Start Here

Close Menu

December 7, 2021

Welcome to the new readers who have joined us this month!

The Strong Money community is full of thoughtful people who are passionate about financial independence.

Join us as we try to become a little wiser and wealthier each week:

Jeez, that was quick – almost the end of the year and time for another portfolio update!

It’s been another interesting year. While we slowly (and hopefully) move past this virus, the economy finally looks like it will stay mostly open from now on, which feels great for society, jobs, and everyone’s sanity!

In this post, I’ll share how our investments are progressing, which shares we’ve been buying, a quick summary of market and some other stuff.

Let’s get started!

Since last time, and as usual, our cash is reducing as we continue investing each month into shares.

Our mortgage balances are coming down due to principal repayments, which combined with an improving Perth market, is helping our property equity steadily increase.

Another noticeable change is the addition of ‘Pearler’. Here’s the story…

As you guys know, I’ve been involved with Pearler from the very beginning after meeting the founders in 2019. Since then, I’ve been providing feedback, testing things out, and so on. Anyway, because of this I was actually offered the opportunity to become a small investor in the company itself.

Since I really like what Pearler is about, what they’re doing for long term investors, and I’m impressed with what they’ve built so far, I recently took them up on that offer – investing some of our savings into a small ownership stake.

I’m sure later this could be misinterpreted as “he recommends Pearler because he owns it.” In reality, it’s the other way round. I liked the idea, the people building it, and felt it genuinely added value to the investing experience of everyday people.

I became a happy customer, then felt confident recommending to friends and readers, and now I just happen to be tagging along as a tiny owner.

All the other stuff came well before I decided to put any money into it. Now, Pearler is not quite at the dividend paying stage yet, so I’ll have to make an exception here 😉 But if they keep building out helpful features and functionality for the community, Pearler could do well as a company over time.

Speaking of which, there are some pretty exciting improvements rolling out soon. Like much cheaper brokerage, the ability to ‘bulk buy’ your brokerage credits via an annual subscription, and even an option for unlimited transactions for ETFs and LICs.

The pricing I saw was extremely sharp, so I’m looking forward to that! There’s also a low fee micro-style investing app coming. I’m not the biggest fans of these personally, but this one actually has a great choice of investments unlike most others.

Equities haven’t done a whole lot since my last update in August.

Aussie shares are basically flat, even though some large dividends have been paid. And global markets, dominated by the US, are slightly higher.

From what I’ve read, profits have been strong this year across the board, so the market was right to recover as strongly as it did after the 2020 crash.

We’ll have to wait and see what happen next (obviously), but it’s my view that a long period of flat prices would really start to wear down newbies who have been used to seeing markets go up every single month!

I also wouldn’t be surprised if markets get spooked about the idea of interest rates rising faster than expected. We could easily see a 10-20% selloff if the collective mood changes.

None of this is ‘news’, I know. But it’s important to stay open to a number of different scenarios playing out. Getting richer today via price gains is nice, but accumulating more shares at lower prices is also a wonderful thing, for your passive income and future wealth.

We’ve been selling down our properties since reaching FI in 2017, and now we only have properties here in Perth. That means I care about what’s happening in Perth much more than I do elsewhere! 😉

Sydney and Melbourne real estate sounds like it has cooled off a bit as more supply becomes available, but Brisbane is still quite strong. Here in Perth, we’ve cooled off somewhat too.

A large number of houses are being constructed which will put a dampener on price growth… unfortunately for us, and fortunately for first time buyers!

