catch’ later.

It’s really the same thing as the DSSP discussed above as offered by AFIC. But just a different name for it.

This Bonus Share Plan (BSP) is offered by another investment company – Whitefield.

And Whitefield also has a special ruling from the ATO, in which you’re allowed to participate and receive ‘bonus’ shares instead of a dividend and franking. You can find some info on their website here.

Many people are wondering what kind of a difference it can make to investment returns. In simple terms, using the DSSP/BSP schemes are simply a way to limit tax on your investment earnings to 30%.

For investors on a tax rate of 32.5% (income of $90k or less) it’ll make a small difference. If you’re on a tax rate higher than that, it can have a huge impact.

Remember, if you’re on a tax rate of 32.5% or less, your tax is essentially fully covered by your franking credits anyway! So you already have it pretty good!

If you’re not sure which tax bracket you’re in, check out this page.

Let’s run a scenario for a high-income earner. This person probably assumed dividend investing was a terrible idea, as they’d be left with little return after paying tax.

So let’s see how the numbers shake out using these DSSP / BSP things…

Some numbers and assumptions to start:

— Our investor purchases shares in either AFIC or Whitefield (or both) to utilise these dividend substitution plans.

— These LICs have a dividend yield of 4% fully franked. This equates to 5.7% grossed-up to include franking.

— Dividend growth and portfolio value grow at the same rate – 3% per annum. This gives us a total return of 7% per annum, plus franking. (Dividend Yield + Dividend Growth = Total Return)

— Our high-earner is on a tax-rate of 47%.

Usually, this investor would be left with a 3% net yield after tax. (5.7% gross, less 47% tax, equals 3% net)

So based on the initial 4% dividend, they lost 1% to tax – franking covered the rest. Once we add in growth, the investor is left with a 6% after-tax total return, to compound over the years.

But by utilising these Bonus Share Plans, our investor can instead receive 4% more shares, rather than a 4% taxable dividend with franking. And those 4% bonus shares aren’t classed as income, so there’s no tax payable.

The result? Our high-earner now earns a 7% after-tax total return, rather than 6%. Now let’s take a look at how this affects his wealth accumulation.

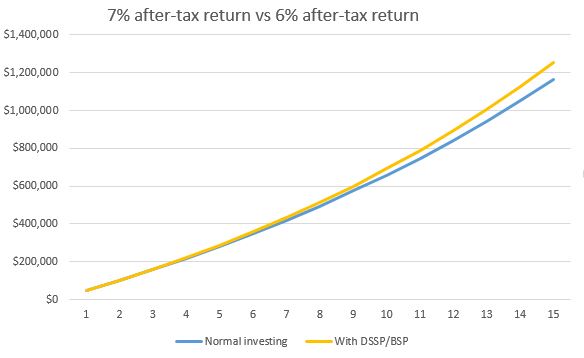

Here’s how the savings look in chart form. This chart measures our investor adding $50k per year to his portfolio.

One line is copping the 47% tax rate on the chin. The other is using the DSSP / BSP offered by AFIC and Whitefield.

I know what you’re thinking, “Wow big deal”. Now, I’ll admit, those lines are pretty damn close to each other.

But believe it or not, this resulted in a difference of about $93,000. Yep, almost a hundred grand!

Now I don’t know about you, but that’s a shitload of money to me!

Here’s the final figures: Investing normally, the end balance after 15 years is $1,163,000. Not bad for an eye-watering tax-bracket!

Investing using the DSSP / BSP resulted in a final balance of $1,256,000.

Taking it to the next logical conclusion…

This means our high-tax investor would have finished with a portfolio spitting out $46,520 in dividends (plus franking) under the first scenario.

But using the dividend substitution plans, his larger portfolio would be throwing off $50,240 (plus franking) in cashflow. A difference in yearly income of around $4,000. Certainly nothing to sneeze at!

By the way, as with most short journeys to financial independence, the result was driven more by saving than investing. As we’ve covered before, saving is where you should focus.

Your tax savings would amount to around $40,000 over 15 years. Quite a bit less, but still worth considering.

Your final balance would, of course, still amount to $1,256,000, using the DSSP / BSP. But if you invested normally and copped the tax, you’d end up with $1,218,000.

In case you’re wondering, your return becomes 6.6% per annum, versus 7% with the BSP. So tax chewed up 0.4% per annum of your return.

Before you get all Scrooge McDuck and start daydreaming of swimming in your tax savings, we need to cover the downsides…

You can simply fill out a form and send it back to the share registry to participate in these plans (just like the DRP). But because nothing is free, there’s a few conditions that come with these plans.

The major issue is Capital Gains Tax. If you sell any of your holding, you’ll be up for a larger than normal amount of CGT. Why?

Well, say you own 1000 shares of AFIC. You elect to participate in the DSSP. One year later you have 1040 shares of AFIC. The company paid you 4% ‘bonus shares’ rather than a 4% dividend. These shares cost you $0.

Let’s say your original parcel of 1000 shares cost you $6000, or $6 per share.

Well, now you have 1040 shares, but your cost basis is still $6000. This means for tax purposes your average cost is now $5.77 per share.

See what’s happening here?

Your cost basis is going down because you’re getting these shares at zero cost. So it’s adding to your future potential Capital Gains Tax. Holy crap, that’s bad right?

Well not necessarily. Here’s the optimal way these plans are used…

Suppose you’re earning a decent income and you’re in the 37% bracket or higher. You could start buying shares in AFIC or Whitefield and elect to participate in these Bonus Share Plans.

Along the course of your road to financial independence, you’ll pay no tax on your dividend income. Your investments will simply compound by themselves and you continue buying more whenever you can.

10-15 years later, your share accumulation hits critical mass. You simply elect to start receiving the cash dividends, plus franking credits, at any point you like, once you believe it’s enough income to cover your expenses.

You obviously never sell your shares, and it’s happy days. The extra CGT owing makes no difference if you never sell.

Essentially, this is a perfect scenario and what these plans were designed for, tax-efficient share accumulation. Of course, the real world is often not that simple. Sometimes things happen or life gets in the way.

In my opinion, these plans are best suited for those paying at least 37% or more in tax, and then only when you’ve considered your own situation carefully.

Yes, you’ll save some tax if you’re in the 32% bracket. But I’m not sure it’s worth it. I probably wouldn’t bother as the savings will be quite small and these plans come at the cost of flexibility.

Personally, I’ve never used the DSSP or BSP because we’re now in a low-tax, early retirement scenario. And in any case, I was too sidetracked investing in property to notice the wonders of dividend investing in the earlier stages of my journey.

But if I was starting today and paying 37% tax or more, I’d most likely go this route and invest in AFIC and Whitefield. It’s pretty easy to say you’ll never sell. But doing it is another matter.

Although not optimal, you could be forced to sell shares if you need to fund a big unexpected expense. Or because of job loss.

You may decide you don’t like LICs anymore and you’d rather invest in index funds. Or, you want to decrease your exposure to Aussie shares because you’re worried about a recession.

At the end of the day, if you think you might sell at some point, really weigh each side before diving in. It’s not set in stone either. You can turn it on or off at any time.

If you fall into a lower tax bracket for a while, you can simply choose to start getting your dividends and franking again.

Alternatively, if you find yourself in a high-tax environment for a while, you can use these plans to optimise your tax for as long as you need.

A fellow blogger also recently wrote about DSSP’s which you might find more concise and helpful than this post!

First, I’ll just say this area is not one I know a lot about. I just don’t feel our situation requires these types of structures. So please take this section with a grain of salt!

Other options to reduce tax and therefore increase your investment returns are owning shares via companies and trusts.

A commonly used one is the Discretionary Trust. Often used by a couple for investing. This can be used to hold investments and distribute certain amounts of income to whoever is in the lowest tax environment.

But once both spouses are paying more than 30% tax, there is often a next step taken. The creation of a ‘bucket company’.

This is where any excess earnings are distributed to the company which pays 30% tax. But the company misses out on the CGT deduction that individuals get.

The result is a maximum tax rate of 30% and flexibility over where to distribute capital gains and income each year to optimise the result.

Keep in mind, these setups create more admin and complexity. Also, they aren’t cheap. You’ll need to see accountants and/or advisers to nail down the best fit for your own situation. And these added costs can really diminish the benefits.

After going through these scenarios, we’ve covered the entire tax spectrum. And it seems to me, there’s not a lot of reasons we should be paying much more than 30% tax on our dividend income.

Once you account for franking, there’s little if any tax to pay. So I ask, how are dividends in Australia inefficient?

This means the 4% yield you see on these LICs we discuss, is pretty close to the yield you should be getting, after tax.

And of course there’s no expenses to go with that, unlike property for example.

So despite the cries of some pointing at the tax consequences by investing for an income stream, the real outcomes are quite benign.

With a 4% net yield, and adding earnings growth in line with the economy of 3-4% per annum, you’re looking at 7-8% per annum return, after tax. And this is while being an income-focused investor.

In retirement, under current rules, it’s even sweeter. Because of franking credit refunds, that yield climbs to anywhere up to 5.7% after-tax, depending on your own tax bracket of course.

Now, whether franking refunds continue is another topic altogether. But even if they don’t, we’re still back in the enjoyable position of 4% net yield and an expected return of 7-8% after-tax.

Even if franking refunds are squashed, franking credits still remain. This means you still get the benefit to offset your tax, just like you have since 1987.

And although it’s no certainty, even the tax-happy Labor party has said the initial franking credit imputation system will remain as it was first established.

In retirement, this means you can earn fully franked dividends of $95k per year and pay no tax. Here’s how…

$95k of fully-franked dividends comes with $40k of franking credits. This gives you a grossed-up income of $135k.

For tax purposes, you pay tax on $135k of income. But you’re also entitled to the $40k of franking credits to offset your tax.

And funnily enough, the tax payable on $135k of income, is $40k. See here.

This means the franking credits pay your tax entirely, leaving you with $95k of cashflow free and clear. No out of pocket tax.

You can double this amount for a couple that holds the shares equally. So that’s $190k of dividends, with franking credits covering the tax bill.

If you’re wondering, a portfolio worth $4.75 million split between two people, producing 4% fully franked dividends would produce this level of income. That’s a fairly massive portfolio and a pretty good outcome.

These folks are still clearing 4% net yield after tax. Again, where’s the inefficiency?

And these tax-friendly scenarios will likely improve over the coming decade as both political parties look keen to cut personal tax rates, or increase the tax brackets.

I’ve talked before about why I like to invest heavily in Australia. Even though Australia will have a recession and market crash at some stage.

As the above articles explain, these tax issues aren’t the reason for my investment approach. But they’re a benefit that I’ll happily tap into for as long as they’re available.

Going over the numbers, these are my takeaways:

On the way to, and during early retirement, this style of investing is very effective…

— For low income earners, dividend investing is incredibly favourable, with no tax to pay and even franking credit refunds boosting your after-tax income.

— For middle income earners, dividend investing is reasonably efficient as there’s no out of pocket tax to pay and you can compound your wealth unaffected by taxes.

— As discussed, for high income earners, there’s a number of ways to optimise your situation, including DSSP / Bonus Share Plans, so you’re paying little or no tax on your dividends.

— Finally, in retirement, there’s no out of pocket tax to pay until you reach a truly mammoth-sized portfolio.

Worst case scenario, you have to pay a small amount of tax as your income grows. There’s worse things I can think of than having a growing amount of cashflow from your investments each year!

So much for the terrible tax consequences of dividend investing. And before you start focusing more on saving tax than on making sensible investments, here’s what Warren Buffett has to say:

“In the meantime, maybe you’ll run into someone with a terrific investment idea, who won’t go forward with it because of the tax he would owe when it succeeds. Send him my way. Let me unburden him.”

WANT PRACTICAL NO BS FINANCE CONTENT EVERY WEEK?

Join thousands of readers and subscribe to the Strong Money Newsletter below.

Yep – I am more than happy to cop another decade of tax knowing that I will enjoy many decades of tax paid income for the future.

It was the $270K income across both of us with tax credits inbuilt that was the final winning argument to go across to dividend growth investing some time ago. I’m ‘going for it’ now until we retire. We are living on the lowest wage and saving and investing my wage now

Nice work Phil.