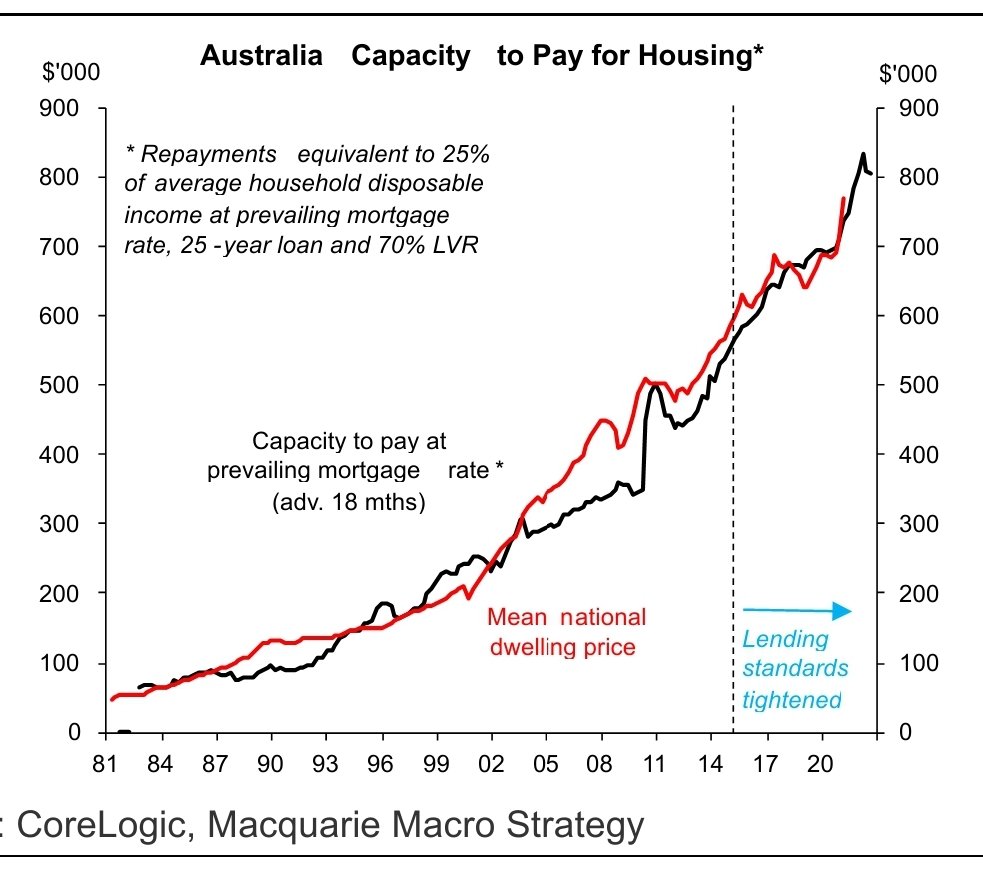

Personally, I think the outlook for Aussie real estate is still decent over the next few years. The economy is growing, lockdowns are fading, and population growth will increase as the borders eventually reopen.

I don’t buy the hysteria around house prices. The reason prices keep rising and have become very high in certain areas is because people have pushed them higher.

There seems to be a level of victim-mentality around prices rising, like some bizarre alien force which is causing it to happen.

No! It’s us. We’re competing for a limited supply of desirable properties, aided by the lowest mortgage rates we’ve ever seen.

Yes, some people will find it really tough or even impossible to buy. But that’s always the case.

They can either work on their personal finances to earn and save more, buy in a more affordable area, or simply rent and invest and build wealth to eventually buy later.

In a boring continuation of previous updates, we’ve been topping up most of our holdings, but mainly our Aussie shares (VAS), international shares (VGS) and the two REITs we own.

In fact, the REITs have been falling recently as (I guess) the market worries about interest rates, so we’ve been buying more. They’re both now trading at prices 10% below the value of their real estate, and on very attractive and sustainable yields of 6-7%.

We also made some small early withdrawals from our peer-to-peer lending account (with no fees), to make an extra couple of purchases.

VGS continues to slowly get bigger, as we add to it for a bit more diversification. But honestly, some of its growth is simply down to performance – the US market has been relentlessly strong.

VGS and QVE have been our best performers this year. Overall, I’m pretty happy with how the portfolio is progressing, including the level of income it’s producing. Speaking of which…

The fun bit! You might remember this chart from my mid-year update when we calculated our investment income for the financial year.

Well, it looks like the current year is going to be a good one. Dividends are increasing pretty much everywhere.

Aussie companies broadly are paying out some very healthy dividends to shareholders, benefitting VAS and Argo. Both our real estate trusts and QVE have all announced dividend increases for the current year too!

I’m very much looking forward to updating this chart next year… it should be a record year, and it’s possible we get close to $30k of investment income 🙂

For new readers: If you’re wondering how we consider ourselves ‘retired’ if our passive income isn’t higher than our household spending, I explain how we manage our money in this article. Short answer: cash from offloading property as we transition into shares.

Another little metric that I started tracking in the last few years is our charity donations.

The goal is simply to grow this every year (hopefully forever), no matter how our finances are doing.