The tax advantages are really the icing on the cake to a strategy that’s so enjoyable to follow!

AFIC was my first buy, purely because I had read Barefoot Investor. I then actually started learning about investing, LICs etc and found Peter Thornhill. I bought Whitefield because of the industrial focus. Subsequently, I found the BSP/DSSP and realised they were great choices for higher tax brackets. Random luck!

After thinking through a bit more I would reinforce 2 points:

1. The BSP/DSSP is great for a buy and hold strategy (presumably much of the readership here), but be aware of the CGT implications if that isn’t your plan. These will be amplified if the labour government proposed CGT deduction changes go through.

2. Be wary of any investment choice solely because of the tax benefits. Governments and policies change and benefits today may not be around in the future. Your choice should always be based on the fundamentals of the investment/LIC – ie long history of growing dividend stream and reliable track record/sound management. Tax benefits should probably be considered as an advantage.

So my personal plan has been to include these 2 LICS in my purchases and possibly weigh them a bit heavier than I would have otherwise but still look for some diversification.

I also agree regarding taxation – it’s a total bugbear of mine hearing people complain of paying too much tax when they are earning heaps of money. First world problem! Be grateful we live in a great country with universal health care and social welfare for those less fortunate. I am sure FI in this country is significantly aided by the availability of free high quality health care.

Great comment SJ, thanks for the reinforcement of those messages!

I don’t have anything to add, I completely agree with all of your points 🙂

I had to laugh when I read your comment on Carpe Dividendum DSSP post about almost canning this post because he beat you to the punch.

I have actually come across the very same thing once before and ended up deleting mine because the other post was better lol. Teaches me for being lazy and not publishing sooner!

Great post as per usual SMA and you may know that I have adjusted my strategies towards a growing income stream much like yourself 🙂

I might be able to shed some light on why people think investing for dividends is inefficient.

Using your example above:

The dividend before the company tax was deducted would have been $135,000. Because of the dividend imputation system Australia has, the company can pay shareholders a lower dividend with a franking credit attached (in your example this is a fully franked dividend of $95,000 with around $40,000 worth of franking credits).

Even though you will not have to pay additional tax on your $95,000 fully franked dividend. It’s important to understand that you have indirectly already paid the 30% company rate on the original dividend amount ($135,000) equating to around $40,000 (which equals the franking credit in this example).

Now let’s say you’re retired with no other income and realised a capital gain of $135,000 to fund your retirement for that year. Under the current laws, if you were to have held the asset for over 12 months, you would be entitled to the 50% CGT discount. This would mean you would only pay tax $14,305 in taxes.

All things being equal, receiving $135,000 in dividends will equate to $40,000 in taxes paid where a capital gain of $135,000 will mean a tax bill of around $14,000. That’s more than double the tax paid by receiving a dividend vs capital gains.

I’m not saying this is a bad thing, in fact, I have changed my approach to dividend investing because of the likes of Thornhill and your articles. But I do understand that dividend investing will always attract a higher tax bill (indirectly or otherwise) vs cap gains. But I’m ok with that due to all the other benefits it has.

Keep the quality content coming mate!

Cheers Firebug!

Looking forward to reading about your new investing strategy.

Appreciate you shedding some light on that. I’ve thought about this a little bit recently, and I’ve seen the argument before, but I’m just not sure I completely buy it as irrefutable as it’s sometimes declared.

Here’s my thoughts: As a shareholder is harvesting capital gains, it may be tax free to a certain point, but what’s often forgotten is the company is still paying 25% tax in the background. So the shareholder is still having his underlying earnings taxed at this rate, same as the dividend investor.

In addition, the selling approach and capital gains argument is usually made in reference to global shares. Global shares also pay dividends, which is a further level of tax for the shareholder which is not optional.

So even selling shares and paying no CGT whatsoever, the underlying shareholding is still taxed at the company rate (20-30%), then the dividends are taxed at our personal rate (0-45%, with no franking credit to offset it. I’ve never seen mention of this from the pro cap-gains crowd.

This means at best it’s the same level of taxation as the dividend investor, but often higher. So in most cases, for an Aussie investor owning global shares the underlying tax outcome is actually less efficient.

The sell-down method is completely valid as we both know, but it would appear better suited to other countries.

Thanks for dropping such a good comment mate, always good to have you stop by 🙂

Interesting, interesting… Definitely some food for thought!

Cheers mate. Keep it up ????

I would hope that no articles get canned. The more content the better, and we all have different takes on things. 🙂

Exactly, it’s not a competition, even the same message delivered from a different angle becomes valuable to a larger group of readers. We’re all shooting for the same thing – to share knowledge around FI and ways to get there 🙂

Thanks Dave. Great topic.

Do you think it would make sense to split investment between husband and wife?..i.e. during the accumulation years the higher income earner buys AFIC/ WHF with the Bonus share plans ticked and the lower income earner can buy a MIlton/ Argo and collect the dividend. That way come retirement both will have a relatively equally valued portfolio…. if that is even a consideration?

First steps to FIRE. Cheers.

Thanks Ryan.

Yes I do think that makes sense, very good suggestion. The small amount of extra tax now is likely to be recouped later when both partners are in low tax brackets, rather than one having the bulk of the holding.

Just a thought to optimise it, one could invest in the lower partner’s name until around half the portfolio is built (at a guess) and then start the Bonus Share Plans in the high income earners name. This will give more franking refunds sooner (assuming they continue) to grow the portfolio quicker, while ending up with the same result.

Hey Dave,

So expanding on this, for example, I am on a $70k income paying 32.5% tax and my wife is under the 18k threshold paying nil tax. It makes sense to invest solely in her name until I hit $90k income? Then at that point would it make more sense to invest solely in my name or split it 50/50?

Cheers

Actually I think the next bracket is 120k – 180k now.

It does make sense to generally invest in the lower earners name. But later it can get more complicated, because then in retirement you’ll be on the same tax rate. And then one of you might work part time. See how it can keep changing depending on the situation?

So have a think about what makes sense for the long term and try not to play the tax optimisation game too much, because I can tell you’re already making it complicated from your comments. Given you have loans attached, it then gets messier. You should probably get some tax advice on that to make sure. But whatever you do, just keep it simple.

By the way, I did a podcast on taxes a while back, some of it may be useful: https://strongmoneyaustralia.com/podcast-how-to-deal-with-taxes/

Yeah you’re right I am making it complicated. The most difficult part is trying to predict your circumstances in the future. I guess it makes sense to contribute as much as possible to super (up to the $25k cap) as we are both on 15% rate anyway, because if I use my work income to buy shares in her name then it is taxed at 30% so we get less in the pocket to purchase the shares right? Then anything left over we can put in her name initially and if she works part time down the track we will have to assess the options and whether it’s beneficial to sell and repurchase in my name (depending on what CGT we would be up for) or just start buying in my name and leave hers. Can I run this calculation of 100% fully franked dividends by you to see if I understand it correctly:

Dividends received = $2000

Franking credit received = $2,000 * 0.3/0.7 = $857

Total amount to declare on tax return = $2,000 + $857 = $2,857

Notional tax at marginal tax rate of 30% = 0.3 * $2,857 = $857

Tax owed = Notional tax – Franking credit received = $0

Is this correct?

PS. Thanks for the link to the tax podcast, will listen to that today.

Yeah I remember doing that myself, and my predictions of our future scenario turned out to be wrong. When retirement and changing work scenarios are involved, it’s more or less impossible to know what the scenario will end up being. Now we have one joint account for investing, and I look back and realise I overcomplicated it before, which came with costs, taxes, and wasted energy trying to predict something unpredictable just to ‘optimise’ taxes.

Super can make sense as you’re suggesting, but it’s not a slam dunk. It depends entirely on if you want/need that money before you reach retirement and what you plan to live off in the meantime, how much you’ll need, etc. There’s no way to answer whether that’s the best move without knowing all the details along with your goals/priorities. Freedom sooner but more tax, or more long term wealth that you lose access to. Depends on your age too and when you expect to hit FI or semi-retire.

Your example is correct as I understand it. When franking credits equal tax owning, then no tax is payable out of pocket 🙂

Thanks Dave appreciate your reply below. Apologies for all of the questions. I’m just really driven to get this right and have success with it. It actually makes sense to have a joint investment account. I guess this would answer my query regarding investing half in wife’s name and half in mine because you would just split the tax returns 50/50 wouldn’t you? so if you invested 100k in your joint account, then the income associated with $50k would go on the wife’s tax return and the income associated with the other $50k would go on mine.

One other question, I think I already know the answer to this but the interest on a credit card used to buy shares would not be tax deductible would it? because it’s a personal loan? or does that change if it’s used for investment purposes. I was comparing NAB Equity Builder with margin loans and saw some 24 month interest free credit cards so got me thinking.

Yes, half ownership means half income declared on each person’s tax return. It may even come up automatically on the system if you wait a while before lodging.

Interest is deductible if the money is used to invest in income producing assets. So in that case, it would be deductible, regardless of what type of loan/credit it is. I won’t comment on specific loans or cards, but it’s typically better to focus energy on earning/saving/investing consistently rather than trying to get more shares sooner with debt and pay a potentially high interest rate.

Ok thanks Dave. I thought 24 months interest free would provide a good opportunity to not only accumulate more shares now, but pay down the non deductible debt quicker. But you’re right, I’ll get whacked with interest if I don’t ensure the credit card is paid off at 24 months, which isn’t worth it even if it’s deductible.

I had another thought – if shares are purchased purely in the name of the spouse not working, and then sold, and then rebought in the name of the high income spouse later down the track, CGT would be nil wouldn’t it because the spouse not working is under the threshold? unless the capital gain is substantial. Sorry to harp on with this. Just want to at least consider all options.

Your zero CGT scenario is correct, tax would be very low/nil with the no-income spouse in event of a sale.

Hey Dave,

In regards to the separate loan used for investment purposes. What happens if you refinance? can you still claim the interest with a different lender and account? so for example, if I set up a $50k account with Lender A and used $50k to purchase shares through this account, can I then set up a $50k account with Lender B and still claim the interest? or is has to be the exact same account that you used to transfer the funds? Would you just need to keep the transaction history from the original account to show the ATO if required?

As far as I know, as long as the loan remains open and balance the same (not larger obviously), then it should be relatively straightfoward to continue claiming the interest and be able to clearly show what’s happening. A simple refinance provided loan splits stay the same is unlikely to impact deductibility

Ok no worries that’s good then, thanks mate

Sorry Dave further to this:

Dividends received = $2000

Franking credit received = $2,000 * 0.3/0.7 = $857

Total amount to declare on tax return = $2,000 + $857 = $2,857

Notional tax at marginal tax rate of 30% = 0.3 * $2,857 = $857

Tax owed = Notional tax – Franking credit received = $0

So this effectively means if my taxable income is $70,000 before any dividends or franking credits, then it will remain $70,000 after taking the above into account? I’m running all the numbers now to work out my best option so need to make sure I understand it all correctly.

To be brutally honest, you’re overthinking it to an extreme degree. Dividends and franking credits are ADDED to your total income, so no your income does not stay the same. But franking credits also count as tax already PAID, meaning in this case franking credits pay the vast majority if not all the tax in this case.

Yeh ok so no tax payable on the dividends received is probably a better way to put it.

Thanks so much for this. I will probably need to read it several more times before it all sinks in, but seriously.. WOW!! You have put so much work into this and have answered so many questions I had re dividends and tax. Love your work.

Awesome, glad you found it helpful Starbuck!

Most of it is probably waffle but there’s hopefully a few useful bits in there 😉

I’d love to see some calculations from the brain trust using Peter Thornhill’s debt recycling strategy. Having changed to P&I loans on our IP’s, our tax deductible interest has reduced, so contemplating taking out a LOC against our PPR for LIC investments (no debt currently on this). Is there a point at which this becomes a useless exercise depending on income/interest rates etc?

It’s getting tricker to work out these days because P&I is almost becoming mandatory these days and the rate differences make it harder to weigh up.

In general, I’d lean towards the lowest rate which is P&I unfortunately. LOC loans tend to be pretty expensive, I’m yet to see a competitive one, and may now be harder to qualify for.