Another healthy increase this year, which I’m quite happy about. I actually had to check our spending for this year and make some extra donations to make sure we hit our goal!

Granted, the numbers aren’t huge, but the idea of growing this every year is really motivating.

Depending on how our personal wealth fares over the next decade or two, this could hopefully get quite large. Whatever I make personally through various endeavors is likely to be recycled into philanthropy over time.

As for where the donations go, typically wildlife/animal/environmental causes we want to support.

It’s steady as she goes, as we keep building the portfolio and use up our cash. At this stage, we’ll probably sell the next property in 2-3 years, so if Elon wants to launch a SpaceX rocket under the Perth real estate market that would be fantastic 😉

At the big picture level, the portfolio and our wealth has actually grown a decent amount in the last year or so. Before that it actually fell for a couple of years due to our properties dropping in value. So it’s nice to be heading in the other direction again!

That’s all from me… how’s your own portfolio this year? What have you been investing in? Let me know in the comments!

Hi Dave, Just interested in your investment with Pearler. Did you get a role as part of your investment? e.g part of the board or a committee or is this just a hands-off investment?

Hey Nat. Nah nothing like that, just a small hands-off stake. I do sometimes chat with them about things that are coming up etc and give feedback but no paid role of any sort.

I love the fact that you’ve decided to invest in a company that you use and that you see can have great benefit for others. It’s a bit “One Up on Wall Street-esque”. Good for you.

Thanks Dylan, I appreciate that 🙂

Always thank you for your great reading,I wanted to ask if you could elaborate a little more on the different platforms available to invest,thank you

Thanks for reading Martin. I’ll assume you’re referring to other online share investing accounts. Most of the others are trading focused – lots of marketing and communication on performance, stock picking, making certain bets, etc. Almost everything other brokers do is designed around getting people to trade more often, including the comparison features, reporting, charts, all of it. Pearler is more interested in helping people invest for the long term, hence the focus on automation, goals, and the lack of trading features and relentless daily news/info which is irrelevant for a long term investor. Hope that helps clarify a bit.

Hi Dave

I recently moved to Pearler as well. And I helped them transfer from one Open Markets broker to another for the first time (I was Pearler’s first Open Trader to Pearler transfer). So far so good… HIN and holdings transfer went smoothly. I’m looking forward to buying more share now…

Hey good stuff Jeff. Glad you’re happy with it so far. They’re very responsive to feedback, so feel free to let them know if you think there’s something that could be improved.

Hi dave, just wondering what REITs you have been buying and hold in your portfolio?

The two REITs I own are Charter Hall Long WALE REIT (CLW) and Centuria Office REIT (COF). Not recommendations 🙂

Hey Dave.

Another great article (and impressive gains on your portfolio over the last year)

Just wondering, before you began using pearler, you used selfwealth’s platform yeah? Was it hard to make the switch?

We recently refinanced with our home loan and did it all ourselves (no mortgage broker) and it was a fair bit of work to do.

I’ve been thinking about charging ours from selfweath but (I’m being lazy also) don’t want the massive hassle if that makes sense.

Cheers Dave and keep up the informative work

Cheers Ryan! Yep I was using SW before, and nah the switch was easy as. Only a small digital process and one document to do from memory. Nowhere near as involved and painful as a mortgage with all that bank paperwork!

Good to read about the continued progress on the investment side, Dave!

Completely agree with your point about the need to always bear in mind that a fall of 10 to 30% is never impossible in equity markets, and the opportunities that creates for people in the accumulation phase to keep accelerating their journey.

And good luck for $30k!

Thanks mate! Absolutely, and it could happen quicker than expected as we learned from 2020, falling 30% in a month.

Hi Dave,

Any chance you could do an article on QVE and why you invested in it? And how it compares to Ex20 (and even small caps like VSO)? I hear that active management in the small cap seems to outperform just the small cap index in Australia. What are your thoughts on small/mid caps?

Thanks!

Hey Kevin. It probably doesn’t warrant an article. There’s no master plan with QVE and I certainly have no clue on its future performance. I bought it for some extra diversification when I still had an all Aussie portfolio, like the value approach, and QVE’s yield/their focus on dividend streams.

It’s true that active has a better track record in small/mid caps in Oz than what you see elsewhere, but no guarantee that will continue and no guarantee that a chosen manager will achieve that either. My overall thoughts these days are if you’re invested in a mix of Aussie/global shares, there’s no real need to have a small/mid Aussie holding.