For anyone who wants to be debt free on their home at some point, I probably wouldn’t bother. But if they don’t mind having debt for shares then I’d look at it. One option could be to go with P&I loan for the cheaper rate but then refinance every few years to access the built up equity.

I don’t think there’s a right answer on this due to rates, loan setups, cashflows and personal preferences.

As long as you think you’ll earn a higher rate of return than you’re paying in interest, then technically it makes sense. If interest rates are 5% and you expect 8% return from shares, then you’re making a 3% margin on that borrowed money. So it all comes back to return expectations and how that compares to rates.

Food for thought! I’m fortunate enough to being into the highest tax bracket, but have the Sydney sized mortgage debt to go along with it.

I’m hoping to embark on a debt recycling strategy soon, so whilst a DSSP/BSP sounds appealing to help with the tax situation, I’m thinking passing up on the dividends to pump back into my mortgage means this is likely not the best idea for now?

Man, that’s a tricky one DebtKing. It’s quite possible the debt recycling could work out better provided you have the cashflow and savings discipline and don’t mind the added complexity.

But given the simplicity and tax advantages of the DSSP/BSP plans, I think that’s also a good choice. Either way is likely to work out pretty good if you just focus on saving hard and putting that cash into investments. Whether it passes through your mortgage first or not, you’ll still end up in a good position.

Hi Dave,

I just read AussieHiFire’s post on the possible changes to imputation which has a different take on the imputation side of things – https://aussiehifire.com/2018/09/09/how-would-the-proposed-changes-to-imputations-credits-affect-fire/

That aside, I’ve been thinking about the tax implications of borrowing for LICs and then DSSPing the dividends whilst debt-recycling (and I know you should never base an investment on tax benefits etc.) especially when someone is in the top tax bracket – the borrowings are tax deductible now, whilst the CGT may never come if you never intend to sell and use dividend income. As long as you can cover the interest payments, then it’s not too bad a situation to be in.

Hey mate, yeah it’s pretty simple to figure out. You’ll simply earn 4% net up to 95k per person, rather than 5.7% net which reduces as income scales up.

I haven’t written about it (only commented), because it doesn’t change my approach and it isn’t even close to happening yet.

So let’s say it comes in, then what? Where else are you going to get a better than 4% net yield after tax from a diversified source?

You can add lots of REITs, but that’s not very diversified. You can add some high yield shares, but then you have to pick stocks or overweight banks etc. You can hold some utility/infrastructure stocks, but again you have to do stock picking. You could hold unlisted managed funds (which are a trust structure and pay no tax), but then your income will be quite variable and possibly not very tax efficient. You can add peer-to-peer lending which I have (but only 5% of portfolio).

In my view, Aussie shares are still the best bet for a 4%+ growing income stream for FI in this country, still tax efficient, no selling needed, still diversified (100-300 companies).

On borrowing to use the DSSP – no! You can only claim interest against an income earning investment. This is not declared as income so the interest cannot be offset against anything. So it is not deductible. I’ve seen someone else mention this, but it’s not allowed!

Thanks for the stopping by and adding to the discussion 🙂

Thanks for clarifying on the DSSP borrowing! I suppose it’s very similar to “you can’t claim interest for when an investment property is not tenanted” as it’s not returning any income.

“On borrowing to use the DSSP – no! You can only claim interest against an income earning investment. This is not declared as income so the interest cannot be offset against anything. So it is not deductible” – I think that puts my debt recycling/to DSSP or not to DSSP thoughts to bed! Thanks Dave.

I’ve also decided to go chat to a tax accountant tomorrow to stop my mind going round in circles so I’ll report back on here if anything new comes up with them.

Haha it had to be too good to be true right? Deducting all that interest while earning zero income in the process.

Yep that’d be good, cheers DebtKing.

Hi Dave,

The interesting part of my post about what happens if we lose the cash refund is the impact on people who are relying on lean FIRE because there is a huge hit to income, particularly for couples who were both able to claim back pretty much all the franking credits. As you say though the changes are a long way from being certain, I thought it was interesting to quantify the numbers though.

As you say though even if the changes do come through Aussie shares are still going to look pretty attractive when they’re giving you that 4% yield, although I think it would make sense to potentially add a bit more diversification to the portfolio if the numbers justify it.

Thanks Aussie HIFIRE.

We’re pretty much that type of couple – we live on 40-45k per year so would pay basically no tax and clear the entire gross dividend yield. The changes would hit us hard, but the investment choice is still more attractive than the alternatives in my view. Given we currently live on a weird mix of capital from selling off our properties, part time income, and investment income, the impact is not so immediate.

We’re lucky to have retired with a bit more than we needed, but in any case, the bonus part time income we now earn means that we barely need any investment income to cover our expenses. Seems to be a weird but common outcome for most FI’ers.

Some tweaking around the edges can help a bit as described but mostly it’ll be a case of accepting the new reality 🙂

Hi DebtKing,

You may be right in saying that, it could be best to accept the dividends and target to reduce the non deductible PPOR debt first, and not sign up for DSSP regardless of the marginal tax bracket.

Are you able to share with us on what your findings were with your accountant re: would interest applicable qualify for deduction if selected DSSP/BSP where no income is received?

I’d be curious to know your findings as I am in similar situation are you with PPOR loan and considering to use equity to invest in shares.

Hey Momentum. I can guarantee you the answer is no. The interest is not deductible if the money has been invested where it is providing no taxable income. These ideas are explained at length in my post on debt recycling.

Strong Money – continually selling me the positives of dividend growth investing. (I’m slowly coming around) great job

Haha thanks Mr FTM!

Great article mate! I have a question about tax, as I’m new to this dividend investing lark and am still a little confused.

So, I have all my dividends going to the DRP in Argo. I realise I need to declare the paid dividends in my tax return, that’s all good. Do I declare the full amount including the franking? Do they automatically take the franking credits out of it? Or do I declare simply the return, minus the franking credits?

Thanks Luke 🙂

You declare the dividend and the franking as well. The dividend and the franking are both counted as income, but the franking also shows up as ‘tax paid’ too. Then you just need to pay the difference (or be refunded) the difference between the franking credit (30%) and your personal tax rate.

Hope that helps.

Very good article.

I think the main thing for me on DRP vs DSSP is the implications of moving overseas triggering a CGT event (which I think Carpe Dividendum touched on).

I do wonder if I held assets in a trust structure and moved overseas, would this trigger a CGT event?

Cheers PTF!

Hmm, I’m really not sure about that stuff, hence why I didn’t go into it in my post 🙂 Hopefully someone else can chime in…

One thing that’s probably worth mentioning (unless it’s so obvious that it’s not worth mentioning…) is that our tax brackets are progressive, meaning you won’t be taxed 37% the moment you bump up into that tax category. For example, if you earn $100k you’ll only be paying about $25k in tax, not $37k. So the 30% you get back will be beneficial up till about $150k or thereabouts.

Thanks for the comment Chris.

You’re correct if dividends are the only income someone earns, like someone who is FI for example.

That’s not the case for a still-working investor though. The reason being, you need to add your dividend income in your tax return, which inevitably falls in the 37% bracket because you’re adding it on top of your declared wages. So you will indeed be paying 37% on dividends in that case.

The ‘effective tax rate’ scenario is covered well by the example of someone earning $95k in fully franked dividends ($135k gross). Over $37k those dividends fall into the 32.5% bracket and then 37.5% over $90k, but because of the lower tax rates below those figures and the tax free threshold, it gives an ‘effective’ tax rate of 30% overall.

Also just came across the idea of Listed Investment Trusts that pay a higher distribution with no tax and without (or with minimal) franking credits – there’s talk (and I understand that it’s all conjecture until Labor ever get their legislation through) that some LICs may change to LITs

https://www.livewiremarkets.com/wires/avoiding-the-great-labor-franking-credit-grab

Any ways, it’ll be interesting to see, what, if anything happens.

Thanks for the link monkeydrugs. Entirely possible, though perhaps unlikely for the old LICs who often have a large amount of capital gains in the portfolio – switching to a trust would cause a huge tax bill. BKI is the most able to switch if it seems prudent.

The trust structure would unfortunately take away the dividend smoothing effect and also means any realised capital gains must be paid out (like an index fund or unlisted managed fund), which would take away partly why LICs are attractive in the first place.

No franking credits would mean the trust is paying out entirely capital gains or investing in unfranked shares like infrastructure, utilities and REITs for example. The index (VAS) would become more attractive than most LITs in my opinion, as it would just be a slightly more efficient way (than LICs) to invest in broad Australian shares for people on lower tax rates, without changing strategy to overweight certain sectors or rely on a fund manager to keep creating capital gains to harvest.

Hola! Just stumbled across the blog. Absolute ripper! I have a question …. is it possible/wise to invest entirely into ARGO (drp) and AFIC (dssp) as a long term investment strategy? I just really want to invest for dividends later in life and have 20 years of share purchasing ahead of me! Basically want to set and forget and just park my money in LIC’s and get myself to financial independence by 50. Just not sure whether it’s a good strategy to go for the ARGO/AFIC combo!

Welcome Chris, and thanks for the feedback 🙂

It’s definitely possible, but whether it’s wise is up for debate. There’s a number of people (smarter than me) who think investing in Australia only is a foolish idea. I obviously have a different view and feel fine about investing predominantly in Australia, for a variety of reasons. Given you’ve already decided on dividend focused shares, I think it makes sense.

Investing regularly in a diversified investment company like Argo and the like, for 20 years, is likely to deliver a solid result and a very healthy income stream. Could other choices have been better? Sure. But if that’s how you’re happy investing and can stick to it, then I think that’s the most important part, than finding the most perfectly tuned portfolio on the planet.

For those concerned about owning international shares too, that can be done simply through their super fund, up to 100% if desired.

Thanks for the reply Dave. Much appreciated. Yeah, I am quite comfortable in investing solely in Australia and Australian focused LIC’s such as Argo and AFIC. I have had a dabble in individual shares and I just don’t have the stomach for it! Would you opt to spread the cash out over a few more LIC’s or just stick to ARG + AFI combo and hope for an overall return of 5% P.A? I figure I could live off $30k in dividends comfortably (+ work 1 day a week) so that would require a grand total of $600k ($300k in AFI and $300k in ARG) invested by the time I’m 50 if I have done my sums right! Or would it be better to chuck another LIC in the mix?

I can’t tell you specifically what to invest in Chris. But personally, I’d feel fine with just a few LICs. There’s others I’ve discussed on this website if you poke around that may be of interest. I’d probably add another one, but that’s just me.

The income is likely to be around 4%, or 5.7% with franking. But if Labor axes franking refunds, that 600k would only provide 24k after tax (the extra franking wouldn’t be refunded). Still a decent income stream, just means a slightly bigger portfolio is needed, or slightly more part time income in this case.

I wouldn’t get too bogged down in the details at this stage, since your cost of living in 20 years is likely to be higher. But working on today’s numbers this looks about right. Just get a plan in place that you’re happy with first and then go from there 🙂

You’re a gentleman and a scholar. Thanks heaps! Might have to do some more reading about the different LIC’s on this website. I could deal with $24k and work a few days a week. I’m happy with my plan of action and now I can just plug away for the next 20 years and work towards that elusive financial independence goal!

No worries, sounds good!

Maybe have a scroll through some of the other posts here to also get some tips on lifestyle//frugality/philosophy to help boost your savings rate 🙂

Great article!! Can you please elaborate more on capital gain tax on dssp specifically on purchasing parcel of shares at different price points and selling part of the shares in the future?

Thank you

Thanks Tracy 🙂

Well that’s where it gets a little messy and if it’s too tricky you can hand it to an accountant. I’m no accountant of course, but I would assume it goes like this…

Let’s say you bought 1000 AFI @ $6 and 1000 AFI @ $7.

You own 2000 shares of AFI, and you receive 80 bonus shares as your dividend (4% div) for the year, your average cost then becomes $6.25, rather than $6.50.

Your parcel of 1000 shares at $6 has received a 40 bonus shares, so that parcel now has a cost of $5.77.