Our property portfolio has gone up so much (Sydney market) but I feel like that means we are waaay too heavy in property. First world problems. So working on increasing ETFs now.

Haha that’s excellent – first world problems indeed! Will you consider cashing out of one or two properties to rebalance your portfolio/reduce risk?

Hi Dave,

Always great to read your annual portfolio update, I actually prefer this perspective over reading the monthly posts that are common on other FI blogs.

Full disclosure, your post couldn’t have been more timely as I was buckling on the decision to invest our $3,000 tax refund. But as soon as I read your paragraph about annual investment income popping $30K this year, I was like [self talk] –

“You know what you have to do! -Stick with the plan and keep pumping ETF’s. You know it works, you’ve done the research, here it is again!”

Thanks for the timely reminder and the diamond chats on FIRE & Chill Podcast too!

Cheers,

Kris – (Present-Self & Future-Self!)

Thanks for that Kris 🙂

Yeah, the other blogs are more about tracking their progress to FI, so mine is more like “FYI, here’s what’s been happening” given our situation is different.

Glad this post came at a good time for you!

Hey Dave. I’m early retired too. Love your articles. My portfolio is about 90% property / 10% ETFs so you can probably figure that I haven’t had your ETF epiphany yet! In your report period, I picked up another house in Adelaide and Sydney. Having just been in the thick of the Sydney market, as of last week, I can vouch that Sydney remains a multi-offer feeding frenzy. You are nicely diversified with your property equity @ 20%, and you’re no doubt getting a better yield % from your other property vs your ETF portfolio. Why bite off the hand that feeds you. Keep it 🙂

Thanks! Sounds like you’re in a pretty good spot to be able to keep accumulating which is fantastic 🙂

Actually, our property yields are crappy compared to our shares. After all costs are accounted for, we’re probably getting net 2.5%, whereas our shares are probably more like 4.5%. Not to mention very large principal repayments as our IO periods rolled off. That does create equity, but it doesn’t stop the properties being a big cash-suck, given I would rather be investing that money to build our share portfolio further.

Loving Pearler. Have even done some customer feedback meetings with a few of the team. Very cool company and product. Congrats on getting in on the ground floor as an investor.

Good stuff, that’s great to hear Declan, and thanks 🙂

Donating FEELS good but does nothing in reality. It’s like the guy next door that buys QVE.

Donating money achieves nothing? How do you figure? I’ve been seeing what my money goes into and I’m happy with the results. Whether it’s wildlife rescue/rehab/release, land management and reforestation, etc. Not sure what exactly you’re referring to. Cash is supporting actual operations, it’s not like moving a stock price AKA ethical investing. Couldn’t disagree more.

Hi Dave,

I’ve just come across your blog and really enjoyed this read. I am new to investing and have a commsec account atm but looks like Pearler might be worth checking out.

What do you think about Betashares DHHF as a solution to long term investing?

Thanks for your great content.

Hi Talia, and welcome 🙂

I think DHHF is an excellent long term investment choice. I wrote an article about DHHF and VDHG here which explains my thoughts and the pros/cons. Hope it helps.

Love your work Dave your podcast is great and you explain everything in such an accessible way. Quick question – As BHP has now moved its UK listing to the ASX, according to the VAS ETF holdings as at 31 Jan 2022, it now makes up over 10% of the ASX 300 and the top 10 holdings now make up almost half of the index. Does this affect

your decision at all to go 50/50 Aus/International given that diversification is reduced even further or not really as you’re still keen on the dividends?

Thanks for the wonderful feedback Gabriele! 🙂

Nah it doesn’t worry me. Not even because of dividends, but it’s really only a few % difference from before and even less when considering net worth. This could even happen naturally with market moves, so would I change my mind based on individual holdings moving? Nope. Otherwise I’m just starting to make up arbitrary limits for what is acceptable or not, which can be a slippery slope in trying to finesse and overly control a portfolio.

The top 10 holdings in Australia have long been a large % of the index, so not much has changed there either. Diversification is a pretty personal thing at the end of the day and depends on what each individual is comfortable with. So it doesn’t bother me, but I get that it might bother others and may exceed what they’re okay with.

Excellent, thanks for the response

Keep up the great work 😃