Your parcel of 1000 shares at $7 has received 40 bonus shares, so that parcel now has a cost basis of $6.73.

Each year you would have to update each parcel to reflect the cost spread across more shares because of your bonus shares received.

It’s similar to what I showed in the article but you simply update the figures for whatever you paid for each parcel. Obviously it’s not much fun and another reason why it’s best to mentally accept they can never be sold lol.

Or you can always say stuff it and just use an average price which would be much easier. Up to you. Hope that helps.

I’ve read this article through multiple times now and still don’t understand the DSSP and how the CGT aspect is calculated when you’re making ongoing investments under the plan. Guess it’s another thing to talk to my accountant about next week (heck that’s going to be quite a long appointment now!)

I do plan on never selling and have a 45% marginal tax rate so it does seem like a really good idea regardless. But want to make sure I have my documentation straight before making the switch. Thanks anyway for your articles though as without your blog I wouldn’t have even known it was a thing that existed!

I’m glad you enjoy it, but I’m sorry it still didn’t make sense to you.

I thought the section ‘How to use the Dividend Substitution/Bonus Share Plans’ was a pretty decent way to explain it? So your cost base stays the same even though you’re buying more shares. This means when you sell, there’s a larger capital gain than there would otherwise be. If you kept buying shares at the market price, you’d simply add that to your cost base.

Like the example, if you had 1000 shares and participated in the DSSP for one year, you’d then have 1040 shares, still with a cost base of $6000. If you then purchase another $6000 of shares, you’d now have 2040 shares at a cost base of $12,000 (assuming same price to keep it simple.

If the market price rose to $7 per share, and you bought $7000 worth, you’d now have 2040 shares with a cost base of $13,000. Whatever the price, you just add on your new purchase to the overall cost base each time you buy. All you need to know is how many shares you own and how much your cost base is. The DSSP shares cost you nothing so you don’t add to the cost base when you receive those shares. The CGT will then be calculated on your cost base and the price you sell at.

Hope that makes a little more sense. But yes, going to an accountant to make sure couldn’t hurt – I’m certainly not one!

Hi SMA,

First of all, thanks for creating high-quality content. I have been binge reading your blog and I’m learning a lot.

I have a question.

What if you invested for income under a company structure? That way you can take out what you need as dividends and leave the rest to grow. I understand that companies do not get CGT benefits as individuals do, but if the strategy is to not sell and in the future transfer the assets to next generation, then wouldn’t this be worth looking at?

Hey Mr D – thanks very much!

Good question. Starting your own company to invest with can certainly be tax effective, but best suited to long term high income earners, given the extra costs and complexities involved. But, if looking to retire on that income in 10-20 years time, and assuming lower tax brackets in retirement, then the company structure is not really needed at that point.

Definitely an option though, depending on time frame, costs, tax savings etc. Also quite possibly there may be CGT benefits of transferring assets to children (best speak to tax expert here), though assets can be passed on to children tax free in an estate anyway if held in personal name.

Thanks for your reply. Although I am not there yet in terms of size and income, investing through a company is something that I’d like to research a bit more.

With a federal election to be there so many lies and half truths banded arround one does not know who to believe,there has been a fair of discussion about non refunding of imputation credits.What about proposed capital gains tax changes current 50% discount to a 25% discount with changes to force all asserts on death of asset holder to be sold and capital gains paid before distribution to beneficiaries after 50% inheritance tax has been paid this evens includes spouse ,this is of concern to me both coming and going Chester

Thanks for the comment Chester. You’re definitely right there – lots of half truths and not much context used when talking about tax changes. I hadn’t heard of the inheritance tax idea, sounds a bit aggressive. Some tax is okay, but it seems like old Billy is perhaps getting a bit carried away with that one!

Hi Dave,

I only recently came across your website and i am enjoying reading about a lot of your topics. Just wondering what is your suggestion for my scenario. I am currently doing my own SMF with ING where i buy and sell shares. I do not trade a lot within my Super, as i leave the trading part with my personal money.

I have only been using ING for about 4 years and going ok but as im almost turning 61 i am not sure if i should continue with my Super as a SMF. I am holding around 13 or 14 stocks and getting approx $12,000 pa on dividends. My concern is that some of the stocks i purchased early 2016 were at the time good buying prices and up to the recent falls we have had some of them were getting to their highs. I know we do not have a crystal Ball but its hard to see them going much higher and we may have another big fall. So i am thinking is it worth seeing them go up, down, up down…i know i am getting dividends, but will that be enough to see my Super grow till retirement age if the actual stocks do not keep going up??

Would i be better having the money in just an index fund? I don’t mind the work involved in looking after my stocks but by just holding to the same stocks i am probably not getting the diversification which maybe i would get in an index fund.

I am trying to build up my cash hub in my super for safety, incase if i lose my job and do not get another, i can draw on my cash hub without having to sell any stocks, if the market is in a downturn.

Hi jdc, thanks for reading 🙂

Not an advisor so obviously I can’t tell you what to do. But here’s some thoughts…

There’s really no way to know which option is the best in advance – and its even possible that if the market falls, it won’t matter how you invest because everything will go down to a certain extent. There’s no real way to future proof against that except holding more cash which you’re doing. So sounds like you’re on the right track.

You’re also right that having a handful of stocks isn’t going to be very diversified, so in that way an index fund is a clear winner as you’ll hold at least 200 companies. Might be worth considering. And if you keep reinvesting your dividends, it’s likely that your dividend income should be a decent addition to the pension assuming you qualify – so while I don’t know your whole situation it looks like you’re in a reasonable position. Hope this is helpful.

Hi Dave, once again! Thanks for the ongoing great advice.

Regarding investing in Lic’s or Eft’s etc!

I earn around 130k annually after all rates are included and salary sacrifice a couple hundred bucks a week. My partner does not work! Am i better of investing in her name ? or mine taking into account my tax bracket. And would it make any difference to the above if i was to take a 100k nab equity loan in my name ?

Thanks. Brad

Hey Brad, I can’t tell you exactly what to do for obvious reasons. But generally, it is more tax efficient to invest in the non-working spouse’s name, if they are expected to be the lower income earner for a long period of time. This way, for someone not working, there will be basically no tax to pay, and under current rules, franking credits will also be fully refunded.

Taking out a loan to invest with would reduce the tax owing on your investments, but it would still not be as efficient as someone investing with a zero tax rate (non working spouse). Also, just to be clear, you wouldn’t be allowed to take out a loan and claim the interest, while also investing that money in your partner’s name – that wouldn’t fly with the tax office as you wouldn’t be an owner of the investments… hope that makes sense. And in any case, I’m not a tax expert lol so take this with a grain of salt.

What about if the loan is in joint names Dave? So for example, wife and I have a 250k loan which we split into 150k and 100k. We pay down the 100k loan to zero (or $1) then redraw to invest in shares. We invest 50k under wife’s name and 50k under my name. So in this case, can I claim the interest on the 50k used to invest in my name, and then my wife can claim the franking credits associated with the 50k worth of shares in her name? I’m guessing in this case we may need to split the 100k again into 2 lots of 50k to make it clean?

Dave, thanks mate. i have the nab equity under my name as it got very complicated trying to have it under my partners only, long story, most of our portfolio is under my partners name, but i recently bought Afi and Vas, about 15k in each through equity builder under my name only, sounds like i am better keeping further share purchases under my Partners name.

Thanks for the wealth of Information over the yrs, You certainly have it down pat.

Brad

Sounds like it, zero tax and franking refunded is hard to beat! And you’re very welcome, thanks for hanging out here 🙂

Hi Dave, discovered your blog recently and have enjoyed binge reading ???? Now you have convinced me that an ETF is good and a LIC even better I’m wondering if I should switch out my Vanguard managed fund for either an ETF or a LIC (or at least invest in a LIC going forward). To purchase a LIC, do you just buy through your broker on the ASX or contact Argo for example and fill in a prospectus? Second question, you mention that you could live off the 4% income you will probably net each year from your investments and never sell any of your portfolio. I’m presuming you want to leave all your portfolio to your kids, or a charity? I’m 57 and could retire now if I lived off 7%, so I’m thinking roughly 4% dividends and sell 3% of my portfolio each year. Does that sound feasible? I’ll probably keep working a day or two a week in a meaningful job as I tried full retiremenot a few years ago and was climbing the walls after a few months! Keep up the good work young man.

Hi Brent. Thanks for reading. Lots of questions in there! This post is mostly about how Aussie dividends are more tax efficient than many people believe. I wrote more about index funds in this post and tend to prefer them a bit more these days.

There’s no way to know whether 7% is a feasible amount to live off, it depends on what future returns are from here, as well as your starting portfolio size and how long you live. Most of those things are unknowns. But if you’re going to keep working and are flexible with your spending, then it could work just fine, especially knowing you also have the pension as a backup plan in any case which isn’t bad at all.

Hey Dave, I know this is an older post but it seemed appropriate for my question.

With the recent changes to tax brackets from the Federal Government, from what I can tell I might be entitled to a partial franking credit refund.. just wanted to grab your thoughts.

Currently earn $40k~ p.a doing part-time work. I’m earning roughly $8k in dividends from investments, a large portion of that is fully franked. With the new tax legislation I would only be paying 19% up to $45,000 which from my understanding means that $5k worth of dividends would be taxed at 19% so of the 30% tax that’s paid by the company.. 11% would be refunded when lodging my tax return?

Thanks in advance.

Hey Scott.

Short version: From what you’ve stated there, that maths sounds about right to me, you should definitely receive a franking refund.

Long version: Add all dividends and franking to your total income tally – so it may be around $48k. That’s your total taxable income. Tax paid at work and franking credits count as total tax paid for the year. You’ll get a refund for the difference between your total tax paid and what the total tax payable is on your earnings.

Hope that helps 🙂

Awesome, thanks Dave.

Dave you should get the Order of Australia medal 5 times over. And head the department of education… no one ever teaches any of this through 12 years of useless schooling.

Thank you for sharing your wisdom!!!

Haha wow that’s extremely generous Michael, thank you for your kind words. But you make a good point – it’s sad that we have to learn about money all by ourselves, often the hard way.

Wow this has to be the best written explanation of what a DSSP is and what it means for your tax bracket!

Thank you very much, you just saved me loads of money!

That’s great to hear Fay, thanks! I’m glad it was helpful 🙂

Hi Dave,

Thanks for another great write up! I’m in the 37% tax bracket and I’m quite interested in the BSP offered by WHF. However, at the moment WHF is trading at a ~9% premium. I’ve also been considering buying MLT which is trading at a ~0.4% premium. Do you think it is worth paying the premium for WFH so that I can reap the benefits of the BSP? Or would I be better off going with MLT?

Thanks mate

Thanks for reading Jase. I would probably only use the DSSP/BSP plans if I was in the highest tax brackets – that’s when the benefits are quite hefty. Until then, I would just choose whichever investment I liked the most. But up to you of course.

Dear Dave, i need your help again.

Can you please explain what a BOP is? I understand what BSP/DSSP are and ive turned mine on for Whitefield as im the higher tax bracket but ANZ shares offer a BOP and until recently i thought it was the same as a BSP but now im not too sure?!

What are the tax implications of a BOP?

Thanks in advance

I’ve never heard of those before, but I looked it up and it does sound pretty similar to a Bonus Share Plan. This forum page has a good rundown of it – https://www.aussiestockforums.com/threads/anz-bonus-option-plan-vs-dividend-reinvestment-plan.27749/#:~:text=The BOP shares are conceptually,1000 shares @ $1 = $1000.

It is a BSP/DSSP/Whatever-you-want-to-call-it. Google” ANZ BOP” and the answer will be available in less time than it takes me to type this. 🙂

Link to T&C’s below.

https://www.anz.com/content/dam/anzcom/shareholder/bonus_option_plan_bop_booklet_final.pdf

Does DRP not lower your cost basis? Is it not counted as “4% bonus share at the cost of $0” ?

Yes, it does lower your cost basis. So you pay not tax on it today, and defer any tax till sometime in the future, possibly never. The people who use the BSP plans typically do it during accumulation phase and then live off the portfolio and simply start receiving the dividends. The higher CGT that would result then never becomes an issue.